Nutricosmetic Ingredients Market Size (2025-2030)

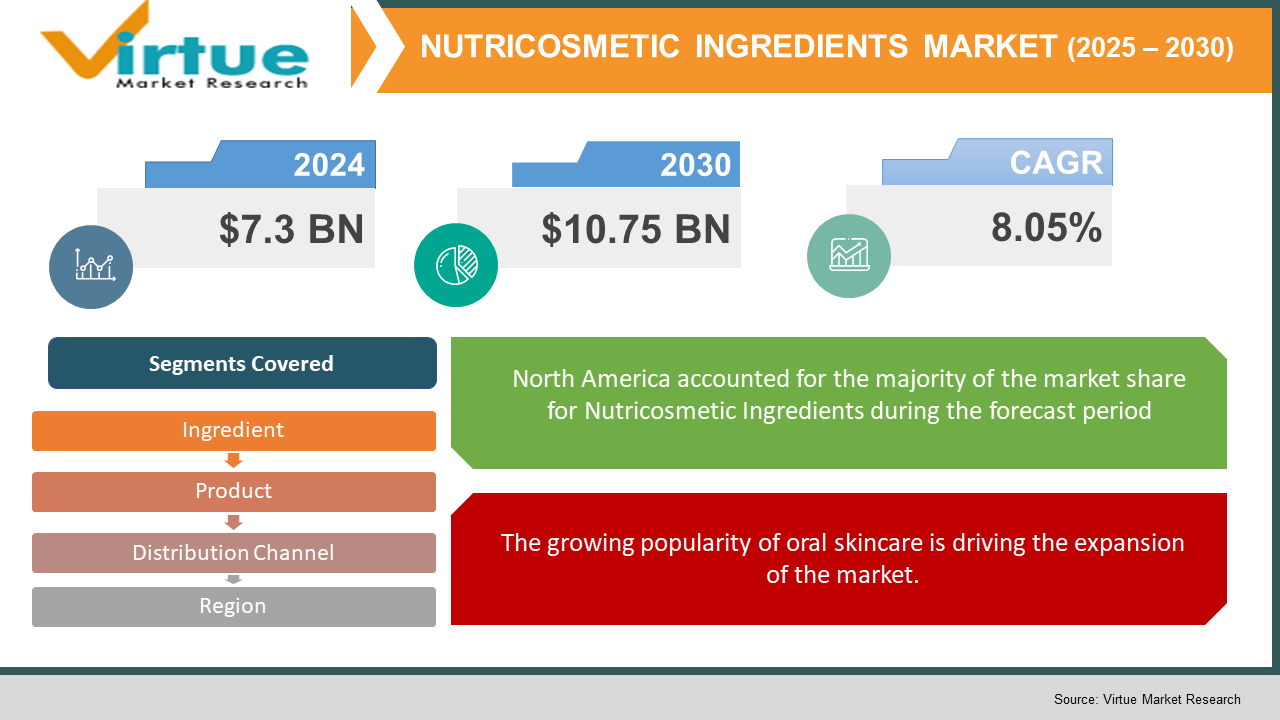

The Nutricosmetic Ingredients Market was valued at USD 7.3 billion in 2023. Over the forecast period of 2025-2030, it is projected to reach USD 10.75 billion by 2030, growing at a CAGR of 8.05%.

Nutricosmetics involves the use of dietary supplements or functional foods designed to improve the health and appearance of the skin. These products commonly include a combination of vitamins, minerals, antioxidants, and bioactive substances that are thought to support skin health from the inside, promoting hydration, collagen synthesis, and protection against ultraviolet (UV) damage. Nutricosmetics are intended to work alongside conventional topical skincare products, offering deeper-level solutions to various skin concerns. The industry is experiencing growth as more consumers seek comprehensive, holistic beauty solutions and a balanced approach to skincare.

Key Market Insights:

- The global nutricosmetics market is witnessing strong growth, fueled by a rising demand for comprehensive wellness and beauty solutions, encouraging consumers to opt for products that address skincare issues from an internal perspective. Furthermore, heightened awareness of the connection between nutrition, lifestyle, and skin health has contributed to the growing popularity of nutricosmetic products, fostering a favorable outlook for market expansion.

