North America Hot Dog and Sausages Market Size (2024-2030)

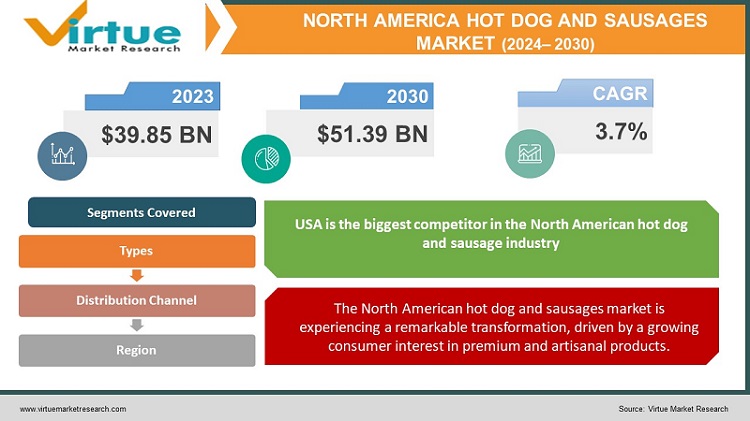

The North America Hot Dog and Sausages Market was valued at USD 39.85 Billion in 2023 and is projected to reach a market size of USD 51.39 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.7%.

A sizzling segment of the food business, the hot dog and sausage market in North America serves up a substantial piece of culinary tradition with a side of contemporary innovation. This market, which spans the US, Canada, and Mexico, is deeply ingrained in the cultural fabric of the area. Hot dogs and sausages are beloved in everything from ballpark concessions to backyard barbecues. Over the past few years, the market has undergone an intriguing transformation. Traditional sausages and hot dogs are still favorites, but there's been a rise in demand for upscale, artisanal, and healthier alternatives. More and more consumers are looking for products with premium meats, distinctive flavor profiles, and simpler ingredient lists. This change has spurred a creative wave among producers, who are experimenting with gourmet toppings, unusual protein sources, and exotic spice combinations to satisfy increasingly discriminating palates. One important reason driving this sector is still convenience. Hot dogs and sausages are popular options for eating at home or while on the road since they provide quick and simple meal solutions for people who are stressed for time. As a result, packaging and preparation techniques have evolved, and pre-cooked, microwaveable, and individually packaged choices are becoming more popular.

Key Market Insights:

The United States accounts for nearly 80% of the North America Hot Dog and Sausages Market.

The premium hot dog segment makes up about 30% of the market. Organic and natural hot dogs account for 10% of total sales. Plant-based sausages account for 5% of the total market. Over 20 billion hot dogs are consumed annually in the United States.

Around 900 million pounds of hot dogs and sausages were sold in retail in 2022.

Hot dogs are most popular during summer, with 7 billion consumed between Memorial Day and Labor Day.

Major League Baseball fans consume over 20 million hot dogs each season. Nearly 150 million hot dogs are consumed on the 4th of July alone.

Hot dog sales in convenience stores account for 10% of the market. The average price of a hot dog at a ballpark is around $4.50.

Annual sales of sausage in the United States are estimated at $12 billion. The North American meat processing industry is valued at over $200 billion.

Hot dogs and sausages together represent about 10% of the processed meat market. Over 200 million pounds of hot dogs are purchased at retail stores annually.

Hot dog and sausage consumption peaks during holidays, with a 25% increase in sales. Nearly 50% of hot dog and sausage sales occur during the summer months.

The North American hot dog and sausage market sees approximately 5% of its sales from food trucks and street vendors.

North America Hot Dog and Sausages Market Drivers:

In the fast-paced rhythm of North American life, convenience has become a prized commodity, and this cultural shift has emerged as a powerful driver in the hot dog and sausages market.

The convenience factor of hot dogs and sausages manifests in multiple ways. First and foremost is the speed of preparation. In a matter of minutes, a satisfying meal can be assembled, whether it's a classic hot dog in a bun or a more elaborate sausage dish. This rapid turnaround time appeals to a wide demographic spectrum, from busy professionals grabbing a quick lunch to parents seeking efficient dinner solutions for their families. The minimal cooking skills required further enhance the accessibility of these products, making them an attractive option for those with limited culinary expertise or confidence in the kitchen. Moreover, the versatility of hot dogs and sausages contributes significantly to their convenience appeal. These products can be prepared using various cooking methods - grilled, boiled, microwaved, or even eaten straight from the package in some cases. This flexibility allows consumers to adapt their meal preparation to different situations, whether it's a rushed weeknight dinner or a leisurely weekend barbecue. The ability to customize hot dogs and sausages with an array of toppings and accompaniments also adds to their appeal, allowing for personalization without the need for complex recipes or ingredients.

The North American hot dog and sausages market is experiencing a remarkable transformation, driven by a growing consumer interest in premium and artisanal products.

