Nutritional Ingredients Market Size (2025 – 2030)

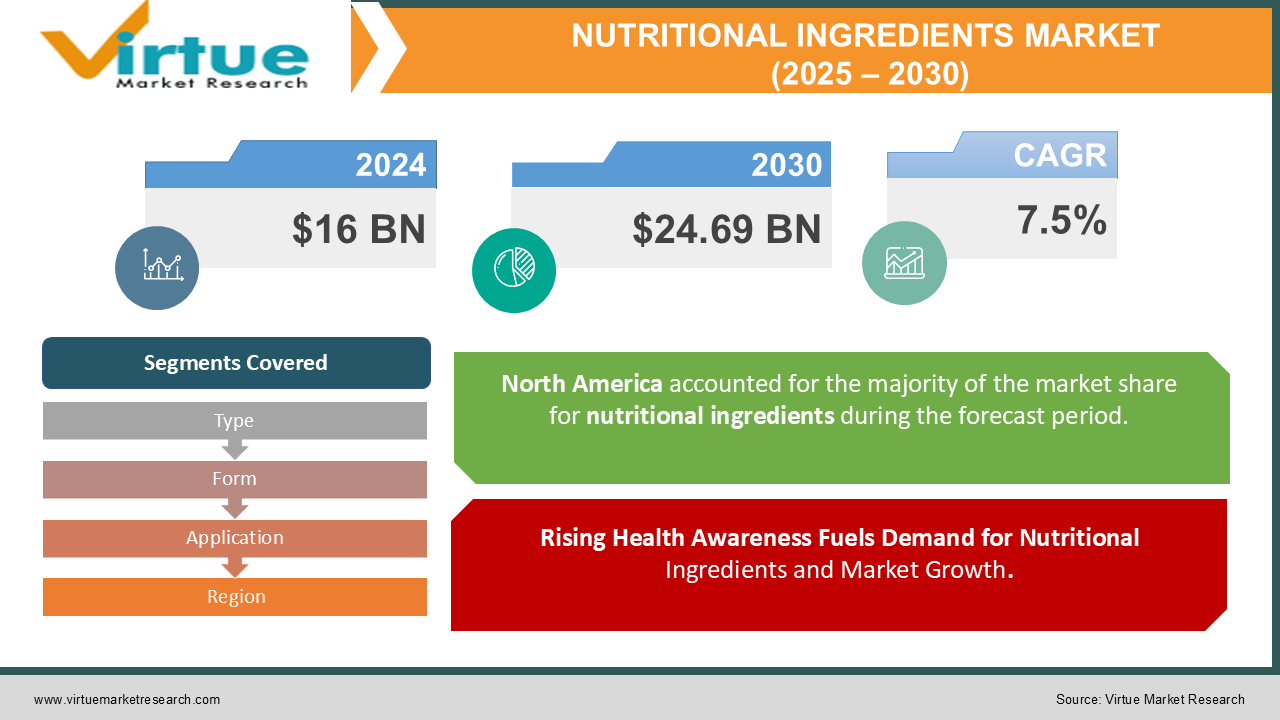

The Nutritional Ingredients Market was valued at USD 16 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 24.69 billion by 2030, growing at a CAGR of 7.5%.

Key Market Insights:

-

Advancements in Food Technology: Innovations in food production and preservation techniques are enhancing the quality and variety of food ingredients, fueling market expansion.

-

Innovative Marketing Strategies: Creative promotional methods and branding efforts are driving consumer awareness and increasing the adoption of food ingredients across global markets.

-

Surge in Processed Goods Exports: The growing trade of processed foods worldwide is boosting the demand for high-quality food ingredients.

-

Rising Consumer Focus on Health and Wellness: A shift toward health-conscious eating and functional foods is driving demand for fortified ingredients that address critical nutritional deficiencies.

-

Impact of Urbanization: Rapid urbanization has strengthened global connectivity, enabling the efficient exchange of processed food products and supporting market growth.

