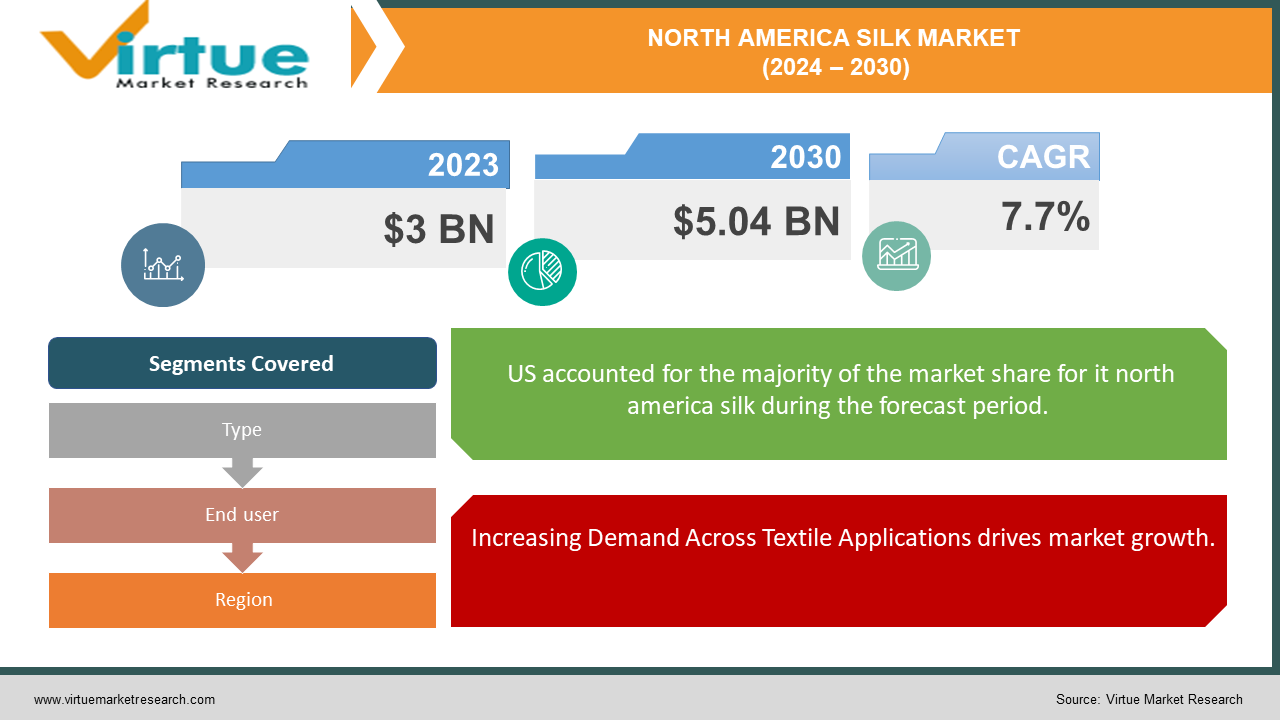

North America Silk Market Size (2024-2030)

The North America Silk Market was valued at USD 3 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 5.04 billion by 2030, growing at a CAGR of 7.7%.

Silk, a natural fiber derived from silkworm cocoons through sericulture, was historically used for parachutes but now finds use in clothing. Its protein fiber, fibroin, is best sourced from Bombyx mori silkworms, with high-quality silk requiring approximately 10,000 cocoons. Silk is versatile, and employed in diverse applications like bicycle tires and medicine. Its absorbency and thermal properties make it ideal for summer wear, offering comfort, softness, and elegance. Textiles represent the largest and fastest-growing use of silk, with mulberry silk dominating the market both in value and volume, poised for continued growth.

The silk market is experiencing steady growth fueled by rising demand in the textile industry, driven by its unique properties. Additionally, diversification into high-value sectors like cosmetics and medical industries, coupled with ongoing technological advancements in sericulture processes, further contribute to its expansion. Moreover, silk's low conductivity makes it ideal for applications such as ties, shirts, haute couture garments, formal dress suits, robes, kimonos, and sundresses. With increasing demand driven by these essential factors, the silk market is poised for growth.

Key Market Insights:

The increasing demand for silk in textiles highlights its enduring appeal and versatility across various applications, shaping market dynamics. Evolving fashion trends drive innovation and product diversification. Additionally, rising purchasing power in emerging markets and favorable government policies stimulate market expansion by broadening consumer demographics and market access. These elements collectively influence the market landscape, showcasing its adaptability to changing consumer preferences and market dynamics.

North America Silk Market Drivers:

Increasing Demand Across Textile Applications drives market growth.

Silk is rapidly expanding its presence in textiles, prized for its luster, luxurious texture, lightweight nature, resilience, and strength. It is integral to a wide array of clothing items such as wedding gowns, blouses, scarves, and neckties, as well as home furnishings like pillows, wall hangings, draperies, and upholstery.

