North America Instant Coffee Market Size (2024-2030)

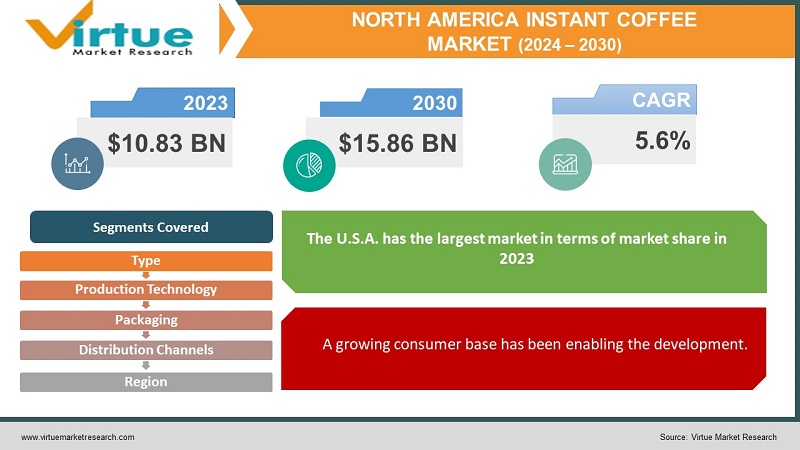

The North American instant coffee market was valued at USD 10.83 billion and is projected to reach a market size of USD 15.86 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5.6%.

Dehydrated coffee beverage concentrates, or instant coffee, are produced from actual coffee beans. After extracting the volatile and soluble components of the beans, the water is eliminated, leaving behind a concentrated, soluble coffee powder. To prepare instant coffee, mix powdered or crystalline coffee solids with hot water or milk and stir. Commercial instant coffee solids are made by spray-drying or freeze-drying, and then they may be rehydrated. In the past, the market had a notable presence owing to its convenience. However, the varieties were limited. Presently, the market has witnessed a boost due to hectic lifestyles and consumer demand. In the future, with a focus on health & wellness trends and sustainability, the market is anticipated to see an upsurge.

Key Market Insights:

The instant coffee industry in the US is projected to bring in $14.6 billion by 2024, with at-home sales accounting for $1.9 billion and out-of-home sales for $12.8 billion.

Mexico's coffee market is expected to increase at a compound annual growth rate (CAGR) of 4.67% between 2023 and 2028, according to Statista.

Up to 2025, instant coffee is expected to have the greatest sales increase (3.8 percent) in the United States.

According to 2023 Coffee Association of Canada research, 71% of Canadians consume coffee daily.

The quantity of caffeine in an 8-ounce cup of instant coffee is around 90 mg, but the same amount of ground coffee is between 125 and 140 mg. To tackle this, manufacturers need to come up with options with varying levels of caffeine content. Additionally, clean labeling policies help raise awareness.

North America Instant Coffee Market Drivers:

Demand for convenience has been facilitating the expansion.

Over the years, urbanization has led to severe economic progress. The standard of living has improved. Better job opportunities are available. Dual income has become the new normal. As such, people are having busy lifestyles. Most of them are constantly on the lookout for convenient and easy-to-prepare food products. Instant coffee fits in well with this ongoing trend. It is easy to prepare, takes less time, and helps people stay active in their work and other activities. Besides, consumers choose this option because it does not compromise on taste or quality. As a result, the demand for instant coffee has risen significantly.

A growing consumer base has been enabling the development.

Instant coffee appeals to a wider range of consumers than just those who traditionally drink coffee. A wide spectrum of customers, including younger generations, professionals with hectic schedules, and those looking for affordable beverage alternatives, find instant coffee an attractive alternative. The market reach has also been widened by the introduction of innovative instant coffee products, such as flavored variants, specialty blends, and single-serve packages. Furthermore, the growing acceptance of instant coffee as a good substitute for brewed coffee and the increasing popularity of coffee culture has contributed to the market's growth. Apart from this, this product is an affordable option. This is helping drive new customers and elevating revenue generation.

North America Instant Coffee Market Restraints and Challenges:

Health concerns and intense competition are the main issues that the market is currently facing.