The increasing sophistication of North American consumers is at the core of this trend. Expansion of palates and expectations have resulted from travel, exposure to a wider variety of culinary cultures, and the growth of food-focused media. Nowadays, consumers aren't content with generic, one-size-fits-all products; instead, they look for goods with exceptional flavor, premium ingredients, and a compelling backstory. This change has created new potential for product differentiation in the hot dog and sausage market that goes beyond convenience and cost. The appeal of premium and artisanal hot dogs and sausages lies in several key attributes. First and foremost is the quality of ingredients. Artisanal producers often prioritize sourcing high-grade meats, sometimes from specific breeds or regions known for their superior flavor profiles. Many emphasize the use of organic, grass-fed, or humanely raised animals, appealing to consumers concerned about ethical and sustainable food production. The careful selection of spices and seasonings also plays a crucial role, with some producers developing proprietary blends that set their products apart from mass-market alternatives.

North America Hot Dog and Sausages Market Restraints and Challenges:

The increased health consciousness of customers is one of the biggest problems facing the sector. Conventional hot dogs and sausages have long been linked to elevated fat and sodium content as well as the presence of nitrates and nitrites, which are preservatives. An increasing number of people are reevaluating their intake of processed meats as knowledge about the connection between nutrition and health grows. Sales of traditional items have decreased as a result of this attitude shift, especially among populations who prioritize health. The difficulty is made much more difficult by the growing amount of nutritional data that is available and the abundance of media that is health-oriented. Today's consumers are better informed of the possible health hazards that come with consuming large amounts of processed meats, such as the connection to certain cancers and cardiovascular diseases. Another big issue facing the industry is regulatory monitoring. Government organizations are enforcing more stringent rules regarding the usage of ingredients, processing techniques, and labeling in the food industry. Manufacturers may find it expensive and time-consuming to comply with these rules, especially smaller artisanal producers who might not have the resources of larger firms.

North America Hot Dog and Sausages Market Opportunities:

The food service sector offers significant opportunities for growth, particularly as the industry recovers from pandemic-related disruptions. Collaborations with chefs to create signature hot dogs or sausages for restaurant menus, developing specialized products for particular food service segments (e.g., schools, hospitals), or creating bulk formats for catering and events could help expand market reach. There's also an opportunity to tap into the growing interest in functional foods. Manufacturers could develop hot dogs and sausages fortified with vitamins, minerals, or other beneficial compounds, positioning them as not just a tasty protein source but also a vehicle for nutrition. An additional strategy for market expansion and differentiation is the increased emphasis on sustainability. Producers can create items with smaller environmental footprints by employing upcycling techniques, sourcing from regenerative agriculture practices, or using sustainable packaging when developing products. This strategy can result in cost savings and enhanced brand reputation in addition to appealing to environmentally sensitive consumers.

NORTH AMERICA HOT DOG AND SAUSAGES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.7% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

USA, CANADA, MEXICO |

|

Key Companies Profiled |

. Hormel Foods Corp, Nestlé S.A., Tyson Foods, Inc., Johnsonville, LLC, Smithfield Foods, Inc., ConAgra Foods, Bar-S Foods (A Sigma Company), Bob Evans Farms, LLC, Hillshire Brands, Jimmy Dean, Oscar Mayer, Perdue Foods, Sabrett, Nathan's Famous, Hebrew National, Maple Leaf Foods, Maple Leaf Prime, Aidells Sausage Company, Applegate Farms, Beyond Meat, Impossible Foods, Morningstar Farms. |

North America Hot Dog and Sausages Market Segmentation:

North America Hot Dog and Sausages Market Segmentation: By Types:

- Traditional Hot Dogs

- Premium and Gourmet Hot Dogs

- Vegetarian and Vegan Hot Dogs

- Organic and Natural Hot Dogs

- Poultry-Based Hot Dogs

- Artisanal and Craft Sausages

At the core of the market are traditional hot dogs, often made from a blend of beef and pork, though all-beef varieties are also popular. These products form the backbone of the industry, deeply ingrained in North American food culture. They come in various sizes, from cocktail wieners to foot-long dogs, catering to different consumption occasions. While facing challenges from health-conscious consumers, traditional hot dogs remain a staple, particularly in settings like ballparks, backyard barbecues, and quick-service restaurants.

One of the market sectors with the quickest rate of growth is vegetarian and vegan hot dogs, which serve the growing needs of flexitarians, vegans, and vegetarians. Usually composed of soy protein, pea protein, or other plant-based ingredients, these products are meant to resemble classic animal hot dog flavors and textures. The quality of these substitutes has greatly increased because of developments in food technology, and as a result, even consumers who are not vegetarians but want to cut back on their meat consumption are beginning to choose them.

North America Hot Dog and Sausages Market Segmentation: By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Retail

- Foodservice

Supermarkets and Hypermarket's channel remains the dominant force in hot dog and sausage distribution. Large grocery chains offer a wide variety of products, from budget-friendly options to premium and specialty items. The extensive reach and high foot traffic of these stores make them crucial for both established brands and new market entrants. Supermarkets often feature dedicated sections for hot dogs and sausages, sometimes including refrigerated and frozen options. They also frequently use these products as loss leaders or promotional items, particularly during peak grilling seasons or major sporting events.

