North America Almond Butter Market Size (2024-2030)

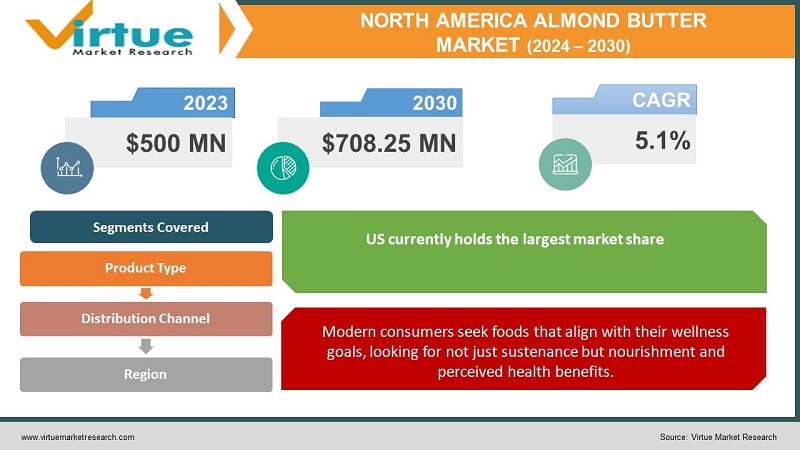

The North America Almond Butter Market was valued at USD 500 Million in 2023 and is projected to reach a market size of USD 708.25 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.1%.

Almond butter, once a niche product, has seen a meteoric rise within the North American market. Almond butter is perceived as a healthy alternative to traditional peanut butter. It boasts high levels of protein, healthy fats, fiber, and crucial vitamins and minerals. Almond butter fits perfectly into plant-based, vegan, paleo, and keto dietary trends, expanding its appeal significantly. Its creamy texture, subtle nutty flavor, and culinary adaptability make it a hit in everything from smoothies, and baked treats, to savory sauces. Water-intensive almond cultivation raises concern. Brands emphasizing sustainable practices gain an edge. Consumers care about the origins of their ingredients, fueling demand for transparency in the supply chain. Almond butter remains pricier than peanut butter, a potential barrier for some consumers. Tree nut allergies limit the market for some, despite peanut-free options. The water-intensive nature of almond farming poses a long-term sustainability challenge. The proliferation of 'healthy' spreads (cashew butter, sunflower seed butter) creates more choices for consumers.

Key Market Insights:

Its nutty, slightly sweet flavor works well in both sweet and savory applications – on toast, in smoothies, with fruits, or even in sauces and baked goods. Almond butter is naturally gluten-free and vegan, expanding its consumer base to those with dietary restrictions or preferences. Concerns about peanut allergies and a desire for greater dietary diversity drive some consumers toward tree-nut alternatives like almond butter. Almond butter aligns with the broader focus on whole foods and plant-based eating, boosting the perception of it as a 'healthy' choice. Marketing often highlights specific benefits of almonds: heart health, vitamin E, and antioxidants – reinforcing the health-conscious image of almond butter. Flavored varieties (chocolate, vanilla, honey-roasted) expand beyond the classic almond butter taste, catering to greater indulgence. These flavors blur the lines between spreads and dessert toppings, broadening almond butter's usage occasions and attracting new customers. Almond butter finds its way into recipes as a flavorful ingredient, enhancing sauces, baked goods, or even savory dishes where its richness adds depth. Smaller brands emphasize premium ingredients, unique flavor combinations, and 'clean' labels to differentiate themselves in the increasingly crowded market. Consumers respond to narratives of small-batch production, sourcing of specific almond varieties, or social impact missions connected to brands. 'Locally made' almond butter with an emphasis on origin and freshness resonates with a growing segment of shoppers seeking quality and traceability. Almond butter has moved beyond specialty health food stores into major supermarkets and grocery chains, indicating widespread demand. Smaller artisanal brands thrive through e-commerce platforms, online subscriptions, and direct-to-consumer models. California, the dominant almond-growing region, faces criticism regarding water usage and its impact on the environment.

