Nootropic Ingredients Market Size (2024 –2030)

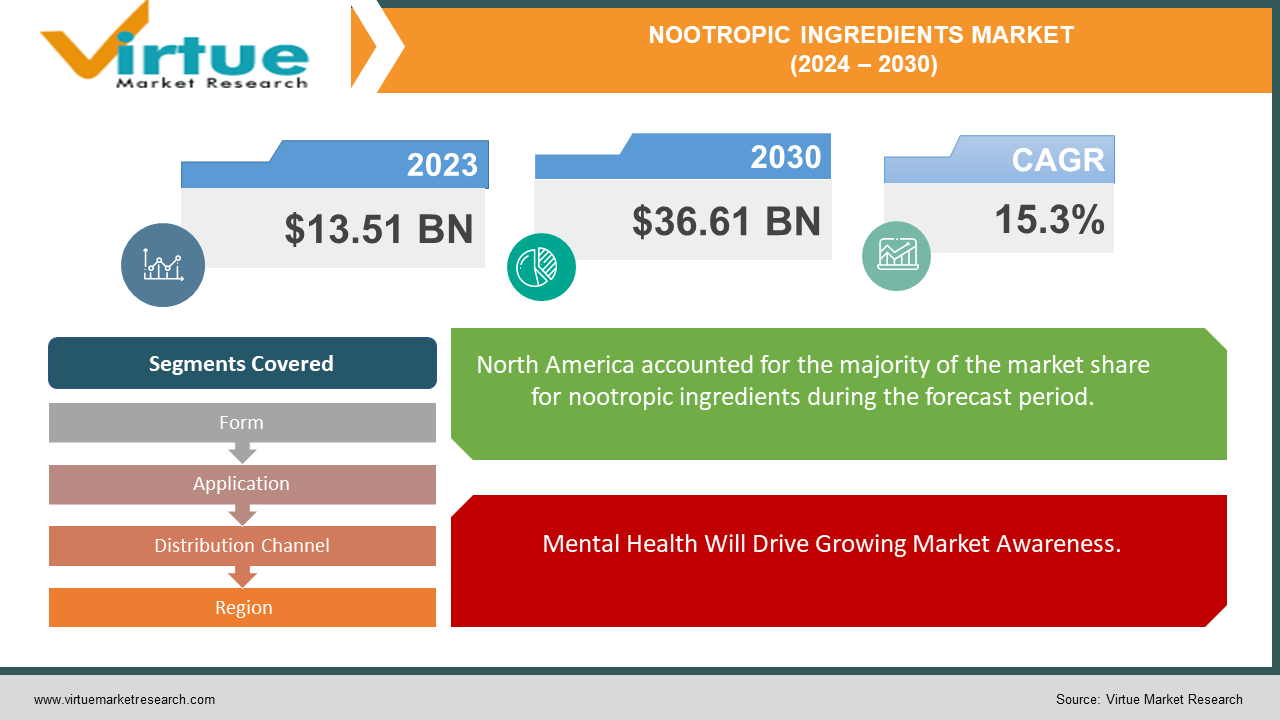

The Global Nootropic Ingredients Market was valued at USD 13.51 billion and is projected to reach a market size of USD 36.61 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 15.3%.

Nootropics, or smart drugs, are synthetically produced in laboratories or found in some medicinal plants like American ginseng. They are renowned for enhancing focus and memory. These medications can support, preserve, and improve brain function. Pharmaceutical companies are keen to offer nootropics because a growing number of people are interested in using them to improve their mental performance. Numerous advantages for brain health and cognitive function are provided by nootropics. In addition to treating cognitive symptoms of diseases like schizophrenia, Parkinson's disease, Huntington's disease, and Alzheimer's disease, they can be used to help with memory issues. Owing to these advantages, there is an increasing need for nootropics. Four varieties of nootropic gummies—energy, sleep, focus, and quiet—have been introduced by a brand-new company named NO. 8 INC. These candies are free of gluten and dairy. AusVitality, an Australian company, has developed a new supplement that blends nootropics and adaptogens. The company says this product increases mental energy, clarity, and focus and is intended to help with burnout and fatigue. The vegan nootropic supplement line BACOP, which enhances brain function, is new from Gaia Herbs. Lively has introduced a comprehensive nootropic supplement with 70 vitamins, herbs, and nutrients that target cognition, sleep, and focus.

Key Market Insights:

Caffeine-based nootropic ingredients account for nearly 30% of the overall nootropic ingredients market share, owing to their widespread availability and popularity.

The market for synthetic nootropic ingredients is growing at a rate of approximately 12% annually, driven by the increasing demand for cognitive enhancement products.

In terms of application, the dietary supplements segment constitutes around 45% of the nootropic ingredients market, reflecting the growing consumer interest in brain health and cognitive performance.

