North America Acai Berry Market Size (2024-2030)

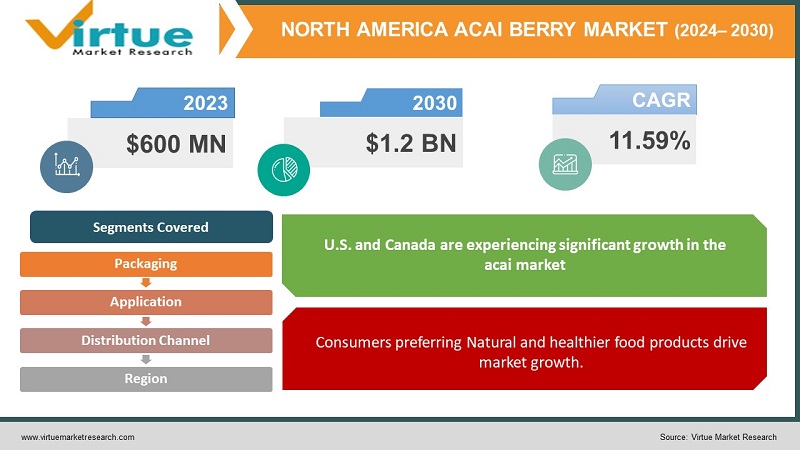

The North America Acai Berry Market was valued at USD 600 million in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 1.2 billion by 2030, growing at a CAGR of 11.59%.

The acai berry is a dark purple fruit with a circumference of approximately 25 mm, harvested from the Acai palm tree native to Central and South America. This flavorful berry is known for its natural antioxidants, including vitamins C and E, as well as unique phytonutrients called anthocyanins. Rich in dietary fiber, the acai berry also provides vitamins B1, B2, B3, E, and C, along with essential minerals such as calcium, zinc, and potassium, as well as proteins and beneficial fatty acids, including Omega 6 and Omega 9. In addition to its use in various nutraceutical and pharmaceutical products, acai berries are often preferred in their dried form due to their convenience for storage and transport. The dried acai berry can be utilized to assist in scar healing and address dry skin issues. Recent advancements in acai berry processing have enabled manufacturers to maintain the nutritional integrity of the products.

Key Market Insights:

The wide range of health benefits associated with acai berries has significantly contributed to their soaring demand in the food and beverage industry. Notable advantages include enhancing cardiovascular health, exhibiting anticancer properties, and reducing the risk of prevalent cognitive disorders like Alzheimer's and Parkinson's diseases. Additionally, there is a growing trend of incorporating acai berries into weight loss supplements.

North America Acai Berry Market Drivers:

Consumers preferring Natural and healthier food products drive market growth.

The growing demand for healthy and natural food options is a primary factor driving the expansion of the acai berry market. As consumers become more conscious of the advantages of consuming natural and unprocessed foods, they are actively seeking alternatives that offer similar health benefits. The acai berry, known for its high antioxidant content and dietary fiber, is particularly appealing. Additionally, the diverse range of acai berry products, including juices powders, and capsules, is further fueling market growth.

North America Acai Berry Market Restraints and Challenges:

Climate vulnerability and harvesting challenges hinder market growth.

The acai berry sector faces significant challenges due to growing climate vulnerability, which could hinder its growth. Predominantly sourced from the Amazon rainforest, acai berries are increasingly threatened by climate change. Alterations in rainfall patterns, rising temperatures, and extreme weather events negatively affect the delicate balance necessary for acai palm cultivation, potentially reducing growth and productivity. Climate variability may lead to supply disruptions, complicating efforts for producers to consistently meet rising demand.

Additionally, the socioeconomic impact on local communities involved in acai berry harvesting must be considered. Many villages rely on acai berry farming as a primary income source. Climate-related disruptions can lead to economic instability, prompting farmers to seek alternative livelihoods or migrate to urban areas. This migration can further constrain the labor force available for acai cultivation, exacerbating supply issues. In response, companies like Sambazon, which imports acai berries from the Amazon, are increasing their investments in sustainable practices and climate resilience strategies. While these efforts are making progress, the challenges remain substantial. Market participants and stakeholders are actively working on developing more resilient acai berry varieties and promoting sustainable farming practices to address these concerns.

