North America Smoothies Market Size (2025-2030)

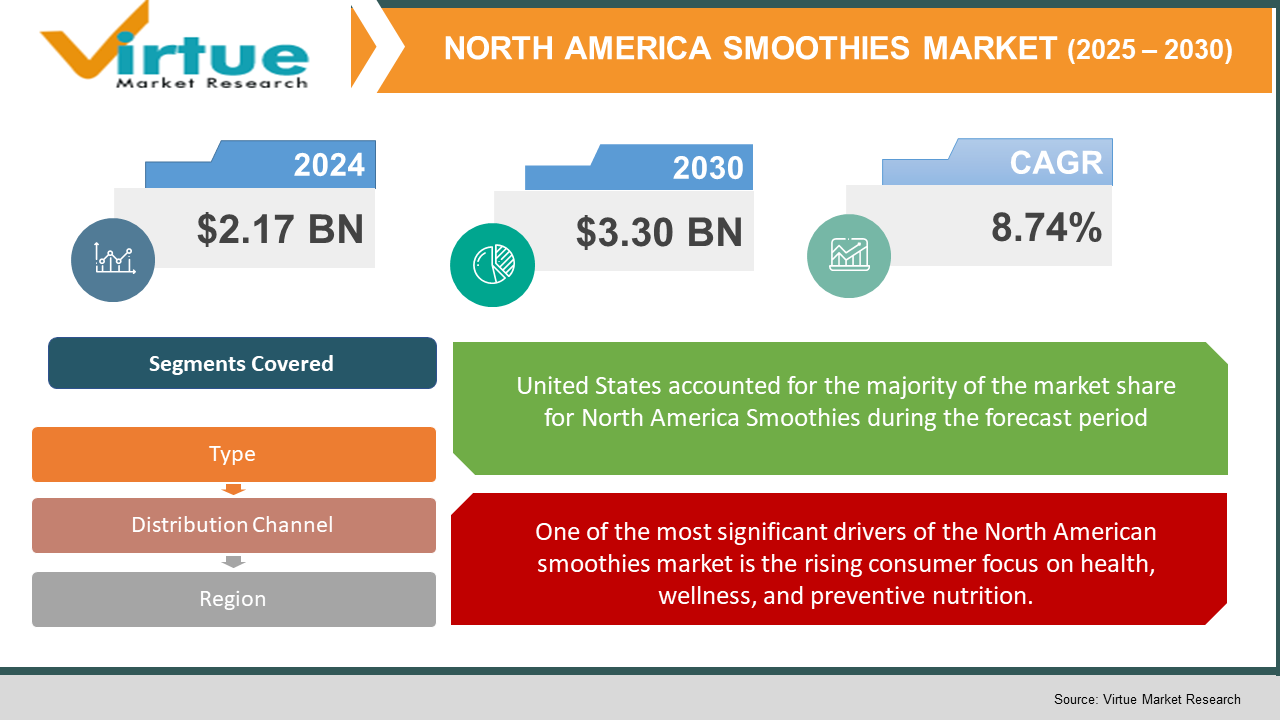

The North America Smoothies Market was valued at USD 2.17 billion in 2024 and is projected to reach a market size of USD 3.30 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.74%.

The North American smoothie market is one of the dynamic and fast-growing segments under the health and wellness food industry. Smoothies have also been ingrained as a diet for most health-conscious American and Canadian consumers due to the impetus of increasing consumer awareness towards nutrition, immunity, and clean-label ingredients. Furthermore, some of the trends influencing market growth are emerging plant-based diets and demand for meal replacement-on-the-go and fitness culture, which have all contributed to increased awareness of health and fitness among people. Traditional fruit mixes-cum-high-protein products, keto, and green detox have branched out widely under diverse mixes today to accommodate lifestyle and diet needs. Moreover, the burgeoning quick-service restaurants and ready-to-drink (RTD) options and the expansion of smoothie bars at retail avenues are strongly contributing to market penetration. Innovations in flavour, functional ingredients, and packaging are expected to keep the North American smoothie market buoyant and competitive shortly.

