North America Hemp Milk Market Size (2024-2030)

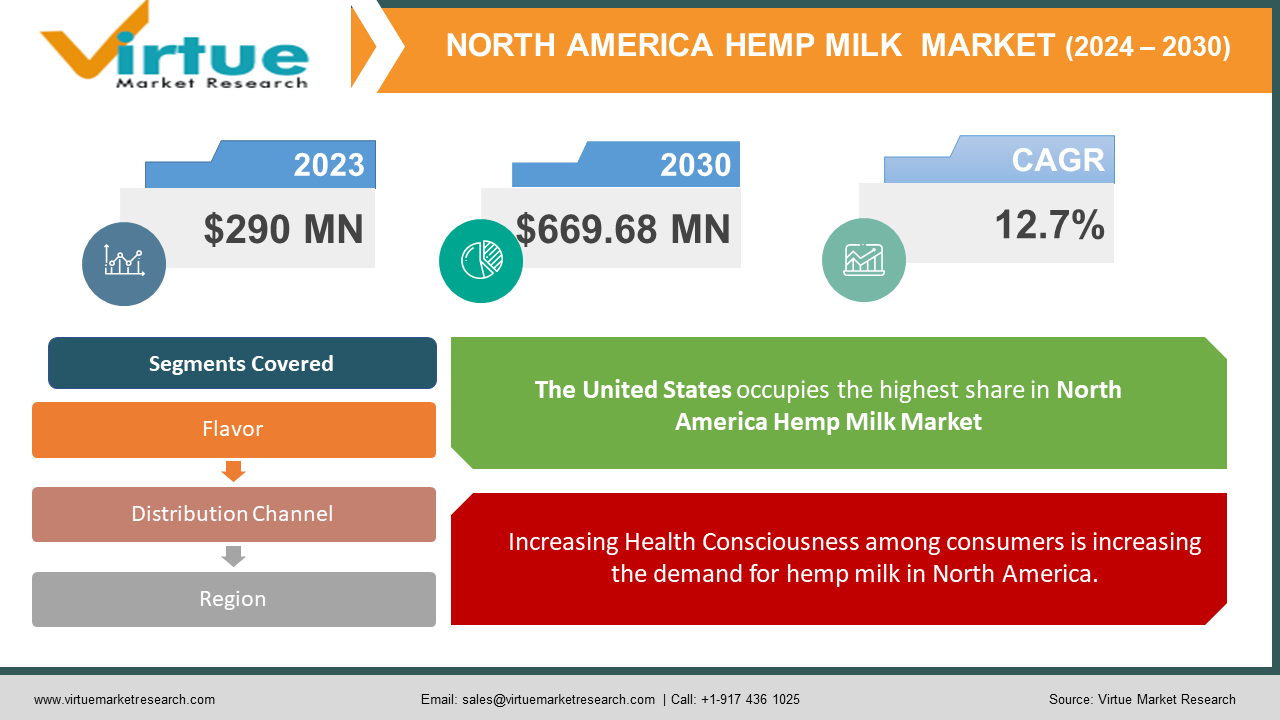

The North America Hemp Milk Market was valued at USD 290 Million in 2023 and is projected to reach a market size of USD 669.68 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 12.7%.

The North American hemp milk market is experiencing substantial growth as consumer demand for plant-based and dairy-free alternatives continues to rise. Hemp milk, derived from hemp seeds, is prized for its nutritional benefits, including high protein content and essential fatty acids. It is gaining popularity among health-conscious consumers seeking lactose-free and environmentally sustainable options. The market is characterized by a range of product varieties, including organic and flavored options, further diversifying consumer choices. The increasing emphasis on health, sustainability, and ethical food consumption is expected to drive the growth of the North American hemp milk market in the coming years.

Key Market Insights:

- Hemp milk is emerging as the fastest-growing product in the North American non-dairy milk market. This surge in popularity is mainly propelled by the increasing awareness of the health benefits associated with hemp milk consumption, which aligns with the growing health consciousness among consumers in the region.

- In the United States, supermarkets and hypermarkets have dominated the plant-based milk market, accounting for a substantial 74% of sales by value in 2022.

- Canada is witnessing a notable trend in online sales of plant-based milk, with an expected compound annual growth rate of 15% through the forecast period, targeting a market value of USD 24 million by the end of 2029.

- The adoption of plant-based milk is on the rise in the U.S., driven by the increasing importance of vegetarian diets within healthy lifestyles, with approximately 70% of U.S. adults having explored dairy alternatives or plant-based meat. Surveys also reveal that about 33% of respondents express interest in adopting vegan lifestyles to reduce environmental impacts. Consequently, the United States stands out as the predominant market in the region, witnessing a substantial volume consumption growth of 32.7% from 2017 to 2022.

- For Canada, the plant-based milk market is projected to experience a CAGR of 9.8% from 2023 to 2029, aiming to achieve a market volume of approximately 292 thousand tonnes by the end of 2023. This growth is primarily attributed to the increasing vegan population. Notably, in 2021, plant-based ready meal retail sales in Canada accounted for 17% of total free-from-ready meal sales. The market's expansion is further propelled by the growing presence of retail partners specializing in vegan food distribution.

