North America Green Solvent Coatings Market Size (2024 – 2030)

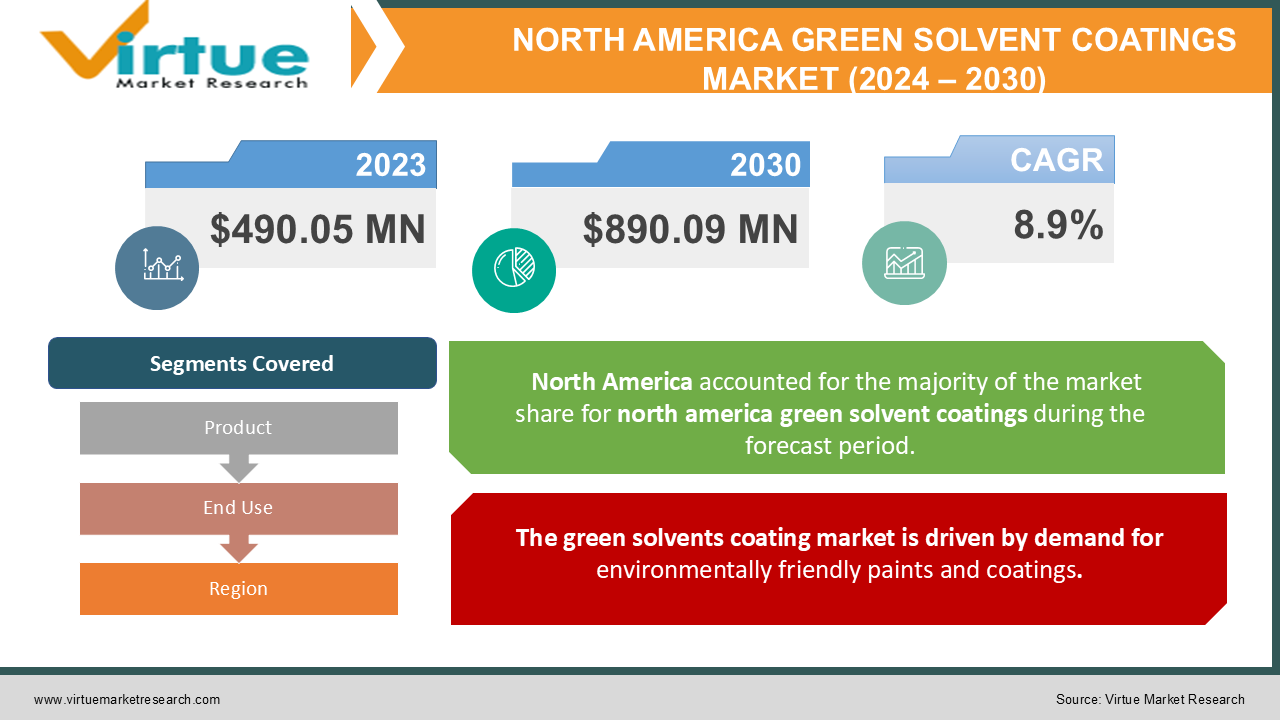

The North America Green Solvent Coatings Market was estimated to be worth USD 490.05 Million in 2023 and is projected to reach a value of USD 890.09 Million by 2030, growing at a CAGR of 8.9% during the forecast period 2024-2030.

Refined glycerin, vegetable oils, lactic acid, bio-succinic acid, sugar cane, and maize are some of the environmentally friendly sources of green solvents. Biorefineries, which turn biomass into fuel and electricity, produce these solvents. They are employed in the synthesis of chemicals like bioalcohols and glycols. Green solvents are biodegradable, non-corrosive, non-carcinogenic, recyclable, and environmentally benign. Their high boiling point, low toxicity, and low miscibility make them good alternatives to traditional solvents derived from crude oil. Paints, coatings, printing inks, household and industrial cleaners, adhesives, medications, and cosmetics are among the products with frequent uses.

Key Market Insights:

- The market share of waterborne coatings is around 60%, while the market share of high-solids coatings is approximately 25%.

- The average price of green solvent coatings ranges from $25 to $40 per gallon, depending on the type and application.

- The total demand for green solvent coatings in North America is estimated to be around 300 million gallons per year.

- Green solvent coatings are anticipated to account for roughly 34% of the market in North America, and Canada holds the biggest market share of 55 % in North America.

- The architectural and industrial sectors together account for nearly 75% of the total green solvent coatings consumption in North America.

Global North America Green Solvent Coatings Market Drivers:

The green solvents coating market is driven by demand for environmentally friendly paints and coatings.

Because of beneficial laws and certification programs that support environmentally friendly products, there is an increasing demand for eco-friendly paints and coatings. These products dissolve or disperse paint compounds using environmentally friendly solvents. The packaging sector, which employs green solvent-based sealants and adhesives for bonding applications, is another motivator. In the upcoming years, these trends are anticipated to drive market expansion.

