North America Ion Exchange Resins Market Size (2024-2030)

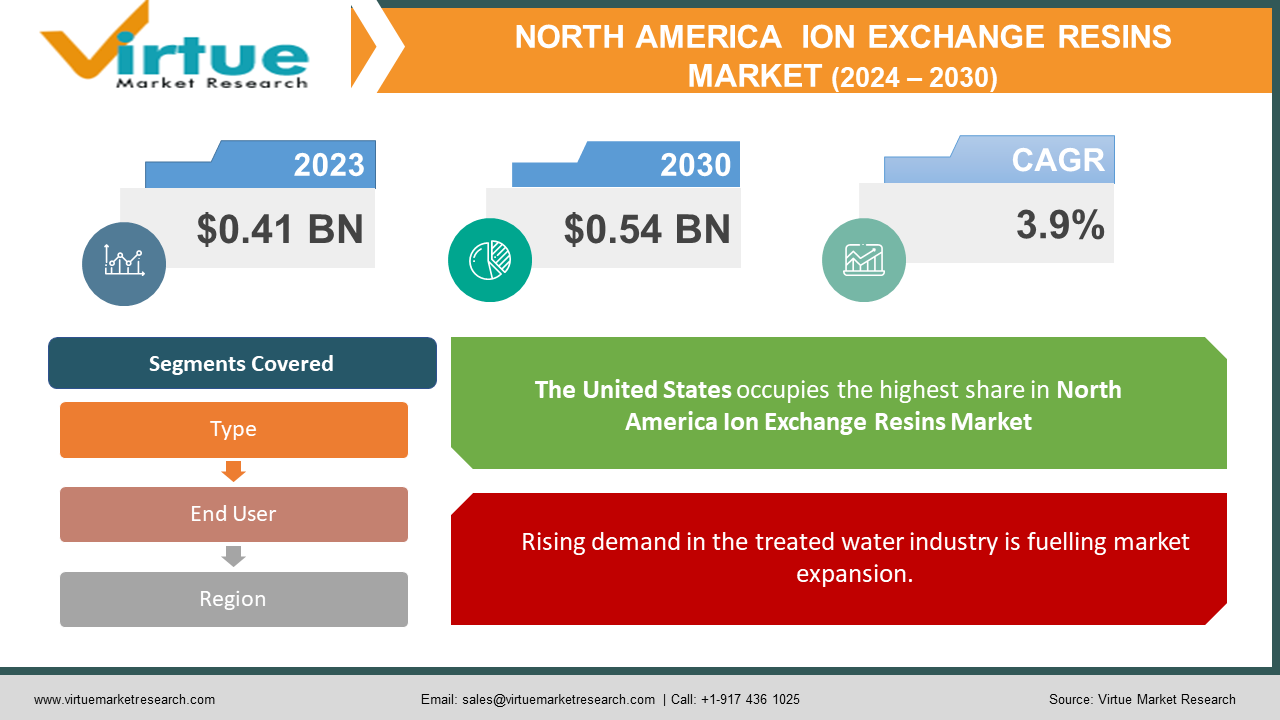

The North American Ion Exchange Resins Market was valued at USD 0.41 billion in 2023 and is projected to reach a market size of USD 0.54 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.9%.

An ion-exchange resin is a resin that acts as a medium for ion exchange. It is an insoluble matrix made of organic polymer substrate that typically takes the shape of tiny, white, or yellowish microbeads. The process is known as ion exchange because the beads are usually porous, offering a large surface area on and inside them where the ions are trapped along with the accompanying release of other ions. Ion-exchange resins have extensive application in various processes related to separation, purification, and decontamination. Water treatment processes involving ion exchange include water softening, condensate polishing, industrial demineralization, producing ultrapure water, and treating wastewater. On the other hand, in several non-water processes, like desiccation and chromatographic separation, it can also offer a way of separation.

Key Market Insights:

Ion exchange resins come in two primary types: anion exchange resins, which substitute negatively charged ions like chloride for arsenic, and cation exchange resins, which substitute positively charged ions like sodium for calcium. Ion exchange resins are frequently used as a water treatment chemical to eliminate pollutants, organic compounds, and traces of metal ions. Ion exchange resins have a wider range of applications in chemical processing, food and beverage production, wastewater treatment, power generation, electronics, and mining because they can remove radioactive elements like uranium, thorium, and lanthanum as well as organic compounds and chlorine. A practical and affordable solution for the purification, isolation, and decontamination of solutions containing ionic species is provided by ion-exchange resins. Ion exchange resins are employed as excipients in formulations for the controlled release of active ingredients, for the purification of antibiotics from fermentation broths, and to mask the unpleasant taste and smell of certain drug compounds.

