North America Rollator Walker Market Size (2024-2030)

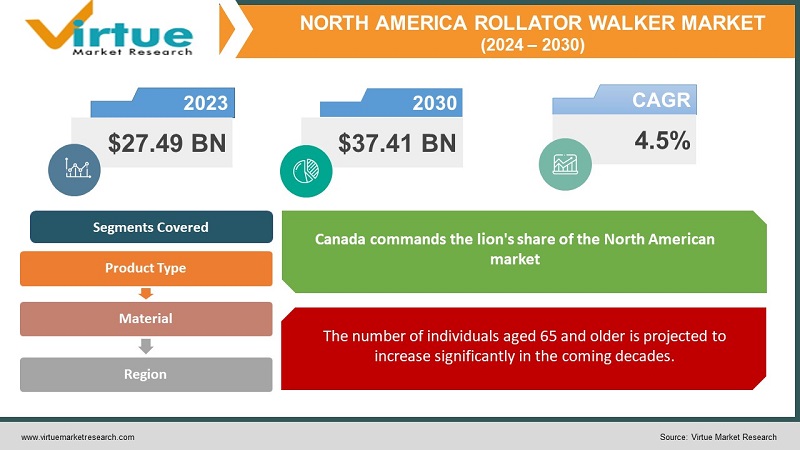

The North America Rollator Walker Market was valued at USD 27.49 Billion in 2024 and is projected to reach a market size of USD 37.41 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.5%.

Rollator walkers, also known as wheeled walkers or rollators, are mobility assistive devices that offer enhanced stability and ease of movement compared to traditional walkers. North America's aging population represents the primary driver of the rollator walker market. As people age, their mobility and balance can become less steady, increasing the need for supportive devices like rollators. Rollators play a crucial role in promoting mobility and independence during recovery from surgeries, injuries, and other medical procedures. Individuals with osteoarthritis, multiple sclerosis, Parkinson's disease, and other chronic conditions often rely on rollators to maintain mobility and independence. Modern rollators boast lightweight construction, intuitive features, and varied designs, making them more appealing to younger demographics and those with active lifestyles. The sleek design of contemporary rollators reduces the stigma traditionally associated with assistive devices, increasing their acceptance among various user groups. Medicaid, Medicare, and private insurance policies often provide partial or full coverage for rollator walkers, increasing accessibility for those who need them. North America boasts a well-established network of medical supply stores, pharmacies, and online retailers offering a wide range of rollator walker options.

Key Market Insights:

The 65+ age group is the fastest-growing demographic in North America. This directly translates to increased demand for rollator walkers as mobility challenges become more prevalent with age. Rollators serve a diverse user base. Younger adults recovering from injuries, those with chronic illnesses, or people seeking active lifestyle support also utilize them, broadening the market scope. Increased healthcare spending associated with the aging population and the treatment of chronic conditions contributes to market growth, as rollator walkers can be prescribed or purchased as part of treatment plans. Smart' rollators are an emerging trend, incorporating sensors for gait analysis, navigation assistance, fall detection, and communication features to enhance user experience and safety. Modern rollators look less clinical, with sleek designs and multiple color choices, boosting user acceptance and addressing stigma. While coverage varies, Medicare, Medicaid, and some private insurance plans offer reimbursement for rollator walkers. This increases accessibility and drives market growth. Some rollator brands are exploring direct-to-consumer sales models, particularly for those offering customization or high-end features. This allows them greater control over marketing and consumer interactions. While canes and walkers are less direct competitors, they present lower-cost alternatives for some individuals. Additionally, mobility scooters are an alternative for users with more significant mobility limitations. Potential users often research extensively online before purchasing, comparing features, reading reviews, and seeking the best fit for their needs. Short-term rollator rentals are becoming more accessible, catering to post-surgical recovery or temporary needs, offering an alternative to outright purchase.

North America Rollator Walker Market Drivers:

The number of individuals aged 65 and older is projected to increase significantly in the coming decades.