- Additionally, significant progress in scientific research and formulation technologies has enabled manufacturers to develop more efficient and targeted nutricosmetics, boosting consumer confidence in their effectiveness and further driving market growth.

Nutricosmetic Ingredients Market Drivers:

The growing popularity of oral skincare is driving the expansion of the market.

The shift towards preventive, holistic, and eco-conscious skincare approaches is driving significant growth in the segment, with offerings that feature clinically proven active ingredients that deliver quick and visible results, generating strong momentum. Additionally, the skincare market within nutricosmetics is seeing the rise of emerging ingredients known for their skin benefits, such as pycnogenol and lycopene. Consumers are increasingly drawn to skincare products enriched with nutrients like vitamin A, vitamin D, and omega-3 fatty acids, which are linked to enhancing skin health, providing ample opportunities for manufacturers to innovate. Furthermore, market players are competing on the basis of ingredients, product formats, packaging, and other innovations. Companies are also incorporating naturally derived active ingredients, offering clean alternatives—ranging from mushrooms in supplements to ground coffee in scrubs and seaweed in skincare products. In addition, businesses are focusing on expanding product distribution through various channels, including pharmacies and retail outlets. These factors are expected to drive market growth throughout the study period.

Nutricosmetic Ingredients Market Restraints and Challenges:

Stringent government regulations and product guidelines pose a significant barrier to the growth of the nutricosmetics market.

The promotion and categorization of nutricosmetics products face significant challenges, particularly in the European region, due to a lack of clear permissions and widespread misinformation about the ingredients and their associated benefits. This misinformation has led to the implementation of stringent regulations that restrict the marketing and promotion of these products, posing a considerable barrier to the growth of the global nutricosmetics market.

The European Food Safety Authority (EFSA) has established guidelines under Regulation 1924/2006, which set specific scientific requirements for health claims related to bone, joint, skin, and oral health. According to these guidelines, claims about maintaining the skin's structure, hydration, elasticity, or appearance are excluded from the scope of the regulations, as these are not considered physiological functions and do not fall under health-related claims. This regulatory limitation represents a major constraint that could potentially impede the overall growth of the global nutricosmetics market.

Nutricosmetic Ingredients Market Opportunities:

The application of probiotics in nutricosmetics presents significant opportunities within the market.

Fermented products containing probiotic ingredients are increasingly popular in the premium beauty market. The production process for these items is both expensive and complex, offering significant opportunities for innovation within this category. The rising trend of "beauty from within" is gaining traction, with consumers seeking organic products that enhance skin health and radiance while minimizing skin issues.

Ongoing research and development in this field suggest that incorporating probiotics into nutricosmetics can enhance their nutritional value and make them entirely safe for use in skin treatments. This aligns with the growing consumer interest in natural, effective solutions for skincare.

Furthermore, the "beauty from within" concept is gaining wider acceptance, fueling market growth and opening new opportunities for the nutricosmetics industry. Companies are actively exploring the use of probiotics in cosmetics to address various skin conditions, such as acne, rosacea, and eczema. This focus on skin health is creating new prospects for manufacturers, particularly those involved in the nutricosmetics sector.

NUTRICOSMETIC INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.05% |

|

Segments Covered |

By Product, product, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Skinade, D-LAB Nutricosmetics, Pfizer Inc., SOS Hair Care and WR Group. |

Nutricosmetic Ingredients Market Segmentation

Nutricosmetic Ingredients Market Segmentation: By Ingredient:

- Carotenoids

- Omega-3

- Vitamins

- Others

Carotenoids, including beta-carotene and lycopene, dominate the nutricosmetics market due to their potent antioxidant properties, which are found in a variety of fruits, vegetables, and marine organisms. Their proven ability to neutralize free radicals and protect against oxidative stress is a key factor driving their popularity in the industry. In addition, as consumers increasingly seek natural and plant-based ingredients, carotenoids offer a strong appeal because of their organic origins.

