North America Glyphosate Market Size (2024-2030)

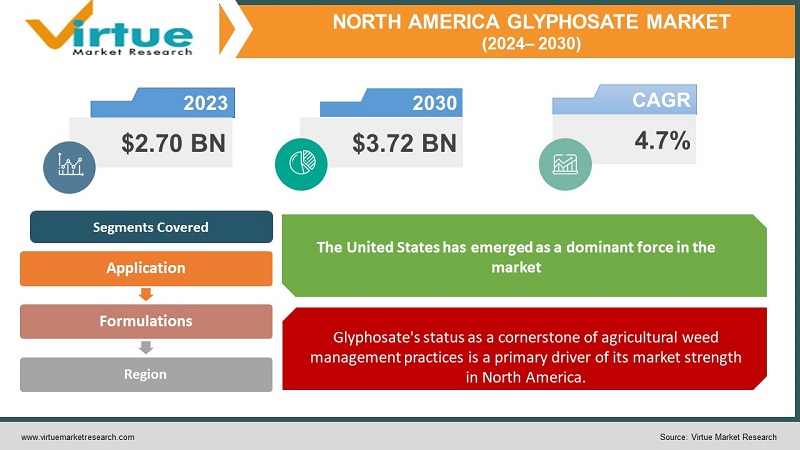

The North America Glyphosate Market was valued at USD 2.70 Billion in 2024 and is projected to reach a market size of USD 3.72 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.7%.

Glyphosate is a broad-spectrum herbicide widely used across North America in both agricultural and non-agricultural settings. Its popularity stems from its effectiveness in controlling a wide range of weeds, a major challenge faced by farmers. Glyphosate's introduction, along with the development of genetically modified "Roundup Ready" crops tolerant to the chemical, has revolutionized farming practices. Glyphosate is integral to modern agriculture. It's used extensively in the cultivation of major crops like corn, soybeans, cotton, canola, and various fruits and vegetables. Its application ranges from pre-planting weed control to managing weeds in growing crops. Homeowners and gardeners use glyphosate-based products in smaller quantities to control weeds in lawns, gardens, and landscapes. The need for efficient weed control to protect crop yields and maximize productivity remains a major driver for glyphosate use. The search for alternatives to glyphosate, driven by weed resistance and consumer concerns, is gaining momentum. However, finding replacements with the same broad-spectrum efficacy and cost-effectiveness remains a challenge.

Key Market Insights:

Farmers face constant pressure to control weeds, which compete with crops for resources, reduce yields, and can hinder harvesting. Glyphosate offers an efficient and cost-effective broad-spectrum solution. The widespread adoption of glyphosate-tolerant crops (e.g., Roundup Ready soybeans, corn) has significantly bolstered glyphosate usage. The large-scale nature of agriculture in North America, especially in the US, encourages the use of proven, cost-effective weed management solutions like glyphosate. We may see a greater divergence between glyphosate's continued use in mainstream agriculture and declining demand within the organic food sector or residential applications due to consumer preferences. Addressing herbicide resistance will require farmers to adopt more diverse weed management strategies, potentially reducing their reliance on glyphosate in the longer term. Developing crops resistant to multiple herbicides or creating new herbicides with unique mechanisms of action are potential avenues to address this issue.

North America Glyphosate Market Drivers:

Glyphosate's status as a cornerstone of agricultural weed management practices is a primary driver of its market strength in North America.

Historically, farmers faced the relentless battle against weeds through a combination of manual removal, mechanical tillage, and targeted herbicides with limited spectrums of effectiveness. Glyphosate transformed this landscape with its broad-spectrum activity and flexibility, offering several key advantages. Glyphosate's ability to eradicate a vast array of weeds, both grasses and broadleaf varieties, simplifies weed management for farmers. It eliminates the need to employ multiple specialized herbicides based on the weed species present in a field. Glyphosate enables no-till or conservation tillage practices, where instead of tilling the soil to control weeds, farmers can directly plant into the residue of the previous crop. This promotes soil health, reduces erosion, and conserves water. Glyphosate reduces the need for labor-intensive manual weeding or multiple tillage passes, conserving both time and costs associated with traditional methods. In many cases, glyphosate provides a more cost-effective weed control solution compared to the use of several specialized herbicides or repeated mechanical interventions. The over-reliance on glyphosate has led to the widespread evolution of glyphosate-resistant weeds. This challenges its long-term efficacy and drives the need for alternative solutions or integrated weed management strategies.