Demand for green solvents is expected to increase in tandem with the growing need for dependable and eco-friendly products.

Soybean oil, bio-succinic acid, distilled glycerin, and lactic acid are examples of green solvents that come from agricultural sources. Because they release fewer volatile organic compounds (VOCs) and are safer for the environment than conventional petroleum-based solvents, manufacturers prefer them. Concerns regarding the effects of hazardous chemicals and solvents used in industry on the environment and human health are what spurred the switch to green solvents. Reactions to these chemicals can cause diseases like tuberculosis, cancer, and asthma. Green solvents are therefore becoming more and more well-liked as safer substitutes in a variety of industries.

North America Green Solvent Coatings Market Challenges and Restraints:

An uninterrupted supply of raw materials is necessary for the production of green and bio-solvents. To guarantee efficient production, it's also critical that these raw materials are constantly of high quality. The ability to obtain reasonably priced renewable raw materials is often necessary for the profitable production of green and bio-solvents. Price fluctuations for raw materials can affect profitability, particularly for smaller companies that might not have as many options as larger corporations to negotiate fixed-price contracts or use price hedging techniques.

North America Green Solvent Coatings Market Opportunities:

The green solvent coatings market in North America presents several encouraging chances for businesses to expand and innovate. These include researching novel bio-based solvents from renewable sources like plants or agricultural waste, developing high-performance environmentally friendly coatings that match or surpass traditional solvent-based ones, expanding geographically into markets with rising environmental consciousness, researching new applications beyond automotive and construction where greener coatings can replace hazardous alternatives, and using sustainability branding to appeal to environmentally conscious consumers. Through the implementation of strategic partnerships, investments, and forward-thinking initiatives, companies can enhance their competitiveness, spur growth, and make a positive impact on the coatings industry's sustainability.

NORTH AMERICA GREEN SOLVENT COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.9% |

|

Segments Covered |

By Product, End Use, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America |

|

Key Companies Profiled |

BASF SE, DuPont, Dow, Cargill, Incorporated, Gevo, AkzoNobel, LyondellBasell N.V., Archer Daniels Midland Company, Emery Oleochemicals |

North America Green Solvent Coatings Market Segmentation

North America Green Solvent Coatings Market Segmentation: By Product

- Bio-Alcohols

- Bio-Methanol

- Bio-Ethanol

- Bio-Glycols

- Lactate Esters

- D-Limonene

- Methyl Soyate

- Others

In 2023, lactate esters accounted for 31.4% of total revenue, making them the most profitable green solvent. Increased demand from sectors like pharmaceuticals, personal care, and industrial solvents was the driving force behind this. Because they can take the place of conventional petroleum-based solvents when manufacturing costs are reduced, lactate esters are preferred. Because of their ability to be recycled, their non-corrosive nature, their biodegradability, and their lack of ozone depletion, they are widely used in paints and coatings. Globally, D-limonene is a well-liked green solvent. It replaces most chlorinated solvents as well as abrasive solvents like acetone, toluene, methyl ethyl ketone, and xylene. Since it is not soluble in water on its own, it is frequently found in cleaning products and combined with surfactants for tasks like tar and asphalt cleaning. To create powerful cleaning solutions, D-limonene is combined with surfactants and materials like calcium and magnesium in cleaning products.

North America Green Solvent Coatings Market Segmentation: By End-use

- Chemical Intermediate

- Pharmaceuticals

- Printing Inks

- Paints & Coatings

- Cosmetics & Personal Care

- Others

With 31.6% of total sales in 2023, the paints and coatings segment led the market. Increased building and infrastructure projects in nations like China, Japan, and India are to blame for this growth. Furthermore, because bio-based paints and coatings provide glossy, long-lasting, and visually appealing finishes for both indoor and outdoor applications, there is an increasing demand for these products. Eighty to ninety percent of the materials used in the pharmaceutical industry are solvents. They contribute significantly to the toxicity profile of pharmaceuticals, even though they are essentially process aids and have no direct effect on reaction outcomes. To develop a sustainable substitute for traditional fossil-based chemicals, researchers are investigating the use of bio-based compounds made from agricultural waste as green solvents to create pharmaceutical ingredients. The use of green solvents in pharmaceuticals has advanced, and this is fueling global market expansion.

North America Green Solvent Coatings Market Segmentation: By Region

- USA

- Canada

- Mexico

By 2030, green solvents are anticipated to account for roughly 34% of the market in North America, and Canada is predicted to hold the biggest market share. Numerous factors, such as the region's concentration of major manufacturers and the heightened availability of raw materials, are responsible for this growth. Because of growing consumer awareness and continuous product innovation aimed at enhancing quality and broadening applications, there is an increasing demand for bio-based solvents in Canada. Furthermore, in favor of more economical and ecologically friendly natural gas feedstocks like sugars and glycerol, North American ethylene plants are moving away from naphtha derived from petroleum. The region's market is expanding thanks in part to the packaging and printing ink industries. Important manufacturers such as Stepan Company and Cargill, Incorporated are contributing to the expansion of the green solvent market in North America.

