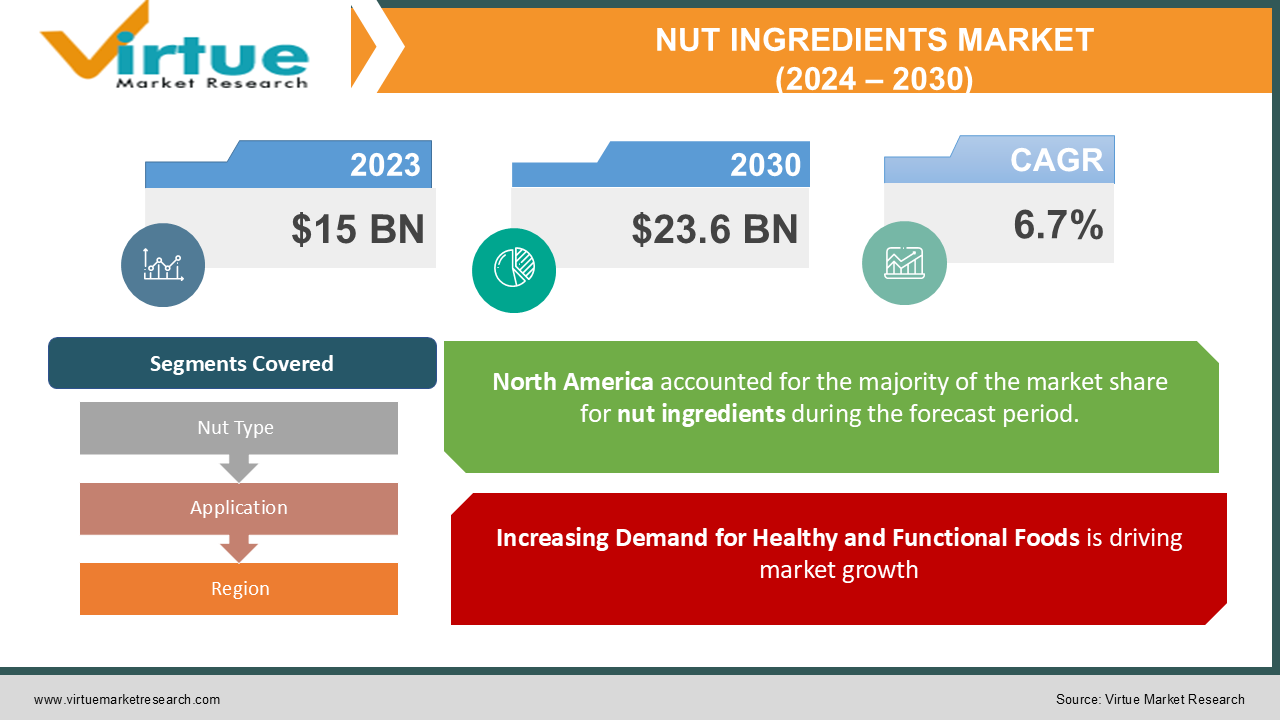

Nut Ingredients Market Size (2024 – 2030)

The Global Nut Ingredients Market was valued at USD 15 billion in 2023 and is expected to grow at a CAGR of 6.7% from 2024 to 2030. By the end of 2030, the market is projected to reach USD 23.6 billion.

Nut ingredients refer to processed forms of nuts—such as almonds, cashews, hazelnuts, pistachios, peanuts, and walnuts—used as functional and flavor-enhancing components in various food and beverage products. These ingredients include nut flour, nut butter, chopped or roasted nuts, nut oils, and nut-based pastes. Nut ingredients offer numerous health benefits, including a rich source of protein, fiber, healthy fats, and antioxidants, making them ideal for snacks, bakery items, confectionery, and dairy alternatives. The increasing demand for plant-based protein, healthy snacking options, and clean-label ingredients is driving the market for nut ingredients. The growth of the market is further fueled by rising consumer interest in nutritious and functional foods, including products free from artificial additives. Product innovations, such as nut-based protein bars, dairy-free nut-based yogurts, and nut-enriched breakfast cereals, are expected to propel the market further during the forecast period.

Key Market Insights:

Almonds are amongst the most versatile nut-based ingredients used in extensive bakery and confectionery applications on account of ease of use, plus nutritional value. Peanut-based ingredients lead in the affordable snack space because peanuts have a pretty high protein content and they're also low cost.

The trend for non-dairy milk, yogurt, and cheese is largely driven by burgeoning vegan and plant-based food demands and the increased uptake of nut-based products primarily almond and cashew-based.