The development and widespread adoption of "Roundup Ready" crops, genetically engineered to tolerate glyphosate, has significantly reinforced the market dominance of this herbicide.

Perhaps the most significant shift was the ability to control weeds directly within growing GM crops. Farmers can apply glyphosate over their fields, eliminating weeds while their soybean, corn, or cotton crops remain unharmed. Glyphosate-resistant crops made no-till or conservation tillage widely feasible. Instead of tilling the soil to control weeds, farmers can rely on glyphosate, promoting soil health, reducing erosion, and conserving resources. Since glyphosate resistance exists across major crops like corn, soybeans, and canola, farmers gain more flexibility in planning crop rotations – a valuable tool for managing weed populations and soil health. The compatibility between glyphosate and GM crops reduces the need for multiple herbicides with specific targets, simplifying weed control strategies and potentially reducing costs. Farmers experiencing the significant efficiency and yield benefits of the "Roundup Ready" system have rapidly adopted GM crops across major agricultural regions. The heavy use of glyphosate over vast acreages has accelerated the evolution of glyphosate-resistant weeds, contested the system's effectiveness, and required farmers to reconsider their strategies. Public or market demand for foods clearly labeled as non-GMO could lead to a shift away from certain glyphosate-dependent GM crops in some sectors of the agricultural industry. While crops themselves are rigorously assessed for safety, the continued debate surrounding glyphosate's health and environmental impact could lead to restrictions on its use, impacting the dynamics of this system. The success of developing new GM crops tolerant to multiple herbicides or alternative herbicides with novel mechanisms of action could reshape weed management strategies. Breakthroughs in non-chemical or precision weed control technologies might present attractive alternatives to the current system, especially if they can match glyphosate's convenience and broad-spectrum efficacy.

North America Glyphosate Market Restraints and Challenges:

Growing public awareness and intensified scientific debate surrounding glyphosate's potential health and environmental risks have become a major restraining factor influencing its market trajectory.

Conflicting assessments of glyphosate's carcinogenic potential exist. While bodies like the US Environmental Protection Agency (EPA) maintain its safety, its classification as a probable carcinogen by the International Agency for Research on Cancer (IARC) fuels public concern. Media coverage of lawsuits and concerns raised by environmental groups have significantly impacted public perception of glyphosate, leading to increased consumer demand for glyphosate-free products. The widespread and often repeated use of glyphosate has led to a major agricultural challenge – the evolution of glyphosate-resistant weeds. This phenomenon undermines the efficacy of glyphosate-based weed control systems, posing a considerable challenge for farmers. Controlling resistant weeds necessitates a shift away from sole reliance on glyphosate, requiring farmers to employ alternative herbicides or integrate practices like crop rotation or tillage, increasing costs and potential environmental impact. Addressing herbicide resistance drives demand for new herbicides with unique mechanisms of action, as well as crop varieties with resistance to multiple herbicides. This creates an innovation imperative for the agrochemical sector. Ongoing litigation targeting glyphosate manufacturers alleging a link to cancer creates significant legal liabilities and influences public opinion, potentially leading to greater restrictions on its use. The need to address resistant weeds and public concerns will likely lead to a greater emphasis on integrated weed management, combining glyphosate judiciously with other techniques. While glyphosate's current dominance in agriculture isn't likely to disappear overnight, the challenges highlighted will accelerate investment in research and development of alternative herbicides and weed control systems.

North America Glyphosate Market Opportunities:

The search for herbicides with novel modes of action (how they target weeds) is a major research focus. A breakthrough offering similar broad-spectrum efficacy as glyphosate, but with a different mechanism, could reshape weed control, particularly in combating resistant weeds. Developing crops resistant to multiple herbicides with distinct modes of action would give farmers more powerful tools to manage weeds and delay resistance development. Expanding populations and economic progress in countries across Asia, Africa, and parts of South America drive the need for efficient crop production and weed control solutions. Glyphosate could see increased use in those agricultural sectors. As developing agricultural sectors modernize, the adoption of GM crops and associated systems compatible with glyphosate might gain momentum, presenting an opportunity for market expansion. Glyphosate is used in forestry for site preparation and to control weeds that compete with young trees. This sector could see targeted growth. Maintaining rights-of-way for railroads, roadsides, and industrial sites often involves vegetation control. Glyphosate-based solutions could remain relevant in this segment, particularly where cost-effectiveness is prioritized. The development of new glyphosate formulations tailored for specific needs or to minimize environmental impact could open new niches within both agricultural and non-agricultural use cases. The North American glyphosate market appears to be at a crossroads. The potential opportunities outlined above highlight the possibility that glyphosate, or herbicides derived from its success, might hold onto relevance even in the face of challenges.

NORTH AMERICA GLYPHOSATE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.7% |

|

Segments Covered |

By application, formulation, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United States, Canada, and Rest of North America |

|

Key Companies Profiled |

Bayer CropScience, Syngenta, Corteva Agriscience, Nufarm, UPL, BASF, Adama, Drexel Chemical Company |

North America Glyphosate Market Segmentation:

North America Glyphosate Market Segmentation: By Application

- Agriculture

- Residential

- Industrial, Infrastructure, and Forestry

Agriculture: Occupies the most significant share, roughly 75-80% of the glyphosate market. This reflects its widespread use across a variety of crops and diverse agricultural regions. Residential: Represents approximately 15-20% of the market. Usage in home gardens and lawns contributes to this segment's share. Industrial, Infrastructure, and Forestry: The remaining smaller segment (around 5-10%) involves applications along roadsides, industrial sites, and within forestry management practices. Agriculture stands as the undisputed dominant application segment for glyphosate in North America. Glyphosate is compatible with a wide range of major crops grown across North America, including corn, soybeans, cotton, and canola. The availability of "Roundup Ready" (glyphosate-tolerant) varieties has expanded its use dramatically. with these crops dominating acreage within the agricultural landscape. Increasing concerns about potential health and environmental risks have led to growing restrictions or bans on glyphosate use in residential settings in certain localities. This segment might see stagnation or even decline. Public demand for "chemical-free" options drives innovation in both chemical and non-chemical weed control solutions for home use, potentially displacing glyphosate-based products over time.

North America Glyphosate Market Segmentation: By Formulations -

- Liquid Concentrates

- Ready-to-Use

- Granular

Liquid Concentrates: Dominate the market, holding an estimated 70-75% share. This is driven by their widespread use in large-scale agriculture, where farmers often purchase concentrates for cost-effectiveness and flexibility. Ready-to-Use: Capture an estimated 15-20% share, catering to the significant residential market and offering ease of use for homeowners. Granular: Represent a smaller niche with around 5-10% share. Their utility lies in specific agricultural and vegetation management applications for localized weed control. Liquid concentrates maintain their position as the most dominant formulation type, particularly within the agricultural sector. The ready-to-use (RTU) segment is likely witnessing the most rapid growth within the North American glyphosate market. A shift towards suburban living can lead to increased demand for convenient weed-control solutions. Potential restrictions on the sale or use of glyphosate concentrates in residential areas could further propel the growth of RTU options. Ease of use and a perception of safer handling might drive some consumers towards RTU formulations, even if they come with a slightly higher price point.

North America Glyphosate Market Segmentation: Regional Analysis:

- USA

- Canada

- Mexico

US: Commands the largest share, likely in the range of 35-45%. This reflects intensive glyphosate use in corn and soybean production. US Southern Plains: Holds a significant share, potentially around 20-30%. Diverse crop production and large-scale agriculture contribute to its position. Western US: Accounts for an estimated 15-25% of the market. High-value fruit and vegetable cultivation drives demand. Canada: Represents a smaller, but still important segment, likely around 10-15% of the North American glyphosate market. The US Midwest stands out as the most dominant region within the North American glyphosate market. The region's focus is on glyphosate-tolerant corn and soybeans. Large-scale farming operations characteristic of the Midwest translates to greater overall glyphosate use per unit of land. The US South is likely experiencing the most rapid growth. Factors driving this include population influx, land conversion to agriculture, and increasing adoption of practices common in the Midwest, like no-till farming and glyphosate-tolerant crops.

