North America Fintech Market Size (2024-2030)

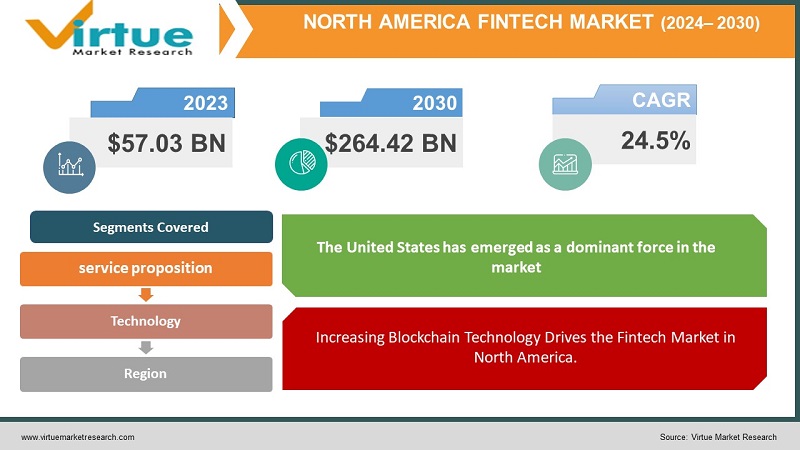

The North America Fintech Market was valued at USD 57.03 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 264.42 billion by 2030, growing at a CAGR of 24.5%.

When technology is integrated into financial services to enhance efficiency, productivity, and service delivery, it falls under the category of financial technology, commonly known as Fintech. Technologies such as artificial intelligence, blockchain, cloud computing, and big data contribute to the enhancement of financial services. Examples of fintech applications include peer-to-peer payment services, automated portfolio managers, mobile banking, and trading platforms such as Google Pay, Venmo, and BHIM-UPI.

Fintech facilitates regulatory oversight of money or capital markets, ensuring consumer safety, security, and the prevention of fraudulent activities. By making financial transactions easier, Fintech increases accessibility and reduces costs associated with investments, loans, bills, automatic payments, and savings. Consequently, Fintech promotes the flow of financial transactions, thereby fostering the advancement of the nation's financial sector.

When technology aids lenders in evaluating borrowers or relevant credentials, it is referred to as fintech lending. Fintech lenders employ technology to assess applications, thereby enhancing operational effectiveness, streamlining processes, and improving communication among stakeholders. This, in turn, enables businesses to enhance customer satisfaction and maintain fiscal health by bolstering security infrastructure and mitigating the risk of borrower insolvency through effective fraud detection.

Fintech lending utilizes digital tools and technology to simplify the loan application, approval, and repayment processes. These web and app-based services serve as conduits for swift and easy access to financial solutions for underserved communities, businesses, homeowners, and students.

Key Market Insights:

The increasing number of partnerships between financial institutions and national regulators has spurred rapid adoption of cutting-edge technology by insurance companies and banks in their day-to-day operations, moving away from outdated operating systems. This trend has opened up significant opportunities in the FinTech market.

Moreover, the growing customer demand for more user-friendly channels to conduct financial transactions, such as through e-commerce sites and mobile banking apps, is anticipated to further propel the FinTech market forward.

North America Fintech Market Drivers:

Increasing Blockchain Technology Drives the Fintech Market in North America.

Cross-border payments worldwide are subject to strict regulation, but the adoption of distributed ledger technology, despite its initial costliness, has managed to reduce some associated expenses and streamline tracking processes. Fintech companies are rapidly developing new platforms for online financial services and innovating at a rapid pace. International financial technology firms are forming partnerships with local cell phone companies, money transfer entities, and banks across the United States, Mexico, and Canada.

The banking sector has witnessed a surge in demand for digital transformation, driven by the necessity for online services amid restrictions on physical bank visits. Consequently, banking institutions are increasingly collaborating with fintech vendors to offer differentiated and competitive services. The digital customer experience is poised to become the primary area of competitive advantage, thus propelling market growth. For instance, in June 2020, Peoples Community Bank expanded its existing partnership with Finastra to accelerate innovation and product launches. The bank plans to enhance its infrastructure by adopting Finastra's Phoenix core platform and integrating Finastra's Fusion digital banking, LaserPro, and other solutions as part of its digitization strategy.

