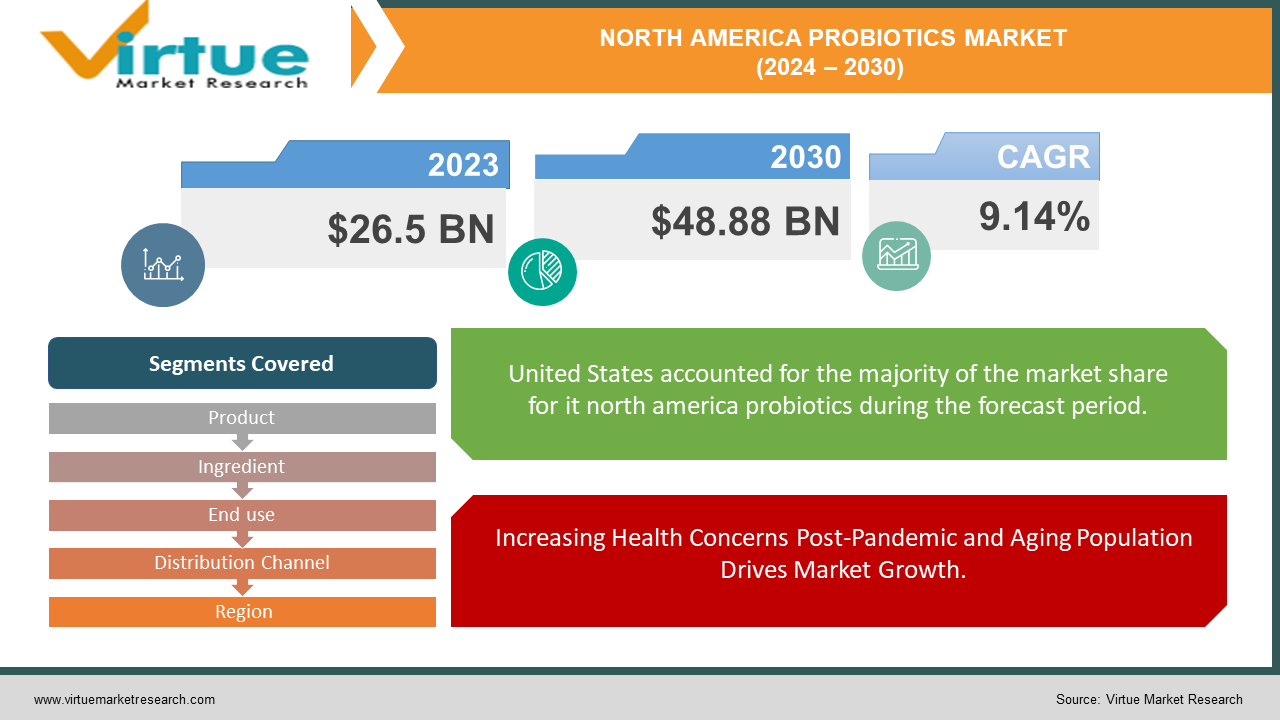

North America Probiotics Market Size (2024-2030)

The North America Probiotics Market was valued at USD 26.5 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 48.88 billion by 2030, growing at a CAGR of 9.14%.

Probiotics encompass live microorganisms known for their potential health advantages upon ingestion. Recognized as beneficial bacteria within the gastrointestinal tract, they play a crucial role in maintaining digestive well-being by outcompeting harmful bacteria. Sources of probiotics vary and include fermented foods like yogurt and sauerkraut, dietary supplements, and even beauty products. Each probiotic strain is distinguished by its unique taxonomy, comprising genus, species, subspecies, and an alphanumeric strain identifier.

Key Market Insights:

In North America, heightened awareness of healthy living amidst a stressful work culture has driven increased probiotic consumption. Additionally, prevalent allergies such as lactose intolerance and peanut allergies have spurred interest in probiotics to foster a beneficial gut microbiome. Probiotics have also gained traction as substitutes in animal feeds, aiming to enhance animal health and the quality of their by-products.

North America Probiotics Market Drivers:

Increasing Health Concerns Post-Pandemic and Aging Population Drives Market Growth.

The increasing awareness of probiotics' health benefits, including enhanced gut health and overall digestive function, is expected to drive market growth. With a rising interest in proactive health management, consumers are seeking natural, non-pharmaceutical solutions to support their gut microbiome. Dairy products are anticipated to achieve significant market penetration due to the growing consumption of functional dairy items aimed at promoting digestive wellness.

Key among these is heightened consumer health consciousness, prompting increased adoption of supplements and foods that support well-being. This trend has been amplified during the COVID-19 pandemic, with a sharper focus on preventive healthcare.

Continual research into probiotics' benefits has fostered the development of innovative formulations tailored to specific strains and health conditions. The convenience of online shopping has further bolstered accessibility, enabling consumers to easily explore a wide range of probiotic products and compare options.

Additional drivers include expanding populations, flourishing economies, and a preference for functional foods in select markets.

North America Probiotics Market Restraints and Challenges:

High Cost hinders market growth.