Key Market Insights:

High consumption frequency over 60% is regular buyers paired with strong preferences for green blends and customizable options.

Ready-to-drink and customisation dominate, with fresh at-home plus smoothie bars leading. Fruit-based smoothies claimed 55% of the market share.

With 177 million consumers and over 60% regular usage, smoothies enjoy deep market penetration. Fresh and frozen formats drive most of the household consumption, with a notable trend toward on-the-go and customizable options.

North America Smoothies Market Drivers:

One of the most significant drivers of the North American smoothies market is the rising consumer focus on health, wellness, and preventive nutrition.

In North America, the smoothie market has anticipated the surge in consumer attention to health, wellness, and preventive nutrition. It is this same concern about obesity, heart disease, and immunity that has made consumers "switch allegiance" from lazy, sugary, carbonated beverages to healthier alternatives like those now being prepared with smoothies. The results of the most popular smoothies these days include being enhanced with proteins, fibres, probiotics, vitamins, and other very special ingredients known as superfoods-including, but not limited to spirulina, chia seeds, and matcha. The post-COVID generation has also witnessed the surge of functional ingredients targeting immunity, energy, digestion, and detoxification. In addition to that, the trend of plant-based diets has also given rise to more vegan and dairy-free smoothies. According to market surveys, over 60% of North Americans have now been found to attach importance to foods or beverages that provide convenience together with nutritional benefits. Thus, this whole lifestyle change directs smoothie companies to embrace clean label, natural ingredients, and sustainability in sourcing, which makes health-conscious consumption a significant long-term growth pathway.

Another major market driver is the rapid growth of smoothie bars, quick-service restaurants (QSRs), and grab-and-go retail formats.

The rapid expansion of smoothie bars, quick-service restaurants (QSRs), and grab-and-go retail formats is yet another major driving force for the overall market. In urban settlements in North America, chains of smoothie bars like Jamba, Smoothie King, and Tropical Smoothie Cafe are aggressively expanding to satisfy the demand for easy, customizable, and fresh beverages. These stores allow customers to customise their smoothies by selecting ingredients according to any dietary requirement, such as low sugar, high protein, vegan, or keto-friendly. Supermarkets and convenience stores, meanwhile, are increasing their shelf space for ready-to-drink smoothies in bottles and pouches. The convenience factor, along with busy lifestyles and evolving trends toward meal replacements, has created an impetus for increased consumption of smoothie beverages. Product innovations like resealable bottles and recyclable materials work in favour of the product being purchased on the go. This perfect trifecta of health, customisation, and convenience is now driving the market in both dine-in and retail channels.

North America Smoothies Market Restraints and Challenges:

One of the primary restraints in the North American smoothies market is the high cost associated with sourcing fresh, organic, and functional ingredients.

Intense costs are among the biggest restraint factors for North America's smoothie market in sourcing fresh, organic, and functional ingredients. As consumer trends continue to inch towards nutrient-rich, clean-label, and plant-based smoothies, manufacturers are facing increasing pressure to include premium components like berries, avocados, protein powders, superfoods, and dairy alternatives such as almond or oat milk. These ingredients are usually high-priced in terms of procurement and require an advanced mechanism of storage, especially if sourced through organic or imported methods, thus raising the production cost the other hand brings higher retail prices, mostly alienating price-sensitive consumers. The same applies to cold-chain logistics for fresh ingredients, vastly encouraging high operating costs, particularly in small to mid-sized brands. Affordability and quality, and nutrition in such a highly competitive market become a key challenge. Rising inflation in food and beverages further complicates the situation for some sectors to make profits without sacrificing the integrity of the product.

