North America Adsorbents Market Size (2025-2030)

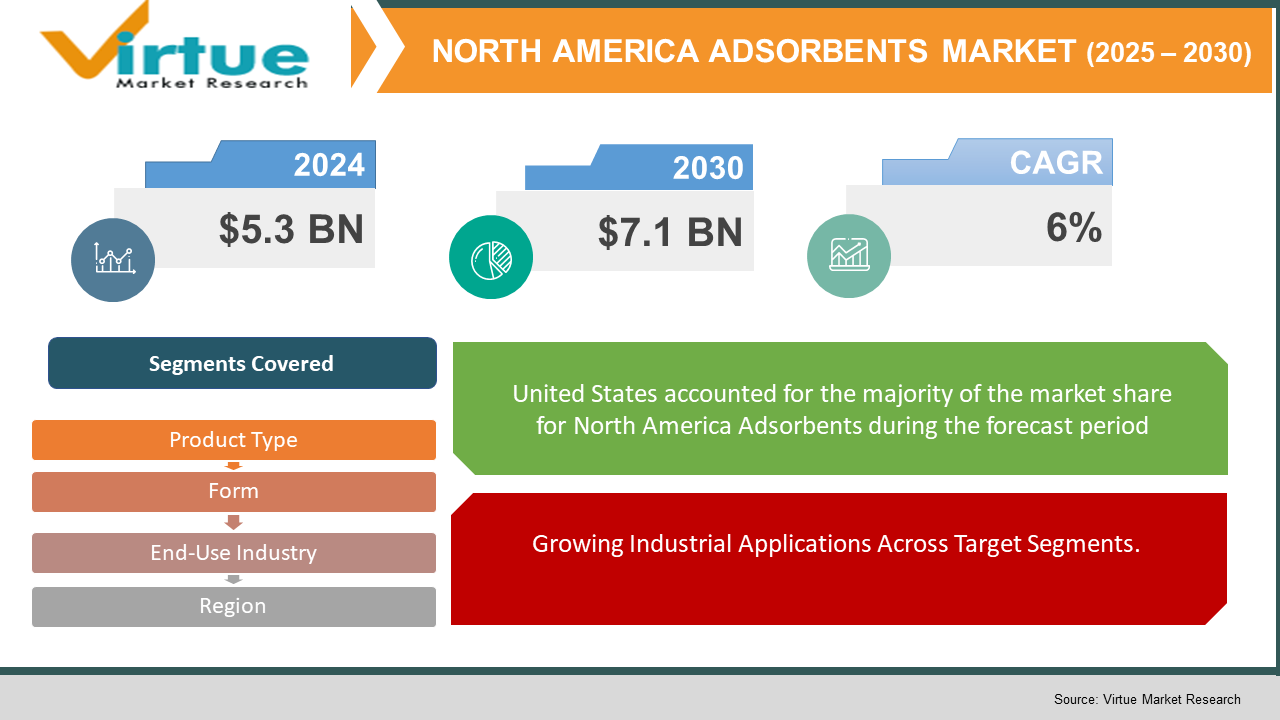

The North America Adsorbents Market was valued at $5.3 billion and is projected to reach a market size of $7.1 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6%.

The North America Adsorbents Market is transforming as an imperative segment across various industries with the increasing focus on environmental sustainability, industrial purification, and compliance with regulations. Adsorbents, substances that adsorb materials to their surface, are being used more and more in various applications, including water and air filtration, petrochemical refining, food and drug processing, and chemical production. Specifically, growing alarm over pollution control and stringent environmental regulations by agencies such as the U.S. Environmental Protection Agency (EPA) have hugely boosted the need for effective adsorbent solutions, particularly in the United States, which dominates the regional market.

Key Market Insights:

In 2023, the United States contributed the most to the North America and Asia-Pacific (APAC) adsorbents market, holding 23% of the regional market share. Its industrial base is well-developed, and it has adopted stringent environmental regulations as the key reasons behind its dominance.

The petrochemical industry is the largest end-use in North America, utilizing approximately 26% of adsorbents, fueled by essential purification and separation operations. Secondly, petroleum refining is still the largest application segment of the world, contributing 33.6% of the market in 2024 because of its application of adsorbents during desulfurization and other refinery operations.

The water treatment sector contributes significantly, with an 18% North American share of the adsorbents market. Increased investment in wastewater treatment plants is set to drive adsorbent use in pollutant elimination and environmental protection.