-

Demand for Clean-Label Ingredients: Consumers prefer natural and organic ingredients with simple, recognizable components and transparent manufacturing processes, making clean-label products a top choice.

-

Sustainability and Ethical Practices: Growing awareness of sustainable and ethical sourcing further drives the preference for eco-friendly and socially responsible food ingredients.

Nutritional Ingredients Market Drivers:

Rising Health Awareness Fuels Demand for Nutritional Ingredients and Market Growth.

The growing emphasis on health and wellness is a key factor driving the nutritional ingredients market. A growing number of consumers are actively seeking healthier food options and incorporating nutritional ingredients into their diets. Surveys indicate that nearly 70% of consumers prioritize the health benefits of food and beverages when making purchasing decisions. This trend is further fueled by the rising incidence of lifestyle-related diseases and an increasing focus on preventive healthcare.

Approximately 40% of the global population is overweight or obese, which has led to a higher demand for weight management products and ingredients. Additionally, around 30% of people worldwide experience micronutrient deficiencies, intensifying the need for fortified foods and dietary supplements. As a result, there has been a notable rise in demand for ingredients such as plant-based proteins, omega-3 fatty acids, and antioxidants.

Personalized Nutrition Drives in the Nutritional Ingredients Market.

The demand for personalized nutrition is rapidly emerging as a key driver in the nutritional ingredients market. Consumers are increasingly seeking customized dietary solutions to meet

their specific nutritional needs. This shift is being fueled by technological advancements, such as genetic testing and personalized health tracking devices. Around 60% of consumers show interest in personalized nutrition, believing that individualized diets can improve overall health and address particular concerns.

Sports nutrition is another area where personalized nutrition is gaining momentum. Athletes and fitness enthusiasts are increasingly turning to ingredients like branched-chain amino acids (BCAAs) and creatine to enhance muscle recovery and performance. The sports nutrition segment is expected to grow at an annual rate of 8%. Furthermore, the rise of personalized nutrition has spurred the growth of digital platforms and apps offering tailored meal plans and nutritional guidance, contributing to a market expansion of approximately 20% in recent years.

Nutritional Ingredients Market Restraints and Challenges:

Supply Chain Disruptions Pose significant Challenges to the Nutritional Ingredients Market.

Supply chain disruptions are posing significant challenges to the nutritional ingredients market. Limited availability of ingredients, logistical difficulties, and trade restrictions are hindering the sector’s growth. These challenges result in shortages, higher production costs, and difficulties in meeting consumer demand. To address these issues, collaborative efforts and innovative solutions are needed.

Enhancing diversification and improving coordination within the supply chain can help reduce the impact of these disruptions. Overcoming these challenges is essential for promoting consumer health and well-being. The industry must adapt and innovate to ensure a reliable supply of nutritional ingredients. Effectively managing supply chain disruptions is crucial for sustaining the continued growth and success of the nutritional ingredients market.

Nutritional Ingredients Market Opportunities:

The growing popularity of clean-label color products is largely driven by increasing health concerns among consumers and a heightened awareness of the health benefits associated with organic food colors. Consumers generally perceive organically grown food as healthier and view it as a nutritious alternative to conventionally grown products. The availability of a wider range of organic color products and the expansion of retail channels have played a key role in the growth of the food color market. Additionally, rising awareness of the medical benefits linked to organic food colors is expected to further boost the demand for natural food and beverages. Factors such as GMO-free content, higher nutrient density, absence of growth hormones and antibiotics, reduced pesticide use, enhanced freshness, and greater environmental sustainability are attracting a growing consumer base to clean-label color products.