North America Acai Berry Market Opportunities:

The usage of powder-form products creates opportunities in the Acai Berry Market.

The increasing preference for powder-based products is expected to significantly drive the acai berry market. Acai berry powder's versatility and convenience make it a favored option among both consumers and businesses. It can be incorporated into a range of applications, including smoothies, dietary supplements, and baked goods, catering to the expanding health-conscious consumer base. The powder's extended shelf life and ease of storage further enhance its appeal.

In June 2023, Navitas Organics announced plans to expand its superfood powder range, with a particular emphasis on acai berry powder. This initiative reflects the rising market demand and the company’s strategic focus on the health and wellness trend. Navitas Organics reported a 15% increase in acai berry powder sales year-over-year, indicating robust consumer interest and uptake.

The surge in home cooking and DIY health products has also contributed to the growing demand for acai berry powder. Consumers are increasingly incorporating superfoods into their recipes, driven by a preference for natural, nutrient-rich ingredients. The adaptability of acai berry powder across various recipes enhances its market reach. In response, companies are launching new product lines and recipes that emphasize the convenience and nutritional benefits of acai berry powder.

NORTH AMERICA ACAI BERRY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.59% |

|

Segments Covered |

By Packaging, application, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA, Canada, Mexico |

|

Key Companies Profiled |

Sambazon, Tropical Acai, Acai Roots, Açaí Berry Foods, Acai Frooty and Organique Acai. |

North America Acai Berry Market Segmentation:

North America Acai Berry Market Segmentation- By Application:

- Food & Beverages

- Nutraceuticals

- Cosmetics

Acai berries are extensively utilized in the food and beverage industry, especially in juices and smoothies, and are also featured in various snacks and desserts. The acai berry's sweet, mild flavor and its high antioxidant content have made it a favored choice among health-conscious consumers.

In the nutraceutical sector, acai berry extract is gaining increasing popularity due to its health benefits. This extract is a sought-after component in dietary supplements, health-focused products, and natural wellness items due to its substantial nutritional value.

The potent antioxidant properties of acai berries have also established them as a prominent ingredient in the cosmetics industry. Acai berry extracts are commonly found in shampoos, conditioners, moisturizers, face creams, and sunscreens, where they help protect the skin from free-radical damage and premature aging.

North America Acai Berry Market Segmentation- By Packaging:

-

Cans

- Bottles

- Pouches

Canned acai berries offer a convenient and popular method for enjoying this superfood. These cans are hermetically sealed, ensuring a long shelf life, and typically contain acai pulp mixed with other ingredients such as sweeteners and coconut water.

Acai berries are also available in bottles, which contain pure acai berry juice extracted from fresh fruit. Bottles provide a user-friendly and secure option for storing the juice while maintaining its freshness.

Additionally, acai berry products are offered in pouches, which provide an economical and practical solution for enjoying the superfood. These pouches hold acai pulp and other ingredients, such as sweeteners, in a compact, lightweight, and leak-proof container.

North America Acai Berry Market Segmentation- By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

Supermarkets and hypermarkets are large retail outlets found in major towns and cities, offering an extensive range of products and services. These stores typically feature a broad selection of both fresh and processed foods, with dedicated sections for alcohol, dry goods, fruits and vegetables, and other groceries. They provide customers with a wide variety of options and usually carry a substantial range of acai berry products.

Convenience stores are smaller retail establishments designed for quick and easy access to groceries and everyday household items. Although their product range is more limited compared to supermarkets, these stores are often situated in residential areas and offer extended opening hours, making them a convenient option for purchasing acai berries.

Online retailers provide a modern solution for acquiring products via the internet, with deliveries generally arriving within one to two days. This method is increasingly popular for obtaining acai berries, as it allows consumers to receive products directly at their doorstep without visiting a physical store. Online retailers also frequently offer detailed product information, including nutritional guidance.