Functional snacks and high protein product lines, particularly nut-based protein bars, nut clusters, and granola are increasingly in demand through healthy-conscious consumers

Global Nut Ingredients Market Drivers:

Increasing Demand for Healthy and Functional Foods is driving market growth:

The global shift towards healthier eating habits has significantly boosted the demand for nut ingredients in various food products. Nuts such as almonds, walnuts, and cashews are rich sources of essential nutrients, including healthy fats, protein, vitamins, and minerals. As consumers increasingly seek functional foods that offer both taste and health benefits, manufacturers are incorporating nut ingredients into snacks, cereals, and dairy alternatives. Additionally, the growing trend of clean-label products has led to a preference for nut-based foods with minimal processing and natural ingredients. Nut flour and butter are being used as substitutes for refined grains and sugar-laden spreads, aligning with consumer demands for nutritious, low-carb, and gluten-free options.

Growth of Plant-Based and Vegan Diets is driving market growth:

The rise of vegan and plant-based diets has created a significant opportunity for nut-based ingredients, particularly in dairy and meat alternatives. Almond milk, cashew yogurt, and peanut-based protein bars have become popular choices among consumers seeking non-dairy and meat-free alternatives. Nut ingredients provide the creamy texture, rich flavor, and protein content required for these products, making them ideal for plant-based food development. Moreover, manufacturers are increasingly marketing nut-based products as sustainable and eco-friendly alternatives, appealing to environmentally conscious consumers. The plant-based movement continues to expand, driving innovation and investment in nut-based food products.

Expansion of the Snack Industry and Premium Confectionery is driving market growth:

The snacking industry is undergoing rapid transformation, with consumers demanding more nutritious, convenient, and indulgent snack options. Nut ingredients are widely used in snack products, including trail mixes, nut clusters, granola bars, and protein snacks. The trend toward premiumization in the confectionery segment has further increased the use of high-quality nuts such as macadamias and hazelnuts. These ingredients are incorporated into chocolates, pralines, and pastries to offer consumers a luxurious experience. The growing popularity of on-the-go snacks and premium treats will continue to drive the market for nut ingredients in the coming years.

Global Nut Ingredients Market Challenges and Restraints:

Rising Costs and Fluctuations in Raw Material Prices are restricting market growth:

The production of nuts is highly dependent on favorable climatic conditions, making the supply of key nut varieties vulnerable to environmental factors such as droughts and frost. In regions such as California, which is a major producer of almonds and walnuts, water scarcity poses a significant challenge. Furthermore, geopolitical issues and disruptions in the global supply chain can impact the availability and pricing of nuts. Fluctuations in the cost of raw materials directly affect the profitability of manufacturers using nut ingredients. Companies must adopt efficient sourcing strategies and invest in alternative supply chains to mitigate the risks associated with price volatility.

Managing Allergen Risks and Regulatory Compliance is restricting market growth:

Nut allergies represent a critical concern for food manufacturers. Regulations governing allergen labeling and cross-contamination are becoming increasingly stringent, particularly in markets such as North America and Europe. Food companies must implement robust quality control measures to ensure their products are free from unintended allergens. Failure to meet regulatory requirements can result in product recalls, financial losses, and damage to brand reputation. The need to invest in allergen-free production facilities or adopt allergen segregation practices increases operational costs, presenting challenges to manufacturers in the nut ingredients market.

Market Opportunities:

There are opportunities coming from the swelling consumer base that is marching with its changing trends of innovation as well as application development opportunities. One potential for opportunity is to design personalized nutrition products by fortifying customers' snack bars, smoothies, and supplements using nut-based ingredients. A large proportion of consumers require snacks for a particular health target: muscle building, weight management, and heart health. Almonds, pistachios, and walnuts are the nuts now being marketed because of unique health benefits such as healthy cholesterol levels and improvement in cognitive ability. Organic and sustainably sourced nut ingredients are another promising area. Consumers seek products reflecting ethical sourcing and sustainable farming practices, especially in light of environmental concerns and making sustainability a priority. Companies are responding to the demand for organic nut farming and fair-trade certification. Innovation in packaging adds another layer of appeal for nut-based snacks. The resalable pouches and portion-controlled packs can also reach the consumer who eats on the go and, as such, are easily assimilated into busy lifestyles. On top of that, new opportunities in distribution networks are availed with e-commerce to distribute nut ingredients especially when targeting the niches that involve selling specialty items in nut butter like artisan nut butter, nut mixes for international or domestic gourmet cuisine, as well as in some foreign locales, there's this rising subscription market on which retail online also avails consumers towards their final brand allegiance, meaning brand loyalty increases in connection with growth for this kind of sector: the nut ingredients one.

NUT INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.7% |

|

Segments Covered |

By Nut Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Blue Diamond Growers, Olam International, Archer Daniels Midland Company (ADM), Barry Callebaut Group, Kanegrade Ltd., Treehouse Almonds, Royal Nut Company, Mariani Nut Company, Borges Agricultural & Industrial Nuts, John B. Sanfilippo & Son, Inc. |

Nut Ingredients Market Segmentation: By Nut Type

-

Almonds

-

Cashews

-

Peanuts

-

Hazelnuts

-

Walnuts

-

Pistachios

-

Macadamias

-

Others

Almonds are the most dominant nut type in the market, driven by their versatility and high nutritional value. They are widely used in bakery products, dairy alternatives, snacks, and confectionery.

