North America Adjuvants Market Size (2025-2030)

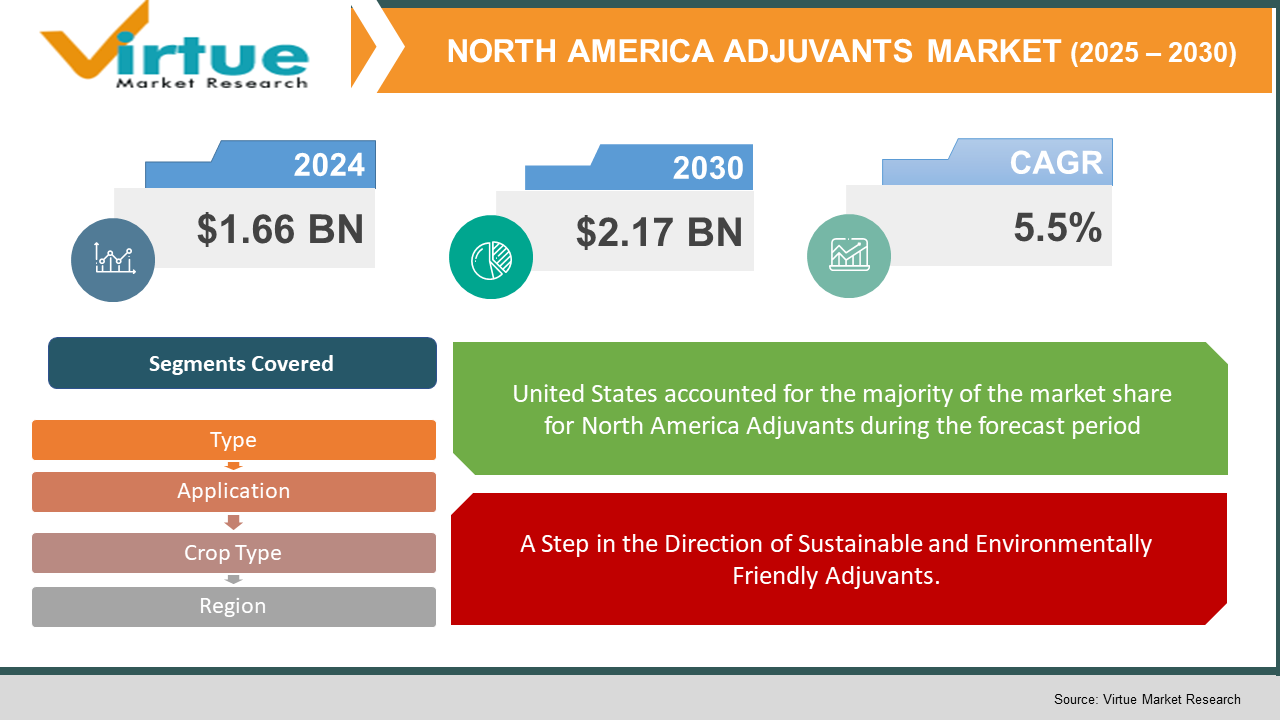

The North America Adjuvants Market was valued at $1.66 billion and is projected to reach a market size of $2.17 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.5%.

The North America Adjuvants Market is being revolutionized, emerging as a vital element of both the agricultural and healthcare industries, pushed by the demand for higher efficacy, sustainability, and regulatory compliance. For the agricultural industry, adjuvant chemicals used to enhance pesticide and herbicide performance are increasingly being used to enhance crop protection, optimize pesticide performance, and minimize environmental impact. This is spurred by the use of precision farming technologies and the need to fight herbicide-resistant weeds. The United States dominates the regional market, spurred by advanced agricultural technology and tight environmental regulations imposed by institutions such as the U.S. Environmental Protection Agency (EPA). The major adjuvant segments are surfactants, oils, and utility adjuvants, each contributing to the enhancement of the application and effectiveness of agrochemicals.

Key Market Insights:

It is North America that contributes the most, with approximately 45% of the overall global consumption of crop adjuvants. This is mainly attributed to the adoption of sophisticated agricultural practices and the growing need for more effective crop protection products with higher yield and sustainability.

In the last three years, there has been a remarkable growth of 30% in the use of bio-based adjuvants in the category of Eco-Friendly Adjuvants. This growth is a reflection of a larger trend in the agricultural industry towards the use of sustainable and environmentally friendly inputs that positively help our planet.

