North America Wafer Biscuits Market Size (2024-2030)

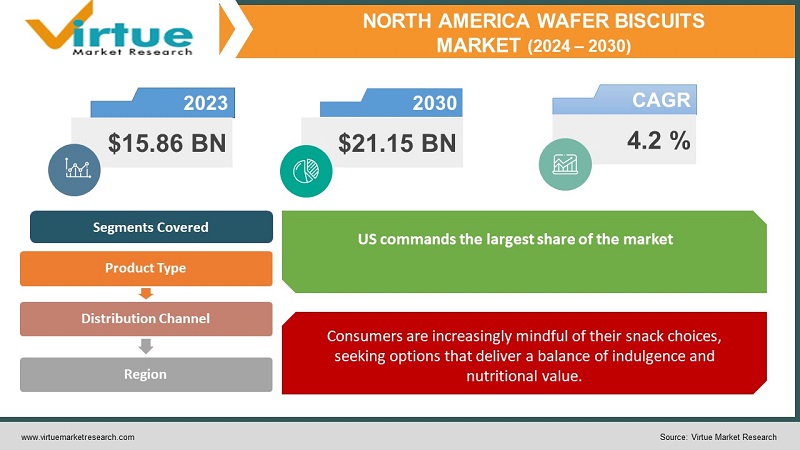

The North America Wafer Biscuits Market was valued at USD 15.86 Billion in 2023 and is projected to reach a market size of USD 21.15 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.2 %.

The North American wafer biscuit market exhibits a combination of major international players like Mondelez International, Ferrero Group, Nestle, and thriving private label or regional brands. Wafer biscuits fit perfectly into the rise of on-the-go snacking and grazing. Their packaging and portability make them a convenient choice. Wafer biscuits offer a balance of crunchy satisfaction with a lighter perception compared to heavy desserts. This taps into the desire for moderation and portion control. Consumers are receptive to innovative flavors and textures in wafers, driving product development beyond classic fillings and coatings. The demand for wafer biscuits with reduced sugar, whole grains, or added protein is on the rise, catering to a growing health-conscious segment. Artisanal wafer biscuits with gourmet fillings, high-quality ingredients, and sustainable packaging cater to a smaller but discerning consumer segment. The pace of life in North America contributes to the need for convenient, satisfying snacks that fit hectic schedules. While healthier variations are available, some wafer biscuits can be high in sugar or refined carbohydrates, a potential concern for some consumers. Expect to see wafer biscuits with added benefits – probiotics, protein-enriched, or incorporating superfood elements.

Key Market Insights:

The wafer biscuit market in North America, while often overshadowed by other snack categories, holds a distinct place in consumer preferences and boasts growth potential. Wafer biscuits offer a satisfying balance of crispy textures and sweet or savory fillings, delivering a sense of indulgence without being overly heavy. Many wafer biscuits have a long history, evoking a comforting sense of nostalgia and tradition, particularly for older demographics. While classic flavors remain popular, the market is witnessing an expansion into bolder, more sophisticated flavor profiles. High-quality ingredients, gourmet flavor combinations, and artisan-style wafer biscuits cater to consumers seeking a more premium snacking experience. Increasingly, inspiration is taken from popular desserts or familiar flavors from other snack categories to create unique and appealing hybrid wafer biscuit options. The general movement towards healthier snacking options influences the wafer biscuit market, with a focus on reduced sugar, added whole grains, and plant-based ingredients. Probiotics, added protein, or fiber-rich wafer biscuits position themselves within the wellness space, appealing to health-conscious consumers. Growing demand for ingredient transparency and 'cleaner' labels with fewer artificial additives influences product development within the segment. Supermarkets and hypermarkets remain the primary distribution channels for wafer biscuits due to their wide reach and product variety. The rise of convenient, on-the-go formats aligns with the growth of wafer biscuits as convenient snacks consumed outside the home. Online retailers offer a wider selection of global wafer biscuit brands and niche flavors, attracting the adventurous consumer and expanding the market reach beyond traditional stores. Aging populations may favor wafer biscuits for their easy-to-eat format. Younger consumers are drawn to innovative flavors and playful marketing. Busy lifestyles and a need for portable snacks suited for packed lunches or commutes boost the appeal of wafer biscuits.