North America Hemp Milk Market Drivers:

Increasing Health Consciousness among consumers is increasing the demand for hemp milk in North America.

Growing awareness of the health benefits associated with hemp milk is a significant driver. Hemp milk is rich in essential nutrients, including omega-3 and omega-6 fatty acids, as well as protein, making it an attractive option for health-conscious consumers. It is often considered a nutritional powerhouse and is sought after by individuals looking for lactose-free, soy-free, and nut-free alternatives. Additionally, hemp milk is perceived as a source of potential wellness benefits, such as heart health and skin improvement, driving its popularity in the region.

The hemp milk market in North America is on the rise due to increasing Plant-Based and Dairy-Free Trends.

The rising trend of plant-based and dairy-free diets is a strong driver of the North American hemp milk market. Many consumers are making a shift towards vegan or dairy-free options due to concerns about lactose intolerance, allergies, ethical reasons, and environmental sustainability. Hemp milk fits into this trend perfectly as it is entirely plant-based and offers a milk-like consistency and taste. This aligns with the changing dietary preferences and lifestyles of a significant portion of the North American population, contributing to the increasing demand for hemp milk products.

North America Hemp Milk Market Restraints and Challenges:

Regulatory Uncertainty is a major hindrance in North America's Hemp Milk market.

One of the major challenges for the hemp milk market in North America is the evolving and sometimes uncertain regulatory environment surrounding hemp and hemp-derived products. While the U.S. Farm Bill of 2018 legalized the cultivation of industrial hemp, including the production of hemp-derived products, the regulations related to the use of hemp in food and beverages, including hemp milk, remain subject to change and interpretation at both federal and state levels. This regulatory uncertainty can make it challenging for businesses to navigate compliance and may impact product labeling, distribution, and overall market growth.

Competition and Consumer Education are important to drive market growth, failure could be challenging for businesses.

The plant-based milk market in North America is highly competitive, with various alternatives like almond milk, soy milk, and oat milk already well-established. Hemp milk is a relatively new entrant, and consumer awareness and education about its nutritional benefits and taste profile are essential for its growth. Additionally, there can be misconceptions about hemp's association with marijuana, which may hinder adoption. Effective marketing and educational campaigns are required to overcome these challenges and build consumer confidence in hemp milk as a viable and healthy alternative to traditional dairy and other plant-based milks.

North America Hemp Milk Market Opportunities:

The North American hemp milk market presents significant growth opportunities driven by increasing consumer demand for plant-based, dairy-free, and nutritionally rich alternatives. As consumers seek healthier and sustainable options, hemp milk's high protein content, essential fatty acids, and eco-friendly cultivation make it an attractive choice. Additionally, the market can leverage the growing trend of incorporating hemp-based products into various food and beverage categories, further expanding its presence in the functional food and beverage sector. With the right marketing, education, and innovative product development, the North American hemp milk market has the potential to meet the evolving preferences of health-conscious and environmentally- aware consumers.

NORTH AMERICA HEMP MILK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

12.7% |

|

Segments Covered |

By Flavor, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, U.SA, Canada, Mexico |

|

Key Companies Profiled |

Hemp Yeah! , Living Harvest (now known as Tempt), Pacific Foods, Good Hemp, Elmhurst 1925, Planet Hemp, Elio's Organic Coconut Hemp Milk, Hippie Hemp Milk, Braham & Murray, SoFresh |

North America Hemp Milk Market Segmentation:

North America Hemp Milk Market Segmentation: By Flavor:

- Original/Unflavored

- Vanilla

- Chocolate

- Other Flavors

The largest segment by flavor in the North American hemp milk market is the Original/Unflavored category having a market share of 64%. This is primarily because the original/unflavored hemp milk serves as a versatile and neutral base that can be incorporated into a wide range of recipes and used as a dairy milk substitute in cooking, baking, and beverages. Many consumers prefer the unflavored option as it allows them to customize the taste according to their preferences, whether it be adding sweeteners, spices, or other flavorings. This segment's popularity is also linked to the broader appeal of a plain, natural product that aligns with a variety of dietary and culinary choices, making it a staple in the hemp milk market. The fastest-growing segment by flavor in the North American hemp milk market is Vanilla growing with a CAGR of 13.4%. This growth is driven by the consumer preference for enhanced taste profiles, as vanilla adds a pleasant and familiar flavor to hemp milk, making it more appealing to a broader audience, including those transitioning from dairy milk. The sweetness of vanilla complements the slightly nutty taste of hemp milk, making it a popular choice for those seeking a tasty and versatile plant-based milk option for various culinary applications, such as in coffee, cereals, and smoothies.

