Nutraceutical Products Market Size (2024 – 2030)

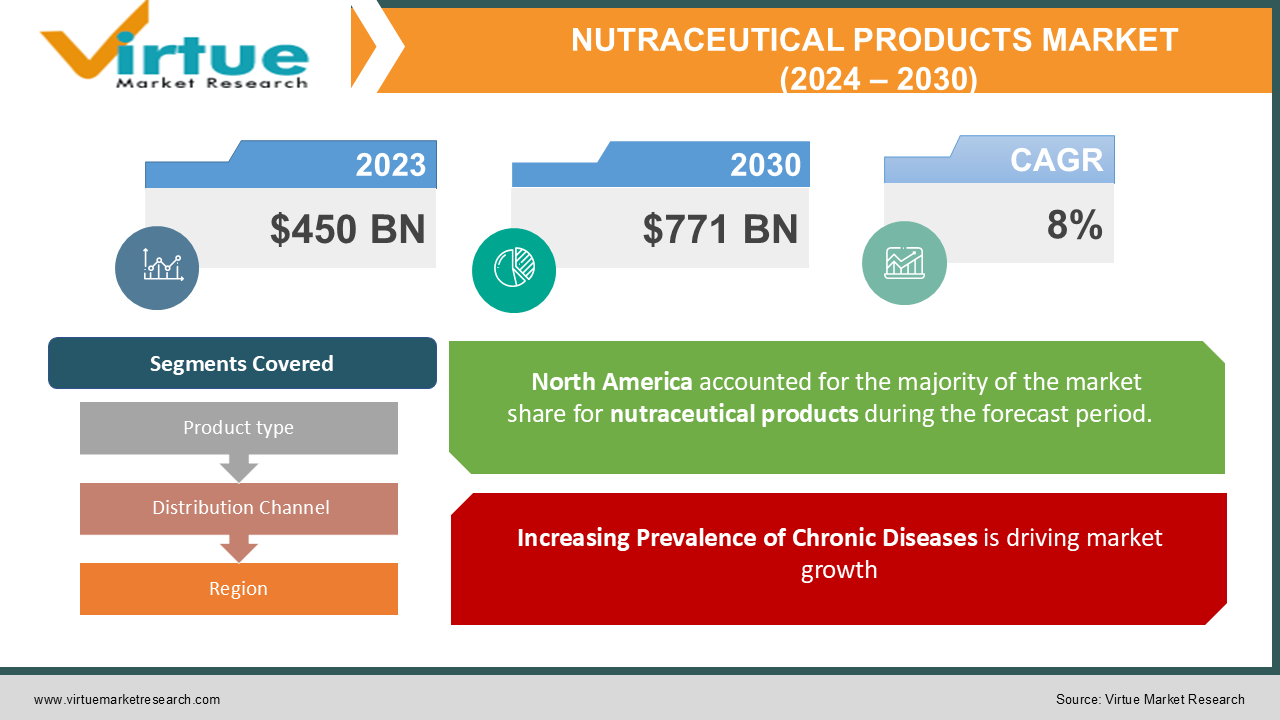

The Global Nutraceutical Products Market was valued at USD 450 billion in 2023 and is projected to grow at a CAGR of 8% from 2024 to 2030, reaching an estimated USD 771 billion by 2030.

Nutraceuticals, encompassing functional foods, dietary supplements, and fortified products, have gained significant traction as consumers increasingly seek to enhance their health and well-being through natural products. This market includes a wide variety of items designed to provide health benefits beyond basic nutrition, such as vitamins, minerals, amino acids, probiotics, and herbal extracts. The growth of this niche market is fueled by a rise in chronic diseases, increased awareness of preventive healthcare, and a growing emphasis on healthy lifestyles.

Key Market Insights:

-

The nutraceuticals segment is witnessing a shift towards plant-based products, with an increasing consumer preference for vegan and vegetarian options, accounting for 30% of the total market in 2023.

-

The dietary supplements segment holds the largest market share at approximately 55%, driven by a rising consumer focus on preventive healthcare and wellness.

-

North America is the leading region in the nutraceutical market, representing about 40% of the global market share, followed by Europe at 30%, with significant growth expected in the Asia-Pacific region due to increasing health awareness.

-

The probiotics segment is projected to grow at the highest CAGR of 9% during the forecast period, as consumers increasingly recognize the benefits of gut health.

-

Online retail channels are rapidly growing, accounting for nearly 25% of sales in 2023, reflecting a shift towards e-commerce and convenience in purchasing health products.

Global Nutraceutical Products Market Drivers:

Increasing Prevalence of Chronic Diseases is driving market growth:

The rising incidence of chronic diseases such as obesity, diabetes, and cardiovascular disorders is a significant driver of the Nutraceutical Products Market. As health issues become more prevalent, consumers are seeking preventive measures to mitigate risks. Nutraceuticals are perceived as effective tools for promoting health and preventing diseases, leading to increased demand for dietary supplements and functional foods that can support overall well-being.