North American Ion Exchange Resins Market Drivers:

Rising demand in the treated water industry is fuelling market expansion.

The most common use of ion exchange resins is in water treatment. The size, form, and actual composition of the resin will depend on the chemicals and impurities that are present in the feed water. The resin with sodium ions at active sites is used to replace the calcium and magnesium ions found in hard water, which has an excess of these salts. Following softening, a solution high in sodium ions, like sodium chloride, regenerates the resin. Ion-exchange resins offer a workable and reasonably priced way to purify, isolate, and decontaminate solutions containing ionic species. Ion exchange resins are utilized in this procedure to extract hazardous heavy metals from solutions, including lead and cadmium. Catalytic and anionic impurities can be de-mineralized by using mixed bed resins with sporadic regeneration cycles.

Surge in demand by food & beverage and pharmaceutical industries is expanding the scope of global market.

The ion exchange ions have seen a surge in demand for its use in the pharmaceutical industry as these Ion exchange resins are used as excipients in formulations to mask the off-putting taste and smell of some drug compounds, purify antibiotics from fermentation broths, and allow for the controlled release of active ingredients. Fruits and the beverage industry use ion exchange resins in a variety of ways to enhance flavor by eliminating unwanted ingredients. Trace metal removal, color decolorization, unpleasant taste and smell, and first water treatment for juice and drink production are common uses.

High demand for use in Power and Chemical Industries is boosting market growth.

Ion exchangers are frequently used to separate elements like uranium from plutonium. Although ion exchange has been a common method for years, solvent extraction has also played a significant role in the separation of the actinide and lanthanide groups of elements. Ion exchange is also used extensively in the reprocessing of radioactive waste materials and the processing of nuclear fuel. By keeping scale from forming, they are the only method that reliably promotes optimal heat transfer. This also effectively reduces or even completely stops rusting. These results, together with the resins' excellent regenerability, provide long-term, cost-effective power plant operation.

North American Ion Exchange Resins Market Restraints and Challenges:

Different limitations put in place by policies of the European Commission and EPA can act as a restraint for the ion exchange resin market. The main obstacles facing the ion exchange resin market are thought to be the EC and other important regulations about water treatment standards and the repeatability of these procedures. Also, the costs related to the raw materials required for ion exchange resins and the production process can pose as restraints for the ion exchange resin market.

North American Ion Exchange Resins Market Opportunities:

Reverse osmosis and other water purification methods are becoming more and more common in both residential and commercial settings. The ion exchange resins are prepared before industrial use and are used to remove significant other elements, organic compounds, and chlorine from various compounds. Ion exchange resin sales are anticipated to increase in tandem with the government's increasing expenditure on infrastructure development. Ion exchange resin sales are predicted to rise more quickly as a result of the mining sector's expansion and the increasing need for freshwater brought about by industrialization and growth. The market expansion of ion exchange resins is anticipated to be supported by all of these factors. During the projected period, these factors are anticipated to fuel the ion exchange resins industry's overall growth.

Also, another reason for the rise of the ion exchange resins market during the forecast period is the expanding reach of end-user industries, including the chemical, power generation, and water treatment sectors.

NORTH AMERICA ION EXCHANGE RESINS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

3.9% |

|

Segments Covered |

By Type, End User, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, , USA, Canada, Mexico |

|

Key Companies Profiled |

DuPont de Nemours, Inc., Purolite Corporation, ResinTech Inc., Bio-Rad Laboratories, Inc., Evoqua Water Technologies, Ecodyne Limited |

North American Ion Exchange Resins Market Segmentation:

North American Ion Exchange Resins Market By Type:

- Cationic

- Anionic

- Others

In 2023, based on the segmentation by type, the cationic type was the segment that dominated the market. This can be accredited to their various applications like dealkalization, saline treatment, and other water treatment applications. Ion exchange resins are utilized in this procedure to extract hazardous heavy metals from solutions, including lead and cadmium. Catalytic and anionic impurities can be de-mineralized by using mixed bed resins with sporadic regeneration cycles. Also, Cationic type resin is expected to see the fastest growth rate over the years and continue its dominance reason being its high demand and versatile uses.

