North America Confectionery Market Size (2025-2030)

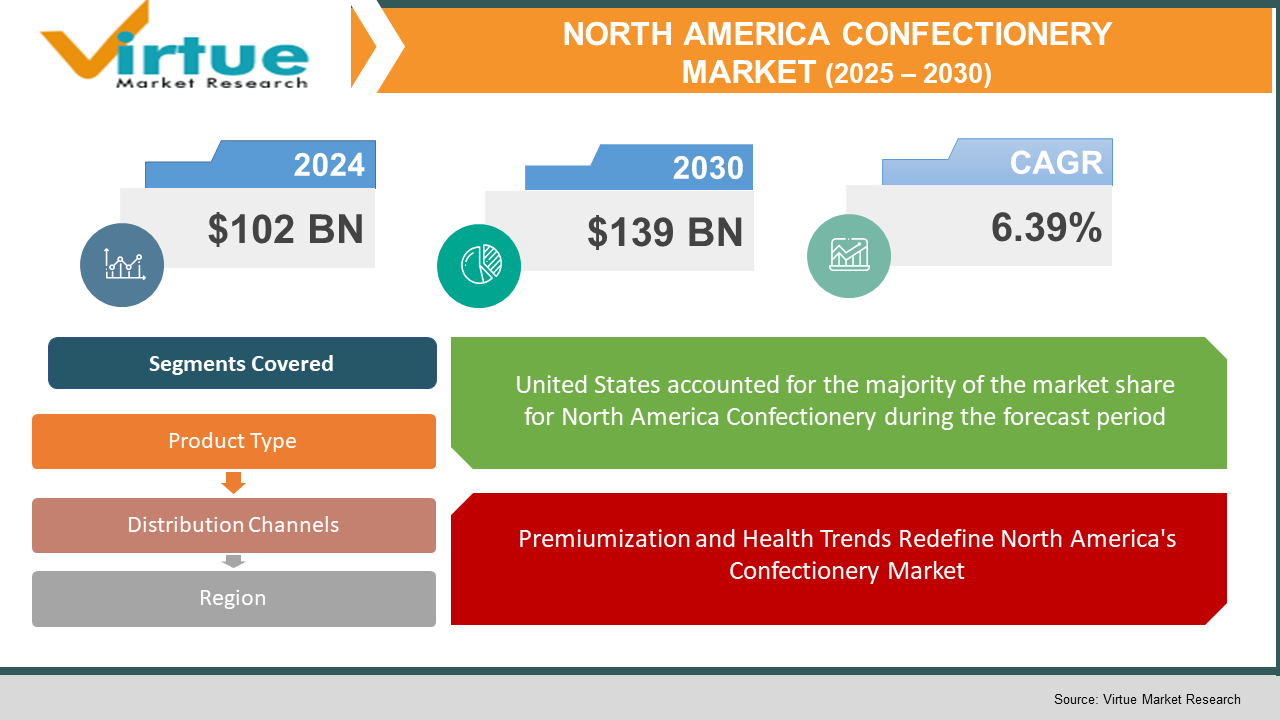

The North America Confectionery Market was valued at USD 102 billion and is projected to reach a market size of USD 139 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 6.39%.

The confectionery industry in North America represents a mature yet continuously evolving market characterized by innovation in Flavors, ingredients, and production technologies. Consumer preferences are shifting toward premium, artisanal, and healthier confectionery options while maintaining indulgence as a core attribute. The market encompasses a wide range of products including chocolates, candies, gums, and pastries, with major players constantly adapting their product portfolios to meet changing consumer demands for natural ingredients, functional benefits, and sustainable packaging solutions.

Key Market Insights:

- According to the National Confectioners Association survey, approximately 81% of American adults purchase confectionery products, with the average consumer spending $104.92 annually on chocolate products and $38.75 on non-chocolate confections, demonstrating the category's strong market penetration.

- Premium chocolate sales have increased by 23% over the past three years, outpacing standard chocolate products which grew at only 4.6%, indicating a significant consumer shift toward higher-quality indulgence experiences despite higher price points in the $8-15 range for specialty chocolate bars.

