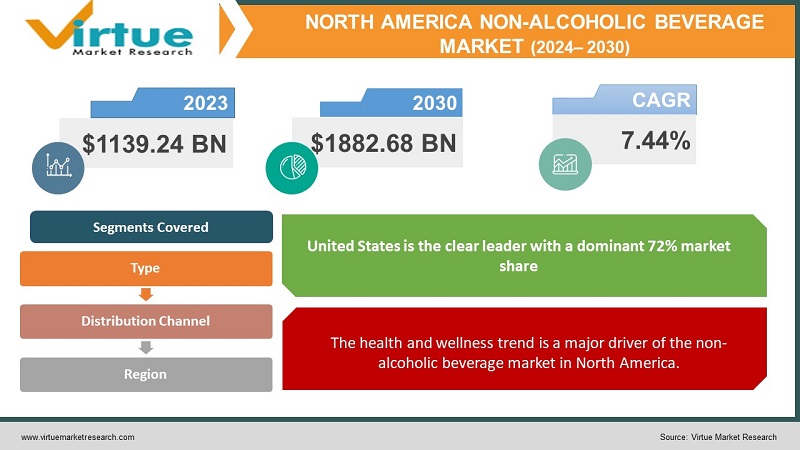

North America Non-Alcoholic Beverage Market Size (2024-2030)

The North America Non-Alcoholic Beverage Market was valued at USD 1139.24 Billion in 2023 and is projected to reach a market size of USD 1882.68 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.44%.

One of the most vibrant and varied areas of the food and beverage business is the non-alcoholic beverage sector in North America. Products in this market include carbonated soft drinks, water in bottles, juices, sports drinks, energy drinks, teas, and coffees that are ready to drink, dairy-free beverages, and plant-based substitutes. The industry is influenced by a number of variables, including shifting customer tastes, wellness and health trends, product formulation advancements, and rising disposable incomes. Over the past ten years, the non-alcoholic beverage industry in North America has grown significantly, and this trend is anticipated to continue. Due to the introduction of new and creative goods as well as the increasing per capita consumption, the market is rather large. The main players in the market are the United States and Canada, with the former holding the greatest share owing to its sizable population and high level of beverage consumption.

Key Market Insights:

- Carbonated soft drinks (CSDs) still hold a significant market share at around 20%, although facing pressure from healthier beverage alternatives.

- The demand for functional beverages, including enhanced waters, sports drinks, and energy drinks, is expected to grow at a CAGR exceeding 7% by 2025, fueled by consumer interest in health and wellness.

- The market for plant-based beverages, including dairy alternatives like soy milk, almond milk, and oat milk, is projected to reach over USD 30 billion by 2024, driven by changing dietary preferences.

- Sales of cold brew coffee and ready-to-drink (RTD) tea are expected to surpass USD 25 billion by 2026 in North America, reflecting a growing consumer preference for convenient and flavourful beverages.

- Over 50% of North American consumers report actively seeking out sugar-free or low-sugar beverage options.

- The demand for natural and organic non-alcoholic beverages is on the rise, with a projected market size exceeding USD 20 billion by 2027.

- E-commerce platforms are capturing a growing share of the North American non-alcoholic beverage market, with online sales projected to reach over USD 20 billion by 2024.

- Subscription box services delivering curated selections of non-alcoholic beverages directly to consumers are gaining traction, particularly within the craft beverage segment.

- North American consumers are increasingly concerned about the environmental impact of beverage packaging. Over 60% of consumers express a preference for recyclable or sustainable packaging materials.

- The use of refillable bottles and reusable containers is gaining traction, with an estimated 10% growth rate projected by 2023.

North America Non-Alcoholic Beverage Market Drivers:

The health and wellness trend is a major driver of the non-alcoholic beverage market in North America.

The shift from high-calorie, sugar-filled beverages to low-calorie, sugar-free alternatives is one of the biggest shifts in consumer behavior. The increased knowledge of the negative health effects of consuming large amounts of sugar, such as obesity, diabetes, and heart disease, is what is causing this change. In response to this trend, beverage producers are repurposing existing goods to include less sugar and launching new ranges of calorie-free beverages. Functional drinks are becoming more and more well-liked since they provide more health advantages than just being hydrated. These beverages are frequently enhanced with probiotics, vitamins, minerals, and other beneficial components. Sports drinks that improve athletic performance, energy drinks that increase focus and endurance, and drinks that promote intestinal health are a few examples.

Technological advancements and continuous product development are crucial drivers of the non-alcoholic beverage market.

Innovations in packaging are enhancing the convenience and appeal of non-alcoholic beverages. For example, resealable and single-serve packaging formats cater to on-the-go consumers. Eco-friendly packaging solutions, such as biodegradable bottles and cans made from recycled materials, address environmental concerns and attract environmentally conscious consumers. The bottled water segment is experiencing significant innovation, with companies introducing enhanced water products. These include flavored waters, vitamin-infused waters, and electrolyte-enhanced waters. Such products cater to consumers looking for hydration options that offer additional health benefits without added sugars or calories.