The synergy of adjuvants and precision ag technologies has experienced a phenomenal surge, posting an impressive 30% increase in the last two years. The increase has tremendously

contributed to increasing the efficiency and effectiveness of pesticide application on the ground.

In 2023, most North American firms invested heavily of approximately USD 500 million, solely in research and development activities on agricultural adjuvants. This huge investment is primarily aimed at the objective of developing solutions that are not only safer but also more efficient to be used in agricultural applications.

North America Adjuvants Market Key Drivers:

A Step in the Direction of Sustainable and Environmentally Friendly Adjuvants.

There is an increasingly prominent and widespread awareness regarding the environmental and health risks that are linked with chemically derived adjuvants. As a result of this heightened awareness, both government authorities and adjuvant manufacturers are making a concerted effort to focus on developing and utilizing renewable and sustainable products in their processes and offerings. For instance, the recent acquisition of Logos Technologies LLC’s NatSurFact business by Stepan Company serves as a notable example of this trend, as it involves the provision of rhamnolipid-based bio-surfactants that are derived from renewable sources. Such initiatives and actions taken by companies are significantly driving the greater adoption of eco-friendly adjuvants within the market landscape.

Implementation of Precision Farming Technology.

Precision farming, which encompasses a range of advanced technologies like aerial spraying, intelligent irrigation systems, and variable rate application systems, is gaining rapid popularity and momentum across North America. In this new-age agricultural scenario, agricultural adjuvants play a crucial role in maximizing these new-age farming practices, as they play a critical role in ensuring better coverage, effective absorption, and penetration of agrochemicals deep inside crops. This synergistic advantage of adjuvants when applied in combination with precision farming technologies greatly increases the overall effectiveness of crop protection practices. Hence, there is growing demand for adjuvants specifically designed for application in the precision farming industry.

North America Adjuvants Market Restraints and Challenges:

The North America Adjuvants Market is poised to expand, but has some serious challenges that may impede its course. One of the main challenges is the highly regulated atmosphere, with agricultural adjuvants in the United States regulated by the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) and needing EPA approval, whereas in Canada, Health Canada's PMRA has strict testing and registration requirements. Such intricate processes can cause product delays and raise expenses, affecting manufacturers' responsiveness. Furthermore, the high costs of developing adjuvants for vaccines—attributable to significant R&D, preclinical development, and clinical testing—present economic challenges, especially for mid-sized biopharmaceutical companies, curtailing innovation and new entrants in the market. The market also faces product differentiation challenges; numerous adjuvants have alike active ingredients and mechanisms, exacerbating competition and price sensitivity, which compresses margins. Furthermore, increasing worries over the safety and environmental footprint of some adjuvants, particularly those derived from animals, impact public sentiment and drive demand toward plant-derived or synthetic types. Meeting such concerns requires sustained investment in producing safer, greener formulations. Overall, even though the North America Adjuvants Market presents encouraging opportunities, it will have to overcome regulatory complexities, huge development costs, competitive intensity, and changing consumer trends to make the most of its growth opportunities.

North America Adjuvants Market Opportunities:

North America Adjuvants Market is poised to experience high growth, driven by major opportunities related to changing agriculture trends and rising consumer pressure for sustainability. A key driver is the transition to environmentally friendly, bio-based, and biodegradable adjuvants designed to reduce environmental footprint, such as lowering chemical runoff and soil erosion. This transition is hastened by advances in nanotechnology and biotechnology, which enable the production of safer and more effective formulations. Besides, the emergence of precision agriculture methods—such as aerial spraying, intelligent irrigation, and variable rate application—has increased the need for adjuvants that enhance the performance of agrochemicals through better spray coverage, absorption, and penetration, hence maximizing pesticide performance while reducing waste. The application of data-driven agricultural practices also enhances the demand for high-performance adjuvants specifically designed to meet the unique demands of individual crops. In addition, the heightened threat of herbicide-resistant weeds creates a pressing demand for new adjuvant innovations that enhance herbicide activity and ensure crop yield maintenance. This has created opportunities for manufacturers to pour resources into research and development in the form of innovative products that challenge these farm obstacles. In total, the North America Adjuvants Market will benefit significantly from the intersection of environmental sustainability initiatives, technological advancements, and the urgent need to overcome farming issues. Businesses that focus on innovation and sustainability are best placed to take advantage of these trends and respond to the increasing demand for effective, environmentally friendly adjuvant products.