Furthermore, blockchain technology, offered by fintech vendors, has had a significant impact on reducing fraud and cyberattacks in the financial industry. Blockchain aids in mitigating data breaches and similar fraudulent activities by facilitating the secure and unaltered transfer of information through a decentralized network.

North America Fintech Market Restraints and Challenges:

Risks to Data and Privacy Hamper Market growth.

Prior to deploying an app, application, or website, companies must conduct security testing. However, this process can introduce unforeseen complications that extend the release timeline. In some cases, developers may opt to release software with known risks to expedite the launch of financial products. Yet, addressing these flaws later in the software development life cycle incurs significant expenses. This challenge stands as a hindrance to the growth of the FinTech Market.

North America Fintech Market Opportunities:

Advanced Technologies create opportunities in the FinTech Market.

The utilization of artificial intelligence, machine learning, big data, and blockchain technology is witnessing significant growth across various industries, particularly within the BFSI sector. The integration of these technologies into BFSI solutions and services is enhancing business operations, boosting efficiency, productivity, and customer satisfaction. The continuous advancements in these technologies contribute to the growth and development of the fintech lending market, particularly during the forecast period, by enhancing and refining solutions, software, and services. Additionally, the rising level of digital literacy among consumers further fuels the market's expansion.

NORTH AMERICA FINTECH MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

24.5% |

|

Segments Covered |

By Service proposition, technology, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United States, Canada, and Rest of North America |

|

Key Companies Profiled |

Goldman Sachs, Avant, LLC, Wealthsimple Inc., Chime Financial, Inc., SoFi Technologies, Inc., Stripe, Inc., Kraken, Mogo, Square, Oscar Health |

North America Fintech Market Segmentation

North America Fintech Market Segmentation By service proposition:

- money transfer and payments

- savings and investments

- digital lending and lending marketplaces

- online insurance and insurance marketplaces

- others

The money transfer and payments segment hold a dominant position in the market, reflecting its significant share of transactions and overall importance within the industry. On the other hand, the online insurance and insurance marketplaces segment is experiencing rapid growth, outpacing other segments in terms of expansion rate.

North America Fintech Market Segmentation By Technology:

- Artificial Intelligence and Machine Learning

- Blockchain

- Mobile Technology

- Big Data Analytics

- Others

The market is currently dominated by the artificial intelligence and machine learning segment, reflecting the widespread adoption and utilization of these technologies across various sectors. Fintech lending, which amalgamates finance and technology, is primarily driven by automation and digitization trends within the market. Moreover, advancements in AI and ML have transformed fintech lending, offering a convenient, fast, secure, and user-friendly platform for various transactions.

Online lending streamlines the application process by reducing prerequisites and paperwork, while also providing flexibility in terms of funding, interest rates, repayment time frames, and methods. The swift resolution of applications contributes to high levels of customer satisfaction and expands lending opportunities to previously untapped consumer segments. Furthermore, fintech organizations leverage AI-driven chatbots and virtual assistants to offer personalized advice and aid consumers in making critical financial decisions, further enhancing customer satisfaction and driving company growth.

The blockchain segment is anticipated to experience significant growth during the market forecast period, fueled by the increasing utilization of cryptocurrencies and digital currencies built on distributed ledger infrastructure for payment purposes.

North America Fintech Market Segmentation- by region

- USA

- Canada

- Mexico

The United States has emerged as a dominant force in the market, reshaping various aspects of lending, investing, loan selection, startup support, and acquisitions of new businesses. The widespread adoption of financial technology services has been notable, with one in every three digital consumers utilizing two or more such services.

In contrast, the Canadian fintech ecosystem is poised for growth. While Canadian cities benefit from strong foundational support for innovation, major hubs still have opportunities to enhance their reputations as leading global fintech ecosystems. Currently, around 700 fintech companies operate in Canada, with 18 new launches recorded in 2020 alone. Key verticals such as payments, lending, back office operations, and digital currencies remain significant areas of focus for numerous Canadian fintech firms.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic had a significant impact on the North American fintech market, presenting both challenges and opportunities. On one hand, the global economic disruptions resulting from the pandemic led to a reduction in consumer spending and investment, thereby making it more difficult for new and small businesses to secure funding and investments. Additionally, fintech companies relying on face-to-face interactions, such as those providing financial planning services, experienced a decrease in demand due to social distancing measures.