E-commerce has emerged as a rapidly growing distribution channel for hot dogs and sausages, a trend accelerated by the COVID-19 pandemic. This channel includes both online grocery platforms and direct-to-consumer sales from manufacturers. Online retail offers convenience and a wide product selection, making it particularly appealing for consumers seeking specialty or hard-to-find varieties. The ability to provide detailed product information, customer reviews, and personalized recommendations makes this channel effective for educating consumers about new or premium products.

North America Hot Dog and Sausages Market Segmentation: Regional Analysis:

- USA

- Canada

- Mexico

With the biggest market share, the USA is the biggest competitor in the North American hot dog and sausage industry. The nation's long-standing cultural love of hot dogs and sausages, especially as mainstays at sporting events, barbecues, and fast-food restaurants, is responsible for this supremacy. The American market is distinguished by a high degree of product innovation, as producers consistently roll out new tastes, healthier options, and easy packaging to satisfy changing consumer needs.

Mexico is the North American market with the quickest rate of growth for hot dogs and sausages, despite having the lowest market share among the three areas at the moment. This rise is being driven by Mexico's fast urbanization, rising disposable incomes, and evolving eating patterns. Western food items, such as hot dogs and sausages, are finding more and more appeal among Mexican customers as they appear on local cuisine and fast-food menus.

COVID-19 Impact Analysis on the North America Hot Dog and Sausages Market:

Sales at supermarkets and grocery stores significantly increased as customers filled up on pantry essentials. During the pandemic, this channel turned into the main engine of expansion for the hot dog and sausage industry. As consumers were more aware of what they were eating, there was a surge in demand for healthier products such as low-fat, low-sodium, and organic hot dogs and sausages. Clear ingredient lists and uncluttered labels were becoming more and more popular. Demand for sausages and hot dogs made entirely of natural components and without artificial additives increased as a result of this trend. Businesses concentrated on enhancing supplier relationships, diversifying their sourcing, and putting inventory management techniques into place to create more resilient supply chains.

Latest Trends/ Developments:

The global spread of the culinary world has impacted the selection of hot dogs and sausages. A growing number of consumers are looking for unusual cuisines, like Thai curries, Korean BBQ, and Mediterranean-inspired combos. Numerous cutting-edge goods that satisfy a range of tastes have proliferated as a result of this trend. Vegetarian and vegan hot dog and sausage options are on the rise due to the increasing popularity of plant-based diets. These substitutes are now more than just copies; they have distinct flavors and textures that appeal to a larger range of consumers. Pre-cooked hot dogs and sausages are becoming more widely available as a result of consumer desire for time-saving options. These items are perfect for busy people and families because they are made to prepare quickly and easily.

Key Players:

- Hormel Foods Corp.

- Nestlé S.A.

- Tyson Foods, Inc.

- Johnsonville, LLC

- Smithfield Foods, Inc.

- ConAgra Foods

- Bar-S Foods (A Sigma Company)

- Bob Evans Farms, LLC

- Hillshire Brands

- Jimmy Dean

Chapter 1. North America Hot Dog and Sausages Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Hot Dog and Sausages Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Hot Dog and Sausages Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Hot Dog and Sausages Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Hot Dog and Sausages Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Hot Dog and Sausages Market– By Type

6.1. Introduction/Key Findings

6.2. Traditional Hot Dogs

6.3. Premium and Gourmet Hot Dogs

6.4. Vegetarian and Vegan Hot Dogs

6.5. Organic and Natural Hot Dogs

6.6. Poultry-Based Hot Dogs

6.7. Artisanal and Craft Sausages

6.8. Y-O-Y Growth trend Analysis By Type

6.9. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. North America Hot Dog and Sausages Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Supermarkets and Hypermarkets

7.3. Convenience Stores

7.4. Specialty Food Stores

7.5. Online Retail

7.6. Foodservice

7.7. Y-O-Y Growth trend Analysis By Distribution Channel

7.8. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. North America Hot Dog and Sausages Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Distribution Channel

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Hot Dog and Sausages Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Hormel Foods Corp.

9.2. Nestlé S.A.

9.3. Tyson Foods, Inc.

9.4. Johnsonville, LLC

9.5. Smithfield Foods, Inc.

9.6. ConAgra Foods

9.7. Bar-S Foods (A Sigma Company)

9.8.Bob Evans Farms, LLC

9.9. Hillshire Brands

9.10. Jimmy Dean

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Busy lifestyles have fueled demand for convenient and ready-to-eat food options, making hot dogs and sausages popular choices.

The increasing focus on health and wellness has led to a decline in red meat consumption, which could impact sales of traditional hot dogs and sausages.

Hormel Foods Corp, Nestlé S.A., Tyson Foods, Inc., Johnsonville, LLC, Smithfield Foods, Inc., ConAgra Foods, Bar-S Foods (A Sigma Company), Bob Evans Farms, LLC, Hillshire Brands, Jimmy Dean, Oscar Mayer, Perdue Foods, Sabrett, Nathan's Famous, Hebrew National, Maple Leaf Foods, Maple Leaf Prime, Aidells Sausage Company, Applegate Farms, Beyond Meat, Impossible Foods, Morningstar Farms.

The USA is the most dominant region in the market, accounting for approximately 70% of the total market share