To enhance flavor, instant coffee frequently has sweeteners, oils, and other ingredients added. Blood sugar surges, energy collapses, and weight gain can all result from these chemicals. According to research, instant coffee had nearly four times the amount of mycotoxins. This can lead to more catastrophic illnesses than roasted coffee. Moreover, compared to traditional coffee, the flavor of instant coffee is more acidic and harsher. Besides this, instant coffee has a higher acrylamide content. Roasting coffee beans releases acrylamide, a chemical that may be hazardous. Overexposure to acrylamide raises the risk of cancer and damages the neurological system. However, the quantity of acrylamide consumed from coffee is far less than the level that has been demonstrated to be hazardous. New manufacturers need to do proper research about the recommended content to prevent repercussions. Furthermore, health-conscious consumers may be discouraged from buying some instant coffee brands due to concerns over artificial flavors, preservatives, and additives. Additionally, the link between caffeine intake and negative health outcomes like anxiety and sleeplessness may affect how consumers perceive the beverage and how much they drink. Apart from this, freshly brewed coffee has been popular for many years. This type of coffee is known for its unique taste and flavor. Instant coffee is usually perceived as having less freshness and quality when compared to brewed coffee. As such, it can be difficult to convince customers to switch to instant coffee. Companies need to create unique choices to stand out in the market.

North America Instant Coffee Market Opportunities:

The ongoing health and wellness trends provide the market with an ample number of possibilities. Incorporating functional ingredients is beneficial. Instant coffee can be loaded with vitamins, minerals, and other antioxidants to enhance the nutritional profile and attract a health-conscious consumer base. Secondly, expansion into emerging economies is advantageous. Mexico, Costa Rica, and Panama are some of the fastest-developing economies. Businesses can introduce new varieties in these regions. This helps in increasing profits. Thirdly, e-commerce is helping with getting new customers. Companies are prioritizing having a virtual presence. This mode gives access to a lot of local and international options.

NORTH AMERICA INSTANT COFFEE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.6% |

|

Segments Covered |

By Type, Production technology, packaging, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

USA, Canada, Rest of North America |

|

Key Companies Profiled |

Nestlé, Starbucks Corporation. The J.M. Smucker Company. Keurig Dr Pepper Inc.. Folgers (The J.M. Smucker Company), Maxwell House (Kraft Heinz Company), Taster's Choice (Nestlé), Nescafé (Nestlé), Eight O'Clock Coffee (Tata Consumer Products), Dunkin' Brands Group, Inc. (Inspire Brands) |

North America Instant Coffee Market Segmentation:

North America Instant Coffee Market Segmentation: By Type:

- Flavored

- Unflavored

The unflavored segment holds the largest market share by type in 2023. Instant coffee without flavoring is well-known for its ease of use, simplicity, and capacity to make a quick cup of coffee without the need for special brewing supplies. Individuals value the uncomplicated flavor of unadulterated coffee and the intensity of the coffee bean flavor. Additionally, people may personalize their instant coffee experience with unflavored coffee by adding milk, flavorings, sweeteners, and other such ingredients. The flavored segment is the fastest-growing. There are many different alternatives available for flavored instant coffee. This includes options like vanilla, caramel, hazelnut, mocha, and pumpkin spice. Customers wishing to experiment with various taste profiles and personalize their drinks may find these flavored alternatives appealing. Manufacturers are investing in R&D activities to bring out new options to attract more customers. Personalization of these flavors as per the needs of customers has been a popular strategy that is increasing the demand for this segment

North America Instant Coffee Market Segmentation: By Production Technology:

- Spray-Dried

- Freeze-Dried

The spray-dried segment is the largest type in this market. The reason why spray-dried instant coffee is so popular worldwide is because it is easily available to customers. A thin mist of coffee extract is sprayed into a heated air chamber to generate this sort of coffee. The moisture in the coffee soon evaporates, leaving behind a dry coffee powder. Besides, since spray-dried instant coffee is typically less expensive than other varieties, people on a budget may purchase it more easily. Freeze-dried instant coffee is the fastest-growing segment. Freeze-dried instant coffee is perceived to have superior quality and is made through a more costly production technique. To make this kind of coffee, the brewed coffee is frozen, and the water is then removed via sublimation, turning the frozen coffee into a dry powder. The coffee's flavor and fragrance are retained during the freeze-drying process, giving the finished product a more closely aligned flavor profile with freshly brewed coffee.

