North America Agricultural Biotechnology Market Size (2024-2030)

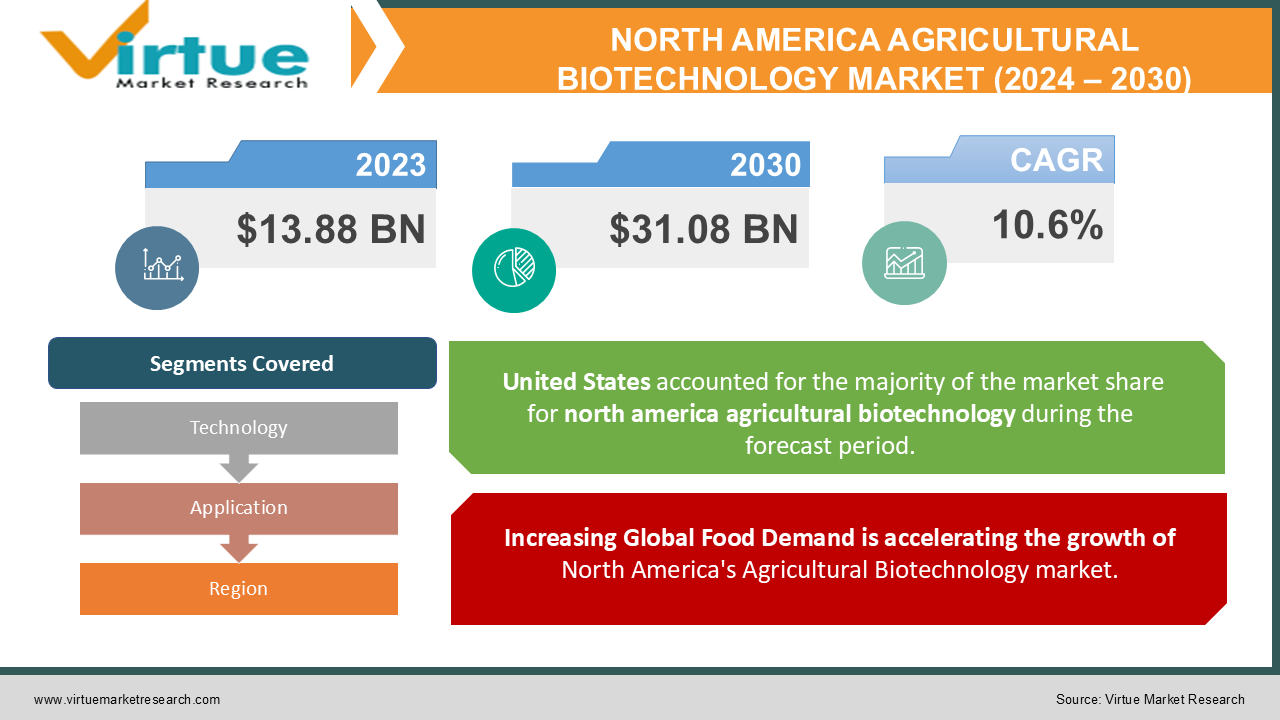

The North America Agricultural Biotechnology Market was valued at USD 13.88 Billion in 2023 and is projected to reach a market size of USD 31.08 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10.6%.

The North American Agricultural Biotechnology market is a dynamic and rapidly evolving sector characterized by the application of cutting-edge biotechnological innovations to enhance crop yields, improve crop resilience, and optimize agricultural practices. With a focus on genetic engineering, gene editing, and biotechnology-driven solutions, the market aims to address pressing challenges such as climate change, increasing food demand, and sustainability. Major players in this market are involved in the development of genetically modified (GM) crops, advanced breeding techniques, and biologically based crop protection solutions. Additionally, regulatory frameworks, public perception, and sustainability concerns continue to shape the landscape, driving innovation and growth in the agricultural biotechnology sector across North America.

Key Market Insights:

- 57% of Americans express concerns about the safety of GMO food products.