North America Almond Butter Market Drivers:

Modern consumers seek foods that align with their wellness goals, looking for not just sustenance but nourishment and perceived health benefits.

It's a shift from merely managing ailments to optimizing health proactively. Preventing problems through food choices becomes paramount. Ingredient lists are dissected, with consumers seeking whole foods and minimizing additives, processed ingredients, and excessive sugar or sodium. Consumers look beyond marketing buzzwords, seeking some grounding in scientific evidence, but are also wary of past fads and conflicting nutritional advice. Dietary choices are driven by individual needs and goals – weight loss, boosting energy, managing chronic conditions, or simply feeling their best. These individuals reduce meat consumption without eliminating it, driven by health, environmental, or ethical reasons. This group adheres to strictly plant-based diets, with varying levels of emphasis on whole foods vs. processed alternatives. Consumers seeking out plant-based options even without fully embracing a vegetarian or vegan label. Interest is driven by curiosity, health, or trying to eat more sustainably. A growing recognition that 'plant-based' doesn't automatically equal 'healthy.' Discerning consumers seek plant-forward options that are also wholesome and minimally processed. Almonds offer a favorable nutritional profile – a good source of protein, fiber, healthy fats, vitamins, and minerals – perfectly aligning with consumers seeking nutrient density. With minimal processing needed to turn almonds into almond butter, it fits the demand for whole-food ingredients and short, understandable labels. The rise of peanut allergies and restrictions in schools makes almond butter a safe, appealing alternative for many families. Almond butter's healthy fats and protein provide satiety, potentially aiding in weight loss or maintaining a healthy weight when incorporated into a balanced diet. Research on the benefits of almonds for cardiovascular health boosts its appeal, particularly for an aging population increasingly conscious of preventative measures. Almond butter is a significant source of plant-based protein, important for vegans, vegetarians, and those just trying to get more plant protein in their diet. Almond butter provides a taste and texture that's somewhat familiar to peanut butter yet distinct. This fills a niche for flexitarians wanting to diversify away from solely animal products.

While classic almond butter has its appeal, flavor innovation is attracting a new wave of consumers and expanding its usage beyond a strictly 'healthy' niche.

Flavors act as an entry point for consumers who might find plain almond butter too 'healthy' tasting or even slightly bitter. Chocolate, vanilla, or honey introduce familiarity and sweetness, opening doors for those who would never consider snacking on the basic version. Flavored almond butter transcends the purely functional 'health food' image and moves into the territory of treats and permissible indulgence. This aligns perfectly with consumers seeking a balance between healthy choices and enjoying what they eat. Cinnamon Swirl almond butter inspires baking experiments, Maple adds depth to sauces, and salted caramel becomes a topping for smoothie bowls. Flavors spark recipe creativity, increasing almond butter usage across the board. Consumers preoccupied with 'clean eating' often grapple with guilt when indulging in traditional sweets. Flavored almond butter, with its health halo, provides a way to experience sweetness without completely derailing wellness goals. Flavors like Snickerdoodle, birthday cake, or cookie dough tap into childhood memories. This creates a positive emotional connection to almond butter, fostering brand loyalty and a willingness to re-purchase. Unlike a whole slice of cake, a spoonful of flavored almond butter offers a satisfying hit of sweetness within a controlled portion, aiding in moderation for those who struggle with overindulgence. Sweet, familiar flavors make almond butter a tastier and more appealing option for kids. This can increase household purchases and instill a taste preference from a young age. Those who are intrigued by almond butter's potential benefits but not fully on board the 'wellness train' are enticed by enjoyable, indulgent flavors. Flavor variety keeps almond butter exciting, preventing boredom and encouraging consumers to try new options, leading to consistent purchases. Flavored and specialty almond butter command premium prices, driving greater profits for producers compared to basic almond butter. Flavored almond butter becomes an attractive gift option due to its indulgence factor, boosting sales and brand recognition. Flavored almond butter finds its way into protein bars, energy bites, ice creams, and other manufactured products, increasing demand for various flavors to meet manufacturing needs. Brands need to carefully calibrate flavors to appeal to a sweet tooth without alienating their core health-conscious consumer base. Overly sweet options risk losing credibility.