North America Wafer Biscuits Market Drivers:

Consumers are increasingly mindful of their snack choices, seeking options that deliver a balance of indulgence and nutritional value.

The snacking landscape is undergoing a significant shift. Consumers are no longer content with mindless munching on empty calories. Instead, there's an increasing demand for snacks that offer some semblance of nutritional value, align with their evolving health goals, and address ethical or sustainability concerns. Consumers now seek indulgence that doesn't leave them feeling guilty. This might mean small portions, cleaner ingredients, or functional benefits that offer something extra. Snacks are now seen as a way to bridge the gap between meals, provide a boost of energy, or offer a nutritional pick-me-up within a busy day. There's a heightened awareness of what goes into snacks. Artificial additives, excessive sugar, and 'mystery ingredients' are becoming red flags for discerning consumers. Consumers are seeking out snacks that cater to individual dietary goals– gluten-free, vegan, high-protein, low-sugar, etc.

Hectic schedules, on-the-go commutes, and long work hours all fuel demand for convenient and portable snack options. Wafer biscuits fit perfectly into this niche.

In today's fast-paced world, convenience often outweighs complexity. This reality extends to our snacking habits, heavily influencing the evolution of the wafer biscuit market. Longer work hours, jam-packed schedules, and on-the-go lifestyles leave consumers with precious little time for elaborate food preparation, including snacking. Even small pockets of time– during commutes, between errands, or while waiting– are potential snacking opportunities. In an instant gratification culture, consumers want snacks that require minimal effort and can be enjoyed immediately. Snacking occurs throughout the day and in various settings – at work, in transit, during workouts, or as quick fuel for busy parents. Snacks must be easy to transport and consume in diverse environments without requiring utensils, complex preparation, or leaving behind messy residue.

North America Wafer Biscuits Market Restraints and Challenges:

Because of their manufacturing, sourcing, or uniqueness, several superfoods fetch higher costs. As a result, there is an economic barrier that can prevent access to a larger market.

Wafer biscuits, even with 'healthier' iterations, can easily be perceived as primarily sugary treats rather than a justifiable part of a balanced diet. The rise of snacks inherently positioned as healthy (fruit & nut bars, yogurt-based snacks) creates competition for wafer biscuits. Consumers are increasingly wary of token healthy ingredients masking a largely indulgent product. Finding authentic ways to incorporate nutritional benefits is needed. Prices of core wafer biscuit ingredients like wheat flour, sugar, and cocoa are subject to market fluctuations due to weather events, global demand, or trade policies. The push for less common inclusions (superfoods, specific nut varieties) can lead to higher costs and potential supply chain vulnerabilities. Global conflicts or trade disputes can disrupt the availability and affordability of imported wafer biscuit ingredients or raise costs for packaging materials. While premiumization has space, a large segment of the wafer biscuit market remains price-sensitive. Balancing innovation with affordability is an ongoing challenge.

North America Wafer Biscuits Market Opportunities:

Gourmet wafer biscuits with unexpected flavor pairings, high-quality inclusions (salted caramel, single-origin chocolate), or sophisticated flavor profiles will elevate the category. Limited edition flavors, artisanal-style branding, or highlighting unique ingredients tap into the desire for a more exclusive and indulgent snacking experience. Premium packaging, curated flavor assortments, and visually appealing wafer biscuits position them as potential options within the gifting market. Individual servings or multi-packs emphasize portion control. This helps wafer biscuits fit the mindset of consumers seeking a balance between enjoyment and moderation. Reduced sugar, naturally sweetened, or sugar-free wafer biscuits will gain broader relevance, as will those focusing on the quality of the sweet element (e.g., dark chocolate, maple syrup). Expanding gluten-free wafer biscuit options with delicious flavor profiles and satisfying textures will unlock this growing consumer segment. Exploring vegan wafer biscuits that go beyond basic substitutions (quality plant-based chocolate, creative cream fillings) caters to dietary trends and those seeking alternatives. Offering nut-free options in appealing flavor combinations provides a safe and enjoyable choice for those with common allergies. North American consumers are increasingly open to savory snacks. Wafer biscuits provide a unique textural canvas for savory iterations.