North America Smoothies Market Opportunities:

The smoothie market in North America is rife with huge opportunities for the introduction of functional and tailored beverages. The more health-focused consumers seek benefits beyond basic nutrition forms, the more they will be interested in smoothies containing adaptogens, collagen, prebiotics, antioxidants, and plant-based proteinsthese would be further substitutable for smoothie brands to create formulations that cater to specific needs like immunity boosting, skin health, mental clarity, and digestive wellness. The advancements in artificial intelligence and data-driven personalisation pave the way for smoothie manufacturers to customise blends according to customer preferences, dietary restrictions, and health goals. Subscription-based models are picking up steam, as are interactive apps that help users track the nutrients they consume and suggest personalised smoothies. Such packages not only appeal to the conscious consumer but are also humorous with their unique packaging and ethical sourcing of ingredients. Truly, this wave of personalisation, wellness focus, and tech-enabled services creates many opportunities for innovation and future growth in the North American smoothies landscape.

NORTH AMERICA SMOOTHIES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.74% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, usa, canada, mexico |

|

Key Companies Profiled |

BASF SE, Schlumberger Limited, Halliburton Company, Clariant AG, Stepan Company, Croda International Plc, Dow Inc., Solvay S.A., Huntsman Corporation, and Evonik Industries AG |

North America Smoothies Market Segmentation:

North America Smoothies Market Segmentation: By Type

- Fruit-Based Smoothies

- Dairy-Based Smoothies

- Green Smoothies

- Protein Smoothies

- Others

Fruit-based smoothies dominate the market for their natural sweetness and high vitamin content, as consumers consider fruit smoothies to be a healthier alternative to soft drinks laden with sugar. Dairy-based smoothies come next in popularity for their creamy texture and rich protein content, but they are facing serious competition from the rise of plant-based smoothies. Green smoothies-mostly packed with leafy veggies such as spinach or kale-are addressing detox and fitness trends and are quickly becoming popular among the health-conscious. Protein smoothies find their strong niche among gym-goers and busy professionals involved with meal replacements. The other segment, accounting for detox, energising, and functional blends, is quickly growing based on consumer need for tailored health benefits: immunity and digestion, to mental clarity.

North America Smoothies Market Segmentation: By Distribution Channel

- Smoothie Bars & QSRs

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Others

The domain of Smoothie and QSR chains includes some of the leading players like Smoothie King and Jamba, who offer specialised blends suitable for the younger generation of health-conscious consumers. Quick service, freshness of ingredients and flavour customisation are some of the features of these outlets. Supermarkets and hypermarkets would then constitute the next distribution channel under RTD smoothies, which are characterised by many ready-to-drink smoothies, usually marketed for convenience on the go. Convenience stores serve the impulse buyer and traveller through single servings. The online retail section is expanding rapidly because of the direct-to-consumer brands' market offering DIY kits, personalised subscriptions, and functional smoothie powders. There are also some other outlets like cafes, gyms, and wellness centres that make up this niche requirement, but mostly serve as incubators for trends on innovative ingredients and blends.

North America Smoothies Market Segmentation: Regional Analysis:

- USA

- Canada

- Mexico

Dominance bides with the United States in the North American smoothies market because of many things: a well-developed culture of health and well-being, a high number of smoothie bar chains in the country, and high spending on functional beverages by consumers. Benefits from such a broad market include ready-to-drink smoothies available off the shelf in supermarkets, as well as customised blends available in smoothie cafes, such as those in the US. Canada is the second and is contributor to growth in the industry by consumption demand among urban citizens who require plant-based, organic, and nutrient-rich beverages. This blending trend moves and converges with health consciousness and rising memberships in gyms, which boosts smoothie consumption in Canadian cities. Meanwhile, Mexico is tapping into the booming fruit drink market and adopting Western way-of-life trends in the coming years. The market is equally gaining the momentum of the conscious trend called nutrition awareness and has further expanded its retail availability.