Average lifespans have increased as a result of improvements in healthcare, nutrition, and general living conditions. The older population segment is growing rapidly as a result of the vast cohort of people born in the post-World War II era who are now approaching senior years. On the other hand, as a result of lower birth rates in recent decades, fewer younger individuals are joining the population to counteract the aging demographic. Decreases in strength, flexibility, and balance brought on by aging-related declines in bone density, muscle mass, and joint health can make walking more challenging and raise the risk of falling. Chronic illnesses like arthritis, heart disease, osteoporosis, and neurological disorders are increasingly prevalent in older adults. These illnesses often have a direct impact on a person's capacity for safe and independent mobility. Recovery from operations falls, and other injuries typically take longer in older persons. During this phase of recovery, rollator walkers are essential for improving mobility and recovering independence. Rollators strike a balance between support and encouraging mobility. They allow seniors to move around confidently, reducing the need for constant assistance from others, and preserving dignity and a sense of autonomy. Rollators with seats and brakes offer crucial stability, minimizing fall risks in both indoor and outdoor settings. This is particularly important as falls can have devastating consequences for the elderly. Used under the guidance of physical therapists or healthcare professionals, rollators facilitate a gradual and safe return to independent movement after injury, surgery, or a period of reduced mobility.

Historically, assistive devices like walkers had a stigma, implying frailty or disability. This is changing due to awareness augmenting its demand.

Rollators have undergone a style overhaul. Out are the sterile, clinical-looking devices. They're now designed to blend in or even stand out as fashion accessories. Innovations focus on ease of use, maneuverability, and comfort. Features like adjustable heights, cushioned seats, and intuitive brakes enhance the user experience and emphasize practical benefits. Instead of highlighting limitations, brands and marketers now promote rollator walkers as tools for independence, activity, and confidence. The emphasis is on what the user can do. The language around rollators is becoming more inclusive. Campaigns aimed at seniors highlight social engagement and maintaining active lifestyles. Messaging for younger user groups might emphasize injury recovery and fitness support. More diverse depictions of rollator users are emerging in media and advertising. This includes active seniors, individuals with temporary disabilities, and younger people using rollators as part of their fitness routines. There's an increased awareness that mobility aids like rollators don't have to be the last resort. They can be used at the first sign of instability or decreasing stamina to prevent falls and maintain safe movement.

North America Rollator Walker Market Restraints and Challenges:

Basic rollators can be purchased for a reasonable price, but more sophisticated models with features like custom fitting, advanced braking systems, or integrated lighting can be somewhat pricey.

While basic rollators can be affordable, more advanced models with features like integrated lighting, advanced braking systems, or custom fitting can be quite expensive. This creates a barrier for some consumers, especially those on fixed incomes. Insurance coverage (Medicare, Medicaid, private) for rollators exists, but it can be inconsistent. Strict eligibility criteria, co-payments, and limits on replacement frequency can leave some users with significant out-of-pocket costs. Disparities in healthcare access and insurance coverage across North America can further complicate the affordability of rollator walkers for certain populations in specific regions. Despite evolving perceptions, a residual stigma persists around using assistive devices. Some potential users might resist the idea of a rollator, associating it with declining capabilities or a loss of self-image. A segment of the population may still be unaware of the benefits of modern rollator walkers or how they differ from outdated stereotypes. This could include both potential users and healthcare providers who might not recommend them proactively. Even when aware, individuals may hesitate to use a rollator due to concerns about appearing frail or dependent, impacting their initial willingness to adopt the device. While rollator design continues to advance, limitations persist. Some models can be bulky, difficult to maneuver in tight spaces, or cumbersome to fold and transport – creating practical hurdles for users. Rollators can struggle on uneven terrain, thick carpets, or in homes with narrow hallways and doorways. This might limit their utility in certain situations or living environments.

North America Rollator Walker Market Opportunities:

The growing segment of individuals aged 65+ is a primary driver of the rollator market. As this population expands, the need for mobility aids will continue to rise, creating a strong base for sustained market growth. Models focusing on lightweight construction, sleek designs, and features promoting continued participation in hobbies and activities. Rollators prioritize comfort, robust support, larger seats, and integrated storage for oxygen tanks or other medical necessities. Rollators offer a less cumbersome alternative to walkers during recovery from surgeries (e.g., hip or knee replacements) or injuries. This short-term use market has room for growth, particularly with increased awareness among healthcare providers. People with Multiple Sclerosis, Parkinson's, or other conditions affecting mobility can benefit from rollators during periods of fatigue or decreased balance. Partnerships with patient organizations could expand awareness and adoption. Rollators as a tool to enable increased walking distances for individuals who want to stay active but face stamina limitations. This taps into the wellness trend and requires messaging emphasizing activity potential. Incorporating sensors for gait analysis, fall detection, and activity tracking opens up new possibilities for health monitoring and personalized support, especially for seniors. Exploring concepts that combine rollator functionality with partial weight-bearing support or easy transitions to a seated position for rests. Connecting rollators to smart home systems and healthcare platforms can offer fall alerts, remote monitoring by family or caregivers, and data insights for healthcare providers.

