North America Wastewater Treatment Service Market Size (2024-2030)

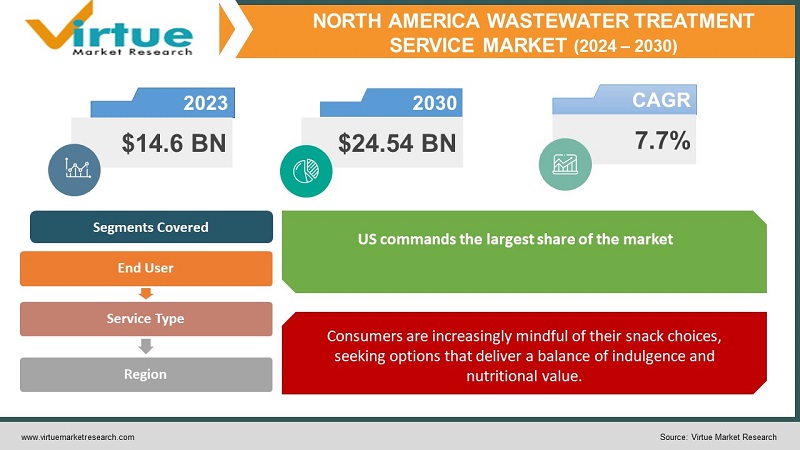

The North America Wastewater Treatment Service Market was valued at USD 14.6 Billion in 2024 and is projected to reach a market size of USD 24.54 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.7%.

The North American wastewater treatment service market encompasses a wide range of activities, all essential for maintaining environmental health, public safety, and regulatory compliance across residential, commercial, and industrial sectors. Wastewater is collected from homes and businesses through sewer networks. This involves sewage, greywater, and often some degree of pre-treatment from commercial or industrial sources. Highly variable waste streams depending on the industry. May contain heavy metals, chemicals, oil, biological matter, and other complex contaminants. Runoff from farms and livestock operations, potentially containing fertilizers, pesticides, and animal waste. A significant consideration, especially as extreme weather events increase. Managing and treating stormwater runoff is crucial to prevent pollution. Growing focus on membrane bioreactors (MBR), advanced oxidation processes for stubborn contaminants, resource recovery (phosphorus, energy), and decentralized treatment solutions.

Key Market Insights:

The intricate network of pipes and infrastructure that gathers wastewater from homes, businesses, and industrial facilities for transport to treatment plants. Regulations continuously evolve to address emerging contaminants of concern, forcing treatment plants to upgrade technology and processes. Many existing wastewater systems across North America are outdated, creating significant opportunities for modernization and system improvements. A shift from viewing wastewater as waste towards seeing it as a resource for energy (biogas), fertilizer (biosolids), and even reclaimed water. Water reuse has become increasingly vital, especially in drought-prone regions. Treated wastewater can be repurposed for irrigation or industrial applications. Wastewater treatment is a key link in the circular economy. Extracting value from waste reduces environmental impact and creates new revenue streams. Sensors, real-time monitoring, and advanced analytics optimize treatment processes, proactively detect problems, and enhance overall efficiency. Big data and AI applications are used to forecast equipment failures, streamline maintenance, minimize downtime, and promote asset longevity. A shift away from solely relying on massive, centralized plants. Decentralized systems are gaining traction for specific communities or industrial applications. Attracting and training a new generation of wastewater specialists is crucial. Focus on upskilling and knowledge retention is key to maintaining operations. Increased automation and user-friendly interfaces can assist new operators in a field that's becoming increasingly technologically complex.

North America Wastewater Treatment Service Market Drivers:

In both the United States and Canada, landmark legislation like the Clean Water Act and its provincial equivalents set the foundation for rigorous wastewater treatment standards. These regulations protect public health and the health of aquatic ecosystems.