NORTH AMERICA WAFER BISCUITS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.2% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA, CANADA, MEXICO |

|

Key Companies Profiled |

Mondelez International, Inc., Kellogg Company, Campbell Soup Company, Dare Foods Limited, Parle Products Pvt. Ltd, Brittania Industries Limited, Pladis Global |

North America Wafer Biscuits Market Segmentation:

North America Wafer Biscuits Market Segmentation: By Product Type -

- Flavors (Classics, Fruit-Based, Gourmet/Innovative, Savory)

- Coating (Fully Coated, partially coated, Uncoated)

- Filling (Cream Fillings, Fruit-Based Fillings, Others)

Classic Flavors: This segment holds dominance, including perennial favorites like vanilla, chocolate, strawberry, and lemon. These flavors appeal to comfort-seekers, offer familiarity, and often evoke a sense of nostalgia. Fruit-Based Flavors: Offers variety with options like raspberry, blueberry, orange, coconut, and other fruit fillings or inclusions. These cater to those seeking brighter, possibly more refreshing flavor notes. Gourmet and Innovative: This rapidly growing segment boasts flavors like salted caramel, coffee-infused variations, spice blends, exotic fruits, and other unusual combinations. They tap into the desire for novelty and cater to more adventurous palettes. Savory: A less established, but emergent segment. Wafer biscuits with cheese fillings, herb infusions, and savory flavor profiles target consumers seeking an alternative to sweet snacks.

North America Wafer Biscuits Market Segmentation: By Distribution Channel -

- Supermarkets and Hypermarkets

- Convenience stores

- Online Retailers

- Vending machines

Supermarkets dominate the business, holding a market share of between 60% and 70%. Endcaps, special promotional displays, and dedicated shelf space make wafer biscuits impossible to miss, driving visibility and potential impulse purchases. Supermarkets are synonymous with competitive prices. This appeals to both budget-conscious shoppers and those seeking value for money when selecting wafer biscuits. Consumers can easily compare prices between different wafer biscuit brands or formats due to their proximity to supermarket shelves. With a 20–25% share, convenience stores are a substantial segment. Their extended business hours serve as a lifesaver for those who have cravings for impulsive snacks beyond regular grocery shop hours. Convenience stores strategically situate themselves in beverage aisles and next to checkouts to cater to customers' requirements for quick snacks. Estimated at 5–10%, the online retailer's industry is smaller but increasing quickly. Global wafer brands, specialty flavours, and difficult-to-find items that aren't available in nearby stores are available to consumers. Growth is fuelled by subscriptions and doorstep delivery, which appeals to people who lead busy lives.

North America Wafer Biscuits Market Segmentation: Regional Analysis:

- US

- Canada

- Mexico

The US commands the largest share of the market, estimated at approximately 70-75%. The vast US population with varied demographics provides a wide consumer base for wafer biscuits. Snacks are deeply woven into American food culture, boosting wafer biscuits' potential reach. A robust network of supermarkets, convenience stores, and online channels ensures widespread product availability. A robust network of supermarkets, convenience stores, and online channels ensures widespread product availability. Canada holds the second-largest share, accounting for roughly 20-25% of the market. Canadians exhibit a receptiveness to innovative wafer biscuit flavors and international trends. The growing emphasis on healthy snacking aligns with the potential for 'better-for-you' wafer biscuit lines to gain traction. Canada's multicultural population drives interest in diverse flavors and the potential for regionally popular wafer biscuits from different parts of the world. Holding an estimated 5–10% share, Mexico is a minor but rapidly expanding segment. Wafer biscuits' potential market is expanded by an increasing middle class with more disposable income. The younger population in Mexico tends to be more gregarious and willing to try new things.

