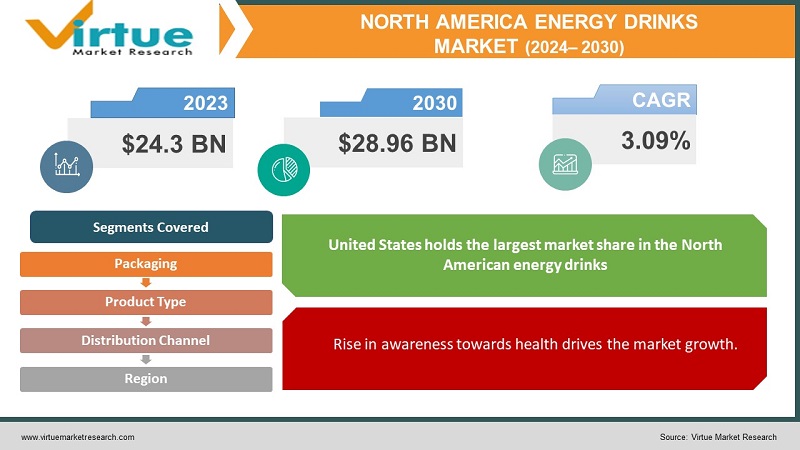

North America Energy Drinks Market Size (2024-2030)

The North America Energy Drinks Market was valued at USD 24.3 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 28.96 billion by 2030, growing at a CAGR of 3.09%.

Energy drinks have gained significant popularity across various age demographics. Over recent years, the demand for energy drinks has surged, leading to an expanded range of options. The market now offers a diverse array of energy drinks, each with its own distinct formulation. In the United States, these beverages are particularly favored by young adults and teenagers. Additionally, companies in the U.S. market have redirected their marketing strategies from targeting athletes to focusing on younger consumers, driven by the rising need for energy drinks to enhance mental alertness.

Key Market Insights:

Energy drinks have swiftly become popular among consumers in North America, particularly within the millennial and Gen Z demographics. These beverages are marketed as enhancing energy levels, mental alertness, and physical performance, with caffeine content ranging from 70 to 250 milligrams per container. This boost in energy allows consumers to extend their work hours. Traditional energy drinks hold the largest market share, with well-known brands such as Red Bull and Monster leading the sector.

North America Energy Drinks Market Drivers:

The growing need for instant boost and alertness, especially among youngsters fuels the drives for energy drink

Energy drink consumption is prevalent among approximately 42% of university students in the United States. In North America, about two-thirds of energy drink users are between the ages of 13 and 35, with men comprising roughly two-thirds of this demographic. There is a growing preference for energy drinks that feature natural or plant-based ingredients, reflecting a broader shift towards healthier and cleaner products. Energy drinks with caffeine content of 20

milligrams per 100 milliliters or more are subject to a 25% tax, which could negatively impact sales in the region. Additionally, health-conscious consumers often opt for energy drinks with lower sugar content or those marketed as "sugar-free" or "reduced sugar," due to concerns about the health risks such as obesity and diabetes.

Rise in awareness towards health drives the market growth.

Another major driver is the rising awareness of health and fitness among consumers. An increasing number of individuals are embracing a more health-conscious lifestyle, seeking beverages that not only provide energy but also offer additional health benefits. In response, energy drink manufacturers are incorporating vitamins, natural ingredients, and other functional components into their products. As a result, energy drinks are increasingly perceived as a healthier alternative to those with high sugar content or excessive caffeine, appealing particularly to health-conscious consumers who prioritize both energy and overall well-being. The rising demand for low-sugar energy drinks underscores a growing health awareness among consumers. High sugar levels in traditional energy drinks have been linked to numerous health problems, such as obesity, diabetes, and heart disease. With the increasing incidence of diabetes in the region, consumers are becoming more aware of the importance of a balanced diet and an active lifestyle.

North America Energy Drinks Market Restraints and Challenges: New flavor and innovation may affect the market growth.

The energy drinks market presents significant opportunities for innovation and diversification. Manufacturers can capitalize on this potential by exploring new flavors, formulations, and packaging strategies to meet diverse consumer preferences. By continuously introducing novel and attractive options, these manufacturers can expand their product lines and capture a larger market share. This proactive strategy allows them to remain relevant and adaptable to changing consumer tastes, thereby promoting sustained growth and enhancing competitiveness within the industry.

