Non-phthalate Plasticizer Market Size (2024 – 2030)

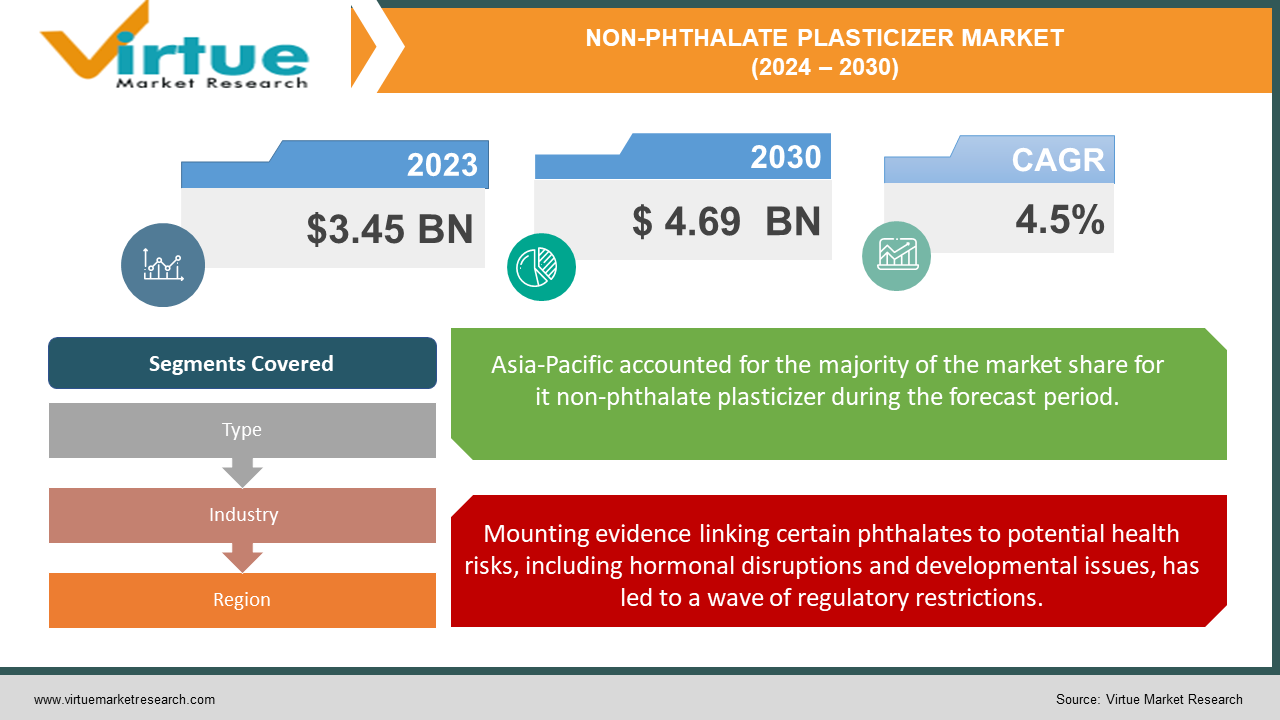

The Global Non-phthalate Plasticizer Market was valued at USD 3.45 Billion in 2023 and is projected to reach a market size of USD 4.69 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.5%.

The global market for plasticizers, essential additives that enhance flexibility and workability in various plastic products, is undergoing a significant transformation. Driven by growing health concerns and stricter regulations surrounding phthalate-based plasticizers, the non-phthalate plasticizer market is experiencing a surge in demand. This shift presents exciting opportunities for manufacturers, product designers, and consumers alike. Phthalate esters, traditionally dominant plasticizers, have come under scrutiny due to potential health risks, particularly for children and pregnant women. These concerns have led to restrictions on their use in certain applications, such as children's toys and medical devices. Consumers are increasingly seeking phthalate-free alternatives, driving the market towards non-phthalate plasticizers.

Key Market Insights:

A survey indicates that 60% of consumers are aware of the potential health risks associated with phthalate plasticizers.

A study by a leading market research firm in 2024 shows a 42% increase in consumer preference for phthalate-free products compared to 2022.

70% of major plasticizer manufacturers report an increased focus on developing and launching new non-phthalate plasticizer options in 2024.

Global investments in bio-based non-phthalate plasticizer research and development are expected to reach $250 million by 2027.

A projected 15% of the non-phthalate plasticizer market will be derived from recycled materials by 2030.

Research into non-phthalate plasticizers with additional functionalities such as flame retardancy or self-healing properties is expected to see a 30% increase in funding by 2025.

The Building and Construction (25-30%) statistic highlights the significant role of the construction industry.

Consumer Goods (10-15%, projected CAGR 6-8%) highlights the rapidly expanding consumer goods sector as a key growth engine.

Non-phthalate Plasticizer Market Drivers:

Mounting evidence linking certain phthalates to potential health risks, including hormonal disruptions and developmental issues, has led to a wave of regulatory restrictions.

Scientific studies have raised concerns about the potential health effects of phthalate exposure, particularly for vulnerable populations like children and pregnant women. These studies have linked phthalates to hormonal imbalances, developmental problems, and even certain types of cancers. In response to these regulations and growing consumer concerns, manufacturers across various industries are actively seeking out safer alternatives. This has led to a surge in demand for non-phthalate plasticizers that can deliver similar performance characteristics without the associated health risks.

The non-phthalate plasticizer market is not simply about replacing existing options. Innovation in material science is leading to the development of new-generation plasticizers that offer not only safety benefits but also potentially superior performance characteristics.