NORTH AMERICA ROLLATOR WALKER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Product Type, Material, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA, Canada, mexico |

|

Key Companies Profiled |

Drive DeVilbiss Healthcare, Medline Industries, NOVA Medical Products, Graham-Field (GF Health Products), Hugo Mobility, Stander, Invacare Corporation |

North America Frozen Fruits Market Segmentation:

North America Frozen Fruits Market Segmentation: By Product Type

- 3-Wheeled Rollators

- 4-Wheeled Rollators

- Specialized Rollators

3-Wheeled Rollators- Three wheels arranged in a triangular pattern, two rear wheels, and one swivel wheel at the front. Prioritize maneuverability and ease of turning in tight spaces. Ideal for indoor use, navigating small apartments, or homes with narrow doorways. Lightweight design. Often more affordable than 4-wheeled models. While precise data can fluctuate, 3-wheeled rollators hold a significant share of the market, estimated to be around 30-40%. 4-Wheeled Rollators- Four wheels for enhanced stability. Usually, incorporate a built-in seat for resting and storage baskets or bags. Better suited for outdoor use on uneven surfaces. Offer greater support and comfort for those needing frequent rest breaks. 4-wheeled rollators dominate the market, capturing an estimated 60-70% share. This reflects the versatility and wider range of features catering to diverse user needs. Specialized Rollators- Designed to promote better posture for those with back pain or specific conditions. Smaller scale, often without seats, specifically for home use. Robust construction with larger, treaded wheels for use on trails, cobblestones, etc. Designed to support higher weight capacities. While less dominant than 3 and 4-wheeled, specialized rollators represent a significant and growing segment as innovation and targeted design increases. They hold a combined estimated market share within the 10-15% range.

North America Frozen Fruits Market Segmentation: By Material

- Aluminum

- Carbon Fiber

- Steel

Aluminum: Aluminum dominates the market, accounting for approximately 75-85% of rollators. Its balance of affordability, appropriate weight, and durability is a key driver. This lightweight metal is the cornerstone of rollator construction, prized for its strength-to-weight ratio and overall affordability. Carbon Fiber: This represents a smaller but expanding segment, estimated at roughly 10-15% market share. Its primary appeal lies in the ultra-lightweight segment. Known for its exceptional strength, rigidity, and extremely lightweight nature. Carbon fiber rollators are often considered premium products. Steel: Steel holds the smallest share, likely below 10%, primarily used in heavy-duty, bariatric models, or in some lower-cost options where weight is less crucial. While less common than the other two, steel finds its niche in specific applications, particularly where increased strength and weight are less of a concern.

North America Frozen Fruits Market Segmentation: Regional Analysis:

- US

- Canada

- Mexico

Canada commands the lion's share of the North American market, estimated at approximately 75-80%. The US has a sizable senior population, a primary driver of rollator demand. A well-established network of medical supply stores, hospitals, and rehabilitation centers makes rollators readily accessible. Medicare, Medicaid, and various private insurance plans often provide reimbursement for rollators, increasing affordability. The US is a major hub for medical device innovation, driving product development and the availability of advanced rollator models. Canada holds the second largest share, accounting for roughly 15-20% of the market. Likewise, the US is experiencing a significant population aging trend, boosting the demand for mobility aids. Mexico currently represents a smaller but rapidly developing segment, with an estimated 5-10% share of the North American market. Mexico's expanding middle class has greater disposable income and an increasing focus on preventative healthcare and wellness. Improvements in Mexican healthcare infrastructure and access could significantly increase accessibility to assistive devices like rollators. The changing age pyramid in Mexico points to a future surge in demand for mobility solutions for the elderly.