The Asia-Pacific region is projected to witness the highest growth rate of around 9% in the nootropic ingredients market, driven by the rising awareness of nootropics and the increasing disposable incomes in the region.

Global Nootropic Ingredients Market Drivers:

Mental Health Will Drive Growing Market Awareness.

In our society, mental illness is extremely common. The World Health Organization (WHO) estimates that 5% of adults and 3.8% of people worldwide suffer from depression. Globally, though, there has been less of an emphasis on mental health awareness. In the midst of lockdowns, the COVID-19 pandemic caused a rise in mental health problems as more people experienced instability and sadness. People began to focus more on their mental health and general well-being as a result. In an effort to feel better, many began taking supplements and eating balanced diets. Nootropics are gaining worldwide traction as more people become aware of mental health conditions and therapies.

Increased Risk of Alzheimer's Disease Will Probably Fuel Market Growth.

The demand for nootropics—which lessen mild symptoms of Alzheimer's disease—is rising as the number of people with the disease rises. Approximately 44 million people worldwide suffer from Alzheimer's disease or related dementias. Over 5.5 million people (5.3 million of whom are older adults) suffer from Alzheimer's disease in the US alone. After age 65, the chance of developing Alzheimer's doubles every five years. The sixth most common cause of death in the United States is Alzheimer's disease, and since 2000, the disease has claimed 89% more lives. A person's life expectancy after diagnosis is usually 4–8 years.

Nootropic Ingredients Market Challenges and Restraints:

Because of their side effects, nootropic products are difficult to meet consumer demand. For instance, consuming over 400 mg of caffeine daily may result in headaches, diarrhea, insomnia, and other problems. Overindulging in caffeine during pregnancy increases the chance of miscarriage. Anxiety, excessive perspiration, and decreased sex drive can result from using Adderall without a prescription. Adderall and alcohol combined may even result in a heart attack. Long-term use of some nootropics can also result in addiction, which can cause additional issues for the user.

Nootropic Ingredients Market Opportunities:

The increasing number of individuals receiving an ADHD diagnosis is driving up demand for nootropic products. According to estimates, 2.8% of adults between the ages of 18 and 44 and 2.2% of children and teenagers under the age of 18 worldwide suffer from ADHD. According to the World Health Organization, the US has the highest percentage of children with ADHD (8.1%), while Iraq has the lowest percentage (0.1%). The prevalence of ADHD is likewise high in other developed nations, with rates of 6.0% and 7.3%, respectively.

NOOTROPIC INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

15.3% |

|

Segments Covered |

By Form, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Onnit Labs, Reckitt Benckiser Group plc., Mental Mojo, LLC, NooCube, Mind Lab Pro, TruBrain, Neu Drinks, Peak Nootropics, Zhou Nutrition, Kimera Koffee |

Global Nootropic Ingredients Market Segmentation: By Form

-

Capsules/Tablets

-

Powder

-

Drinks

With nearly 45.1% of sales, capsules, and tablets are the most widely used nootropic supplement form. They are easy to take, which appeals to people, and businesses are producing them in a variety of forms, which increases their appeal. With a projected growth rate of 16.3%, drinks are expected to grow the fastest. Nootropics are now included in shots and ready-to-drink beverages to aid with focus and memory. Nootropics that are drinkable are gaining popularity because they provide a rapid mental boost. The second most popular form is powder and major players in the nootropics industry are starting to enter the market, including Reckitt Benckiser Group PLC. For instance, in May 2019, they introduced Sharp PS and Neuriva - Neurofactor. The pure coffee fruit extract in these powders sets them apart from other products by supporting improved brain function. It is anticipated that this will advance the market.

Global Nootropic Ingredients Market Segmentation: By Application Analysis

-

Memory Enhancement

-

Mood & Depression

-

Attention & Focus

-

Anti-aging & longevity

-

Sleep

Memory enhancement accounts for 42% of sales in the nootropics market, making it the largest category. There is a great demand for these supplements because they improve memory. Supplements that improve memory are becoming more and more popular in wealthier nations like China, India, and Brazil. As more people enroll in college, they want to sharpen their memory in order to perform better at work and in the classroom. Because they improve productivity, help people remember things better, and keep them competitive in the job market, memory enhancement supplements are very popular. With 19% of the market, attention and focus is another well-liked category. These supplements influence specific brain chemicals, which aid in improving concentration. They're also known as brain boosters, smart drugs, or cognitive enhancers. These supplements are frequently given to children by parents in an effort to improve focus and learning. They are also used by athletes and others to sharpen their focus during practice and competition.