North America Almond Butter Market Restraints and Challenges:

The cost of producing almonds is far higher than that of producing peanuts, which is their conventional equivalent. The finished product made from almond butter will unavoidably bear this cost.

Almonds themselves are significantly more expensive to produce than peanuts, their traditional counterpart. This cost is inevitably passed on to the final almond butter product. The higher price tag of almond butter, even when justified due to ingredient cost, creates a psychological barrier for some consumers, particularly those on a budget. The affordability and familiarity of peanut butter remain a major competitor. Almond butter has to not only justify its benefits but also overcome ingrained consumer habits. During times of economic uncertainty, consumers may revert to cheaper alternatives, impacting almond butter sales despite its desirable qualities. The massive almond cultivation concentrated in California faces intense scrutiny over water usage, especially during droughts. This creates negative environmental associations for almond-based products. A growing segment of consumers base their purchasing decisions on sustainability and ethical brand practices. Negative publicity around almond farming could deter those consumers. Brands making vague sustainability claims without transparent supply chain practices are likely to be challenged by critics and discerning consumers. The sheer number of almond butter brands, both established and new entrants, creates intense competition for limited shelf space in grocery stores. Flavor innovation is a double-edged sword. While necessary for attracting attention, the constant outpouring of new flavors can be overwhelming and confusing for consumers. Small artisanal brands emphasizing quality and unique aspects may struggle to communicate these effectively to shoppers bombarded with choices. Major food corporations entering the almond butter space, often through acquiring smaller brands, can leverage their distribution networks and marketing power, squeezing niche players. While almond butter dominates nut butter alternatives, cashew butter, sunflower seed butter, and others are gaining popularity, potentially chipping away at its market share. While plant-based eating is entrenched, specific food trends within that sphere can be less predictable. Almond butter needs to solidify its appeal beyond buzzwords to ensure long-term demand.

North America Almond Butter Market Opportunities:

While almond butter enjoys broad appeal, there's still room to cater to underserved demographics—older consumers, and specific ethnic groups, and expand into lower-income segments where price may be a greater barrier. Almond butter is often seen as a snack or breakfast food. Highlighting its use in evening desserts ('healthy' cookie dough bites), post-workout recovery, or as a simple savory sauce base opens up new consumption occasions. Almond butter's versatility in both sweet and savory dishes is underutilized. Brands investing in recipe development, collaborations with food bloggers, or even simple recipe cards in-store, drive usage and inspire consumers. Showcasing almond butter as a 'secret ingredient' for richness in soups, curries, and baked goods not traditionally associated with nuts, emphasizes its role as a powerful culinary tool, not just a spread. More research is emerging on the benefits of almonds for gut health, cognitive function, and blood sugar control. Brands proactively showcasing this science in a consumer-friendly way enhance almond butter's value proposition. Almond butter enriched with probiotics, protein powders, or adaptogens aligns with consumer interest in convenient ways to boost their health through everyday foods. These value-added versions create a whole new sub-category. California's almond production faces scrutiny over its water use. Brands demonstrating water-saving practices, investment in regenerative agriculture, or sourcing from regions with less strained water resources gain trust with environmentally conscious consumers. Traceability is increasingly important. Stories about almond sourcing, ethical labor practices, and social impact initiatives build brand loyalty among a values-driven consumer base. Partnering with health influencers, recipe developers, or fitness personalities expands reach. This is especially important for reaching younger consumers active on social media.