- Functional confectionery products containing added vitamins, protein, or adaptogens captured 14.3% market share in 2022, growing at 17.8% annually since 2020, with 62% of millennial consumers reporting willingness to pay a premium of up to 30% for confections offering health benefits beyond simple indulgence.

- Seasonal confectionery sales account for 44% of annual category revenue in North America, with Halloween generating $4.9 billion, Christmas $4.4 billion, Easter $3.7 billion, and Valentine's Day $2.4 billion in confectionery sales, making seasonal product innovations critical drivers for manufacturer growth strategies.

North America Confectionery Market Drivers:

Premiumization and Health Trends Redefine North America's Confectionery Market.

North American consumers are increasingly seeking premium confectionery experiences, with 67% of surveyed consumers expressing willingness to pay more for products with high-quality ingredients and distinctive flavor profiles. This premiumization trend has led to a 15.2% annual growth in artisanal chocolate sales since 2020, compared to just 2.8% growth in mass-market chocolate products. Confectionery manufacturers have responded by introducing limited-edition collections, single-origin chocolate products, and hand-crafted confections that command 40-60% higher retail prices than standard offerings. The health-conscious consumer segment has simultaneously expanded, with 72% of millennials and Gen Z consumers actively seeking confectionery products with natural ingredients, reduced sugar content, and functional benefits. Products labelled "better-for-you" have seen remarkable 22.4% sales growth annually, with sugar-free confections expanding market share from 6.1% to 11.3% over the past three years. Manufacturers have invested heavily in R&D, with the top five confectionery companies collectively allocating $1.8 billion in 2024 toward alternative sweetener research and functional ingredient integration. Dark chocolate with high cocoa content (70%+) has experienced a 31% sales increase since 2020, driven by consumer awareness of its antioxidant properties and lower sugar content.

The strategic expansion of digital retail channels and innovative in-store merchandising approaches are revolutionizing confectionery distribution and consumer engagement.

E-commerce sales of confectionery products have grown exponentially in North America, with online channel revenue increasing by 86% between 2020 and 2022, reaching $7.1 billion annually. Direct-to-consumer subscription models for premium chocolate and specialty confections have attracted 4.2 million subscribers across major platforms, generating predictable revenue streams and valuable consumer data for manufacturers. Approximately 58% of confectionery consumers now research products online before purchase, while 36% regularly buy confectionery through digital channels, primarily seeking unique products unavailable in local retail environments. In physical retail locations, confectionery companies have invested in innovative merchandising technology, including digital shelf displays that have demonstrated a 17% sales lift in pilot programs and interactive sampling stations that boost conversion rates by 23% compared to traditional displays. Cross-merchandising strategies linking confectionery with complementary categories like coffee, wine, or entertainment products have shown average basket value increases of $12.40 per transaction.

North America Confectionery Market Restraints and Challenges:

The major challenge to the industry is that of health concerns regarding sugar consumption and government regulations.

Health concerns represent significant market headwinds, with 64% of consumers actively attempting to reduce sugar consumption according to recent survey data. Government regulations targeting sugar content and marketing restrictions, particularly those aimed at products advertised to children, have forced manufacturers to reformulate approximately 31% of their product portfolios at considerable expense. The industry faces substantial raw material challenges, with cocoa prices increasing 28% since 2020 due to climate change impacts in growing regions, while vanilla prices have fluctuated up to 500% in five-year cycles. Labor shortages throughout the supply chain have increased production costs by 12.3% since 2019, with specialized confectionery manufacturing positions remaining unfilled for average periods of 3.2 months. Meanwhile, the market faces fierce competition from alternative snacking categories, with protein bars, fruit snacks, and savory options capturing 14% of traditional confectionery occasions according to consumer substitution studies

North America Confectionery Market Opportunities:

The integration of sustainability practices presents substantial growth opportunities, with 73% of consumers expressing willingness to pay premiums of 10-15% for environmentally responsible confectionery products. Manufacturers implementing traceable cocoa sourcing have reported sales increases averaging 18% compared to conventional alternatives. The functional confectionery segment is projected to reach $9.7 billion by 2028, with products incorporating adaptogens, probiotics, and nootropic ingredients showing particular promise among wellness-oriented consumers. International flavor innovations present significant growth vectors, with globally-inspired confections experiencing 24% annual growth as North American consumers seek authentic experiences from regions like Japan, India, and the Middle East.