The probiotics market faces several constraints, with one of the primary challenges being the high costs associated with research and development to innovate new probiotic strains. Significant investments are necessary for establishing laboratories, acquiring research equipment, and recruiting skilled professionals to conduct R&D activities.

Furthermore, the use of probiotics in populations where their efficacy is not yet approved can potentially result in adverse effects, prompting consumer skepticism regarding their health benefits. This regulatory uncertainty poses a notable restraint on market growth and adoption.

North America Probiotics Market Opportunities:

Innovative products in different sectors create opportunities.

The burgeoning probiotics market presents numerous opportunities for companies to develop innovative products catering to consumer demand for digestive health benefits. This growth is fueled by evolving consumer preferences and purchasing patterns, as more individuals seek out functional foods and beverages that promote digestive wellness.

Within this landscape, the probiotics supplements market segment stands out as a particularly promising avenue for pharmaceutical companies to venture into. By introducing products that align with consumer health priorities, pharmaceutical firms can effectively expand their product portfolios and capitalize on the expanding probiotics market.

NORTH AMERICA PROBIOTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.14% |

|

Segments Covered |

By Product, ingredient, end use, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA, Cnada, mexico |

|

Key Companies Profiled |

Arla Foods, Yakult Honsha Co., Ltd., BioGaia, i-Health, Inc., Chr. Hansen Holding A/S, Lifeway Foods Inc., DuPont De Nemours, Inc., Mother Dairy Fruit & Vegetable Pvt. Ltd., Danone, Kerry Group plc |

North America Probiotics Market Segmentation:

North America Probiotics Market Segmentation By Product:

- Probiotic Food & Beverages

- Dairy Products

- Non-Dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

The probiotic food and beverage segment has emerged as a dominant force in the market, driven by manufacturers fortifying their products with enzymes and probiotics to meet consumer demand for higher nutritional and fiber content. These ingredients, widely integrated into products like fish oil and yogurt, aim to mitigate gut health issues. Increasing consumer awareness about enhancing quality of life and rising disposable incomes have spurred the adoption of probiotics as a health solution, prompting manufacturers to expand their operations to meet the growing demand in the food and beverage sectors.

Meanwhile, the probiotic dietary supplements segment is poised for significant growth in the forecast period. Rising health concerns such as hypertension, sedentary lifestyles, obesity, and inadequate diets are fueling interest in wellness programs, driving demand for probiotic supplements. These supplements are recognized for bolstering immune systems and addressing various gastrointestinal conditions, dental health issues, and potentially even breast cancer. In the United States, a growing number of adults and children are turning to dietary supplements like probiotics to supplement their diets and improve overall health.

North America Probiotics Market Segmentation By Ingredient:

- Bacteria

- Yeast

The bacteria-based ingredient segment holds a dominant position in the market, offering a wide array of health benefits for both humans and animals. These products serve as aflatoxin adsorbents, aid in preventing colon cancer, and contribute to managing oral diseases, urinary tract infections, respiratory infections, gastrointestinal disorders, and other bacterial infections. The growth of the market is propelled by several factors, including the rising popularity of functional foods, the adoption of probiotic ingredients in developing economies, and increasing disposable incomes.

Looking ahead, the demand for yeast-based probiotics is expected to increase significantly. These products offer distinct advantages over bacterial probiotics, particularly in treating intestinal issues, managing gastric acidity, and addressing various forms of diarrhea. Yeast-based dietary supplements are favored for their substantial content of proteins, amino acids, vitamin B, and peptides. Additionally, probiotic yeast is widely regarded as safe for consumption across all age groups.

North America Probiotics Market Segmentation By End-use:

- Human Probiotics

- Animal Probiotics

The human probiotic segment has asserted dominance in the market, driven by factors such as the aging population and the corresponding increase in chronic diseases. This demographic shift is anticipated to heighten the demand for probiotics to help manage prevalent chronic conditions like colon cancer, inflammatory bowel disease (IBD), and diarrheal illnesses.

Concurrently, the animal probiotics segment is poised for growth in the forecast period. There has been a notable uptick in the adoption of probiotics in farm animal feed in recent years. Probiotics have demonstrated significant benefits in enhancing immune systems, optimizing animal performance, and improving digestive health. Growing concerns over animal welfare and the desire to minimize antibiotic use in livestock further underscore the increasing demand for animal probiotics.

North America Probiotics Market Segmentation By Distribution Channel:

- Hypermarkets / Supermarkets

- Pharmacies / Drugstores

- Specialty Stores

- Online Stores

- Others

Probiotics sold through hypermarkets and supermarkets dominate the market, driven by the convenience of accessing a diverse range of products in one location. This ease of purchase has bolstered the position of supermarkets and hypermarkets as prominent distribution channels in recent years. Meanwhile, the regulatory environment governing probiotics has shaped their availability in pharmacies and drugstores, where probiotic supplements are often classified as over-the-counter (OTC) products, accessible without a prescription.

Simultaneously, online distribution channels have witnessed significant growth in the probiotics industry, driven by their convenience and accessibility. Online shopping enables consumers to explore and compare a wide array of probiotic offerings from the comfort of their homes, eliminating the need to visit physical stores.