NORTH AMERICA ALMOND BUTTER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.1% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA, CANADA, MEXICO |

|

Key Companies Profiled |

Barney Butter, Justin's, Mara Natha, Once Again Nut Butter, J.M. Smucker Company , Nutzo, Artisan Organics, Dastony, Georgia Grinders, Nikki's Coconut Butter |

North America Almond Butter Market Segmentation:

North America Almond Butter Market Segmentation: By Product Type

- Natural Almond Butter (Plain)

- Flavored Almond Butter

- Organic Almond Butters

- Textured and Almond Butters

Natural Almond Butter (Plain): Likely holds the largest share, as the "foundation" of the category, but its share is decreasing due to flavor innovation. Flavored Almond Butter: Gaining ground rapidly, with no single flavor dominating, but chocolate being consistently popular. Organic Almond Butters: A significant share, but cost constraints slow its growth versus conventional options. Textured and Almond Butters with Additions: These represent smaller, but often fast-growing niche segments within the overall market. While flavored varieties are on the ascend, organic (plain) almond butter likely retains its dominance. Natural almond butter was the pioneering product and established its place in the market before the flavor explosion. Its neutral taste makes it the most versatile in the kitchen, lending itself to both sweet and savory applications. Dedicated health-focused consumers often prefer the purity and ingredient simplicity of natural almond butter. Flavored almond butter is experiencing the most significant growth trajectory. They attract consumers who might be intimidated by the taste or perceived 'healthiness' of plain almond butter. Flavors fulfill cravings for sweetness and provide a 'permissible indulgence' within health-focused eating patterns.

North America Almond Butter Market Segmentation: By Distribution Channel

- Supermarkets and Grocery Stores

- Natural and Specialty Food Stores

- Online Sales

- Food Service

Supermarkets and Grocery Stores: The backbone of the market. These offer a wide variety of brands, flavors, and jar sizes, catering to diverse shoppers. Natural and Specialty Food Stores: Emphasize organic, artisanal, or niche almond butter brands, often commanding a premium price point. Online Sales: Offers convenience, access to smaller brands, and often a wider flavor selection. Includes both e-commerce giants and brand-owned direct-to-consumer platforms. Food Service: Though less direct-to-consumer, the use of almond butter in cafes, restaurants, smoothie shops, etc., drives awareness and creates trial opportunities that can lead to future purchases. Supermarkets and Grocery Stores command the lion's share due to their widespread reach and consumer shopping habits. Online sales of almond butter are experiencing significant growth. The ease and convenience of online shopping drive overall growth across many consumer goods categories, including almond butter.

Market Segmentation: Regional Analysis:

- USA

- Canada

- Mexico

USA: Holds the lion's share of the North American market, likely upwards of 80%. The undisputed powerhouse of almond butter production and consumption, with the most developed and diverse market. Canada: Possesses a smaller yet notable share, likely in the 10-15% range of the overall North American market. While smaller than the US, Canada possesses a significant and growing market for almond butter, with evolving consumer preferences. Mexico: Represents the smallest current share, likely below 5%, but with considerable potential for significant growth. Almond butter has a smaller, but rapidly expanding presence in Mexico, driven by growing consumer interest in healthy and plant-based alternatives. The USA's dominance within the North American almond butter market stems from several factors. California, the primary almond-growing region in North America, is situated within the US, providing a steady supply and shaping consumer familiarity with its products. The sheer size of the US population, combined with growing interest in healthier food options, creates a vast potential consumer base for almond butter. Almond butter has been widely available in the US for longer relative to Canada and Mexico, resulting in greater market penetration and consumer awareness.