COVID-19 Impact Analysis on the North America Wafer Biscuits Market:

The COVID-19 pandemic sent shockwaves through countless industries, and the North American wafer biscuit market was no exception. While wafer biscuits remained a pantry staple for many, the way consumers purchased and consumed them experienced a significant shift. As the pandemic gripped the continent in early 2020, panic buying surged. Consumers, worried about lockdowns and limited grocery store access, stockpiled non-perishable items, including wafer biscuits. This sudden spike in demand temporarily strained supply chains. Manufacturers scrambled to ramp up production, while retailers grappled with keeping shelves stocked. With restaurants and offices closed, people were snacking more at home, potentially leading to increased wafer biscuit consumption within households. During uncertain times, consumers often gravitate towards familiar and comforting foods. Wafer biscuits, with their nostalgic appeal and sweetness, might have fit this bill for some. Fewer trips to convenience stores, a key channel for impulse wafer biscuit purchases, could have led to a decline in unplanned purchases. With in-person shopping restricted, consumers turned to online platforms to buy groceries, including wafer biscuits. This accelerated the growth of e-commerce within the wafer biscuit market.

Latest Trends/ Developments:

An upsurge in popularity of ancient grains and ingredients used traditionally across various cultures (e.g., amaranth, teff, black rice). These ancient ingredients offer novel antioxidants, nutrients, and textures, adding an element of both health and novelty to wafer biscuits. The rich histories and traditional usage narratives behind these ingredients become a powerful marketing tool. Wafer biscuits align perfectly with the plant-forward eating trend. This includes both vegan options and wafer biscuits highlighting plant-based ingredients. High-protein plant-based wafer biscuits appeal to both vegetarians/vegans and those seeking to reduce meat intake for health or ethical reasons. Exploring novel plant-based protein sources (algae, pea protein, unique nuts) to create diverse flavors and textures in vegan wafer biscuits. Wafer biscuits incorporating fermented foods like kimchi or sauerkraut tap into the booming interest in probiotics for digestive health. Wafer biscuits infused with savory spices, and herbs, and inspired by international cuisines create a more sophisticated and adult snacking experience.

Key Players:

- Mondelez International, Inc.

- Kellogg Company

- Campbell Soup Company

- Dare Foods Limited

- Parle Products Pvt. Ltd

- Brittania Industries Limited

- Pladis Global

Chapter 1. North America Wafer Biscuits Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Wafer Biscuits Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Wafer Biscuits Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Wafer Biscuits Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Wafer Biscuits Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Wafer Biscuits Market– By Product Type

6.1. Introduction/Key Findings

6.2. Flavors (Classics, Fruit-Based, Gourmet/Innovative, Savory)

6.3. Coating (Fully Coated, partially coated, Uncoated)

6.4. Filling (Cream Fillings, Fruit-Based Fillings, Others)

6.5. Y-O-Y Growth trend Analysis By Product Type

6.6. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. North America Wafer Biscuits Market– By Distribution channel

7.1. Introduction/Key Findings

7.2. Supermarkets and Hypermarkets

7.3. Convenience stores

7.4. Online Retailers

7.5. Vending machines

7.6. Y-O-Y Growth trend Analysis By Distribution channel

7.7. Absolute $ Opportunity Analysis By Distribution channel , 2024-2030

Chapter 8. North America Wafer Biscuits Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Distribution Channel

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Wafer Biscuits Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Mondelez International, Inc.

9.2. Kellogg Company

9.3. Campbell Soup Company

9.4. Dare Foods Limited

9.5. Parle Products Pvt. Ltd

9.6. Brittania Industries Limited

9.7. Pladis Global

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Consumers view health as a multifaceted, proactive pursuit encompassing physical and mental well-being. Wafer biscuits align perfectly with this desire for deeply rooted, preventative solutions

Many high-quality wafer biscuits, especially those ethically sourced or with rarer ingredients, command higher prices. This creates an economic barrier, potentially limiting access to a wider demographic

Mondelez International, Inc., Kellogg Company, Campbell Soup Company

Dare Foods Limited, Parle Products Pvt. Ltd, Brittania Industries Limited

Pladis Global.

The US currently holds the largest market share, estimated at around 70%.

Mexico exhibits the fastest growth, driven by its increasing population, and expanding economy