Their recognized benefits for skin health—such as enhancing complexion, providing sun protection, and offering anti-aging effects—further boost their popularity within the beauty and wellness sector. Moreover, scientific research supporting the role of carotenoids in improving skin vibrancy and resilience continues to build consumer confidence in their effectiveness. Consequently, the demand for nutricosmetics, particularly those containing carotenoids, is rising, driven by their antioxidant strength, natural sourcing, and proven skincare benefits.

Nutricosmetic Ingredients Market segmentation By Product:

- Skin Care

- Hair Care

- Weight Management

- Others

The skincare segment holds the largest share of the nutricosmetics market, driven by the evolving consumer preference for comprehensive, long-term solutions to skin health. Unlike traditional skincare, which focuses on external treatments, nutricosmetics take an internal approach, addressing the underlying causes of skin concerns. This holistic approach appeals to consumers seeking solutions that go beyond surface-level care.

Additionally, the increasing demand for sustainable and natural products further boosts the popularity of nutricosmetics, as many formulations include bioactive compounds derived from plant and marine sources. With the rise of busy lifestyles, consumers are turning to simplified routines that combine nutrition and skincare in a single product, further propelling the market. As scientific research continues to highlight the connection between nutrition, gut health, and skin condition, the demand for nutricosmetics in skincare is steadily increasing.

Nutricosmetic Ingredients Market segmentation By Distribution Channel:

- Drug Stores/Pharmacies

- Supermarkets and Hypermarkets

- Specialist Stores

- Online Stores

- Others

Drug stores and pharmacies provide the advantage of professional guidance and credibility, attracting consumers who seek expert recommendations for their skincare needs, which contributes to the growing sales of nutricosmetics. In addition, supermarkets and hypermarkets capitalize on convenience, using their broad reach to offer an integrated shopping experience, further expanding the market. Specialist stores target niche segments by providing an exclusive selection of premium nutricosmetic products, appealing to discerning customers who are looking for specialized solutions, thus supporting market growth.

Online stores offer the added benefit of doorstep delivery and a wide range of product choices, catering to tech-savvy consumers who prioritize convenience, positively influencing market growth. Furthermore, the rise of e-commerce platforms, along with evolving consumer preferences for easy access, is enhancing the availability and reach of nutricosmetics, driving market expansion.

Nutricosmetic Ingredients Market Segmentation- by region

-

North America

-

Europe

- Asia Pacific

- South America

- Middle East & Africa

North America holds the largest market share in the nutricosmetics sector. Consumers in the region, particularly in the United States and Canada, tend to be cautious about the concept of "beauty foods" and often prioritize products that offer specific benefits such as UV protection and wrinkle reduction, which can create challenges for new product launches.

Additionally, the growing awareness of hair loss among American men, with two-thirds experiencing some degree of hair loss by age 35 and approximately 85% facing thinning hair by age 50, has spurred the introduction of products aimed at hair health.

In Europe, the nutricosmetics market is driven by evolving consumer preferences and a focus on holistic wellness trends. Consumers in the region have long embraced health and beauty-conscious lifestyles, with a growing emphasis on internal nourishment for skin health. Nutricosmetics, which align with this mindset, are gaining popularity as they offer integrated solutions to skincare. Moreover, the increasing demand for premium skincare and wellness products in Europe, particularly in specialist stores, has created a favorable environment for nutricosmetics. The region's robust regulatory framework and stringent quality standards further enhance the credibility of nutricosmetic products, fostering consumer trust and supporting market expansion.

COVID-19 Pandemic: Impact Analysis

During the COVID-19 pandemic, nutricosmetic companies initially experienced a decline in revenue due to widespread store closures and stock shortages across various countries. However, the rapid growth of e-commerce has significantly boosted sales, as consumers turned to online channels to purchase nutricosmetic products. In response, companies in the sector focused on enhancing their digital presence by partnering with third-party online retailers like Amazon.

Additionally, many brands began offering personalized virtual consultations through their official websites, allowing them to engage with consumers more directly.