COVID-19 Impact on the Global North America Green Solvent Coatings Market:

The market for green solvents has been significantly impacted by the COVID-19 pandemic. Concerns about worker safety and the risk of infection hurt businesses that use green solvents, including those that produce paint and coatings, ink, adhesives, and sealants. During this period, construction projects also came to a halt, which decreased the need for green solvents used in construction and building. Nonetheless, the pharmaceutical industry's growing need for bio-based solvents for medication formulations supported the green solvents market during this difficult time.

Latest Trend/Development:

Due to growing consumer preference for eco-friendly products, stricter regulations limiting harmful emissions, and growing environmental consciousness, the green solvent coatings market in North America is expanding rapidly. The use of bio-based solvents made from renewable plant sources rather than conventional petroleum-based ones is becoming more common. Water-based coatings that reduce hazardous solvents and volatile organic compounds (VOCs) are also becoming more popular. Technological advancements are also helping to improve the performance of green coatings. The need for these sustainable coatings is being driven by certain industries, such as aerospace, automotive, and construction, to meet their environmental goals. To meet the stricter clean air regulations, manufacturers are spending money on research and development to create cutting-edge green solvent coatings with improved application and durability characteristics. Increasing consumer awareness of environmental issues is ultimately a major factor driving this market's expansion across a range of applications.

Key Players:

- BASF SE

- DuPont

- Dow

- Cargill

- Incorporated

- Gevo

- AkzoNobel

- LyondellBasell N.V.

- Archer Daniels Midland Company

- Emery Oleochemicals

Market News:

- LyondellBasell will take part in Chinaplas 2023, which will take place in Shenzhen from April 17–20. The company intends to highlight its most recent partnerships with collaborators from all points along the value chain, such as Jiangsu WMGrass, Genox, and Nippon Paint China, during this exhibition. LyondellBasell wants to help China's creative recycling ecosystems and contribute to a more sustainable future by fortifying local partnerships.

- As part of its energy transition strategy, Shell plc published its Energy Transition Progress Report 2022 in March 2023, proving that it had met its climate targets. The report details the important steps Shell has taken to further its energy transition initiatives.

Chapter 1. NORTH AMERICA GREEN SOLVENT COATINGS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. NORTH AMERICA GREEN SOLVENT COATINGS MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. NORTH AMERICA GREEN SOLVENT COATINGS MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. NORTH AMERICA GREEN SOLVENT COATINGS MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. NORTH AMERICA GREEN SOLVENT COATINGS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. NORTH AMERICA GREEN SOLVENT COATINGS MARKET – By Product

6.1. Introduction/Key Findings

6.2 Bio-Alcohols

6.3. Bio-Methanol

6.4. Bio-Ethanol

6.5. Bio-Glycols

6.6. Lactate Esters

6.7. D-Limonene

6.8. Methyl Soyate

6.9. Others

6.10. Y-O-Y Growth trend Analysis By Product

6.11. Absolute $ Opportunity Analysis By Product , 2024-2030

Chapter 7. NORTH AMERICA GREEN SOLVENT COATINGS MARKET– By End-use

7.1. Introduction/Key Findings

7.2 Chemical Intermediate

7.3. Pharmaceuticals

7.4. Printing Inks

7.5. Paints & Coatings

7.6. Cosmetics & Personal Care

7.7. Others

7.8. Y-O-Y Growth trend Analysis By End-use

7.9. Absolute $ Opportunity Analysis By End-use, 2024-2030

Chapter 8. NORTH AMERICA GREEN SOLVENT COATINGS MARKET – By Region

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Product

8.1.3. By End-use

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. NORTH AMERICA GREEN SOLVENT COATINGS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. BASF SE

9.2. DuPont

9.3. Dow

9.4. Cargill

9.5. Incorporated

9.6. Gevo

9.7. AkzoNobel

9.8. LyondellBasell N.V.

9.9. Archer Daniels Midland Company

9.10. Emery Oleochemicals

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The North America Green Solvent Coatings Market was estimated to be worth USD 490.05 Million in 2023 and is projected to reach a value of USD 890.09 Million by 2030, growing at a CAGR of 8.9% during the forecast period 2024-2030.

Green solvents are derived from vegetable oils, lactic acid, bio-succinic acid, beat, sugarcane, maize, and refined glycerin.

Demand for sustainable paints and coatings and demand for reliable and environmentally friendly goods rises are the drivers of the North America Green Solvent Coatings Market.

Uncertainty regarding the dependability and enough supply of feedstocks may provide a problem for the green solvent coating market.

D-Limonene product is the fastest growing in the North America Green Solvent Coatings Market.