Its absorbent properties make silk exceptionally comfortable in warm weather, while its low conductivity retains warmth in cold climates. This versatility extends to various clothing types including shirts, ties, formal dresses, lingerie, pajamas, robes, dress suits, sundresses, and kimonos. In India, silk is traditionally used to create sarees, emphasizing its cultural and textile significance.

Increasing popularity in cosmetics and medical applications increases market demand.

The rising popularity of silk in cosmetics and medical applications is driving its market expansion. In cosmetics, silk proteins are prized for their moisturizing, anti-aging, and skin-rejuvenating properties, leading to their inclusion in various skincare and beauty products. This trend capitalizes on the robust growth of the cosmetics industry.

On the medical front, silk's biocompatibility, strength, and flexibility make it ideal for use in sutures, tissue engineering, and medical implants. Ongoing advancements in bioengineering and nanotechnology are uncovering new applications for silk in medicine, expanding its role beyond traditional uses. This diversification into high-value sectors is creating new markets and growth opportunities, significantly shaping the dynamics of the silk market.

North America Silk Market Restraints and Challenges:

Health hazards hinder market growth.

Health hazards during silkworm rearing pose significant challenges to market growth. The process involves handling diseased worms and their excreta, potentially impacting worker health. These risks include factors related to reproductive health, contributing to conditions like endometrial cancer. Despite these challenges, the silk production process combines ancient techniques with modern innovations, encompassing cocoon production, reeling, throwing, weaving, and dyeing. Silk fibroin and silk polypeptide, integral components of silk varieties like Mulberry, Tussar, and Eri silk, find applications across diverse industries.

High Material Costs hinder market growth.

Silk stands out as one of the most costly materials, requiring delicate care such as dry cleaning. Vulnerable to sun and water damage, silk's upkeep adds to its expense for consumers, posing challenges to market growth due to its overall high cost.

North America Silk Market Opportunities:

The silk used in different industries creates opportunities in the market.

Silk's absorbent nature and thermal properties benefit cosmetics, while its softness and elegance enhance medical textiles. Despite its luxurious appeal, silk's high maintenance costs, necessitating dry cleaning and susceptibility to sun and water damage, contribute to its expensive status. Its versatility spans textiles for gowns, wedding attire, scarves, and household items like pillows and upholstery. Silk's application extends to diverse products including bicycle tires and summer wear. However, challenges such as health risks during silkworm rearing may affect market growth in the forecast period.

Development and Advanced Products create opportunities.

Moreover, the rapid advancement of the silk industry, requiring fewer production funds, presents lucrative opportunities for market players in the forecast period. Additionally, manufacturers' development of technologically advanced products in sericulture is poised to further bolster the future growth of the silk market.

NORTH AMERICA SILK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.7% |

|

Segments Covered |

By Type, end user, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA, CANADA, MEXICO |

|

Key Companies Profiled |

Anhui Silk, Jinchengjiang Xinxing Cocoon Silk Co. Ltd., Bolt Threads, Kraig Biocraft Laboratories Inc., Qingdao Textiles Group Fiber Technology Co. Ltd., Wujiang First Textile Co. Ltd., Camenzind and Co. AG, Libas Ltd., Eastern Silk Industries Ltd. and Eris Global. |

North America Silk Market Segmentation:

North America Silk Market Segmentation- By Type:

- Eri Silk

- Mulberry Silk

- Tussar Silk

- Others

The mulberry silk sub-segment is expected to experience rapid growth during the analysis period, driven by its reputation for high quality and nourishing properties for human skin. Known for its softness, antibacterial traits, and hypoallergenic benefits, mulberry silk is sought after for treating skin conditions like atopic dermatitis, contributing to its strong market demand. These unique attributes are projected to significantly impact the silk market size in the forecast period.

Furthermore, mulberry silk is increasingly gaining traction in the cosmetics sector, where its natural protein structures offer benefits for skin and hair care products. Silk proteins, renowned for their moisturizing and anti-aging properties, are being integrated into various cosmetics such as creams, serums, and makeup items. This trend is driven by the expanding cosmetics industry and consumer preference for natural and sustainable beauty solutions. The versatility and biocompatibility of silk position it as a promising ingredient in this sector, with the potential for ongoing growth as research and product innovation continue.

North America Silk Market Segmentation- By End User:

- Textile

- Cosmetics

- Medical

The textile sub-segment held the largest share of the silk market, driven by its exceptional properties such as lightweight fabric, luxurious feel, and strong durability. Silk plays a pivotal role in various applications including surgical sutures, clothing like wedding dresses, gowns, blouses, scarves, and neckties, as well as household items such as pillows, wall hangings, draperies, and upholstery. This diverse usage is expected to further propel the textile sub-segment throughout the analysis period.