COVID-19 Impact Analysis on the North America Smoothies Market:

The COVID-19 pandemic had a mixed but transformational effect on the North American smoothies market. Early lockdowns saw many of the smoothie bars and quick-service restaurants temporarily close, leading to a decline in in-store sales. This, however, was soon offset by strong demand for health-boosting, immunity-enhancing beverages, as consumers began focusing more on nutrition and preventive wellness measures. Retail sales of ready-to-drink smoothies surged substantially, especially those with functional ingredients such as vitamin C, zinc, and antioxidants. The pandemic also helped drive the acceptance of online shopping for groceries and subscription smoothie kits, thereby increasing the e-commerce channel. Moreover, consumer interest in clean-label, natural, and plant-based products spurred product reformulation efforts. Even though supply chains were initially disrupted, their resilience formed the basis for long-lasting demand-led growth and innovations for the smoothies sector.

Latest Trends/ Developments:

To support immunity, gut health, stress relief, and cognition, adaptogens, collagen, probiotics, turmeric, and mushrooms are being added for increased functionality in the North American smoothie scene. Expect to find more exotic and global flavours like yuzu, matcha, and tropical fruits in stores and menus, treating sophisticated palates to new taste experiences. Plant-and-vegan formulation expansions continue, with almond, oat, and soy milks backing dairy-free offerings that are bolstered with A-list functionalities. The new generation of personalisation is coming on strong via AI customisation, build-your-own smoothie bars, and subscription kits geared to individual nutrient preferences. Packaging sustainability has been high on the agenda, with the implementation of compostable cups, recyclable materials, and cutting back on single-use plastic, which resonates strongly with eco-conscious consumers. Afterwards, the online and direct-to-consumer model growth has been propelled by e-commerce kits and delivery services, given transformations in lifestyle changes and advanced cold chain technology that prolongs the life span of fresh ingredients.

Key Players:

- BASF SE

- Schlumberger Limited

- Halliburton Company

- Clariant AG

- Stepan Company

- Croda International Plc

- Dow Inc.

- Solvay S.A.

- Huntsman Corporation

- Evonik Industries AG

Chapter 1. North America Smoothies Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary source

1.5. Secondary source

Chapter 2. NORTH AMERICA SMOOTHIES MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. NORTH AMERICA SMOOTHIES MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. NORTH AMERICA SMOOTHIES MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. NORTH AMERICA SMOOTHIES MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. NORTH AMERICA SMOOTHIES MARKET – By Type

6.1 Introduction/Key Findings

6.2 Fruit-Based Smoothies

6.3 Dairy-Based Smoothies

6.4 Green Smoothies

6.5 Protein Smoothies

6.6 Others Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. NORTH AMERICA SMOOTHIES MARKET – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Smoothie Bars & QSRs

7.3 Supermarkets & Hypermarkets

7.4 Convenience Stores

7.5 Online Retail

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel , 2025-2030

Chapter 8. NORTH AMERICA SMOOTHIES MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Distribution Channel

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. NORTH AMERICA SMOOTHIES MARKET – Company Profiles – (Overview, Type , Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 Schlumberger Limited

9.3 Halliburton Company

9.4 Clariant AG

9.5 Stepan Company

9.6 Croda International Plc

9.7 Dow Inc.

9.8 Solvay S.A.

9.9 Huntsman Corporation

9.10 Evonik Industries AG

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The North America Smoothies Market was valued at USD 2.17 billion in 2024 and is projected to reach a market size of USD 3.30 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.74%.

Rising health consciousness and demand for functional, nutrient-rich beverages are key drivers of the North American smoothies market.

Based on Service Provider, the North America Smoothies Market is segmented into material manufacturers, Raw Material Suppliers, Lab information management systems, Distributors & Wholesalers, End-to-End Solution Providers.

The United States is the most dominant region for the North America Smoothies Market.

BASF SE, Schlumberger Limited, Halliburton Company, Clariant AG, Stepan Company, Croda International Plc, Dow Inc., Solvay S.A., Huntsman Corporation, and Evonik Industries AG are the key players in the North America Smoothies Market.