- The top five biotech crop-growing nations collectively cultivate 174.5 million hectares of biotech crops.

- Over 95% of animals raised for meat and dairy consumption in the United States are fed with GMO crops.

- The United States is the global leader in GMO crop cultivation, with more than 185 million acres dedicated to this technology.

- Approximately 94% of soybean crops in the United States have been genetically modified to possess herbicide tolerance.

- Nearly 90% of field corn production in the US relies on genetically modified varieties.

- An estimated 77% of papaya grown in Hawaii is bioengineered.

- Around 94% of soybean crops in the United States have been genetically modified.

North America Agricultural Biotechnology Market Drivers:

Increasing Global Food Demand is accelerating the growth of North America's Agricultural Biotechnology market.

The growing global population, coupled with changing dietary preferences and urbanization, has led to a significant increase in food demand. Agriculture biotechnology plays a crucial role in meeting this demand by enhancing crop yields and improving the nutritional content of crops. According to the United Nations, the world's population is expected to reach 9.7 billion by 2050. To meet this demand, food production needs to increase by approximately 70%. Biotechnology-driven crops, such as genetically modified (GM) varieties, have shown higher yields and resistance to pests and diseases, contributing to increased food production. For example, GM maize varieties have demonstrated yield improvements of up to 25% in some cases.

Climate Change Mitigation is a significant driver of the agriculture biotechnology market in North America.

Climate change poses significant challenges to agriculture, including unpredictable weather patterns, droughts, and increased pests and diseases. Agriculture biotechnology offers solutions by developing crops that are more resilient to these challenges, helping to secure food production in a changing climate. For instance, the National Oceanic and Atmospheric Administration (NOAA) reports an increase in extreme weather events in North America, including droughts, floods, and heat waves. Biotechnology companies have been working on drought-tolerant and heat-resistant crop varieties. These innovations can help safeguard crop yields, reduce the risk of crop failure, and contribute to food security.

North America Agricultural Biotechnology Market Restraints and Challenges:

Regulatory Hurdles pose a hindrance to the growth of this market.

One of the primary challenges in the North American Agriculture Biotechnology market is navigating complex and evolving regulatory frameworks for genetically modified organisms (GMOs) and other biotechnological products. Strict regulations, labeling requirements, and public scrutiny can hinder the development and commercialization of biotech crops. Different U.S. states had varying regulations on GMO labeling, creating a complex landscape for biotech companies. Moreover, gaining regulatory approval for new biotech products can be a lengthy and costly process.

Consumer Perception and Public Resistance in North America is a major challenge for the agriculture biotechnology market.

Public perception of genetically modified organisms (GMOs) and other biotechnological products can be a significant challenge. Negative perceptions related to health and environmental concerns, as well as consumer demand for non-GMO and organic products, can impact market acceptance. Consumer sentiment in North America has been influenced by various factors. A 2020 Pew Research Center survey found that 49% of U.S. adults believe that GMOs are generally unsafe to eat. This perception can affect consumer choices and influence food purchasing decisions, impacting the market for biotech-derived products.

North America Agricultural Biotechnology Market Opportunities:

The North American Agricultural Biotechnology Market presents a range of promising opportunities driven by the need for sustainable and efficient agriculture practices. With increasing concerns about food security, climate change, and growing global populations, biotechnology offers solutions such as genetically modified (GM) crops, precision agriculture technologies, and advanced breeding techniques. These innovations can enhance crop yields, improve crop resilience to changing environmental conditions, reduce the need for chemical inputs, and contribute to sustainable farming practices. Additionally, the rising consumer demand for healthier and more nutritious food options opens doors for biotechnological advancements aimed at improving the nutritional content of crops, thereby creating avenues for growth and innovation within the North American agricultural biotechnology sector.