NORTH AMERICA CONFECTIONERY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.39% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA, MEXICO, CANADA |

|

Key Companies Profiled |

Mars Inc., Hershey, Mondelez International, Nestlé, and Ferrero |

North America Confectionery Market Segmentation:

North America Confectionery Market Segmentation: By Product Type:

- Chocolate Confectionery

- Sugar Confectionery

- Gum Products

- Others

The chocolate confectionery segment dominated the North American market with approximately 58.7% revenue share, valued at $30.9 billion. Premium chocolate products grew at 9.2% annually, significantly outpacing the 2.1% growth of standard chocolate offerings. Dark chocolate specifically experienced 11.4% growth, driven by health-conscious consumers seeking higher cocoa content and antioxidant properties. Manufacturers have responded with single-origin products, bean-to-bar offerings, and innovative flavor combinations incorporating spices, herbs, and functional ingredients that command 40-60% higher retail prices than conventional chocolates.

The sugar confectionery segment held 27.3% market share in 2022, with hard candies, gummies, and pastilles collectively representing $14.4 billion in retail sales. This segment has undergone significant transformation with 68% of new product launches featuring natural colors and flavors, compared to just 31% in 2018. Functional gummies containing vitamins, minerals, and adaptogens have emerged as the fastest-growing sub-segment, expanding at 21.7% annually as consumers seek treat options with perceived health benefits. Major manufacturers have responded by acquiring specialized wellness confectionery brands, with acquisition premiums averaging 3.7x annual revenue for companies with established functional candy portfolios.

North America Confectionery Market Segmentation: By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

Supermarkets and hypermarkets remained the dominant distribution channel for confectionery in North America, accounting for 42.6% of total sales in 2024. These retailers leverage extensive shelf space, strategic merchandising locations (including checkout areas that generate 28% of impulse confectionery purchases), and cross-promotional opportunities to drive category sales. Data analytics implementation in this channel has improved inventory management and promotional effectiveness, with targeted confectionery promotions delivering 15-22% higher returns on investment when aligned with complementary product categories and seasonal events.

Online retail represents the fastest-growing distribution channel, expanding at 23.4% annually and reaching 16.8% market share in 2022. This channel's growth is driven by subscription services, which retain 68% of customers beyond six months, and direct-to-consumer platforms offering exclusive products unavailable in traditional retail environments. Digital retail enables efficient targeting of niche consumer segments, with 41% of online confectionery shoppers purchasing specialty products like international sweets, craft chocolates, and nostalgic candies that have limited brick-and-mortar distribution. Manufacturers investing in optimized e-commerce packaging and temperature-controlled shipping solutions have reduced damage rates from 11.2% to 2.7%, significantly improving customer satisfaction and repeat purchase rates in this rapidly expanding channel.

North America Confectionery Market Segmentation: Regional Analysis:

- United States

- Canada

- Mexico

The United States dominated the North American confectionery market, accounting for 78.3% of regional sales at $41.2 billion. American consumers demonstrate the highest per capita confectionery consumption in the region at 19.6 pounds annually, with particularly strong seasonal purchasing patterns that generate 46% of annual sales during key holidays. The premium segment has shown remarkable growth in urban markets, with specialty chocolate shops experiencing 12.3% annual revenue increases in metropolitan areas with populations over 1 million. Regional preferences are pronounced across the country, with the Northeast showing 27% higher consumption of dark chocolate products, while the South demonstrates 18% stronger performance in gummy and chewy candy categories.