North America Acai Berry Market Segmentation- By Region

- U.S

- Canada

- Mexico

The U.S. and Canada are experiencing significant growth in the acai market, driven by the widespread adoption of acai products. The popularity of ready-to-eat acai bowls and the fruit's versatility in various food and beverage applications have contributed to this trend. In the U.S., the rise of acai reflects a broader shift towards health-conscious eating habits and a preference for innovative and flavorful food experiences. The increasing presence of acai in smoothie bowls on menus underscores its growing appeal, suggesting a strong and promising future for this market segment.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has significantly impacted economies and industries worldwide due to lockdowns and business closures. The food and beverage sector, in particular, has faced severe disruptions, including the shutdown of offices and factories, as well as interruptions in supply chains. These challenges have constrained the growth of the acai berry market. The closure of restaurants has had a cascading effect on related industries, such as food production, alcohol production, food and beverage transportation, fishing, and agriculture. This disruption has been especially detrimental in industrialized regions where large quantities of food products are typically imported using just-in-time logistics.

During the lockdown, with gyms closed and remote work becoming the norm, maintaining health through dietary choices has become a primary focus for many individuals. Increased awareness of the acai berry's unique health benefits and healing properties has led to a significant rise in its demand during the COVID-19 pandemic.

Latest Trends/ Developments:

In March 2024, SAMBAZON acquired SunOpta’s frozen acai and smoothie bowl segment. This acquisition is set to enhance SAMBAZON’s manufacturing capabilities in the U.S., allowing the organization to broaden its product portfolio and innovate further, including expanding into tropical fruits and purees. This strategic move is expected to strengthen SAMBAZON’s presence in the acai berry market.

In 2023, major cosmetic companies such as Estée Lauder and L’Oréal began incorporating acai berry components into their product formulations. For instance, Estée Lauder’s Nutritious Super-Pomegranate Radiant Energy Moisture Creme features acai berry extract for its antioxidant benefits, emphasizing its role in enhancing skin vitality and protecting against environmental stressors. This trend highlights the growing use of acai berries not only for their nutritional advantages but also for their skincare benefits.

Key Players:

These are top 10 players in the North America Acai Berry Market :-

- Sambazon

- Tropical Acai Roots

- Açaí Berry Foods

- Acai Frooty

- Organique Acai

- Nativo Acai

- Acai Exotic

- Amazon Power

- Acai Berry Company

Chapter 1. North America Acai Berry Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Acai Berry Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Acai Berry Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Acai Berry Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Acai Berry Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Acai Berry Market– By Application

6.1. Introduction/Key Findings

6.2. Food & Beverages

6.3. Nutraceuticals

6.4. Cosmetics

6.5. Y-O-Y Growth trend Analysis By Application

6.6. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 7. North America Acai Berry Market– By Packaging

7.1. Introduction/Key Findings

7.2. Cans

7.3. Bottles

7.4. Pouches

7.5. Y-O-Y Growth trend Analysis By Packaging

7.6. Absolute $ Opportunity Analysis By Packaging, 2024-2030

Chapter 8. North America Acai Berry Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets/Hypermarkets

8.3. Convenience Stores

8.4. Online Retail

8.5. Y-O-Y Growth trend Analysis By Distribution Channel

8.6. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 9. North America Acai Berry Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.1.4. Rest of North America

9.1.2. By Distribution Channel

9.1.3. By Packaging

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. North America Acai Berry Market– Company Profiles – (Overview, Distribution Channel Portfolio, Financials, Strategies & Developments)

10.1. Sambazon

10.2. Tropical

10.3. Acai Roots

10.4. Açaí Berry

10.5. Foods Acai

10.6. Frooty

10.7. Organique Acai

10.8. Nativo Acai Acai Exotic

10.9. Amazon Power

10.10. Acai Berry Company

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The growing demand for healthy and natural food options is a primary factor driving the expansion of the acai berry market

The top players operating in the North America Acai Berry Market are - Sambazon, Tropical Acai, Acai Roots, Açaí Berry Foods, Acai Frooty and Organique Acai.

The food and beverage sector, in particular, has faced severe disruptions, including the shutdown of offices and factories, as well as interruptions in supply chains. These challenges have constrained the growth of the acai berry market

In March 2024, SAMBAZON acquired SunOpta’s frozen acai and smoothie bowl segment.

Mexico is anticipated to be the fastest-growing region within the North American market.