NUTRITIONAL INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Type, Form, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company, Cargill,Tate and Lyle, Ingredion Incorporated, Novozymes, Community Foods Limited , Kerry Groups, Symrise AG , Givaudan Flavours , DuPont, Specialty food ingredient |

Nutritional Ingredients Market Segmentation: By Type

-

Specialty

-

Bulk

The demand for packaged ready-to-eat meals, including confectionery, biscuits, beverages, and chocolates, is a key lifestyle factor driving the market for bulk ingredients. The growth of food service retail chains, along with an increasing number of restaurants and cafés, has further supported this market. These establishments purchase large quantities of food ingredients, such as grains, spices, and herbs, from wholesalers. The bulk food ingredients market is expanding due to various factors, including changing lifestyles, the influence of Western culture, and a growing workforce. Additionally, the increasing preference for tea and coffee over carbonated drinks is expected to further fuel market growth. The rising demand for herbal and ayurvedic teas, known for their health benefits, is also contributing to this trend in multiple regions globally.

Specialty food ingredients are commonly used to preserve, emulsify, add color, enhance texture, and improve the nutritional profile of processed foods. These ingredients are essential for offering consumers a wide range of safe, affordable, and high-quality foods. The food and beverage industry widely uses specialty ingredients to enhance the taste and flavor of processed food. The health benefits of specific food ingredients, such as enzymes and nutritional additives aimed at reducing risks of hypertension, diabetes, chronic diseases, and promoting cognitive health promote market growth.

Nutritional Ingredients Market Segmentation: By Form

-

Preservative

-

Sweeteners

-

Flavors and Spices

-

Nutrients

-

Emulsifiers

-

Others

The sweetener segment has captured a significant share of the global market and is expected to maintain its position throughout the forecast period for the food ingredients market. Sweeteners are a crucial ingredient in the processed food and beverage sector, where they are used to add sweetness and act as preservatives due to the high osmotic pressure created by sugar solutions.

Simultaneously, the global population continues to grow, and increasing work pressures are driving individuals to seek convenient, time-saving solutions, such as processed and packaged foods. Over the years, the availability of processed foods has expanded, influencing consumer eating habits.

Nutritional Ingredients Market Segmentation: By Application

-

Beverages

-

Fortified Food Products

-

Bakery

-

Confectionary

Specialty food ingredients are anticipated to see significant growth in the coming years, fueled by the rising demand from the food processing industry. As food manufacturers increasingly seek ingredients that enhance flavor, texture, and nutritional value, the market for specialty ingredients is expected to expand. This growth is further supported by consumer preferences for more innovative and functional food products. The rising use of specialty ingredients such as antioxidants, micronutrients, and other additives by food manufacturers to improve food quality will significantly fuel the growth of the specialty food ingredients market.

The growing consumer preference for ready-to-eat food is also contributing to the expansion of the food ingredients market, as these products offer convenience and time savings. The inclusion of preservatives in processed foods helps maintain quality and reduce spoilage caused by microorganisms, which is anticipated to drive the demand for food preservatives in the future. Synthetic preservatives are widely used due to their cost-effectiveness and ability to be tailored to specific application needs. However, the natural preservative segment is expected to be the fastest-growing, as consumers increasingly prefer natural foods over synthetic alternatives.

Fortified food products are seeing strong growth within the global food ingredients market, largely driven by the rising demand for dietary supplements and micronutrient-enriched food items. These fortified products, which are enhanced with vitamins, minerals, and fiber, have played a crucial role in reducing global malnutrition. Key companies are focusing on launching multivitamin-enriched food products to meet the growing consumer demand for these nutritional solutions.

Nutritional Ingredients Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America is projected to experience substantial growth in the global food ingredients market, driven by the increasing demand for multifunctional ingredients that offer health benefits. For example, the inclusion of prebiotics in food products, which enhance mineral absorption, improve gut health, and boost bone strength and immunity, is gaining popularity. The growing food processing sector in the region is also expected to positively impact the market. Additionally, the rising demand for convenience foods is anticipated to further propel the food ingredients market in the coming years.