North America Non-Alcoholic Beverage Market Restraints and Challenges:

For beverage makers, upholding high standards of quality and ensuring food safety presents a significant challenge. Products have to abide by safety standards established by organizations like Health Canada and the U.S. Food and Drug Administration (FDA). Standards for ingredients, processing, packaging, and storage must all be followed. Any departure from these requirements may lead to product recalls, fines, and reputational harm to the brand. Regulations pertaining to labeling and advertising are also major concerns for the sector. On product labels, manufacturers are required to offer precise and understandable information about ingredients, nutritional value, and health claims. False or misleading promises may result in consumer outrage and governmental action. Regulations must also be followed in advertising and marketing activities to safeguard consumers and avoid misleading advertising. The non-alcoholic beverage market is highly competitive and saturated, posing challenges for both new entrants and established players. The presence of numerous brands and product varieties makes it difficult for companies to differentiate themselves and capture market share.

North America Non-Alcoholic Beverage Market Opportunities:

Although the North American non-alcoholic beverage sector is getting close to maturity, emerging regions offer substantial development potential. By utilizing their experience and well-known brands, businesses may increase their footprint in these areas. Rapid economic expansion in emerging nations, especially in Asia and Latin America, is creating a growing middle class with rising disposable incomes. Demand for premium and functional non-alcoholic goods, as well as premium drinks, is being driven by this group. Beverage firms are finding new prospects as a result of urbanization and changing lifestyles in emerging nations. Convenient, ready-to-drink drinks are becoming more and more in demand as more people relocate to cities. In addition, the popularity of other non-alcoholic beverages is increasing due to the adoption of Western diets and lifestyles. It is anticipated that demand for nutrient-dense and functional drinks will keep rising. Businesses should look at potential to develop drinks that target certain health needs, such as drinks with added protein, gut health benefits, and immunity-boosting properties. Innovation in this market can increase customer loyalty and interest.

NORTH AMERICA NON-ALCOHOLIC BEVERAGE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.44% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United States, Canada, Rest of North America |

|

Key Companies Profiled |

Coca-Cola Company (US), PepsiCo (US), Nestlé (Switzerland), Keurig Dr Pepper (US), The Kraft Heinz Company (US), Red Bull GmbH (Austria), Monster Beverage Corporation (US), Oatly (Sweden), California Farms (US), Danone (France), Lacroix (US), Blue Bottle Coffee (US). |

North America Non-Alcoholic Beverage Market Segmentation:

North America Non-Alcoholic Beverage Market Segmentation: By Types:

- Carbonated soft drinks

- Bottled water

- Juices

- Functional beverages

- RTD teas and coffees

- Dairy-based beverages

- Plant-based beverages

Carbonated soft drinks continue to be a dominating sub-type in the non-alcoholic beverage industry. Despite dropping sales due to health concerns, this category maintains a considerable market share. Companies are reformulating goods to lower sugar content and adding new tastes to appeal to health-conscious customers.

Plant-based drinks are the market's fastest-growing sub-type. The growing popularity of plant-based diets, along with rising lactose sensitivity, is boosting demand for dairy-free alternatives. Almond milk, soy milk, oat milk, and other plant-based beverages are becoming increasingly popular, appealing to both vegans and those seeking healthier alternatives.

North America Non-Alcoholic Beverage Market Segmentation: By Distribution Channel:

- supermarkets and hypermarkets

- online platforms

- direct-to-consumer sales

For non-alcoholic drinks, retail establishments such as supermarkets, hypermarkets, convenience stores, and specialty shops continue to be the primary distribution route. These shops give customers quick access to a large selection of goods and brands. Physical businesses continue to be popular because they are convenient for customers to make quick purchases.

The most rapidly expanding distribution channel is e-commerce, which is fueled by the rise in popularity of online platforms. Online shopping is becoming more and more popular among consumers due to its affordability, ease, and wide selection. Personalized shopping experiences and home delivery are provided via e-commerce platforms and direct-to-consumer business models, which increase customer convenience.

North America Non-Alcoholic Beverage Market Segmentation: Regional Analysis:

- USA

- Canada

- Mexico

In the North American non-alcoholic beverage sector, the United States is the clear leader with a dominant 72% market share. Numerous elements that are ingrained in American society, consumer behaviour, and industrial innovation are responsible for this supremacy. The size and diversity of the American non-alcoholic beverage market are its defining features. Traditional carbonated soft drinks and cutting-edge functional beverages are only two of the many alternatives available on the market to satisfy any type of consumer taste. The success of the sector is largely due to this variety, which enables it to adjust to shifting consumer preferences and health trends.