For product types, molecular sieves top the market at 27.6% of global demand in 2024. Due to their sophisticated adsorption properties and adaptability, they find common application in the oil & gas, chemical, and pharmaceutical industries.

In 2024, North America accounted for 40% of the total revenue of the global adsorbents market, demonstrating its strategic significance in industrial development, technological advancement, and regulatory compliance.

North America Adsorbents Market Key Drivers:

Stringent Environmental Policies and Sustainability Strategies.

North America, more so the United States, has had stringent environmental policies to curtail industrial emissions and improve water quality. Government agencies such as the U.S. Environmental Protection Agency (EPA) have stringent regulations for air and water treatment, forcing industries to embrace cutting-edge adsorbent technologies. This regulatory burden forces the need for effective materials such as molecular sieves and activated carbon, which are central in ensuring compliance throughout sectors such as oil & gas, chemicals, and pharmaceuticals.

Growing Industrial Applications Across Target Segments.

The diversity of adsorbents has resulted in their extensive use in many industries. In petroleum refining, adsorbents play a key role in the removal of impurities like sulfur and water from fuels. Adsorbents are used in the chemical and petrochemical industries for separation and purification. The increasing focus on air and water quality has also triggered the application of absorbents in environmental uses, such as air purification and wastewater treatment.

Advances in Adsorbent Materials and Technology.

Continuous research and development have contributed to great advancements in adsorbent materials, making them more efficient and applicable. Advances in polymeric adsorbents have yielded products with increased adsorption capacities, chemical stability, and reusability. These advances are responsive to the changing demands of industries like pharmaceuticals, food processing, and water treatment, where high-performance adsorbents are critical.

North America Adsorbents Market Restraints and Challenges:

Challenges to the Growth of North America's Adsorbents Market.

The North American adsorbents market is confronted with several key challenges that may hinder its growth. One of the main issues is the volatility of raw material prices, especially for products such as activated carbon, silica gel, and alumina. These price fluctuations have the potential to increase production costs, impacting manufacturers' profitability and potentially resulting in higher end-user prices. Another urgent issue is the environmental impact of adsorbent production and disposal. Raw material extraction and processing may cause ecological degradation, while spent adsorbent disposal is problematic due to potential toxicity and lack of biodegradability. This calls for sustainable production technologies and proper waste management techniques. Technological constraints also pose challenges. Though there have been developments in adsorbent materials, problems like low adsorption capacity, selectivity, and regeneration efficiency still exist. These constraints may limit the use of adsorbents in particular industrial applications, thus influencing market growth. Finally, the market is threatened by rival technologies such as membrane filtration and advanced oxidation processes, which may provide alternative, efficient, or cheaper solutions in particular uses. The use of such alternatives can deplete the market for conventional adsorbents, hindering market growth.

North America Adsorbents Market Opportunities:

Rising Opportunities in North America's Adsorbents Market Fuelled by Sustainability and Technological Innovation.

The North American adsorbents market is expected to grow strongly, fuelled by rising environmental regulations and greater emphasis on sustainability. Industries are looking for next-generation adsorbent materials to comply with strict emission controls and purify processes more efficiently. Demand is especially high in areas such as water treatment, air purification, and chemical production. Technological innovation is also creating new opportunities for market growth. Advances in the design of new adsorbent materials with improved efficiency and selectivity are making it possible to use them in more applications, such as renewable energy systems and advanced manufacturing processes. These technologies are not only enhancing performance but also lowering the costs of operation, thus making adsorbents more appealing to a greater number of industries. In addition, increasing focus on the principles of circular economy is stimulating recycling and reuse of adsorbent materials. This trend is promoting the use of sustainable adsorbents that can be regenerated and reused for several cycles, thus minimizing waste and saving resources. These sustainable methods are likely to gain prominence, offering further growth prospects to the market.