The Asia Pacific nutritional ingredients market is also seeing significant growth, fueled by several factors, including changing dietary habits, heightened health awareness, and rising disposable incomes. The market is shifting towards plant-based ingredients, with a growing preference for vegetarian and vegan diets. This trend is supported by the increasing demand for plant-based proteins, vitamins, and minerals.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic disrupted global supply chains, leading to logistical challenges in sourcing and producing ingredients. Economic uncertainties during the pandemic also altered consumer spending habits, resulting in changes to purchasing priorities. Demand for specific supplements, particularly those related to immunity, saw a sharp increase, while other segments experienced a decline in sales. Furthermore, heightened health concerns led to greater scrutiny of ingredient quality and safety.

Overall, the pandemic brought both challenges and opportunities, reshaping market dynamics and highlighting the need for adaptability and resilience in navigating unforeseen global events. The crisis heightened awareness around immune health and wellness, driving the demand for foods that support immune function and overall well-being. Consumers increasingly turned to ingredients like vitamin C, vitamin D, zinc, elderberry, and medicinal mushrooms to strengthen their immune systems.

Latest Trends/ Developments:

In January 2024, Dr. Reddy's Laboratories Ltd. revealed its acquisition of MenoLabs, a women's health and dietary supplement portfolio, from Amyris, Inc. This acquisition is expected to significantly enhance the company's position and drive growth in the women's health and wellness market.

In July 2023, Oriflame Cosmetics AG introduced two new health supplements in India. The products include a calcium supplement fortified with vitamin D and magnesium to support bone density, and an Iron Complex designed to address iron deficiency in women.

In April 2023, Genetic Nutrition, a UK-based sports supplement brand, expanded its presence by launching its high-quality health and wellness range in India. The company aims to offer premium supplements to the Indian market through this new segment.

Key Players:

These are top 10 players in the Nutritional Ingredients Market :-

-

Archer Daniels Midland Company

-

Cargill

-

Tate and Lyle

-

Ingredion Incorporated

-

Novozymes

-

Community Foods Limited

-

Kerry Groups

-

Symrise AG

-

Givaudan Flavours

-

DuPont

-

Specialty food ingredient

Chapter 1. Nutritional Ingredients Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Nutritional Ingredients Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Nutritional Ingredients Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Nutritional Ingredients Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Nutritional Ingredients Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Nutritional Ingredients Market – By Type

6.1 Introduction/Key Findings

6.2 Specialty

6.3 Bulk

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Nutritional Ingredients Market – By Form

7.1 Introduction/Key Findings

7.2 Preservative

7.3 Sweeteners

7.4 Flavors and Spices

7.5 Nutrients

7.6 Emulsifiers

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Form

7.9 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 8. Nutritional Ingredients Market – By Application

8.1 Introduction/Key Findings

8.2 Beverages

8.3 Fortified Food Products

8.4 Bakery

8.5 Confectionary

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Nutritional Ingredients Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Form

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Form

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Form

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Form

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Form

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Nutritional Ingredients Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Archer Daniels Midland Company

10.2 Cargill

10.3 Tate and Lyle

10.4 Ingredion Incorporated

10.5 Novozymes

10.6 Community Foods Limited

10.7 Kerry Groups

10.8 Symrise AG

10.9 Givaudan Flavours

10.10 DuPont

10.11 Specialty food ingredient

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Consumers are increasingly seeking customized dietary solutions to meet their specific nutritional needs. This shift is being fueled by technological advancements, such as genetic testing and personalized health tracking devices.

The top players operating in the Nutritional Ingredients Market are - Archer Daniels Midland Company, Cargill, Tate and Lyle, Ingredion Incorporated and Novozymes.

The COVID-19 pandemic disrupted global supply chains, leading to logistical challenges in sourcing and producing ingredients.

In July 2023, Oriflame Cosmetics AG introduced two new health supplements in India. The products include a calcium supplement fortified with vitamin D and magnesium to support bone density, and an Iron Complex designed to address iron deficiency in women.

Asia-Pacific is the fastest-growing region in the Nutritional Ingredients Market.