North America Hemp Milk Market Segmentation: By Distribution Channel:

- Supermarkets

- Convenience Stores

- Online Retail

- Health Food Stores

- Others

The largest segment by distribution channel in the North American hemp milk market is Supermarkets which have a market share of 58%. This dominance can be attributed to the widespread availability and accessibility of hemp milk in these retail outlets. Supermarkets and hypermarkets offer a one-stop shopping experience, making it convenient for consumers to discover and purchase a variety of food and beverage products, including hemp milk. These stores typically stock a wide range of brands and flavors, providing consumers with numerous options and the opportunity to incorporate hemp milk into their daily diets easily. The fastest-growing segment by distribution channel in the North American hemp milk market is Online Retail growing with a CAGR of 19%. This growth is attributed to the increasing trend of e-commerce and online shopping, which has been further accelerated by the COVID-19 pandemic. Consumers are increasingly seeking the convenience and accessibility of purchasing hemp milk and other plant-based products online. Online retail platforms offer a wide variety of hemp milk brands and flavors, often with competitive pricing and doorstep delivery options.

North America Hemp Milk Market Segmentation: Regional Analysis:

- U.SA.

- Canada

- Mexico

The largest region in terms of the North American hemp milk market is the U.S.A. holding a market share of 54%. This is because the U.S.A. has a well-established market for plant-based and dairy-free alternatives, including hemp milk. With a growing number of health-conscious and environmentally- aware consumers, a developed retail infrastructure, and a history of embracing dietary trends, the U.S.A. leads the region in both the production and consumption of hemp milk, making it the largest market in North America. The U.S.A. is also the fastest-growing region in the North American hemp milk market. This growth is primarily driven by increasing consumer demand for plant-based and dairy-free alternatives, health consciousness, and an environmentally sustainable lifestyle. The U.S. has a large and diverse population with a strong emphasis on dietary choices, making it a hub for plant-based milk adoption. The market also benefits from a robust retail infrastructure, widespread availability of hemp milk products, and active promotion by both established and emerging brands, further fueling its rapid expansion within the country.

COVID-19 Impact Analysis on the North American Hemp Milk Market:

The COVID-19 pandemic had a mixed impact on the North American hemp milk market. Initially, there was a surge in demand for plant-based and shelf-stable products, including hemp milk, as consumers stockpiled essential items. However, disruptions in supply chains and retail operations affected the availability and distribution of hemp milk. The economic uncertainty led some consumers to prioritize essential purchases over premium-priced products like hemp milk. As the situation normalized, the market rebounded with increasing health consciousness and dietary preferences, and the demand for hemp milk continued to grow, driven by its perceived health benefits and sustainability aspects.

Latest Trends/ Developments:

- One notable trend in the North American hemp milk market is the continuous expansion of product varieties. Manufacturers are introducing a wide range of flavored hemp milk, including vanilla, chocolate, and original, to cater to diverse consumer tastes. Additionally, there is a growing emphasis on producing organic and non-GMO options, further enhancing the market's appeal to health-conscious consumers seeking customization and transparency in their plant-based milk choices.

- A significant development in the market is the increased availability of hemp milk in mainstream retail outlets. It has transitioned from being primarily available in health food stores to being stocked in major supermarket chains and convenience stores across North America. This broader retail presence is making hemp milk more accessible to a wider consumer base, contributing to its market growth as consumers can conveniently incorporate it into their everyday diets.

Key Players:

- Hemp Yeah!

- Living Harvest (now known as Tempt)

- Pacific Foods

- Good Hemp

- Elmhurst 1925

- Planet Hemp

- Elio's Organic Coconut Hemp Milk

- Hippie Hemp Milk

- Braham & Murray

- SoFresh

Chapter 1. North America Hemp Milk Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Hemp Milk Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Hemp Milk Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Hemp Milk Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Hemp Milk Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Hemp Milk Market– By Distribution channel

6.1. Introduction/Key Findings

6.2. Supermarkets

6.3. Convenience Stores

6.4. Online Retail

6.5. Health Food Stores

6.6. Others

6.7. Y-O-Y Growth trend Analysis By Distribution channel

6.8. Absolute $ Opportunity Analysis By Distribution channel , 2024-2030

Chapter 7. North America Hemp Milk Market– By End-User Industry

7.1. Introduction/Key Findings

7.2. Original/Unflavored

7.3. Vanilla

7.4. Chocolate

7.5. Other Flavors

7.6. Y-O-Y Growth trend Analysis By End-User Industry

7.7. Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 8. North America Hemp Milk Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By End User

8.1.3. By Distribution channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Hemp Milk Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Hemp Yeah!

9.2. Living Harvest (now known as Tempt)

9.3. Pacific Foods

9.4. Good Hemp

9.5. Elmhurst 1925

9.6. Planet Hemp

9.7. Elio's Organic Coconut Hemp Milk

9.8. Hippie Hemp Milk

9.9. Braham & Murray

9.10. SoFresh

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The North America Hemp Milk Market was valued at USD 290 Million in 2023 and is projected to reach a market size of USD 669.68 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 12.7%.

Increasing Health Consciousness among consumers and increasing Plant-Based and Dairy-Free Trends are drivers of the North America Hemp Milk market.

Based on flavor, the North American Hemp Milk Market is segmented into Original/Unflavored, Vanilla, Chocolate, and Other Flavors.

The U.S.A. is the most dominant region for the North America Hemp Milk Market.

Hemp Yeah!, Living Harvest (now known as Tempt), Pacific Foods and Good Hemp are a few of the key players operating in the North America Hemp Milk Market