COVID-19 Impact Analysis on the North America Rollator Walker Market:

The rollator walker market was not exempt from the seismic waves caused by the COVID-19 epidemic, which affected almost every business. Rollators and raw materials could not be imported or manufactured easily because of lockdowns, border restrictions, and plant outages. Temporary shortages and possible price volatility resulted from this. Early in the pandemic, rollator sales and fitting services were negatively hampered by people's fears of going to crowded medical supply stores and their decreased access to elective treatment. Regular mobility examinations and the prescription of assistive devices were neglected in favor of treating COVID-19 patients, which took up a disproportionate quantity of resources and attention. Some rehabilitation institutions were forced to close or scale back due to lockdowns and safety concerns, which caused a delay in the availability of rollators for patients undergoing physical therapy or recovering from surgery. Particularly among the elderly, the pandemic increased people's awareness of their health and susceptibility. As a result, some people started thinking forward and using rollators to preserve their freedom and safe mobility. Interest in at-home mobility solutions increased as a result of the need to reduce hospital or clinic visits. Teleconsultations with healthcare doctors and rollator sales on the internet both experienced expansion. Rollators may become more widely acknowledged as important resources in the post-COVID rehabilitation process for those who, after recovering from the virus, continue to have weakness or balance problems.

Latest Trends/ Developments:

Rollators are shedding their clinical appearance. Sleek designs, vibrant colors, and ergonomic features transform them into lifestyle products with greater user acceptance. Rollators are designed with ease of use in mind – simple folding mechanisms, adjustable handles, comfortable handgrips, and lightweight construction make them accessible to a wider range of users. More brands offer customizable options with various colors, accessories (baskets, cup holders, etc.), and even rollators tailored for specific activities (e.g., outdoor models with larger wheels). Sensors embedded in rollators can track activity levels, gait patterns, and potential fall risks, providing valuable health insights to users, caregivers, and healthcare providers. Technology assists users with visual impairments or for navigating complex environments like hospitals, providing guidance and warnings for enhanced safety. Rollators are being marketed as fitness support tools for seniors wanting to maintain longer walking distances and for individuals recovering from injuries or dealing with temporary mobility limitations. Rollators play an increasing role in post-surgical rehabilitation and are promoted as tools to prevent falls and regain independence as quickly as possible Rollator companies might collaborate with fitness centers, rehabilitation clinics, or senior living communities to shift the perception of rollators toward proactive wellness support. Some rollator brands are bypassing traditional retail channels to sell directly to consumers online. This can offer greater model choice and potentially lower costs due to streamlined distribution. Short-term rollator rentals are becoming more accessible for temporary needs (post-surgery, rehabilitation), making them a viable option for budget-conscious users or those unsure of long-term requirements. The growing use of telehealth platforms opens up avenues for virtual assessments, consultations, and personalized rollator recommendations by healthcare providers to improve accessibility.

Key Players:

- Drive DeVilbiss Healthcare

- Medline Industries

- NOVA Medical Products

- Graham-Field (GF Health Products)

- Hugo Mobility

- Stander

- Invacare Corporation

Chapter 1. North America Rollator Walker Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Rollator Walker Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Rollator Walker Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Rollator Walker Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Rollator Walker Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Rollator Walker Market– By Product Type

6.1. Introduction/Key Findings

6.2. 3-Wheeled Rollators

6.3. 4-Wheeled Rollators

6.4. Specialized Rollators

6.5. Y-O-Y Growth trend Analysis By Product Type

6.6. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. North America Rollator Walker Market– By Material

7.1. Introduction/Key Findings

7.2. Aluminum

7.3. Carbon Fiber

7.4. Steel

7.5. Y-O-Y Growth trend Analysis By Material

7.6. Absolute $ Opportunity Analysis By Material , 2024-2030

Chapter 8. North America Rollator Walker Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Material

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Rollator Walker Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Drive DeVilbiss Healthcare

9.2. Medline Industries

9.3. NOVA Medical Products

9.4. Graham-Field (GF Health Products)

9.5. Hugo Mobility

9.6. Stander

9.7. Invacare Corporation

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

North America, like many developed nations, has a rapidly aging population. The senior segment (65+) is the fastest growing and a core driver of demand for mobility aids like rollators.

While basic rollators exist, models with advanced features, smart technology, or custom fitting can be expensive, creating a barrier for some consumers. While coverage exists, it can be inconsistent, leaving users with significant out-of-pocket costs. Reimbursement procedures can be complex and eligibility criteria strict.

Drive DeVilbiss Healthcare, Medline Industries, NOVA Medical Products,

Graham-Field (GF Health Products), Hugo Mobility, Stander, Invacare Corporation.

Canada currently holds the largest market share, estimated at around 75%.

Mexico exhibits the fastest growth, driven by its increasing population, and expanding economy.