Global Nootropic Ingredients Market Segmentation: By Distribution Channel

-

Offline

-

Online

Over 70.1% of sales take place in physical stores as opposed to online ones. Large retail chains, such as Tesco, Costco, Walmart, and Walgreens, are growing by drawing in more consumers and selling more goods. These stores are doing well because people like to look things over before they buy them. However, the growth of online sales is outpacing that of physical stores. Every year, the number of people making purchases online increases by 15.3%. People's lifestyles are changing, and they now prefer to shop online, which is the reason for this change. Online shopping offers the convenience of seeing what products are available and having them delivered right to your door.

Global Nootropic Ingredients Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

With more than 30.0% of the market's revenue, North America holds the largest share. It is anticipated to continue to lead in the future. This is a result of the increased emphasis on health and wellness, as well as the presence of large corporations. With a projected growth rate of 16.2%, the market is expanding at the fastest rate in Asia Pacific. Natural and herbal nootropics that support brain function are particularly popular. Since COVID-19, there has been an increase in interest in this topic, particularly in China and India. The Middle East and Africa are likewise experiencing rapid growth. The market is being driven by the increased concern that people there have for their general health. Pure nootropics and supplements to support memory, focus, and other brain functions are sold by Nootropix, an online retailer based in Abu Dhabi, United Arab Emirates.

COVID-19 Impact on the Global Nootropic Ingredients Market:

In 2020, the COVID-19 pandemic and worldwide lockdowns caused disruptions to trade and the supply chain, which resulted in a shortage of raw materials and impacted the production of new products globally. But nootropics gained popularity during this period as more people used the internet and faced health issues like depression and weakened immunity. The pandemic's increased stress levels contributed to a rise in the market for medications that improve memory. As a result, during the COVID-19 era, the market for nootropic drugs grew thanks to a rise in stress, increased internet use, and online advertisements.

Latest Trend/Development:

The market for nootropic ingredients is expanding swiftly and changing to follow emerging trends. Better products and more options for consumers are the results of increased research and development efforts. For the health of their brains, people are becoming more and more interested in natural and organic solutions, such as plant extracts and herbs. Additionally, as technology advances, supplements become more potent. The demand is increasing in regions like Asia-Pacific where people are growing more conscious of their health. To offer a greater range of products, businesses are collaborating and purchasing with one another. It's now simpler than ever to locate and purchase these supplements because more people are shopping online. All things considered, the market is evolving quickly due to new ideas, consumer preferences, and corporate collaboration.

Key Players:

-

Onnit Labs

-

Reckitt Benckiser Group plc.

-

Mental Mojo, LLC

-

NooCube

-

Mind Lab Pro

-

TruBrain

-

Neu Drinks

-

Peak Nootropics

-

Zhou Nutrition

-

Kimera Koffee

Market News:

-

Reckitt's brand Neuriva teamed up with Alton Brown in September 2022 to inspire consumers to think beyond. Through this collaboration, Brown's love of food and nutrition is combined with the goal of enhancing mental health.

Chapter 1. Nootropic Ingredients Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Nootropic Ingredients Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Nootropic Ingredients Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Nootropic Ingredients Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Nootropic Ingredients Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Nootropic Ingredients Market – By Form

6.1 Introduction/Key Findings

6.2 Capsules/Tablets

6.3 Powder

6.4 Drinks

6.5 Y-O-Y Growth trend Analysis By Form

6.6 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 7. Nootropic Ingredients Market – By Application

7.1 Introduction/Key Findings

7.2 Memory Enhancement

7.3 Mood & Depression

7.4 Attention & Focus

7.5 Anti-aging & longevity

7.6 Sleep

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Nootropic Ingredients Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Offline

8.3 Online

8.4 Y-O-Y Growth trend Analysis By Distribution Channel

8.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Nootropic Ingredients Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Form

9.1.3 By Application

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Form

9.2.3 By Application

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Form

9.3.3 By Application

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Form

9.4.3 By Application

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Form

9.5.3 By Application

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Nootropic Ingredients Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Onnit Labs

10.2 Reckitt Benckiser Group plc.

10.3 Mental Mojo, LLC

10.4 NooCube

10.5 Mind Lab Pro

10.6 TruBrain

10.7 Neu Drinks

10.8 Peak Nootropics

10.9 Zhou Nutrition

10.10 Kimera Koffee

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Nootropic Ingredients Market was estimated to be worth USD 13.51 billion in 2023 and is projected to reach a value of USD 36.61 billion by 2030, growing at a CAGR of 15.3% during the forecast period 2024-2030.

Growing Market Awareness Will Be Driven by Mental Health and Alzheimer's Disease Likely to Rise, Driving Market Growth are the driving factors of the Global Nootropic Ingredients Market.

The adverse effects of nootropic products are predicted to restrain market expansion.

Drinks form type is the fastest in the Global Nootropic Ingredients Market.

Asia-Pacific region is the fastest in the Global Nootropic Ingredients Market.