Mexico is the nation with the greatest rate of growth in the non-alcoholic beverage industry, while having a 10% market share in North America. The non-alcoholic beverage market in Mexico has been growing at remarkable rates each year, surpassing that of its counterparts in North America and establishing itself as a prominent participant in the sector. Mexico's non-alcoholic beverage industry is growing quickly due to a number of causes. First, there has been a notable change in the knowledge and tastes of consumers. Mexican customers are looking for healthier options to replace customary high-sugar beverages, especially the younger generations.

COVID-19 Impact Analysis on the North America Non-Alcoholic Beverage Market:

The first several months of the epidemic were characterized by panic purchases and a change in consumer behaviours. Shoppers loaded up on necessities, which created a demand spike for bottled water and longer-lasting, shelf-stable drinks. However, when consumers grew accustomed to the new normal and fears lessened, this tendency was only short-lived. Global supply chains were affected by lockdowns and social distancing measures, which had an effect on the availability of components and raw materials. There were difficulties in producing non-alcoholic drinks, especially those that depended on certain fruits, herbs, or foreign ingredients. Producers were forced to adjust by repurposing goods to reduce dependency on limited ingredients and procuring locally if feasible. With extra advantages like vitamins, probiotics, electrolytes, or adaptogens, the market for functional drinks has grown significantly. Customers looked for drinks that would improve their general health in addition to satisfying their thirst. The market for non-alcoholic beverages was also impacted by the plant-based revolution, as demand for plant-based milk substitutes skyrocketed.

Latest Trends/ Developments:

Consumers are increasingly health-conscious, seeking beverages that not only quench their thirst but also offer added benefits. This has fueled the rise of the functional beverage segment, encompassing everything from enhanced waters infused with electrolytes or vitamins to sports drinks boasting improved performance-enhancing properties. The rise of plant-based diets is significantly impacting the non-alcoholic beverage market. Consumers are seeking eco-friendly and ethically sourced alternatives to traditional dairy products. Sparkling water, once a niche option, is now a mainstream beverage. Flavoured sparkling waters with innovative taste combinations like citrus ginger, cucumber mint, and even watermelon chili are capturing consumer interest. The growing diversity of the North American population is influencing beverage trends. Flavors inspired by different cultures, such as hibiscus tea, ginger beer, and flavoured coconut water, are gaining traction, offering consumers a taste of the world. The environmental impact of single-use plastic bottles is a growing concern. This is leading to a rise in refillable bottle programs and the popularity of reusable containers for water and other beverages.

Key Players:

-

- Coca-Cola Company (US)

- PepsiCo (US)

- Nestlé (Switzerland)

- Keurig Dr Pepper (US)

- The Kraft Heinz Company (US)

- Red Bull GmbH (Austria)

- Monster Beverage Corporation (US)

- Oatly (Sweden)

- California Farms (US)

- Danone (France)

- LaCroix (US)

- Blue Bottle Coffee (US)

Chapter 1. North America Cheese Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Cheese Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Cheese Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Cheese Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. North America Cheese Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Cheese Market– By Type

6.1. Introduction/Key Findings

6.2. Carbonated soft drinks

6.3. Bottled water

6.4. Juices

6.5. Functional beverages

6.6. RTD teas and coffees

6.7. Dairy-based beverages

6.8. Plant-based beverages

6.9. Y-O-Y Growth trend Analysis By Type

6.10. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. North America Cheese Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. supermarkets and hypermarkets

7.3. online platforms

7.4. direct-to-consumer sales

7.5. Y-O-Y Growth trend Analysis By Distribution Channel

7.6. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. North America Cheese Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Distribution Channel

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Cheese Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Coca-Cola Company (US)

9.2. PepsiCo (US)

9.3. Nestlé (Switzerland)

9.4. Keurig Dr Pepper (US)

9.5. The Kraft Heinz Company (US)

9.6. Red Bull GmbH (Austria)

9.7. Monster Beverage Corporation (US)

9.8. Oatly (Sweden)

9.9. California Farms (US)

9.10. Danone (France)

9.11. LaCroix (US)

9.12. Blue Bottle Coffee (US)

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Consumers are increasingly prioritizing healthier beverage choices. This includes a demand for sugar-free, low-calorie options, functional beverages with added benefits like electrolytes or probiotics, and natural or organic ingredients.

Consumers are increasingly wary of artificial sweeteners and other additives. Finding natural and healthy alternatives to enhance flavour and functionality is crucial.

Coca-Cola Company (US), PepsiCo (US), Nestlé (Switzerland), Keurig Dr Pepper (US), The Kraft Heinz Company (US), Red Bull GmbH (Austria), Monster Beverage Corporation (US), Oatly (Sweden), California Farms (US), Danone (France), Lacroix (US), Blue Bottle Coffee (US).

The market is dominated by USA, which commands a market share of around 72%.

With a market share of about 10%, Mexico is the nation that is expanding the quickest.