NORTH AMERICA ADSORBENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Product Type, form, end use industry, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, usa, canada, mexico |

|

Key Companies Profiled |

Arkema S.A., Honeywell International Inc., BASF SE, Cabot Corporation, Clariant AG, W. R. Grace & Co., Calgon Carbon Corporation, Zeochem AG, Porocel Industries, LLC, Zeolyst International |

North America Adsorbents Market Segmentation:

North America Adsorbents Market Segmentation: By Product Type

- Activated Carbon

- Molecular Sieves (Zeolites)

- Activated Alumina

- Silica Gel

- Polymeric Adsorbents

- Others

Polymeric adsorbents are the fastest-growing product segment in the North American adsorbents market. Polymeric adsorbents are synthetic materials that have porous structures, high adsorption capacity, and chemical stability, which make them very effective for selective adsorption and separation applications. They are widely used across many industries, such as pharmaceuticals, water treatment, and food processing. In the pharma industry, polymeric adsorbents are used to purify antibiotics, enzymes, and other therapeutic drugs to maintain high product quality and meet stringent regulatory requirements. These adsorbents are used in the food and beverage industry for decolorization and elimination of unwanted flavors, improving product purity and flavor. Their use in water treatment applications, especially the elimination of organic pollutants, is a testament to their increasing relevance in environmental applications. The need for effective and sustainable purification technology is driving the development of polymeric adsorbents in the region.

On the other hand, activated carbon is still the leading product type in the North American adsorbents market. With its superior adsorption capabilities, activated carbon is a widely used substance for water treatment, air filtering, and industrial applications. Its porous structure and high surface area facilitate effective elimination of impurities and contaminants and thus have found a niche in municipal water treatment plants as well as in industrial effluent treatment. In particular, the powdered form of activated carbon dominates a major share in the market owing to the convenience of use and economy of price. Furthermore, environmental standards becoming stricter, as well as rising concern regarding air and water quality, have added fuel to the need for activated carbon across different sectors. Its proven effectiveness, combined with continued technology developments, guarantees its sustained superiority in the North American adsorbents industry.

North America Adsorbents Market Segmentation: By Form

- Powder

- Flakes

- Others

Powdered adsorbents now lead the North American market for their high surface area and fast adsorption rates. The small particle size facilitates effective removal of impurities in such applications as water treatment, air cleaning, and chemical processing. Powdered forms are preferred by industries for their flexibility and effectiveness in removing a broad spectrum of impurities. Their ease of handling and incorporation into current systems further establishes them as market leaders.

Flake-type adsorbents are the most rapidly growing category in the North American market. They have a larger particle size, minimizing pressure drop across filtration systems and qualifying them for high flow rate applications like industrial gas cleaning and large-scale wastewater treatment. Flakes have the capacity for multiple regeneration cycles, which boosts their cost-effectiveness and popularity in sustainable operations. With industries looking for cost-effective and recyclable alternatives, demand for flake-type adsorbents will increase immensely.

North America Adsorbents Market Segmentation: By End-Use Industry

- Petrochemical Industry

- Water Treatment

- Chemical Industry

- Automotive and Transportation

- Pharmaceutical and Food Industries

- Building & Construction

- Others

The water treatment industry is now the fastest growing among North America's adsorbent market. Growth is fueled by rising water pollution concerns, infrastructural aging, and demand for potable water. Adsorbents such as zeolites and activated carbon are widely employed to purify water sources by removing impurities in the form of organic substances, heavy metal compounds, and volatile organic substances. The increasing focus on sustainable water management and tight environmental regulations are also driving demand for high-performance adsorbent materials in municipal and industrial water treatment plants in the region. On the other hand, the petrochemical sector is the leading end-use industry for adsorbents in North America.

This leadership owes to the widespread application of adsorbents in such processes as gas purification, catalysis, and hydrocarbon separation. Adsorbents like activated carbon and molecular sieves play vital roles in removing impurities like sulfur compounds, nitrogen compounds, and water from petrochemical feedstocks and natural gas. The shale gas boom and increase in petrochemical plant builds in the United States and Canada have created major demand for the use of adsorbents here. Also, the emphasis of the industry towards the production of cleaner fuels following environmental requirements keeps propelling the use of adsorbents in refining and processing processes.

North America Adsorbents Market Segmentation: By Region

- United States of America (USA)

- Canada

- Mexico

The United States leads the North American adsorbents market by far and holds about 86% of the regional market share as of 2024. The reason behind this is the country's strict environmental regulations, well-developed industrial base, and huge demand across sectors like petrochemicals, water treatment, and pharmaceuticals. Canada has an estimated 9% market share, with growth in its market being driven by the growing oil and gas sector, especially in Alberta, and rising investments in environmental sustainability efforts. Mexico has a contribution of about 5% to the regional market, with its demand for adsorbents mainly driven by the development of the manufacturing sector and initiatives to enhance water treatment plants. Together, these three nations determine the North American adsorbents market dynamics, each one being driven by its own industrial operations and regulatory environment.