North America Instant Coffee Market Segmentation: By Packaging:

- Sachet

- Jar

- Pouch

- Others

Jars are the segment holding the largest market share in 2023. Because glass jars are airtight and help keep coffee fresh while shielding it from air and moisture, they are used for instant coffee. Moreover, coffee tastes and smells better in glass jars than in paper or plastic bags. Glass may appear nearly fresh even after years of usage since it is extremely durable and doesn't easily scratch or wear. Pouches are the fastest-growing category. Instant coffee is frequently sold in flat plastic bags with one side open for filling and three sides sealed. These bags are offered in a variety of colors and patterns. These pouches don't need any extra equipment to brew coffee, making them convenient. Coffee bags are a popular choice for individuals who are constantly on the go because they are lightweight and portable. Furthermore, compared to other forms of coffee packaging, they can also be more affordable and have a longer shelf life.

North America Instant Coffee Market Segmentation: By Distribution Channels:

- Supermarkets & Hypermarkets

- Specialty Stores

- Online Retail

- Others

The largest growing distribution channels are supermarkets and hypermarkets. Clients may ask questions, communicate with the shopkeepers, and assess the visual quality of their offerings. By negotiating over the goods, they may even alter the price. Moreover, people who are unfamiliar with the Internet might prefer to physically purchase the products. Furthermore, easy accessibility is another important factor propelling this category. These stores are usually present in every neighborhood, raising demand. The distribution channel that is growing the fastest is online retail. The industry has expanded as a result of the growing trend of digitalization. Because it's convenient, customers go with this choice. Online shoppers may order goods and have them delivered right to their homes. They will also have easier access to a greater selection of both domestic and foreign items. Besides, online merchants may help their clients by providing incentives and free shipping on regular purchases.

North America Instant Coffee Market Segmentation: Regional Analysis:

- U.S.A

- Canada

- Mexico

The U.S.A. has the largest market in terms of market share in 2023. Countries like New York, California, Massachusetts, and Washington are the prominent ones. These areas have people who are on the go. Most of them are working in these places. The demand for convenience has risen as a result. Besides, there is a growing distribution channel of supermarkets, e-commerce, and other convenience stores. A lot of major players are present in this area. Key companies include Nestlé, Starbucks Corporation, The J.M. Smucker Company, and Keurig Dr Pepper Inc. Canada is the fastest-growing market. Many immigrants from Asian countries come to this region for study and work reasons. Instant coffee is a popular beverage in Asian countries. This elevates the sales of coffee. Besides this, there has been a lot of product innovation and development. Many flavored options are being commercialized by Canadian companies to attract more clients. Furthermore, the cold weather drives a lot of people to consume this hot beverage.

COVID-19 Impact Analysis on the North American Instant Coffee Market:

There were several ways in which the viral outbreak impacted the market. The new normal included social isolation, movement restrictions, and lockdowns. Transportation, logistics, and supply chain management were all impacted by this. Manufacturing and production operations were disrupted due to this. Safety constraints presented obstacles to operations. The main emphasis was on working remotely. The National Coffee Association's Data Trends report stated that pandemic limitations reduced office coffee production by 55%. An economic downturn was seen. Many people lost their jobs. Restaurants, lodging facilities, and other eating places had to close. The food and beverage industry experienced losses as a result. The majority of the funds were allotted to healthcare-related projects. This caused delays in collaborations and launches. Many only purchased necessities. However, on the other hand, there was a spike in sales. A majority of the population was advised to work from home. This increased their screen time tremendously. As a result, people began to rely on caffeine to stay active. Social media gained prominence. A lot of cooking channels started to emerge. This encouraged people to experiment with their beverages, including instant coffee. Dalgona coffee was one such trend that was made by whipping the coffee until it was thick and frosty. A National Coffee Data Trends report stated that during the second half of the pandemic, 25% of Americans experimented with other coffee forms, including instant, single cups, ground, or whole beans. Post-pandemic, the market has picked up and is growing. Normal functioning has resumed owing to the relaxation of rules and regulations.