The US Environmental Protection Agency (EPA)) to set water quality standards – maximum allowable levels of various pollutants that can be safely present in water bodies. Under the CWA and its equivalents, facilities discharging wastewater (from cities to industrial sites) require permits. These permits stipulate discharge limits and monitoring requirements tailored to the potential impact of the wastewater. Regulatory agencies have the authority to monitor compliance, issue fines, or even pursue legal action for violations that threaten the health of waterways and communities. As scientific knowledge of specific pollutants grows, standards evolve. Limits on once-overlooked contaminants become stricter or are newly regulated for the first time. Excess nutrients (phosphorus & nitrogen) fueling algal blooms and dead zones in the Great Lakes have led to a targeted crackdown on nutrient discharge limits. Municipalities, manufacturers and, any entity discharging wastewater, must ensure their treatment systems meet the standards. This fuels continuous upgrades, retrofits, or even new plant construction. Replacing outdated systems becomes an opportunity to adopt the modern technologies necessary to comply with current and evolving regulations. Savvy plant operators often invest in advanced treatment before regulations tighten further, getting ahead of the curve and easing future compliance burdens.

Wastewater is no longer just seen as something to be disposed of. Rather, it's being more and more recognized as a possible asset.

Methane gas generated during treatment can be captured and used to power the treatment plant itself or sold back to the energy grid. Treated wastewater to high standards can be reused for non-potable purposes like irrigation, landscaping, or certain industrial processes, easing pressure on freshwater resources. Resource recovery creates additional revenue streams for wastewater treatment plants, offsetting operational costs. Reducing reliance on chemical fertilizers, generating clean energy, and conserving freshwater all have positive environmental impacts that drive investment in these technologies. Government incentives or changing policies may further accelerate the adoption of resource recovery solutions. This creates opportunities for technology providers and specialized engineering services. As businesses and municipalities adopt greater sustainability targets, they'll seek wastewater treatment solutions that go beyond basic treatment toward resource recovery

North America Wastewater Treatment Service Market Restraints and Challenges:

The wastewater system in North America is largely antiquated, with some parts existing for several decades. The cost of replacement or rehabilitation is extremely high.

A vast portion of North America's wastewater infrastructure is outdated, some dating back many decades. Rehabilitation or replacement comes at a staggering price tag. Ignoring maintenance or pushing back necessary upgrades leads to failing systems, fines, and potential environmental harm - an even more expensive scenario in the long run. As regulations evolve, plants need expensive add-ons for specialized processes: nutrient removal, advanced filtration, and disinfection for emerging contaminants. The burden often falls on municipalities. Limited tax revenues, competing priorities, and public resistance to rate hikes make securing funds a major hurdle. Small towns or rural areas struggle even more with the costs of modernizing, lacking the economies of scale larger cities have. Modern treatment plants often use sophisticated technologies. Skilled and certified operators are crucial for optimal function and to prevent problems.

North America Wastewater Treatment Service Market Opportunities:

While massive municipal plants remain crucial, there's a shift towards smaller-scale, decentralized treatment systems for specific needs. These systems can be tailored to a community, industrial site's effluent, or even a single commercial building, treating wastewater closer to the source. Decentralized systems offer benefits like quicker deployment time, modular design for easy scaling, and the potential for specialized treatment of highly contaminated wastewater. Technologies to capture phosphorus and nitrogen for fertilizer production are in demand, supporting agriculture while reducing treatment plant costs. Maximizing biogas production from wastewater and investing in its efficient conversion to energy helps plants become more self-sufficient. Advanced treatment for the safe reuse of water in irrigation, industry, or even aquifer recharge expands the water supply, especially in drought-prone regions. Smart systems optimize treatment processes in real-time, responding to fluctuations in inflow quality and quantity for maximum efficiency. Predictive maintenance enabled by data analysis can prevent equipment breakdowns, extending asset life and minimizing costly disruptions. The sector's aging workforce and looming skills gap create a significant need and a chance for innovative solutions. Attracting a younger generation to the field is crucial. This requires changing public perception of wastewater careers as tech-focused and vital for the environment.