COVID-19 Impact Analysis on the North America Adsorbents Market:

The pandemic of COVID-19 severely affected the North American adsorbents market, mostly because of widespread industrial closures and supply chain disruptions. In the United States, strict lockdowns caused manufacturing units to shut down temporarily, especially in the petrochemical, water treatment, and chemical industries, which are heavy users of adsorbents. This led to a sharp reduction in the demand for adsorbent products at the height of the pandemic. Moreover, shortages of labor and logistical issues also increased production delays and hampered the timely deliveries of raw materials and finished goods. The same applied to Canada and Mexico, with industrial processes slowing down because of concerns regarding health and safety, and thus affecting regional demand for adsorbents. With the loosening of restrictions and industries having adjusted to new operational standards, there was a slow revival in the market. The revival was especially significant in the field of water treatment, fueled by heightened awareness of cleanliness and the need for pure water, causing a revival in demand for adsorbents used in purification. Overall, although the pandemic had presented serious short-term challenges to the North American adsorbents industry, the industry proved resilient and is well on the way towards recovery, facilitated by the recovery of mainstay industries as well as an increased emphasis on environmental sustainability.

Trends/Developments:

In August 2023, DuPont launched an innovative ion exchange resin specifically designed for green hydrogen production. This development underscores the growing importance of adsorbents in sustainable energy applications, particularly in facilitating clean hydrogen generation.

In September 2023, Lanxess introduced a new mixed-bed resin tailored for producing ultra-pure water essential in semiconductor manufacturing. This advancement highlights the critical role of adsorbents in high-tech industries requiring stringent purity standards.

Key Players:

- Arkema S.A.

- Honeywell International Inc.

- BASF SE

- Cabot Corporation

- Clariant AG

- W. R. Grace & Co.

- Calgon Carbon Corporation

- Zeochem AG

- Porocel Industries, LLC

- Zeolyst International

Chapter 1. North America Adsorbents Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. North America Adsorbents Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Adsorbents Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Packaging TYPE Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Adsorbents Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. North America Adsorbents Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Adsorbents Market – By Product TYPE

6.1 Introduction/Key Findings

6.2 Activated Carbon

6.3 Molecular Sieves (Zeolites)

6.4 Activated Alumina

6.5 Silica Gel

6.6 Polymeric Adsorbents

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Product TYPE

6.9 Absolute $ Opportunity Analysis By Product TYPE, 2025-2030

Chapter 7. North America Adsorbents Market – By Form

7.1 Introduction/Key Findings

7.2 Powder

7.3 Flakes

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Form

7.6 Absolute $ Opportunity Analysis By Form , 2025-2030

Chapter 8. North America Adsorbents Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 Petrochemical Industry

8.3 Water Treatment

8.4 Chemical Industry

8.5 Automotive and Transportation

8.6 Pharmaceutical and Food Industries

8.7 Building & Construction

8.8 Others

8.9 Y-O-Y Growth trend Analysis End-Use Industry

8.10 Absolute $ Opportunity Analysis End-Use Industry , 2025-2030

Chapter 9. North America Adsorbents Market Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Form

9.1.3. By End-Use Industry

9.1.4. By Product TYPE

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. North America Adsorbents Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Arkema S.A.

10.2 Honeywell International Inc.

10.3 BASF SE

10.4 Cabot Corporation

10.5 Clariant AG

10.6 W. R. Grace & Co.

10.7 Calgon Carbon Corporation

10.8 Zeochem AG

10.9 Porocel Industries, LLC

10.10 Zeolyst International

.

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The market is spurred on by stringent environmental laws, growing purification demand, and industrial expansion in oil & gas, chemicals, and pharmaceuticals.

The largest applications are petroleum refining, water treatment, gas separation, and air purification operations, and pharmaceuticals and food processing.

: AI improves adsorbent materials' performance by optimizing adsorption, water purification, and air cleaning performance.

The U.S. leads in adsobernent consumption due to strict environmental regulations and industrial growth, especially in oil & gas and manufacturing states

Major trends include nanomaterial and bio-based adsorbents, increased sustainable utilization, and continued enhanced adsorbent regeneration technology.