NORTH AMERICA ADJUVANTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Type, APPLICATION, CROP TYPE, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA, CNADA, MEXICO |

|

Key Companies Profiled |

Corteva Agriscience, BASF SE, Helena Agri-Enterprises, LLC, Stepan Company, Evonik Industries AG, GlaxoSmithKline plc, Novavax, Inc., CSL Limited, SEPPIC, SPI Pharma |

North America Adjuvants Market Segmentation:

North America Adjuvants Market Segmentation: By Type

- Activator Adjuvants

- Utility Adjuvants

Activator adjuvants, including surfactants, oil adjuvants, and ammonium fertilizers, are growing rapidly within the North American market for agricultural adjuvants. Activator adjuvants increase the effectiveness of pesticides by enhancing the spread, penetration, and uptake of active ingredients, resulting in more effective pest and disease management. The rising incidence of herbicide-resistant weeds has spurred demand for activator adjuvants since they allow herbicides to function more effectively at reduced application rates. Advances in surfactant technologies have also contributed to this growth, with advances like premium surfactants providing enhanced spreading and penetration properties. For example, a leading agrochemical business saw year-over-year sales increases of 25% for premium surfactant products for systemic herbicides, mirroring the increasing demand for activator adjuvants in contemporary agriculture.

Utility adjuvants, such as drift control agents, compatibility agents, acidifiers, and water conditioners, presently dominate the North American market for agricultural adjuvants. Utility adjuvants significantly contribute to improving the handling and application properties of agrochemical formulations, providing optimal performance, and minimizing environmental footprint. Due to their capability to stabilize mixtures of agrochemicals, avoid drift during application, and ensure optimal pH levels for maximizing pesticide effectiveness, they are universally used. The growing use of precision farming methods and the requirement for efficient agrochemical applications have also added to the demand for utility adjuvants. With farmers looking to make the best use of resources and reduce environmental impact, utility adjuvants have become essential in contemporary agriculture.

North America Adjuvants Market Segmentation: By Application

- Herbicide Adjuvants

- Insecticide Adjuvants

- Fungicide Adjuvants

- Other Applications

The adjuvants for fungicides segment is growing very fast in the North American market. This growth is fueled by the growing demand for efficient disease management in crops, especially with the emergence of resistant fungal strains. Adjuvants increase the effectiveness of fungicides by increasing spray coverage, adhesion, and penetration, thus leading to improved disease control. As farming operations become more sustainable and integrated pest management systems, the market for fungicide adjuvants is likely to see its growth continue.

Herbicide adjuvants at present control the North American adjuvants market with a large share. Their domination arises from the extensive utilization of herbicides in many crops for weed control. Adjuvants serve to boost the performance of herbicides by enhancing their spread, retention, and penetration onto the surface of plants. The rising use of no-till and reduced-till agricultural practices, which are dependent greatly on herbicides for weed management, adds to the demand for herbicide adjuvants.

North America Adjuvants Market Segmentation: By Crop Type

- Crop-Based (Grains & Cereals, Fruits & Vegetables, Oilseeds)

- Non-Crop-Based (Turf & Ornamental Grass, Others)

The grains and cereal segment is the largest in the North American adjuvants market, with more than 40% of total consumption. Wheat, barley, and corn are widely planted throughout the United States and Canada, making the use of adjuvants necessary to improve the effectiveness of herbicides, fungicides, and insecticides. Adjuvants enhance spray retention, spreading, and penetration, resulting in improved pest and disease management and increased crop yields. The rise in demand for staple foods and the increasing emphasis on improving agricultural productivity are driving the market in this segment. The fruit and vegetables segment is the most rapidly growing segment in the North American adjuvants market.

The demand for high-value crops and the development of greater attention on integrated pest management (IPM) techniques are fueling this growth. Adjuvants are widely utilized in fruit and vegetable cultivation to increase the efficacy of crop protection products and crop quality. The widespread embrace of contemporary farming techniques and the growing recognition of farmers regarding the advantages of adjuvants are fueling the strong growth in this segment.

North America Adjuvants Market Segmentation: By Region

- United States of America (USA)

- Canada

- Mexico

The North America Adjuvants market is dominated by the United States, which possesses the largest share of 85% in the region, with its widespread agricultural activities and technologically advanced farming practices. Canada, with its large agricultural area and usage of sustainable farming practices, is growing at a very rapid pace in the adjuvants market and possesses a market share of 10%. Mexico, although it represents a decreasing percentage of the market currently, is becoming the fastest-growing nation in the area with a 5% market share, fueled by rising use of new agricultural practices and government policies aimed at increasing agricultural productivity.