NORTH AMERICA WASTEWATER TREATMENT SERVICE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.7% |

|

Segments Covered |

By Service Type, end user, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA, CANADA, MEXICO |

|

Key Companies Profiled |

Xylem, Veolia, Suez, AECOM, Jacobs, Evoqua Water Technologies , Fluence, Centrisys/CNP, Black & Veatch |

North America Wastewater Treatment Service Market Segmentation:

North America Wastewater Treatment Service Market Segmentation: By End User -

- Municipal

- Industrial

- Commercial

Municipal: The dominant player, typically accounting for around 60-70% of the North American wastewater treatment service market. This reflects the sheer scale of public infrastructure and the continuous need for upgrades. Industrial: A significant segment, holding approximately 20-30% share. Increasingly stringent discharge regulations drive the need for industrial wastewater solutions. Commercial: Represents the smallest segment, around 5-10%. While important, its share is limited by smaller-scale treatment systems compared to municipal or complex industrial projects. Municipal is the Undisputed Leader. Aging infrastructure and the push for ever-cleaner water mandates continuously fuel this segment. Enormously centralized plants serve millions of people, leading to large, long-term contracts. While smaller than municipal overall, industrial shows the fastest growth trajectory.

North America Wastewater Treatment Service Market Segmentation: By Service Type -

- Design & Engineering

- Construction & Installation

- Equipment & Technology

- Operation & Maintenance (O&M)

Design & Engineering: The critical initial phase. Encompasses feasibility studies, system and process design, hydraulic modeling, regulatory compliance plans, and the creation of detailed blueprints used for construction. Construction & Installation: The physical building of new wastewater treatment plants (WWTPs), retrofits, upgrades, and the installation of specialized equipment. Requires civil engineering, contractors, and close coordination with equipment suppliers. Equipment & Technology: Companies specializing in the manufacture and supply of core treatment components: pumps, aeration systems, filters, membranes, disinfection units, bioreactors, sludge handling equipment, and a wide array of other technologies. Operation & Maintenance (O&M): The ongoing work of keeping plants functional, efficient, and compliant. Includes process monitoring, equipment maintenance, troubleshooting, asset management, and regulatory reporting. Due to the vast number of existing wastewater treatment facilities and the continuous, essential nature of this service, O&M often holds the dominant market share. The need to remove emerging contaminants and meet tighter effluent standards drives demand for advanced technologies and the specialized expertise to implement them. Focus on extracting value (energy, nutrients) from wastewater creates a growing market for specialized equipment and niche engineering services. Areas with aging infrastructure see greater focus on construction and upgrades. Regions with specific water quality concerns (e.g., harmful algal blooms) may see faster growth in specialized treatment technologies.

North America Wastewater Treatment Service Market Segmentation: Regional Analysis:

- USA

- Canada

- Mexico

The United States: Historically holds the dominant share of the North American market and is likely to continue its dominance. Estimates often place the US share around 75-80% of the total market. Canada: Possesses a significant market share, likely within the range of 15-20%. Mexico: Currently holds the smallest market share, likely in the 5-10% range, but has potential for significant growth as the country invests in improved wastewater infrastructure. The US holds the most substantial share of the North American market, the sheer size of the population and the corresponding scale of its wastewater infrastructure generate huge demand for maintenance, upgrades, new technologies, and operating services. Many US cities, especially in the Northeast and Midwest, have older systems in need of extensive modernization to meet current water quality standards. The US Environmental Protection Agency (EPA) sets nationwide standards, with many states adding even more stringent local regulations, pushing the need for advanced treatment. While a smaller current market share, Mexico exhibits strong potential to become the fastest-growing region within the North American wastewater services market. Rapid population growth and urbanization alongside increasing industrialization are straining Mexico's wastewater systems. The need to expand treatment capacity and improve existing infrastructure is significant.