COVID-19 Impact Analysis on the North American Glyphosate Market:

Movement restrictions, worker safety concerns, and logistical challenges led to disruptions in glyphosate production, transportation, and distribution networks. This temporary strain on the supply chain created uncertainties in product availability, particularly for smaller retailers. Lockdowns and increased time spent at home fueled a surge in DIY projects, including gardening and lawn care. This translated to a significant rise in demand for glyphosate-based products in the residential homeowner market segment. While the pandemic didn't fundamentally eliminate the need for weed control, it forced adjustments. Supply chain delays and fluctuating prices led some farmers to temporarily modify their herbicide use patterns or explore alternative solutions. The heightened global emphasis on ensuring a stable food supply chain supported the continued use of essential agricultural inputs, including glyphosate, even amidst potential market disruptions. Lockdowns and a preference for minimizing in-person shopping drove consumers towards online platforms for purchasing glyphosate products for residential use. This trend not only benefited established online retailers but also opened doors for smaller online vendors. The e-commerce boom created new opportunities for smaller suppliers and distributors of glyphosate-based products, increasing competition within the market. This could potentially have long-term implications for market dynamics. The growth of online channels could, in the long term, influence how agricultural retailers and suppliers engage with farmers. Digital platforms might become a significant channel for glyphosate sales and information dissemination in the future. The pandemic exposed potential vulnerabilities in the glyphosate supply chain. We might see a focus on supply chain diversification and strengthening existing networks to bolster resilience against future disruptions.

Latest Trends/ Developments:

Mounting concerns about glyphosate's long-term safety, coupled with the problem of weed resistance, are intensifying the search for viable alternatives. There's a shift towards IWM, where glyphosate is used strategically alongside other practices like crop rotation, tillage (where appropriate), cover crops, and diverse herbicides. While glyphosate may retain significance within the agricultural landscape, these trends are likely to create pockets of opportunity for new players, niche solutions, and a potential decline in glyphosate's market dominance in the long term. The regulatory landscape surrounding glyphosate is in flux. Potential restrictions on its use, particularly in non-agricultural settings, could reshape the market. Increased scrutiny and re-evaluation of the herbicide are likely to continue. Rising public awareness and concerns about glyphosate's safety profile are influencing consumer choices and retailer decisions. We might see stronger demand for glyphosate-free products and greater market segmentation. Regulatory and consumer pressures will drive innovation within the agrochemical sector to develop alternatives that offer farmers effective weed control while addressing safety and environmental concerns.

Key Players:

- Bayer CropScience

- Syngenta

- Corteva Agriscience

- Nufarm

- UPL

- BASF

- Adama

- Drexel Chemical Company

Chapter 1. North America Glyphosate Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Glyphosate Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Glyphosate Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Glyphosate Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Glyphosate Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Glyphosate Market– By Application

6.1. Introduction/Key Findings

6.2. Formulations

6.3. Residential

6.4. Industrial, Infrastructure, and Forestry

6.5. Y-O-Y Growth trend Analysis By Application

6.6. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 7. North America Glyphosate Market– By Formulations

7.1. Introduction/Key Findings

7.2. Liquid Concentrates

7.3. Ready-to-Use

7.4. Granular

7.5. Y-O-Y Growth trend Analysis By Formulations

7.6. Absolute $ Opportunity Analysis By Formulations , 2024-2030

Chapter 8. North America Glyphosate Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Application

8.1.3. By Formulations

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Glyphosate Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Bayer CropScience

9.2. Syngenta

9.3. Corteva Agriscience

9.4. Nufarm

9.5. UPL

9.6. BASF

9.7. Adama

9.8. Drexel Chemical Company

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Glyphosate is a cornerstone of modern agriculture due to its broad-spectrum effectiveness in controlling diverse weeds. Protecting crops from competition for resources safeguards yields and maximizes productivity

Conflicting scientific assessments exist regarding glyphosate's potential link to cancer. While regulatory bodies like the US EPA maintain its safety, its classification as a probable carcinogen by the IARC fuels public uncertainty and drives calls for stricter controls.

Bayer CropScience, Syngenta, Corteva Agriscience, Nufarm, UPL, BASF.

US Midwest currently holds the largest market share, estimated at around 35%.

The US Southern States exhibits the fastest growth, driven by its increasing population, and expanding economy