North America Probiotics Market Segmentation- by region

- U.S.A.

- Canada

- Mexico

The United States is poised to experience the fastest growth in the probiotics market within the region. A significant portion of the North American population faces various allergies such as peanut allergies and lactose intolerance, prompting a shift towards probiotics to cultivate a beneficial gut microbiome. Increased awareness about health and wellness has further driven probiotics consumption. The U.S. market for probiotic products is pivotal due to its expanding consumer base spanning all age groups from infants to seniors.

Moreover, rising disposable incomes and a growing emphasis on healthy lifestyles contribute significantly to the market's expansion in the country.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has significantly altered people's dietary preferences and consumption patterns. There's been a heightened awareness regarding daily food choices, with a notable increase in demand for immune-boosting products in response to the pandemic's impact. This shift has had a positive effect on the probiotics market, prompting substantial product launches aimed at meeting the rising consumer demand for immune support.

Latest Trends/ Developments:

January 2023: KeVita, a brand under Tropicana, expanded its Sparkling Probiotic Lemonade line by introducing a mango flavor alongside its classic and peach offerings. These products were rolled out in major US retail chains such as Kroger and Walmart.

July 2022: BioGaia introduced its BioGaia Pharax probiotic products for children into the US market. Claiming to enhance children's immune and upper respiratory systems, these products aim to meet growing health needs.

June 2022: Danone North America launched Activia+ Multi-Benefit Probiotic Yogurt Drinks, fortified with vitamins C, D, and zinc. Positioned to support immune health, these drinks were introduced as part of Danone's probiotic offerings in the market.

Key Players:

These are the top 10 players in the North America Probiotics Market: -

- Arla Foods

- Yakult Honsha Co., Ltd.

- BioGaia

- i-Health, Inc.

- Chr. Hansen Holding A/S

- Lifeway Foods Inc.

- DuPont De Nemours, Inc.

- Mother Dairy Fruit & Vegetable Pvt. Ltd.

- Danone

- Kerry Group plc

Chapter 1. North America Probiotics Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Probiotics Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Probiotics Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Probiotics Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Probiotics Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Probiotics Market– By Product

6.1. Introduction/Key Findings

6.2. Probiotic Food & Beverages

6.2.1. Dairy Products

6.2.2. Non-Dairy

6.2.3. Cereals

6.2.4. Baked Food

6.2.5. Fermented Meat

6.2.6. Dry Foods

6.3. Probiotic Dietary Supplements

6.3.1. Food Supplements

6.3.2. Nutritional Supplements

6.3.3. Specialty Supplements

6.3.4.Infant Formula

6.4. Animal Feed

6.5. Y-O-Y Growth trend Analysis By Product

6.6. Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. North America Probiotics Market– By Ingredient

7.1. Introduction/Key Findings

7.2. Bacteria

7.3. Yeast

7.4. Y-O-Y Growth trend Analysis By Ingredient

7.5. Absolute $ Opportunity Analysis By Ingredient, 2024-2030

Chapter 8. North America Probiotics Market– By Distribution Channels

8.1. Introduction/Key Findings

8.2. Hypermarkets / Supermarkets

8.3. Pharmacies / Drugstores

8.4. Specialty Stores

8.5. Online Stores

8.6. Others

8.7. Y-O-Y Growth trend Analysis By Distribution Channels

8.8. Absolute $ Opportunity Analysis By Distribution Channels , 2024-2030

Chapter 9 . North America Probiotics Market– By End-use

9.1. Introduction/Key Findings

9.2. Human Probiotics

9.3. Animal Probiotics

9.4. Y-O-Y Growth trend Analysis By End-use

9.5. Absolute $ Opportunity Analysis By End-use, 2024-2030

Chapter 10. North America Probiotics Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.1.4. Rest of North America

10.1.2. By Product

10.1.3. By Ingredient

10.1.4. Distribution Channels

10.1.5. End-use

10.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. North America Probiotics Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1. Arla Foods

11.2. Yakult Honsha Co., Ltd.

11.3. BioGaia

11.4. i-Health, Inc.

11.5. Chr. Hansen Holding A/S

11.6. Lifeway Foods Inc.

11.7. DuPont De Nemours, Inc.

11.8. Mother Dairy Fruit & Vegetable Pvt. Ltd.

11.9. Danone

11.10. Kerry Group plc

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

In North America, heightened awareness of healthy living amidst a stressful work culture has driven increased probiotic consumption

The top players operating in the North America Probiotics Market are - Arla Foods, Yakult Honsha Co., Ltd., BioGaia, i-Health, Inc., Chr. Hansen Holding A/S, Lifeway Foods Inc., DuPont De Nemours, Inc., Mother Dairy Fruit & Vegetable Pvt. Ltd., Danone, Kerry Group plc.

The COVID-19 pandemic has significantly altered people's dietary preferences and consumption patterns.

. The burgeoning probiotics market presents numerous opportunities for companies to develop innovative products catering to consumer demand for digestive health benefits. This growth is fueled by evolving consumer preferences and purchasing patterns, as more individuals seek out functional foods and beverages that promote digestive wellness.

The United States is poised to experience the fastest growth in the probiotics market within the region.