COVID-19 Impact Analysis on the North America Adjuvants Market:

The COVID-19 outbreak made a significant impression on the North American adjuvants market, and it made both sectors face new challenges and opportunities. Supply chain disturbances, labor scarcity, and logistics complexities slowed down the availability and application of adjuvants and other inputs in agriculture, which could impact crop yields. The pandemic increased the level of concern regarding food security and sustainable agriculture, drawing attention to the importance of adjuvants in enhancing the effectiveness of pesticides and herbicides. Conversely, the vaccine adjuvants market grew at a high rate due to the pressing need for COVID-19 vaccines, as adjuvants played a critical role in enhancing immune responses. This growth spurred greater research, development, and investment, emphasizing the significance of adjuvants in vaccine effectiveness. Agricultural adjuvants were hindered, while the vaccine industry accelerated, demonstrating the diverse impacts of the pandemic on various aspects of the North American adjuvants market.

Trends/Developments:

In August 2024, KCC Corporation bought Momentive Performance Materials Group, a U.S. company that produces agricultural adjuvants for conventional and organic agriculture, to reinforce its market share in the North American region.

In May 2024, FMC Corporation signed a research partnership with AgroSpheres, an AgTech leader, to speed up the creation of new bioinsecticides as part of FMC's aim to advance sustainable crop protection products.

In February 2024, Innvictis Crop Care released seven multi-purpose adjuvants with Inntero technology that will enhance field performance and ease handling and storage for farmers.

In November 2023, Nufarm released a new herbicide technology to help farmers fight challenging weeds in cereal crops, increasing crop yield and efficiency.

In September 2023, Lanxess launched a new mixed-bed resin specifically for the production of ultra-pure water used in semiconductor production, emphasizing the indispensable role of adsorbents in high-tech sectors demanding high levels of purity.

In August 2023, DuPont introduced a novel ion exchange resin that is particularly designed for green hydrogen production, reflecting the increasing prominence of adsorbents in applications for sustainable energy.

Key Players:

- Corteva Agriscience

- BASF SE

- Helena Agri-Enterprises, LLC

- Stepan Company

- Evonik Industries AG

- GlaxoSmithKline plc

- Novavax, Inc.

- CSL Limited

- SEPPIC

- SPI Pharma

Chapter 1. North America Adjuvants Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. North America Adjuvants Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Adjuvants Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Packaging TYPE Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Adjuvants Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. North America Adjuvants Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Adjuvants Market – By TYPE

6.1 Introduction/Key Findings

6.2 Activator Adjuvants

6.3 Utility Adjuvants

6.4 Y-O-Y Growth trend Analysis By TYPE

6.5 Absolute $ Opportunity Analysis By TYPE , 2025-2030

Chapter 7. North America Adjuvants Market – By Application

7.1 Introduction/Key Findings

7.2 Herbicide Adjuvants

7.3 Insecticide Adjuvants

7.4 Fungicide Adjuvants

7.5 Other Applications

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. North America Adjuvants Market – By Crop Type

8.1 Introduction/Key Findings

8.2 Crop-Based (Grains & Cereals, Fruits & Vegetables, Oilseeds)

8.3 Non-Crop-Based (Turf & Ornamental Grass, Others)

8.4 Y-O-Y Growth trend Analysis Crop Type

8.5 Absolute $ Opportunity Analysis Crop Type , 2025-2030

Chapter 9. North America Adjuvants Market Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Application

9.1.3. By Crop Type

9.1.4. By TYPE

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. North America Adjuvants Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Corteva Agriscience

10.2 BASF SE

10.3 Helena Agri-Enterprises, LLC

10.4 Stepan Company

10.5 Evonik Industries AG

10.6 GlaxoSmithKline plc

10.7 Novavax, Inc.

10.8 CSL Limited

10.9 SEPPIC

10.10 SPI Pharma

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The market is driven by the use of precision agriculture, growing demand for sustainable agriculture, and the requirement for better crop protection solutions.

Significant users are the agricultural industry (specifically cereals, grains, and fruits & vegetables) and the pharma sector, especially vaccine manufacturing.

AI is transforming vaccine adjuvant manufacturing by facilitating speedy analysis of genomic information and immunity prediction, hence speeding up the development of potent vaccines.

Canada is the most rapidly growing nation in the North American agricultural adjuvants market and is significantly contributing to overall regional growth.

The major trends are the incorporation of AI in vaccine production, the growth of bio-based and green adjuvants, and the growing application of sophisticated formulations such as suspension concentrates in agriculture.