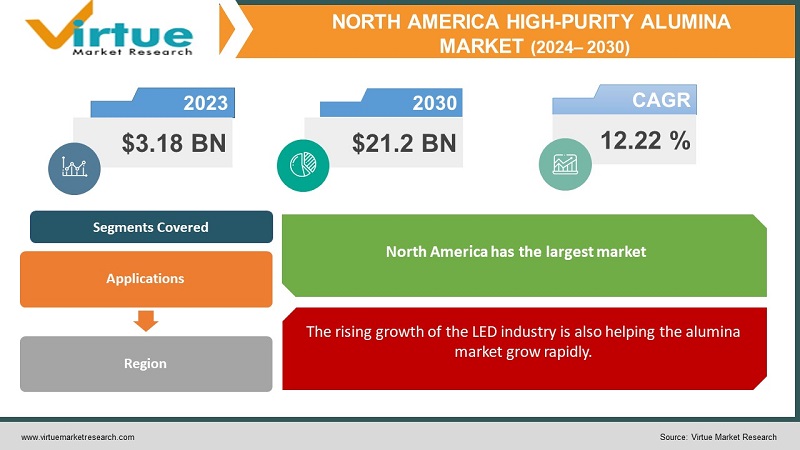

North America High-purity Alumina Market Size (2024-2030)

The North America High-purity Alumina market was valued at USD 3.18 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 21.2% from 2024 to 2030, reaching USD 12.22 billion by 2030.

Alumina, also known as aluminum oxide (Al₂O₃), is a versatile and abundant material found in nature as corundum, the mineral behind ruby and sapphire gemstones. It's also produced synthetically for various uses. This white, crystalline substance boasts impressive properties: extreme hardness (second only to diamond), high melting point, excellent chemical resistance, and good thermal conductivity. These attributes make it valuable in diverse applications, from being the key ingredient for aluminum metal production to acting as an abrasive in sandpaper and grinding wheels. Additionally, its high-purity form finds use in advanced ceramics for LED lights, semiconductors, and even medical implants. So, whether you're polishing your car or gazing at a dazzling ruby, alumina plays a crucial role in our world

Key Market Insights:

The North American high-purity alumina market is poised for robust growth, driven by the surging demand for LEDs, semiconductors, and lithium-ion batteries. The LED segment reigns supreme, fueled by the widespread shift towards energy-efficient lighting. Meanwhile, semiconductors witness strong demand from booming electronics and auto industries. Lithium-ion batteries, crucial for electric vehicles and renewable energy storage, are propelling the need for high-purity alumina as an anode material. Stringent environmental regulations and the quest for sustainable solutions are fostering the development of cleaner production processes. However, supply chain disruptions and fluctuating raw material prices pose challenges. Overall, the North American high-purity alumina market presents exciting opportunities for players who can adapt to evolving trends and ensure a sustainable supply chain.

North America High-Purity Alumina Market Drivers:

The rising growth of the LED industry is also helping the alumina market grow rapidly.

High-purity alumina (HPA) is the unsung hero behind North America's booming LED revolution. This remarkable material forms the foundation of LED substrates, acting as a sturdy platform for emitting light efficiently. Think of it as the stage where the light show happens! HPA's magic lies in its unique properties. It's incredibly transparent, allowing light to pass through with minimal interference. Moreover, it boasts exceptional thermal conductivity, efficiently dissipating heat and preventing premature LED failure. This translates to brighter, longer-lasting lights that consume less energy – a win-win for both wallets and the planet. As North America embraces LEDs for everything from homes and offices to streetlights and stadiums, the demand for HPA is skyrocketing.

Government support for clean energy is driving market growth.

The future is looking bright, both literally and figuratively, for high-purity alumina (HPA) in North America. Government initiatives promoting renewable energy and energy efficiency are acting like sunshine on this versatile material, creating a fertile ground for its applications in LEDs and EVs, ultimately accelerating market growth. Imagine this: solar panels generate clean energy, powering energy-efficient LED lighting thanks to HPA's efficient light emission. This reduces dependence on fossil fuels and saves energy, a double win for the environment and wallets. Similarly, consider the surge in electric vehicles, all requiring HPA-based separators in their lithium-ion batteries. These initiatives not only promote cleaner transportation but also create a demand for HPA, fueling economic growth.