Conversely, the pandemic accelerated the adoption of digital payments and financial services as individuals increasingly turned to online shopping and contactless payment methods to minimize physical contact. This shift created new opportunities for fintech companies specializing in digital payment solutions, mobile banking, and online financial services. Consequently, there has been a notable surge in demand for digital financial solutions, including e-commerce platforms, digital wallets, and mobile banking apps.

Latest Trends/ Developments:

- November 2023: Stripe, a renowned financial infrastructure platform for businesses, expanded its support for JCB, a prominent card network in Japan and a leading global payment network. With this expansion, JCB is now integrated into Stripe's services across 39 countries and territories, facilitating seamless payment acceptance for businesses in these markets from over 154 million JCB cardholders.

- April 2022: Stripe, a platform offering financial infrastructure solutions for businesses, introduced the Stripe Partner Ecosystem, a novel partner program featuring top-tier companies whose services empower Stripe users to thrive in the digital economy.

- March 2022: SoFi Technologies, Inc., a digital personal finance company, announced the completion of its acquisition of Technisys S.à.r.l. ("Technisys"), a renowned cloud-native, digital multi-product core banking platform. This strategic acquisition enhances SoFi's capabilities and positions it as a comprehensive financial services platform, aligning with its objective to provide best-in-class products and establish itself as a one-stop destination for financial solutions. The addition of Technisys complements and strengthens SoFi's Galileo business, furthering its vision of creating the premier fintech platform akin to the AWS of finance.

Key Players:

These are top 10 players in the North America Fintech Market: -

- Goldman Sachs

- Avant, LLC

- Wealthsimple Inc.

- Chime Financial, Inc.

- SoFi Technologies, Inc.

- Stripe, Inc.

- Kraken

- Mogo

- Square

- Oscar Health

Chapter 1. North America Fintech Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Fintech Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Fintech Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Fintech Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Fintech Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Fintech Market– By Service proposition

6.1. Introduction/Key Findings

6.2. money transfer and payments

6.3. savings and investments

6.4. digital lending and lending marketplaces

6.5. online insurance and insurance marketplaces

6.6. others

6.7. Y-O-Y Growth trend Analysis By Service proposition

6.8. Absolute $ Opportunity Analysis By Service proposition , 2024-2030

Chapter 7. North America Fintech Market– By Technology

7.1. Introduction/Key Findings

7.2. Artificial Intelligence and Machine Learning

7.3. Blockchain

7.4. Mobile Technology

7.5. Big Data Analytics

7.6. Others

7.7. Y-O-Y Growth trend Analysis By Technology

7.8. Absolute $ Opportunity Analysis By Technology , 2024-2030

Chapter 8. North America Fintech Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Service proposition

8.1.3. By Technology

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Fintech Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Goldman Sachs

9.2. Avant, LLC

9.3. Wealthsimple Inc.

9.4. Chime Financial, Inc.

9.5. SoFi Technologies, Inc.

9.6. Stripe, Inc.

9.7. Kraken

9.8. Mogo

9.9. Square

9.10. Oscar Health

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The increasing number of partnerships between financial institutions and national regulators has spurred rapid adoption of cutting-edge technology by insurance companies and banks in their day-to-day operations, moving away from outdated operating systems. This trend has opened up significant opportunities in the FinTech market

The top players operating in the North America Fintech Market are - Goldman Sachs, Avant, LLC, Wealthsimple Inc., Chime Financial, Inc., SoFi Technologies, Inc., Stripe, Inc., Kraken, Mogo, Square, Oscar Health

The COVID-19 pandemic had a significant impact on the North American fintech market, presenting both challenges and opportunities. On one hand, the global economic disruptions resulting from the pandemic led to a reduction in consumer spending and investment, thereby making it more difficult for new and small businesses to secure funding and investments.

The utilization of artificial intelligence, machine learning, big data, and blockchain technology is witnessing significant growth across various industries, particularly within the BFSI sector.

The Canadian fintech ecosystem is poised for growth. While Canadian cities benefit from strong foundational support for innovation, major hubs still have opportunities to enhance their reputations as leading global fintech ecosystems