Latest Trends/ Developments:

Businesses are emphasizing sustainable methods to cause minimal impact on our environment. This includes local sourcing for coffee beans to reduce the carbon footprint. Additionally, organic farming practices are being given prominence. This farming method does not use chemicals, fertilizers, or other harmful compounds to obtain the yield. Plants produced by this method have more nutrition and a lesser prevalence of chronic illnesses. Secondly, products are being commercialized as biodegradable and recycled items to prevent pollution and landfills. Apart from this, fair trade certifications are being given by esteemed governmental institutions to certain companies to highlight their practices.

Key Players:

- Nestlé

- Starbucks Corporation

- The J.M. Smucker Company

- Keurig Dr Pepper Inc.

- Folgers (The J.M. Smucker Company)

- Maxwell House (Kraft Heinz Company)

- Taster's Choice (Nestlé)

- Nescafé (Nestlé)

- Eight O'Clock Coffee (Tata Consumer Products)

- Dunkin' Brands Group, Inc. (Inspire Brands)

- In April 2023, Nestlé introduced Nescafé Ice Roast, the first instant coffee specifically made for iced beverages, in China and Mexico. This soluble coffee may be drunk over ice with milk or cold water and is composed entirely of Robusta coffee beans. Its flavor profile is mildly roasted and free of bitter undertones.

- In January 2023, Tata Consumer Products (TCPL) released Tata Coffee Grand Premium. It is a premium instant coffee made just of coffee and flavor-locked decoction crystals. The crystals are used to keep the coffee's aroma and flavor intact. TCPL claims that as consumers in non-Southern regions frequently chose 100% coffee blends over coffee-chicory mixtures, the introduction was planned with their taste preferences in mind.

- In October 2022, Blue Bottle Coffee, Inc. launched the Craft Instant Espresso in the U.S. This is the brand's first soluble espresso, made with a proprietary extraction and freeze-drying technique to yield a premium product.

Chapter 1. North America Instant Coffee Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Instant Coffee Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Instant Coffee Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Instant Coffee Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Instant Coffee Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Instant Coffee Market– By Type

6.1. Introduction/Key Findings

6.2. Flavored

6.3. Unflavored

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. North America Instant Coffee Market– By Packaging

7.1. Introduction/Key Findings

7.2. Sachet

7.3. Jar

7.4. Pouch

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Packaging

7.7. Absolute $ Opportunity Analysis By Packaging, 2024-2030

Chapter 8. North America Instant Coffee Market– By Distribution Channels

8.1. Introduction/Key Findings

8.2. Supermarkets & Hypermarkets

8.3. Specialty Stores

8.4. Online Retail

8.5. Others

8.6. Y-O-Y Growth trend Analysis By Distribution Channels

8.7. Absolute $ Opportunity Analysis By Distribution Channels , 2024-2030

Chapter 9 . North America Instant Coffee Market– By Production Technology

9.1. Introduction/Key Findings

9.2. Spray-Dried

9.3. Freeze-Dried

9.4. Y-O-Y Growth trend Analysis By Production Technology

9.5. Absolute $ Opportunity Analysis By Production Technology, 2024-2030

Chapter 10. North America Instant Coffee Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.1.4. Rest of North America

10.1.2. By Type

10.1.3. By Packaging

10.1.4. Distribution Channels

10.1.5. Production Technology

10.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. North America Instant Coffee Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1. Nestlé

11.2. Starbucks Corporation

11.3. The J.M. Smucker Company

11.4. Keurig Dr Pepper Inc.

11.5. Folgers (The J.M. Smucker Company)

11.6. Maxwell House (Kraft Heinz Company)

11.7. Taster's Choice (Nestlé)

11.8. Nescafé (Nestlé)

11.9. Eight O'Clock Coffee (Tata Consumer Products)

11.10. Dunkin' Brands Group, Inc. (Inspire Brands)

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The North American instant coffee market was valued at USD 10.83 billion and is projected to reach a market size of USD 15.86 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5.6%.

Demand for convenience and a growing consumer base are the main factors propelling the North American instant coffee market.

Based on packaging, the North American instant coffee market is segmented into sachets, jars, pouches, and others

The United States is the most dominant region for the North American instant coffee market.

Nestlé, Starbucks Corporation, and The J.M. Smucker Company are the key players operating in the North American instant coffee market