Canada represented 13.5% of the North American confectionery market in 2022, with distinctive consumption patterns including 24% higher dark chocolate preference and 17% lower gum product purchases compared to U.S. consumers. The Canadian market has embraced sustainability initiatives more rapidly, with eco-friendly packaged products gaining 31% market share compared to 19% in the United States. Provincial regulations affecting sugar content labeling have accelerated reformulation efforts, with 38% of confectionery products in Canada featuring reduced sugar formulations compared to 24% in the broader North American market. The country's cultural diversity has supported strong performance of internationally inspired confections, which represent 14.7% of category sales compared to 9.3% in the United States.

COVID-19 Impact Analysis on the North America Confectionery Market:

The COVID-19 pandemic fundamentally altered North American confectionery consumption patterns, with at-home indulgence occasions increasing 37% during peak lockdown periods as consumers sought comfort foods amid uncertainty. Premium chocolate sales surged 19.2% in 2020-2021 despite economic pressures, reflecting consumers' willingness to spend on affordable luxuries when other experiential categories were unavailable. Distribution channels underwent rapid transformation, with e-commerce penetration in the confectionery category accelerating by approximately five years against pre-pandemic projections, reaching 14.3% of sales by 2021 compared to just 5.7% in 2019.

Latest Trends/ Developments:

The adoption of upcycled ingredients in confectionery products has gained significant traction, with 27 major manufacturers introducing products utilizing cocoa fruit pulp, imperfect nuts, and other previously discarded food components, achieving waste reduction of 14-22% while appealing to environmentally conscious consumers who demonstrate 28% higher brand loyalty to companies with transparent sustainability practices.

Hershey's acquisition of Lily's Sweets for $425 million represents the accelerating consolidation of mainstream manufacturers and better-for-you confectionery brands, providing established companies immediate access to growing market segments while allowing innovative brands to leverage large-scale distribution networks and marketing resources that drove 37% sales growth for acquired brands within their first year under corporate portfolios.

Key Players:

- The Hershey Company

- Mondelēz International

- Mars, Incorporated

- Ferrero Group

- Nestlé S.A.

- General Mills, Inc.

- Lindt & Sprüngli AG

- Perfetti Van Melle

- Tootsie Roll Industries

- Ghirardelli Chocolate Company

Chapter 1. NORTH AMERICA CONFECTIONERY MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. NORTH AMERICA CONFECTIONERY MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. NORTH AMERICA CONFECTIONERY MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. NORTH AMERICA CONFECTIONERY MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. NORTH AMERICA CONFECTIONERY MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. NORTH AMERICA CONFECTIONERY MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Chocolate Confectionery

6.3 Sugar Confectionery

6.4 Gum Products

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type , 2025-2030

Chapter 7. NORTH AMERICA CONFECTIONERY MARKET – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3 Convenience Stores

7.4 Online Retail

7.5 Specialty Stores

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel , 2025-2030

Chapter 8. NORTH AMERICA CONFECTIONERY MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Distribution Channel

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. NORTH AMERICA CONFECTIONERY MARKET – Company Profiles – (Overview, Packaging Product, Portfolio, Financials, Strategies & Developments)

9.1 The Hershey Company

9.2 Mondelēz International

9.3 Mars, Incorporated

9.4 Ferrero Group

9.5 Nestlé S.A.

9.6 General Mills, Inc.

9.7 Lindt & Sprüngli AG

9.8 Perfetti Van Melle

9.9 Tootsie Roll Industries

9.10 Ghirardelli Chocolate Company

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The market includes chocolate, sugar confectionery (candies, gummies, mints), and gum products sold across retail, convenience stores, and online platforms.

Growth is driven by premiumization, innovation in Flavors, healthier variants, seasonal demand, and strong branding by major players

Major players include Mars Inc., Hershey, Mondelez International, Nestlé, and Ferrero

Yes, there is increasing demand for low-sugar, organic, vegan, and functional confectionery that fits wellness trends

Trending products include plant-based chocolates, artisanal candies, sugar-free alternatives, and personalized confectionery experiences