Moreover, the increased prevalence of skin issues caused by prolonged mask-wearing, coupled with heightened consumer awareness of health and skincare, led to a surge in demand for skin health supplements. This shift in consumer behavior has driven more individuals to seek beauty supplements, further contributing to the growth of the nutricosmetics market.

Latest Trends/ Developments:

July 2023: Cantabria Labs launched the Toty Brand in the North American market, showcasing the Solaria Infusion Antioxidant Booster. This daily supplement combines a powerful mix of antioxidants, including PLE FernBoost Technology and Camu-Camu, a superfruit rich in Vitamin C, aimed at enhancing skin health.

April 2022: Nykaa, an Indian e-commerce platform specializing in beauty, wellness, and fashion, expanded into the nutricosmetics sector by acquiring a 60% stake in Nudge Wellness. This strategic acquisition allowed Nykaa to diversify its portfolio and tap into the growing demand for nutricosmetic products.

Key Players:

These are top 10 players in the Nutricosmetic Ingredients Market :-

- Laboratoire Dermatologique ACM

- Amway

- Vitabiotics Ltd.

- Forza Industries Ltd.

- Skinade

- D-LAB Nutricosmetics

- Pfizer Inc.

- SOS Hair Care

- WR Group

- Natrol LLC

Chapter 1. Nutricosmetic Ingredients Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Nutricosmetic Ingredients Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Nutricosmetic Ingredients Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Product Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Nutricosmetic Ingredients Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Nutricosmetic Ingredients Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Nutricosmetic Ingredients Market – By Ingredient

6.1 Introduction/Key Findings

6.2 Carotenoids

6.3 Omega-3

6.4 Vitamins

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Ingredient :

6.7 Absolute $ Opportunity Analysis By Ingredient :, 2025-2030

Chapter 7. Nutricosmetic Ingredients Market – By Product

7.1 Introduction/Key Findings

7.2 Skin Care

7.3 Hair Care

7.4 Weight Management

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Product

7.7 Absolute $ Opportunity Analysis By Product , 2025-2030

Chapter 8. Nutricosmetic Ingredients Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Drug Stores/Pharmacies

8.3 Supermarkets and Hypermarkets

8.4 Specialist Stores

8.5 Online Stores

8.6 Others

8.7 Y-O-Y Growth trend Analysis Distribution Channel

8.8 Absolute $ Opportunity Analysis Distribution Channel , 2025-2030

Chapter 9. Nutricosmetic Ingredients Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Product

9.1.3. By Distribution Channel

9.1.4. By Ingredient

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Product

9.2.3. By Distribution Channel

9.2.4. By Ingredient

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Product

9.3.3. By Distribution Channel

9.3.4. By Ingredient

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By DISTRIBUTION CHANNEL

9.4.3. By Product

9.4.4. By Ingredient

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By DISTRIBUTION CHANNEL

9.5.3. By Product

9.5.4. By Ingredient

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Nutricosmetic Ingredients Market – Company Profiles – (Overview, Packaging Automation Portfolio, Financials, Strategies & Developments)

10.1 Laboratoire Dermatologique ACM

10.2 Amway

10.3 Vitabiotics Ltd.

10.4 Forza Industries Ltd.

10.5 Skinade

10.6 D-LAB Nutricosmetics

10.7 Pfizer Inc.

10.8 SOS Hair Care

10.9 WR Group

10.10 Natrol LLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global nutricosmetics market is witnessing strong growth, fueled by a rising demand for comprehensive wellness and beauty solutions, encouraging consumers to opt for products that address skincare issues from an internal perspective.

The top players operating in the Nutricosmetic Ingredients Market are - Skinade, D-LAB Nutricosmetics, Pfizer Inc., SOS Hair Care and WR Group.

During the COVID-19 pandemic, nutricosmetic companies initially experienced a decline in revenue due to widespread store closures and stock shortages across various countries

The application of probiotics in nutricosmetics presents significant opportunities within the market.

Which is the fastest-growing region in the Nutricosmetic Ingredients Market?