North American Ion Exchange Resins Market By End-Use Industry:

- Power

- Chemical

- Food & Beverage

- Electronics

- Metal & Mining

- Pharmaceuticals

- Others

In 2023, based on the segmentation by end-user industry, the power sector dominated the market. This can be accredited to the surge in demand for power generation. They are necessary for polishing the condensate in the water-steam circuits and demineralizing the cooling and make-up water. They are the only way to keep the scale from forming and continuously promote the best possible heat transfer. Also, the power sector remained the fastest growing sector in the segment causing a surge in the power demand and its generation, and will continue to dominate over the period.

North American Ion Exchange Resins Market Segmentation: Regional Analysis

- USA

- Canada

- Mexico

In 2023, the USA remained to be the dominant market in the North American Region. The US market is being helped by the growing use of ion exchange resins in chemical control systems in nuclear power plants. There are more than 93 nuclear power plants in the US, which significantly contribute to a surge in demand for the resins and drive the market to expansion.

Also in the US, the Environmental Protection Agency is primarily concerned with water quality. Standard SAC resin is capable of eliminating barium and radium, two divalent cations that are governed by the National Primary Drinking Water Standards of the United States Environmental Protection Agency (EPA). One previous evolving factor that the US is constantly improving is water purification which has led to the expansion in the market for ion exchange resins due to its application in water purification.

COVID-19 Impact Analysis on the North American Ion Exchange Resins Market:

The COVID-19 Pandemic caused much distress across almost every industry whether it be automotive, construction, retail, or any other. However, Ion Exchange Resin Market was no exception. Due to the lockdowns and various restrictions imposed, there was the problem of reduced labor which resulted in less production in that period. Also, supply disruptions caused much distress to the market due to the raw material mobility restrictions. But as we are coming out of this pandemic, the ion exchange resin market is expected to recover at a fast pace just like the other industry.

Latest Trends/ Developments:

The ion exchange resin industry continues to be guided by the move toward its versatile uses in varied industries like water treatment, pharmaceuticals, power generation, and many others. As a result, there are new developments like resin for semiconductor ultrapure water by LANXESS and the First Ion Exchange Resin for Green Hydrogen Production by DuPont to support the production of hydrogen from water. This is opening new horizons for the ion exchange resins industry and due to this trend, the industry will continue to develop over time.

Key Players:

- DuPont de Nemours, Inc.

- Purolite Corporation

- ResinTech Inc.

- Bio-Rad Laboratories, Inc.

- Evoqua Water Technologies

- Ecodyne Limited

Recent Developments:

- September 26, 2023, DuPont Introduces First Ion Exchange Resin for Green Hydrogen Production

- October 28, 2021, Ecolab to Acquire Purolite, a Leading Global Provider of Fast-Growing, High-Value Separation and Purification Solutions to Life Sciences and Critical Industrial Markets

Chapter 1. North America Ion Exchange Resins Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Ion Exchange Resins Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Ion Exchange Resins Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Ion Exchange Resins Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Ion Exchange Resins Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Ion Exchange Resins Market– By Type

6.1. Introduction/Key Findings

6.2. Cationic

6.3. Anionic

6.4. Others

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. North America Ion Exchange Resins Market– By End-User Industry

7.1. Introduction/Key Findings

7.2. Power

7.3. Chemical

7.4. Food & Beverage

7.5. Electronics

7.6. Metal & Mining

7.7. Pharmaceuticals

7.8. Others

7.9. Y-O-Y Growth trend Analysis By End-User Industry

7.10. Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 8. North America Ion Exchange Resins Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By End User

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Ion Exchange Resins Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. DuPont de Nemours, Inc.

9.2. Purolite Corporation

9.3. ResinTech Inc.

9.4. Bio-Rad Laboratories, Inc.

9.5. Evoqua Water Technologies

9.6. Ecodyne Limited

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The North American Ion Exchange Resins Market was valued at USD 0.41 billion in 2023 and is projected to reach a market size of USD 0.54 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.9%.

The Rising demand in the treated water industry and pharmaceutical industry is propelling the North American ion Exchange resin industry

Based on Type, the North American ion Exchange resin market is segmented into Cationic, Anionic, and Other types.

The USA is the most dominant region for the North American ion Exchange resin market.

DuPont de Nemours, Inc., Purolite Corporation, ResinTech Inc., Bio-Rad Laboratories, Inc., Evoqua Water Technologies, Ecodyne Limited