NORTHE AMERICA AGRICULTURAL BIOTECHNOLOGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

10.6% |

|

Segments Covered |

By Technology, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

USA, CANADA, MEXICO |

|

Key Companies Profiled |

Elantas GmbH (Germany), Axalta Coating Systems (the U.S.), Von Roll Holdings AG (Switzerland), Hitachi Chemicals Company Ltd. (Japan), 3M Company (the U.S.), and Kyocera Corporation (Japan) |

North America Agricultural Biotechnology Market Segmentation:

North America Agricultural Biotechnology Market Segmentation: By Technology:

- Genetic Engineering

- Tissue Culture

- Embryo Rescue

- Somatic Hybridization

- Molecular Diagnostics

Genetic engineering, also known as genetic modification, involves the manipulation of an organism's genetic material to achieve desirable traits. In agriculture, this often involves the introduction of specific genes into plants or animals to enhance traits such as resistance to pests, diseases, or environmental stress, and to improve crop yields or animal production. Genetic engineering had a market share of 25%, making it the largest segment. In the North American Agricultural Biotechnology market, genetic engineering has been widely adopted to create genetically modified crops with various traits such as herbicide tolerance, insect resistance, and improved nutritional content. These crops have had a significant impact on agricultural practices in the region.

The fastest growing segment is tissue culture. Tissue culture is a technique in which plant cells, tissues, or organs are grown in vitro on a nutrient medium. It is used for the propagation of plants, including crops, with desirable traits. Tissue culture enables rapid clonal propagation, disease-free plant production, and the preservation of endangered species. Tissue culture held 20% of market share in this market.

North America Agricultural Biotechnology Market Segmentation: By Application

- Vaccine Development

- Transgenic Crops & Animals

- Antibiotic Development

- Biofuels

Transgenic crops and animals involve genetic modification to introduce desirable traits such as pest resistance, disease resistance, or improved nutritional value. This segment is the largest holding around 30% of market share. It includes the development and commercialization of genetically engineered plants and animals used in agriculture. Genetically modified crops are widely adopted in North American agriculture due to increased yields and their potential, reduced pesticide use, and enhanced resistance. These crops also offer economic benefits to farmers making them an appealing choice. Artificial insemination has become the most adopted biotechnology solution for livestock, specifically for cattle production.

Vaccine development is anticipated to have the fastest growth rate in the projected period. Emerging diseases are risky for crop and livestock health which increases the need to develop vaccines to protect them against these diseases. Vaccine is a more sustainable alternative to chemical pesticides and antibiotics and regulatory bodies have supported the development of agricultural vaccines to ensure food safety and reduce the use of traditional chemical pesticides making vaccine development a crucial part of the growth of this market.

North America Agricultural Biotechnology Market Segmentation: Regional Analysis:

- U.S.A

- Canada

- Mexico

USA held the largest market share, accounting for over 48% of market revenue in North America's Agricultural Biotechnology market. The USA is a significant player in all segments, including transgenic crops and animals, vaccine development, antibiotic development, nutritional supplements, and biofuels. The USA has consistently led in the adoption of genetically modified crops, with a significant portion of its corn, soybean, and cotton crops being genetically modified. The country also invests heavily in agricultural research and development.

The USA is the fastest-growing region as well in this market. The USA has been at the forefront of biotechnology research and development, leading to continuous advancements in the field. This innovation has resulted in the introduction of new and more efficient biotechnological solutions for agriculture, which will continue in the future as well.

COVID-19 Impact Analysis on the North America Agricultural Biotechnology Market:

The COVID-19 pandemic has had a mixed impact on the North America Agricultural Biotechnology Market. On one hand, it highlighted the importance of resilient and sustainable agricultural practices, driving interest in biotechnology solutions. The need to ensure food security in times of crisis underscored the value of technologies that can enhance crop yields and protect against pests and diseases. However, disruptions in supply chains, labor shortages, and economic uncertainties posed challenges to the market. According to a report by the International Service for the Acquisition of Agri-Biotech Applications (ISA), while demand for agricultural biotechnology remained strong, logistical issues during the pandemic created hurdles for the distribution and adoption of biotech products in North America and beyond. Additionally, regulatory agencies adjusted some timelines and procedures to accommodate pandemic-related constraints, affecting the regulatory processes for biotech products. As the situation evolves, the long-term impact of COVID-19 on the North American Agricultural Biotechnology Market continues to be monitored, with resilience and innovation being key drivers in adapting to the changing landscape.