Additionally, silk is increasingly making inroads into the cosmetics segment, leveraging its natural protein structures beneficial for skin and hair care products. Silk proteins, renowned for their moisturizing and anti-aging effects, are being incorporated into a wide range of cosmetics, from creams and serums to makeup products. This trend is fueled by the expanding cosmetics industry and growing consumer preference for natural and sustainable beauty solutions. The versatile and biocompatible nature of silk positions it as a promising ingredient in this sector, with the potential for sustained growth as research and product development efforts continue to advance.

North America Silk Market Segmentation- by region

- U.S.A.

- Canada

- Mexico

The US market dominates the North American Silk Market, benefiting from a large consumer base that values luxury textiles. Silk is renowned for its association with elegance and sophistication, making it highly desirable for high-quality clothing, accessories, and home furnishings. The fashion industry in the United States drives demand for premium textiles like silk, with American designers frequently incorporating silk fabrics into their collections, further boosting its popularity among consumers.

Moreover, North America is seeing an uptick in silk usage in niche markets such as cosmetics and medical applications, driven by technological advancements and growing awareness of its unique properties. The region boasts high consumer purchasing power and a strong presence of luxury brands, contributing to the robust market landscape.

Canada's silk market is forecasted to experience growth, while Mexico's market also shows promising potential for expansion in the future.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic prompted businesses in hospitality, retail, and tourism to reassess their operations. Likewise, the silk market experienced a downturn due to transportation accessibility challenges, leading to delays and cancellations of purchases by both local and international buyers amid market uncertainty. These factors collectively contributed to a decline in silk fiber markets during the outbreak period.

Despite these challenges, governmental agencies are implementing strategic initiatives to support and advance the silk sector, aiming to mitigate the adverse impacts and foster recovery.

Latest Trends/ Developments:

January 17, 2024: AMSilk GmbH and Danish 21st.BIO A/S partnered to accelerate AMSilk's production of recombinant spider silk protein using E. coli.

December 14, 2023: Kraig Biocraft Laboratories Inc. announced the successful creation of its latest batch of recombinant spider silk, marking an early start to the production season and validating its manufacturing strategy.

October 04, 2023: Bolt Threads Inc. finalized a merger agreement with Golden Arrow Merger Corp, taking Bolt Threads public.

Key Players:

These are the top 10 players in the North American Silk Market: -

- Anhui Silk

- Jinchengjiang Xinxing Cocoon Silk Co. Ltd.

- Bolt Threads

- Kraig Biocraft Laboratories Inc.

- Qingdao Textiles Group Fiber Technology Co. Ltd.

- Wujiang First Textile Co. Ltd.

- Camenzind and Co. AG

- Libas Ltd.

- Eastern Silk Industries Ltd.

- Eris Global

Chapter 1. North America Silk Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Silk Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Silk Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Silk Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Silk Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Silk Market– By Type

6.1. Introduction/Key Findings

6.2. Eri Silk

6.3. Mulberry Silk

6.4. Tussar Silk

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. North America Silk Market– By End User

7.1. Introduction/Key Findings

7.2. Textile

7.3. Cosmetics

7.4. Medical

7.5. Y-O-Y Growth trend Analysis By End User

7.6. Absolute $ Opportunity Analysis By End User , 2024-2030

Chapter 8. North America Silk Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By End User

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Silk Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Anhui Silk

9.2. Jinchengjiang Xinxing Cocoon Silk Co. Ltd.

9.3. Bolt Threads

9.4. Kraig Biocraft Laboratories Inc.

9.5. Qingdao Textiles Group Fiber Technology Co. Ltd.

9.6. Wujiang First Textile Co. Ltd.

9.7. Camenzind and Co. AG

9.8. Libas Ltd.

9.9. Eastern Silk Industries Ltd.

9.10. Eris Global

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The increasing demand for silk in textiles highlights its enduring appeal and versatility across various applications, shaping market dynamics. Evolving fashion trends drive innovation and product diversification.

The top players operating in the North America Silk Market are - Anhui Silk, Jinchengjiang Xinxing Cocoon Silk Co. Ltd., Bolt Threads, Kraig Biocraft Laboratories Inc., Qingdao Textiles Group Fiber Technology Co. Ltd., Wujiang First Textile Co. Ltd., Camenzind and Co. AG, Libas Ltd., Eastern Silk Industries Ltd. and Eris Global

The COVID-19 pandemic prompted businesses in hospitality, retail, and tourism to reassess their operations. Likewise, the silk market experienced a downturn due to transportation accessibility challenges, leading to delays and cancellations of purchases by both local and international buyers amid market uncertainty.

. Its versatility spans textiles for gowns, wedding attire, scarves, and household items like pillows and upholstery.

Canada's silk market is forecasted to experience growth, while Mexico's market also shows promising potential for expansion in the future.