Rise of electric vehicles (EVs) is supporting market growth.

High-purity alumina (HPA) is playing a starring role in the North American electric vehicle (EV) revolution. Think of HPA as the invisible guardian angel within lithium-ion batteries, the powerhouse propelling EVs. Nestled within the battery, HPA forms microporous separators, acting as a safety net between the anode and cathode. This critical role ensures smooth ion flow for efficient energy transfer while preventing short circuits, crucial for battery performance and safety. As North America accelerates its EV adoption, the demand for HPA is surging. This translates to safer, longer-range, and more reliable EVs hitting the road, fueled by the silent power of HPA. So, the next time you see an EV whiz by, remember, there's a hidden champion within – HPA, keeping the wheels (and electrons) turning smooth

North America High-Purity Alumina Market challenges and restraints:

Competition from established low-purity alumina producers

The high-purity alumina (HPA) market isn't without its challengers. Incumbent players in the traditional, less-refined alumina market are eyeing niches where supreme purity isn't the top priority. Think of it as a battle of titans: HPA, the sleek, high-tech champion, versus its bulkier, more established cousin. Traditional alumina, while lacking HPA's pristine quality, boasts advantages like lower cost and readily available production processes. This makes it a tempting option for applications where absolute purity isn't crucial. For example, in some ceramics or abrasives, the slight performance difference might not justify the higher cost of HPA. This "purity paradox" creates a competitive landscape where HPA needs to showcase its unique value proposition. It must emphasize applications where its superior properties truly shine, like LED substrates or cutting-edge medical implants. Additionally, continuous innovation can help HPA reduce its cost barrier, making it more competitive even in less demanding applications.

Producing high-purity alumina requires complex processes and stringent quality control, leading to higher costs compared to lower-purity alternatives

High-purity alumina (HPA) wears a crown of exceptional quality, but it comes at a price. Unlike its less-refined cousins, producing HPA involves a meticulously choreographed dance of sophisticated processes and rigorous quality control. Think of it as transforming rough diamonds into flawless gems – each step adds value, but also expense. These complex measures, from specialized equipment to multi-stage purification, ensure the removal of even the tiniest impurities. While this guarantees unmatched performance in demanding applications like LEDs and EV batteries, it also drives up the cost compared to readily available, lower-purity alternatives. This cost barrier can be a double-edged sword. In applications where ultimate purity isn't a game-changer, like certain ceramics or abrasives, budget-conscious users might opt for the cheaper, slightly less perfect option. This limits HPA's reach and can stifle market growth.

Limited availability of high-quality raw materials

The North American High-Purity Alumina (HPA) market faces a potential roadblock: sourcing high-quality raw materials. Not all bauxite deposits, the source of aluminum, are created equal. Impurities like iron and silicon can wreak havoc on HPA's pristine quality. So, finding deposits with minimal nasties becomes a treasure hunt, potentially limiting large-scale production. However, explorers are not easily discouraged. New extraction methods and alternative sources like aluminum scrap are being explored to secure this precious building block, ensuring HPA's future shines bright.

Market Opportunities:

North America's high-purity alumina market brims with potential, driven by booming LED, semiconductor, and lithium-ion battery sectors. Soaring demand for energy-efficient LEDs illuminates the market, while robust electronics and automotive industries fuel the need for ever-more advanced semiconductors. The rise of electric vehicles and renewable energy storage propels lithium-ion batteries, where high-purity alumina shines as a key anode material. Sustainability reigns supreme, with stricter regulations and eco-conscious consumers pushing cleaner production processes. However, challenges lurk in the form of supply chain disruptions and volatile raw material prices. For players who navigate these hurdles and embrace sustainable practices, the North American high-purity alumina market promises a bright future

NORTH AMERICA HIGH PURITY ALUMINA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.22% |

|

Segments Covered |

By Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

USA, Canada, Mexico |

|

Key Companies Profiled |

Almatis, Sumitomo Chemical, Alteo, CHALCO Aluminium Corporation, Honeywell International Inc |

North America High-Purity Alumina Market Segmentation

North America High-Purity Alumina Market Segmentation by Application

- LED industry

- Semiconductor industry

- Lithium-ion batteries

- Phosphors

- Sapphire industry

The electronics industry reigns supreme as the current king of high-purity alumina (HPA) consumers, utilizing it for the critical roles of LED substrates in energy-efficient lighting, semiconductor materials for high-performance chips, and lithium-ion battery separator membranes. But HPA's versatility extends far beyond this realm, shining in medical devices with its biocompatibility and high purity for implants and prosthetics, technical ceramics where its exceptional wear resistance and heat tolerance come in handy, and even phosphors for improved brightness and efficiency in lighting and displays. So, while electronics currently hold the crown, HPA's diverse capabilities ensure its reign extends across various industries, shaping the future of technology and innovation.