Nut Ingredients Market Segmentation: By Application

-

Bakery and Confectionery

-

Snacks and Bars

-

Dairy Alternatives

-

Beverages

-

Others

The bakery and confectionery segment holds the largest share in the application category, as nut ingredients are essential components in cookies, pastries, chocolates, and other baked goods.

Nut Ingredients Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the dominant region in the nut ingredients market, with a high consumption of nut-based products across various applications, including snacks, dairy alternatives, and baked goods. The United States, in particular, is a major consumer and producer of nuts such as almonds and peanuts.

COVID-19 Impact Analysis on the Nut Ingredients Market:

The COVID-19 pandemic had mixed effects on the nut ingredients market. The supply chain and other restrictions on agricultural activities altered the availability and pricing of some nuts, such as almonds and cashews. Factors such as these often made the markets volatile. In turn, this usually makes sourcing for manufacturers increasingly challenging. The pandemic fueled higher interest in healthy food, especially in foods associated with boosting immunity. More consumers demanded products based on nuts. Nuts are nutrient-dense rich in all essential vitamins and minerals, which is why it became an appealing choice for health-conscious consumers during this time. Also, the shift towards online grocery shopping greatly bolstered sales of nut ingredients. E-commerce platforms, for example, gave effortless access to a wide variety of nut-based snacks and pantry staples, making it easy for consumers to bring these products into their diets. Overall, although the pandemic presented its challenges, it emphasized the growing importance of health and wellness within a market landscape that was changing rapidly and positioning nut ingredients favorably.

Latest Trends/Developments:

Several major trends and developments are seen in the nut ingredients market. A notable trend includes increasing sustainable and responsible sourcing. The companies have been increasing investment in organic farming, setting up fair-trade partnerships to ensure responsibly sourced products that are highly demanded by consumers. New flavoring and processing technologies also are opening avenues for nut-based products. This involves the introduction of flavored nut clusters and freeze-dried nut snacks for the convenience-seeking consumer looking for new and healthy snack alternatives. The nut-based dairy alternatives market continues to be vast with products such as almond milk, cashew yogurt, and peanut butter milk becoming more popular with consumers in search of plant-based products. These alternatives not only align with the dietary preferences but also broader health and wellness trends. Also, personalization and customization are increasingly becoming an important consumer trend. Consumers increasingly demand bespoke nutrition solutions, thus emerging nut-based protein bars and meal kits that focus on the different needs and preferences of each consumer. In general, the nut ingredients market is developing dynamically with sustainability, innovation, and personalized nutrition being core drivers for the future growth of the market as well as adaptation to consumer needs.

Key Players:

-

Blue Diamond Growers

-

Olam International

-

Archer Daniels Midland Company (ADM)

-

Barry Callebaut Group

-

Kanegrade Ltd.

-

Treehouse Almonds

-

Royal Nut Company

-

Mariani Nut Company

-

Borges Agricultural & Industrial Nuts

-

John B. Sanfilippo & Son, Inc.

Chapter 1. Nut Ingredients Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Nut Ingredients Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Nut Ingredients Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Nut Ingredients Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Nut Ingredients Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Nut Ingredients Market – By Nut Type

6.1 Introduction/Key Findings

6.2 Almonds

6.3 Cashews

6.4 Peanuts

6.5 Hazelnuts

6.6 Walnuts

6.7 Pistachios

6.8 Macadamias

6.9 Others

6.10 Y-O-Y Growth trend Analysis By Nut Type

6.11 Absolute $ Opportunity Analysis By Nut Type, 2024-2030

Chapter 7. Nut Ingredients Market – By Application

7.1 Introduction/Key Findings

7.2 Bakery and Confectionery

7.3 Snacks and Bars

7.4 Dairy Alternatives

7.5 Beverages

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Nut Ingredients Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Nut Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Nut Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Nut Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Nut Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Nut Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Nut Ingredients Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Blue Diamond Growers

9.2 Olam International

9.3 Archer Daniels Midland Company (ADM)

9.4 Barry Callebaut Group

9.5 Kanegrade Ltd.

9.6 Treehouse Almonds

9.7 Royal Nut Company

9.8 Mariani Nut Company

9.9 Borges Agricultural & Industrial Nuts

9.10 John B. Sanfilippo & Son, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Nut Ingredients Market was valued at USD 15 billion in 2023 and is projected to reach USD 23.6 billion by 2030, growing at a CAGR of 6.7%.

Key drivers include rising demand for healthy and functional foods, growth of plant-based diets, and expansion of the snack industry.

The market is segmented By Product (Almonds, Cashews, Peanuts, Hazelnuts, Walnuts, Pistachios, Macadamias, and Others) and by Application (Bakery, Snacks, Dairy alternatives, Beverages, Others).

North America is the most dominant region due to high consumption of nut-based products across various applications.

Leading players include Blue Diamond Growers, Olam International, ADM, and Barry Callebaut Group.