COVID-19 Impact Analysis on the North America Wastewater Treatment Service Market:

Building and renovation work were delayed during the first lockdown. Staffing and regular maintenance schedules were impeded by social distancing techniques. Project delays were also caused by budgetary uncertainties as municipalities reallocated resources towards an emergency pandemic response. Building and renovation work were delayed during the first lockdown. Staffing and regular maintenance schedules were impeded by social distancing techniques. Project delays were also caused by budgetary uncertainties as municipalities reallocated resources towards an emergency pandemic response. It makes sense that public health issues gained center stage during the pandemic's early phases. Policymakers and the public may not have given wastewater treatment the immediate attention it needed, even though it is ultimately vital for public health. A possible method for tracking outbreaks is to test wastewater for the SARS-CoV-2 virus. Studies revealed that the genetic material of the virus might predict an increase in cases by being found in wastewater, giving public health professionals important early warning information. Increased frequency of handwashing and cleaning may have temporarily increased the volume of wastewater produced in homes as a result of increased public awareness of hygiene practices. Businesses that specialize in increasing the capacity of treatment plants would have benefited from this.

Latest Trends/ Developments:

A major shift away from merely viewing wastewater as something to dispose of. Instead, a focus on extracting valuable resources is taking hold. Technologies for efficiently capturing phosphorus and nitrogen (for fertilizer production) are in high demand, especially in regions battling nutrient pollution. Maximizing biogas production from sludge and its conversion to electricity is key to making treatment plants more self-sufficient and reducing operational costs. Driven by drought and water scarcity worries, advanced treatment trains to produce highly purified water for irrigation, industrial reuse, or even aquifer recharge are gaining importance. While centralized systems remain crucial, decentralized treatment systems are on the rise. These range from containerized units to constructed wetlands. Decentralized solutions can offer faster deployment, modularity, and the ability to tailor treatment to a specific industry or community's needs. These approaches leverage biological processes, engineered wetlands, or green infrastructure to treat wastewater while providing ecological advantages. The integration of sensors, real-time monitoring, data analytics, and AI is transforming wastewater management, allowing for greater efficiency and predictive responses.

Key Players:

- Xylem

- Veolia

- Suez

- AECOM

- Jacobs

- Evoqua Water Technologies

- Fluence

- Centrisys/CNP

- Black & Veatch

Chapter 1. North America Wastewater Treatment Service Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Wastewater Treatment Service Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Wastewater Treatment Service Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Wastewater Treatment Service Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Wastewater Treatment Service Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Wastewater Treatment Service Market– By End User

6.1. Introduction/Key Findings

6.2. Municipal

6.3. Industrial

6.4. Commercial

6.5. Y-O-Y Growth trend Analysis By End User

6.6. Absolute $ Opportunity Analysis By End User , 2024-2030

Chapter 7. North America Wastewater Treatment Service Market– By Service Type

7.1. Introduction/Key Findings

7.2. Design & Engineering

7.3. Construction & Installation

7.4. Equipment & Technology

7.5. Operation & Maintenance (O&M)

7.6. Y-O-Y Growth trend Analysis By Service Type

7.7. Absolute $ Opportunity Analysis By Service Type , 2024-2030

Chapter 8. North America Wastewater Treatment Service Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By End User

8.1.3. By Service Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Wastewater Treatment Service Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Xylem

9.2. Veolia

9.3. Suez

9.4. AECOM

9.5. Jacobs

9.6. Evoqua Water Technologies

9.7. Fluence

9.8. Centrisys/CNP

9.9. Black & Veatch

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Laws like the Clean Water Act (US) and similar provincial legislation across Canada set the foundation for rigorous wastewater treatment standards designed to protect waterways and public health.

Modernizing aging infrastructure, upgrading plants to meet stricter regulations, or building new systems is incredibly expensive. This is a major constraint, particularly for smaller municipalities or rural areas with limited budgets.

Xylem, Veolia, Suez, AECOM, Jacobs, Evoqua Water Technologies.

The United States currently holds the largest market share, estimated at around 75%.

Mexico exhibits the fastest growth, driven by its increasing population, and expanding economy.