Preferring organic products restrain the market.

Amid the growing momentum of health and wellness trends in North America, energy drink companies have the opportunity to reposition their products beyond mere energy sources, highlighting them as functional beverages that enhance overall well-being. By innovating and

promoting energy drinks with natural ingredients, reduced sugar content, and additional health benefits, these companies can effectively target the expanding market of health-conscious consumers. This strategy aligns well with the regional shift towards healthier beverage options and offers a competitive edge in a market where consumers are increasingly prioritizing their physical and mental health.

North America Energy Drinks Market Opportunities:

Energy drink manufacturers face regulatory challenges due to the increasingly stringent labeling requirements and regulations across different countries in North America. Navigating these varied and evolving regulatory environments presents a complex challenge, often requiring modifications to product formulations and marketing strategies to ensure compliance. These adjustments can influence market entry and expansion, as adhering to regulatory standards is crucial for maintaining a successful presence in the regional energy drinks market.

NORTH AMERICA ENERGY DRINKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.09% |

|

Segments Covered |

By Product Type, packaging, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA, Canada, mexico |

|

Key Companies Profiled |

Red Bull, Tan Hiep Phat Group, PepsiCo, Suntory, Osotspa Public Company Limited, Fraser and Neave Beverages, Osotspa Co., Ltd., Yakult Honsha Co., Ltd., Otsuka Pharmaceutical, Oishi Group. |

North America Energy Drinks Market Segmentation:

North America Energy Drinks Market Segmentation- By Product Type:

- Drinks

- Shots

- Mixers

During the forecast period, the mixer segment is expected to capture a substantial market share, propelled by the growing use of energy drinks as mixers for alcoholic beverages. The rising demand for energy drinks as potential enhancers of physical and cognitive performance is a significant factor driving market growth. This trend highlights the shifting consumer preferences and the expanding uses of energy drinks beyond solo consumption, establishing them as essential ingredients in mixed beverages for diverse occasions.

North America Energy Drinks Market Segmentation- By Packaging:

- Bottles

- Cans

- Others

The market is currently led by the bottle segment, but the cans segment is expected to see growth in the coming years. The dominance of bottles is due to factors such as familiarity and established consumer preferences. However, the projected increase in the cans segment is driven by the benefits of aluminum cans. These cans are noted for their superior durability compared to plastic, being less susceptible to cracking or breaking. Additionally, their 100% recyclability distinguishes them from plastic bottles, which can only be recycled a limited number of times

before ending up in landfills. These advantages are contributing to the growing popularity and anticipated expansion of the cans segment in the market.

North America Energy Drinks Market Segmentation- By Distribution Channel:

- Supermarkets/Hypermarkets

- Food Services

- Online Retail

- Specialist Stores

- Others Distribution Channels

The online retail segment is expected to experience significant growth in the coming years, largely due to the widespread availability of energy drinks on e-commerce platforms. The convenience and ease of online shopping are central to this anticipated expansion. Additionally, online platforms offer detailed information about products, including pricing, benefits, and comprehensive value assessments. This transparency enables consumers to make well-informed decisions by evaluating multiple factors before purchasing energy drinks, thereby contributing to the projected increase in the online retail segment.

North America Energy Drinks Market Segmentation- by region

- U.S

- Canada

- Mexico

The United States holds the largest market share in the North American energy drinks sector, largely due to the significant number of individuals engaged in high-intensity physical activities such as hiking, cycling, and running. Hiking, in particular, is the most popular outdoor activity in the country, with around 60 million participants as of 2022, and an additional 881,000 individuals joining. Energy drinks, with their caffeine content, contribute to enhanced alertness and attention, which are crucial for activities like hiking, while also supporting improved heart and brain function and increased energy levels.