Growing Awareness of Nutrition and Wellness is driving market growth:

There is a heightened awareness among consumers about the importance of nutrition and its impact on health. Educational campaigns, social media, and health-focused platforms have empowered individuals to make informed choices regarding their dietary habits. This shift towards preventive healthcare has resulted in a rising interest in nutraceutical products, as consumers actively seek out options that enhance their health and support long-term wellness.

Aging Population and Demand for Specialized Products is driving market growth:

The global aging population is driving demand for nutraceutical products tailored to the needs of older adults. As people age, they become more susceptible to health issues and are increasingly seeking solutions that can improve their quality of life. Nutraceuticals targeting age-related concerns, such as joint health, cognitive function, and heart health, are gaining traction, prompting manufacturers to innovate and create specialized formulations for this demographic.

Global Nutraceutical Products Market Challenges and Restraints:

Lack of Standardization and Regulation is restricting market growth:

One of the primary challenges facing the Nutraceutical Products Market is the lack of standardization and regulatory oversight. Unlike pharmaceuticals, which undergo rigorous testing and approval processes, nutraceuticals often operate in a less regulated environment. This can lead to inconsistencies in product quality, efficacy, and safety, creating skepticism among consumers and limiting market growth.

Consumer Skepticism Regarding Effectiveness is restricting market growth:

Despite the increasing awareness of health and wellness, some consumers remain skeptical about the effectiveness of nutraceutical products. This skepticism may stem from misinformation, negative experiences with certain products, or doubts about the claims made by manufacturers. To overcome this challenge, companies must invest in educating consumers about the science behind their products and providing transparent information that builds trust.

Market Opportunities:

The Nutraceutical Products Market offers numerous growth and innovation opportunities, considering the shifting consumer trends and preferences. Perhaps the most promising one is personalized nutrition solutions. With growing awareness of different health needs of people, consumers increasingly seek nutraceuticals tailored to an individual's profile, which includes genetic predispositions, lifestyle factors, and health conditions. Companies that invest in research into developing personalized formulations and employing technology to deliver customized products will have a huge advantage over competitors. The expansion into emerging markets is yet another huge opportunity. There is an increase in disposable incomes and awareness of health and wellness, which is gradually making countries in Asia-Pacific, Latin America, and Africa key markets for nutraceutical products. Brands that establish a presence in these regions and tailor their product offerings to suit local preferences will be better placed to capture a bigger share of the market. Local distributors can be partnered with and e-commerce platforms used as a means of entry and expansion into the market. Finally, the growth of e-commerce is a tremendous opportunity for nutraceutical brands. The advantage of e-commerce, on account of the ease and access provided by online shopping and greater reach to audiences, cannot be overstated. Investment in powerful online platforms, digital marketing strategies, and direct-to-consumer models are available avenues for such firms. Providing subscription services and a customized shopping experience also contributes to enhanced customer loyalty and retention. This can further be coupled with product development and marketing integration using technology. Advances in biotechnology, artificial intelligence, and data analytics can enable companies to develop innovative nutraceutical products that align with emerging health trends. For instance, AI analysis of consumer preferences and health data can be used to develop more effective formulations. Technology adoption can help increase brand visibility, streamline operations, and improve customer engagement.

NUTRACEUTICAL PRODUCTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8% |

|

Segments Covered |

By Product type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Herbalife Nutrition Ltd., Amway Corporation, GNC Holdings, Inc., Nestlé S.A., Abbott Laboratories, Blackmores Limited, Glanbia PLC, Bayer AG, Nature's Way Products, LLC, The Nature's Bounty Co. |

Nutraceutical Products Market Segmentation: By Product Type

-

Functional Foods

-

Dietary Supplements

-

Fortified Foods & Beverages

-

Omega-3 Fatty Acids

The most dominant segment in the product type category is Dietary Supplements, accounting for approximately 55% of the market share. This segment's growth is fueled by a heightened focus on preventive healthcare and the increasing consumer awareness of the benefits of supplements in supporting overall health. Vitamins, minerals, and herbal supplements are particularly popular as consumers seek convenient ways to enhance their nutritional intake.

Nutraceutical Products Market Segmentation: By Distribution Channel

-

Supermarkets/Hypermarkets

-

Health Food Stores

-

Pharmacies

-

Online Retail

-

Direct Sales

In the distribution channel category, Supermarkets/Hypermarkets remain the most dominant segment, representing around 35% of total sales. These retail formats provide consumers with easy access to a wide range of nutraceutical products in one location, contributing to their popularity. However, online retail is rapidly gaining ground, driven by consumer preference for convenience and the ability to compare products easily.