Latest Trends/ Developments:

A growing trend involves biotechnology companies forming strategic collaborations and partnerships with both industry peers and research institutions. By pooling resources and expertise, these collaborations aim to accelerate innovation and the development of biotechnological solutions for agriculture. This approach helps companies access a broader knowledge base, share development costs, and expand their product portfolios, ultimately strengthening their competitive position in the market.

Sustainability has become a prominent trend in the agriculture biotechnology sector. Companies are increasingly focusing on developing and commercializing biotech products that align with sustainable farming practices, such as reduced chemical usage and improved resource efficiency. By addressing the growing demand for environmentally friendly and socially responsible agricultural solutions, companies can tap into a rapidly expanding market segment and secure a larger market share in North America and beyond.

Key Players:

- Monsanto (now part of Bayer)

- DuPont Pioneer (now part of Corteva Agriscience)

- Syngenta

- BASF

- Bayer Crop Science

- Corteva Agriscience

- Dow AgroSciences (now part of Corteva Agriscience)

- KWS SAAT SE

- Verdeca

- Evogene

- In August 2023, Syngenta Seeds and Sustainable Oils formed an agreement for the sale of camelina sativa (camelina) seeds, which serve as an ultra-low carbon oilseed crop suitable for producing sustainable aviation fuel and renewable fuels. This partnership underscores Syngenta's unwavering dedication to facilitating the widespread adoption of regenerative farming practices by making them economically viable for farmers in the USA.

- In March 2023, Corteva Agriscience unveiled an innovative gene-editing technology designed to enhance the protection of high-performing corn hybrids. This pioneering approach leverages proprietary technology to consolidate various disease-resistant traits native to the crop into a single genetic locus. The aim is to provide more effective solutions for combating the most destructive corn diseases encountered by North American farmers.

Chapter 1. North America Agricultural Biotechnology Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Agricultural Biotechnology Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Agricultural Biotechnology Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Agricultural Biotechnology Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Agricultural Biotechnology Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Agricultural Biotechnology Market– By Technology

6.1. Introduction/Key Findings

6.2. Genetic Engineering

6.3. Tissue Culture

6.4. Embryo Rescue

6.5. Somatic Hybridization

6.6. Molecular Diagnostics

6.7. Y-O-Y Growth trend Analysis By Technology

6.6. Absolute $ Opportunity Analysis By Technology, 2023-2030

Chapter 7. North America Agricultural Biotechnology Market– By Application

7.1. Introduction/Key Findings

7.2. Vaccine Development

7.3. Transgenic Crops & Animals

7.4. Antibiotic Development

7.5. Biofuels 7.5. Y-O-Y Growth trend Analysis By Application

7.6. Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 8. North America Agricultural Biotechnology Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Technology

8.1.3. By Application

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Agricultural Biotechnology Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Monsanto (now part of Bayer)

9.2. DuPont Pioneer (now part of Corteva Agriscience)

9.3. Syngenta

9.4. BASF

9.5. Bayer Crop Science

9.6. Corteva Agriscience

9.7. Dow AgroSciences (now part of Corteva Agriscience)

9.8. KWS SAAT SE

9.9. Verdeca

9.10. Evogene

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The North America Agricultural Biotechnology Market was valued at USD 13.88 Billion in 2022 and is projected to reach a market size of USD 31.08 Billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 10.6%.

Increasing Global Food Demand, and Climate Change Mitigation are helping in expanding North America Agricultural Biotechnology market

Based on application, the North American Agricultural Biotechnology market is divided into Vaccine Development, Transgenic Crops and Animals, Antibiotic Development, and Biofuels.

The USA is the most dominant region for the North America Agricultural Biotechnology Market.

Syngenta, BASF, Bayer Crop Science, and Corteva Agriscience are the key players operating in the North America Agricultural Biotechnology Market