Canada is projected to be the fastest-growing market in North America, with an anticipated CAGR of 5.81% by value from 2024 to 2030. This growth is supported by a rising youth demographic driven by increased educational and employment opportunities. As of 2022, approximately 65% of the Canadian population was between the ages of 15 and 64, a factor expected to boost market expansion, along with high participation rates in sports and recreational activities.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic, which began in 2020, had a moderate impact on the energy drinks market. Manufacturers faced notable challenges such as disruptions in the supply chain, labor shortages, partial or full shutdowns of manufacturing facilities, and difficulties in sourcing raw materials. These factors collectively created significant obstacles for energy drink producers during the pandemic's unprecedented conditions. The operational constraints and market uncertainties highlighted the broader economic effects of the health crisis on the energy drinks industry.

Latest Trends/ Developments:

July 2023: Monster Beverage Corporation announced that its subsidiary, Blast Asset Acquisition LLC, had completed the acquisition of nearly all assets of Vital Pharmaceuticals, Inc. and certain of its affiliates (collectively referred to as “Bang Energy”) for approximately USD 362 million.

July 2023: WWE and Nutrabolt, the owner of the C4 brand, revealed an expansion of their multi-year partnership with the introduction of their first co-branded product collaboration. This includes WWE-themed flavors of C4 Ultimate Pre-Workout Powder and C4 Ultimate Energy Drink.

July 2023: Zevia LLC, based in Los Angeles, is exploring the possibility of securing a new distribution partner to shift its business focus from selling multi-packs in grocery stores to offering single-serve cold beverages in convenience stores.

Key Players:

These are top 10 players in the North America Energy Drinks Market :-

- Red Bull

- Tan Hiep Phat Group

- PepsiCo

- Suntory

- Osotspa Public Company Limited

- Fraser and Neave Beverages

- Osotspa Co., Ltd.

- Yakult Honsha Co., Ltd.

- Otsuka Pharmaceutical

- Oishi Group

Chapter 1. North America Energy Drinks Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Energy Drinks Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Energy Drinks Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Energy Drinks Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Energy Drinks Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Energy Drinks Market– By Product Type

6.1. Introduction/Key Findings

6.2. Drinks

6.3. Shots

6.4. Mixers

6.5. Y-O-Y Growth trend Analysis By Product Type

6.6. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. North America Energy Drinks Market– By Packaging

7.1. Introduction/Key Findings

7.2 Bottles

7.3. Cans

7.4. Others

7.5. Y-O-Y Growth trend Analysis By Packaging

7.6. Absolute $ Opportunity Analysis By Packaging, 2024-2030

Chapter 8. North America Energy Drinks Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets/Hypermarkets

8.3. Food Services

8.4. Online Retail

8.5. Specialist Stores

8.6. Others Distribution Channels

8.7. Y-O-Y Growth trend Analysis By Distribution Channel

8.8. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 9. North America Energy Drinks Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.1.4. Rest of North America

9.1.2. By Distribution Channel

9.1.3. By Packaging

9.1.4. Product Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. North America Energy Drinks Market– Company Profiles – (Overview, Distribution Channel Portfolio, Financials, Strategies & Developments)

10.1. Red Bull

10.2. Tan Hiep Phat Group

10.3. PepsiCo

10.4. Suntory

10.5. Osotspa Public Company Limited

10.6. Fraser and Neave Beverages

10.7. Osotspa Co., Ltd.

10.8. Yakult Honsha Co., Ltd.

10.9. Otsuka Pharmaceutical

10.10. Oishi Group

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Energy drinks have swiftly become popular among consumers in North America, particularly within the millennial and Gen Z demographics. These beverages are marketed as enhancing energy levels, mental alertness, and physical performance, with caffeine content ranging from 70 to 250 milligrams per container

The top players operating in the North America Energy Drinks Market are - Red Bull, Tan Hiep Phat Group, PepsiCo, Suntory, Osotspa Public Company Limited, Fraser and Neave Beverages, Osotspa Co., Ltd., Yakult Honsha Co., Ltd., Otsuka Pharmaceutical, Oishi Group.

The COVID-19 pandemic, which began in 2020, had a moderate impact on the energy drinks market.

Energy drink manufacturers face regulatory challenges due to the increasingly stringent labeling requirements and regulations across different countries in North America. Navigating these varied and evolving regulatory environments presents a complex challenge, often requiring modifications to product formulations and marketing strategies to ensure compliance.

Canada is projected to be the fastest-growing market in North America, with an anticipated CAGR of 5.81% by value from 2024 to 2030