COVID-19 Impact Analysis on the North America Almond Butter Market:

Social distancing protocols and potential worker shortages within processing facilities could have slowed down production, impacting product availability on store shelves in the short term. The pandemic likely led to increased cleaning and safety protocols, potentially raising production costs for almond butter manufacturers—a cost that might have been passed on to consumers to some extent. With limitations on in-person shopping, consumers increasingly turned to online platforms to buy groceries, including almond butter. This trend might have accelerated the growth of e-commerce channels for nut butter sales. The pandemic's economic impact might have led some cost-conscious consumers to shift towards more affordable options like peanut butter compared to premium-priced almond butter. Brands that capitalized on the e-commerce boom and offered convenient online ordering with home delivery likely gained a competitive edge. Subscription services offering recurring deliveries of almond butter could have emerged as a convenient option for regular users during this time. Single-serving, portion-controlled packaging might have gained traction as consumers adapted to smaller household routines and potentially increased snacking at home. The rise of snacking occasions throughout the day presented an opportunity for innovative and portable single-serve almond butter packets marketed for on-the-go convenience. While some disruptions might linger, raw almond supplies and processing are expected to stabilize, leading to a more consistent product flow. With normalized supply chains, almond butter prices are likely to stabilize, potentially making it more accessible to a broader range of consumers. The heightened awareness of health and immunity is likely to persist, potentially benefiting the market for nut butter like almond butter perceived as having nutritional value.

Latest Trends/ Developments:

California's almond production faces intense criticism about its water consumption, particularly in drought-prone years. Companies are proactively investing in water-saving irrigation, exploring alternative growing regions, or highlighting regenerative agricultural practices. Consumers increasingly seek out brands with transparent sourcing, demonstrating a commitment to sustainability and addressing a core pain point for almond products. We're seeing more use of whole or sliced almonds in almond butter variations for textural interest. Zero-waste approaches utilize almond pulp (leftover from milk production) in snacks or baking mixes. Roasted almond flour is gaining popularity in home baking, while almond oil is finding its way into skincare due to its richness in vitamin E and fatty acids. Consumers scrutinize ingredient lists, demanding shorter, pronounceable ingredient lists, and minimal additives. Even flavored almond butter is shifting towards natural flavor extracts and avoiding artificial ingredients to align with the health-conscious consumer base. Incorporating superfood seeds (chia, hemp), pea-protein for added protein, or even probiotics for gut health aligns with the wellness focus and turns almond butter into a multi-functional food. Emphasizing 'limited-edition' or 'seasonal' almond butter drives a sense of exclusivity, allowing brands to experiment with unique flavor combinations and cater to adventurous consumers.

Key Players:

- Barney Butter

- Justin's

- Mara Natha

- Once Again Nut Butter

- J.M. Smucker Company

- Nutzo

- Artisan Organics

- Dastony

- Georgia Grinders

- Nikki's Coconut Butter

Chapter 1. North America Almond Butter Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Almond Butter Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Almond Butter Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Almond Butter Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Almond Butter Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Almond Butter Market– By Product Type

6.1. Introduction/Key Findings

6.2. Natural Almond Butter (Plain)

6.3. Flavored Almond Butter

6.4. Organic Almond Butters

6.5. Textured and Almond Butters

6.6. Y-O-Y Growth trend Analysis By Product Type

6.7. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. North America Almond Butter Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Supermarkets and Grocery Stores

7.3. Natural and Specialty Food Stores

7.4. Online Sales

7.5. Food Service

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. North America Almond Butter Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Distribution Channel

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Almond Butter Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Barney Butter

9.2. Justin's

9.3. Mara Natha

9.4. Once Again Nut Butter

9.5. J.M. Smucker Company

9.6. Nutzo

9.7. Artisan Organics

9.8. Dastony

9.9. Georgia Grinders

9.10. Nikki's Coconut Butter

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

. More consumers are turning to plant-based options like almond butter for their protein and healthy fat content, aligning with veganism, vegetarianism, and flexitarian lifestyles.

Almond production in California has a significant water footprint. This raises sustainability concerns, especially during periods of drought which are frequent in the region.

Barney Butter, Justin's, Mara Natha, Once Again Nut Butter, J.M. Smucker.

The US currently holds the largest market share, estimated at around 80%.

Mexico exhibits the fastest growth, driven by its increasing population, and expanding economy.