Market Segmentation: Regional Analysis

- USA

- CANADA

- MEXICO

Asia Pacific reigns supreme, boasting over 71% market share in 2023 due to its booming electronics and LED industries, driven by factors like government support and large manufacturing bases. North America follows closely, fueled by similar technological advancements in LEDs and EVs, with a projected CAGR of 21.6% until 2030. Europe exhibits moderate growth, balancing established markets with stricter regulations, while South America, and Middle East & Africa show promise due to their developing economies and resource potential.

COVID-19 Impact Analysis on the North America High-Purity Alumina Market

While the COVID-19 pandemic initially disrupted the North American High-Purity Alumina (HPA) market due to supply chain issues and economic downturns, a rebound has emerged. While the immediate impact saw declines in demand from certain sectors like automotive and construction, the long-term outlook remains positive. The pandemic's push for clean energy technologies like LEDs and electric vehicles, both heavily reliant on HPA, has fueled market growth in those areas. Additionally, government support for sustainable initiatives and growing environmental awareness further bolster the demand for HPA's unique properties. Overall, the HPA market in North America is expected to weather the pandemic's aftershocks and experience continued growth driven by its crucial role in advancing sustainable and innovative technologies.

Latest trends/Developments

The high-purity alumina market sees a surge, driven by booming LED, semiconductor, and lithium-ion battery sectors. LEDs rule the roost, fuelled by the energy-efficient lighting shift. Semiconductors experience strong demand from the electronics and auto industries. Lithium-ion batteries, crucial for electric vehicles and renewable energy storage, propel high-purity alumina demand as an anode material. Sustainability becomes paramount, with stricter regulations and eco-conscious consumers pushing for cleaner production processes. However, supply chain disruptions and fluctuating raw material prices pose challenges. Players who adapt to these trends and prioritize sustainable practices are poised to profit in this promising market.

Key Players:

- Almatis

- Sumitomo Chemical

- Alteo

- CHALCO Aluminium Corporation

- Honeywell International Inc

Chapter 1. North America High-Purity Alumina Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America High-Purity Alumina Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America High-Purity Alumina Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America High-Purity Alumina Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America High-Purity Alumina Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America High-Purity Alumina Market– By Application

6.1. Introduction/Key Findings

6.2. LED industry

6.3. Semiconductor industry

6.4. Lithium-ion batteries

6.5. Phosphors

6.6. Sapphire industry

6.7. Y-O-Y Growth trend Analysis By Application

6.8 . Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 7. North America High-Purity Alumina Market, By Geography – Market Size, Forecast, Trends & Insights

7.1. North America

7.1.1. By Country

7.1.1.1. U.S.A

7.1.1.2. Canada

7.1.1.3. Mexico

7.1.1.4. Rest of North America

7.1.2. By Application

7.1.3. Countries & Segments - Market Attractiveness Analysis

Chapter 8. North America High-Purity Alumina Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1. Almatis

8.2. Sumitomo Chemical

8.3. Alteo

8.4. CHALCO Aluminium Corporation

8.5. Honeywell International Inc

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The North America High-purity Alumina market was valued at USD 3.18 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 21.2% from 2024 to 2030, reaching USD 12.22 billion by 2030.

The rising growth of the LED industry, Government support for clean energy, Rise of electric vehicles (EVs) are the reasons that are driving the market

Based on application it is divided into five segments – LED industry, Semiconductor industry, Lithium-ion batteries, Phosphors, Sapphire industry

North America is the most dominant region for the North America High-Purity Alumina Market.

Almatis, Sumitomo Chemical, Alteo, CHALCO Aluminium Corporation, Honeywell International Inc