Nutraceutical Products Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

The North American region dominates the Nutraceutical Products Market, accounting for approximately 40% of the global market share. This dominance can be attributed to a strong consumer base that prioritizes health and wellness, coupled with a well-established distribution network. The United States, in particular, is a significant contributor to the market, with a growing demand for dietary supplements and functional foods. The region's emphasis on preventive healthcare and the increasing awareness of the benefits of nutraceuticals further drive market growth.

COVID-19 Impact Analysis on the Nutraceutical Products Market:

The COVID-19 pandemic has both challenged and created opportunities in the Nutraceutical Products Market. Many people turned more health conscious and started being concerned about their immunity, which made them turn towards nutraceutical products. There was a high demand among consumers for dietary supplements, which include vitamins C and D, zinc, and probiotics, in order to enhance immunity and general health. The increased demand has led to manufacturers increasing their production and coming up with new formulations to meet consumer demand. However, the pandemic caused a disruption in supply and logistics and disrupted the availability of some raw materials and ingredients for various companies. Delays in the production and distribution affected their ability to meet the high demand. It will also enhance the shift of the people from physical retail shops toward the online platform, leading brands to upgrade their online presence. Along with this, this new consumer behavior will carry through due to a protracted length because the newly developed healthy attitude among the people in health consciousness would assure demanding nutraceutical products towards preventive healthcare needs. It would therefore be companies able to cope with the challenges arising out of the pandemic, adjusting the offerings to changing preferences.

Latest Trends/Developments:

The Nutraceutical Products Market is witnessing the existence of numerous key trends and developments shaping its future. For instance, there are growing demand patterns for plant-based and vegan nutraceuticals. A consumption pattern that has been rising due to health benefits, environmental benefits, as well as for ethical grounds has brought forward a rapidly expanding market for supplements naturally sourced. In response to these new demand patterns and consumer preferences, brands would come forward to develop innovative forms of plant-based formulations appealing to the taste buds and conscience of healthy and ecological consumers. Another major trend is functional foods that deliver health benefits beyond the basic nutrition of a product. Omega-3 fatty acids, antioxidants, and probiotics are all added to products as consumers look to improve specific aspects of their health. Companies formulate more foods to support digestive health, heart health, and cognitive function to match consumer demand for multifunctional products. Personalized nutrition is also an emerging relevance within the nutraceuticals space. Genetic testing and data analytics enable companies to develop customized supplement regimens based on the health profile of an individual. The trend reflects an interest in personalized wellness by consumers, creating opportunities for differentiation in a crowded marketplace. Sustainability is another important factor in product development within the nutraceuticals market. Consumers are more sensitive to issues concerning green packaging and fair sourcing. Actually, the consumer response is predicted to be greater on the consumer's perception toward a good brand with a sense of sustainability, which gives the ethical supply chain for brands - enhancing loyalty as well as trust.

Key Players:

-

Herbalife Nutrition Ltd.

-

Amway Corporation

-

GNC Holdings, Inc.

-

Nestlé S.A.

-

Abbott Laboratories

-

Blackmores Limited

-

Glanbia PLC

-

Bayer AG

-

Nature's Way Products, LLC

-

The Nature's Bounty Co.

Chapter 1. Nutraceutical Products Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Nutraceutical Products Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Nutraceutical Products Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Nutraceutical Products Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Nutraceutical Products Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Nutraceutical Products Market – By Product

6.1 Introduction/Key Findings

6.2 Functional Foods

6.3 Dietary Supplements

6.4 Fortified Foods & Beverages

6.5 Omega-3 Fatty Acids

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Nutraceutical Products Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3 Health Food Stores

7.4 Pharmacies

7.5 Online Retail

7.6 Direct Sales

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Nutraceutical Products Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Product

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Nutraceutical Products Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Herbalife Nutrition Ltd.

9.2 Amway Corporation

9.3 GNC Holdings, Inc.

9.4 Nestlé S.A.

9.5 Abbott Laboratories

9.6 Blackmores Limited

9.7 Glanbia PLC

9.8 Bayer AG

9.9 Nature's Way Products, LLC

9.10 The Nature's Bounty Co.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Nutraceutical Products Market was valued at USD 450 billion in 2023 and is projected to reach USD 771 billion by 2030, growing at a CAGR of 8% from 2024 to 2030.

Key drivers include the increasing prevalence of chronic diseases, growing awareness of nutrition and wellness, the rise of the aging population, and a preference for natural and organic products.

The market is segmented by product type (functional foods, dietary supplements, fortified foods & beverages) and distribution channel (supermarkets/hypermarkets, health food stores, pharmacies, online retail).

North America is the dominant region, accounting for approximately 40% of the global market share, driven by a strong consumer focus on health and wellness.

Key players include Herbalife Nutrition Ltd., Amway Corporation, GNC Holdings, Inc., Nestlé S.A., Abbott Laboratories, and others.