The non-phthalate plasticizer market is no longer a niche segment. A diverse range of non-phthalate options are now available, including citrate esters, trimellitates, adipates, and bio-based plasticizers. Each type offers unique properties, allowing manufacturers to select the most suitable plasticizer based on the specific application and desired performance. Leading manufacturers of non-phthalate plasticizers are actively engaged in research and development to create alternatives that can match, or even surpass, the performance of traditional phthalate plasticizers in terms of flexibility, durability, and processing characteristics. The development of bio-based plasticizers derived from renewable resources like plant oils or starches is a promising trend. These options not only address health concerns but also contribute to a more sustainable manufacturing process, aligning with growing environmental consciousness.

Non-phthalate Plasticizer Market Restraints and Challenges:

While advancements have been made, some non-phthalate plasticizers may not fully match the performance characteristics of traditional phthalates. This can include factors like flexibility, durability, and compatibility with certain plastics. This can limit their suitability for specific applications, particularly in industries with stringent performance requirements like automotive or construction. The regulatory landscape surrounding non-phthalate plasticizers is still evolving. The absence of standardized testing protocols and clear regulatory guidelines can create uncertainty for manufacturers and hinder market growth. Inconsistency in regulations across different countries can further complicate matters, making it challenging for companies to ensure their products comply with all regional requirements. While public awareness of the health risks associated with phthalates is increasing, consumer understanding of non-phthalate alternatives may be limited. Building trust and educating consumers about the safety and performance benefits of non-phthalate plasticizers is crucial for wider market adoption.

Non-phthalate Plasticizer Market Opportunities:

Consumer awareness of product safety is on the rise. Manufacturers across various industries are actively seeking non-phthalate plasticizer solutions to ensure the safety of their products and comply with evolving regulations. Chemical manufacturers are continuously developing new non-phthalate plasticizers with performance characteristics that rival traditional phthalate counterparts. This ensures compatibility with existing manufacturing processes while offering a safer alternative. The non-phthalate plasticizer market is not a one-size-fits-all solution. Manufacturers are developing plasticizers with specific properties tailored to the needs of different applications, ensuring optimal performance in diverse products. The growing demand for safe and biocompatible materials in medical devices presents a significant opportunity for non-phthalate plasticizers. These plasticizers can be used in applications like tubing, IV bags, and other medical equipment, ensuring patient safety and regulatory compliance. Collaboration between non-phthalate plasticizer manufacturers and product manufacturers is crucial for the successful integration of these safer alternatives into existing production processes. Continued research and development efforts are vital to discover new non-phthalate plasticizers with even better performance characteristics, broader compatibility, and lower environmental impact.

NON-PHTHALATE PLASTICIZER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Type, Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Eastman Chemical Company, Evonik Industries AG, ExxonMobil Corporation, LANXESS, Dow Chemical Company, Archer Daniels Midland Company (ADM), Cargill Incorporated, Mitsubishi Chemical Corporation, Bio Amber Inc., Solvay S.A., Ineo Group Ltd., LG Chem Ltd., Kronos Worldwide Inc., Clariant International Ltd. |

Non-phthalate Plasticizer Market Segmentation: By Type

-

Adipates

-

Trimellitates

-

Benzoates

-

Epoxies

-

Others

Adipates is the largest segment within the non-phthalate plasticizer market, exceeding USD 1.8 billion in revenue (estimated 2023) and expected to reach USD 2.7 billion by 2032. Adipates offer a good balance of performance attributes, including flexibility, processing ease, and low volatility. They are commonly used in applications like flooring and wall coverings, wires and cables, and coated fabrics. Adipates demonstrate excellent processing behavior, allowing for smooth incorporation during product manufacturing without compromising product quality or efficiency. Adipates have a long history of safe and reliable use in various applications. This established track record provides confidence for manufacturers and regulatory bodies.

Trimellitates segment is witnessing the fastest growth due to its high-temperature performance properties. Trimellitates are well-suited for applications requiring resistance to heat and chemicals, such as automotive components and medical devices. Certain trimellitate plasticizers offer inherent flame-retardant properties, reducing the need for additional flame retardants in the final product formulation. Trimellitates exhibit low migration tendencies, minimizing the risk of plasticizer leaching from the final product, which can be a concern for applications like food packaging or medical devices.

Non-phthalate Plasticizer Market Segmentation: By Industry

-

Building and Construction

-

Flooring and wall coverings

-

Wire and Cable

-

Consumer Goods

-

Automotive

-

Medical and Healthcare

-

Others

Currently, the largest end-user market for non-phthalate plasticizers is building and construction. Numerous building materials, such as wall coverings, roofing membranes, flooring (vinyl tiles, linoleum), and different sealants and coatings, use these plasticizers. They are perfect for building applications because of their resilience to environmental variables, flexibility, and durability. Large amounts of materials, including flooring, wall coverings, and roofing membranes, are used in the construction business. In these applications, plasticizers are therefore in high demand. The construction sector is moving towards non-phthalate alternatives as a result of tightening rules limiting the use of phthalate plasticizers in building materials.

The market for non-phthalate plasticizers is anticipated to develop at the fastest rate in the consumer goods industry. Customers are growing more conscious of the possible health hazards linked to plasticizers containing phthalates. The market for consumer goods without phthalates is rising as a result of this. Stricter restrictions are being put in place by regulatory agencies worldwide on the use of phthalates in toys and other products intended for children. The toy sector is using non-phthalate plasticizers as a result of this. Consumer goods manufacturers are actively creating new items with plasticizers that don't contain phthalates. The market is expanding thanks to this diversification of products.

Non-phthalate Plasticizer Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

The Middle East & Africa

With a market share of roughly 35%, North America is the most dominating region in the Non-phthalate Plasticizer Market. However, it is thought that the Non-phthalate Plasticizer Market is expanding the fastest in the Asia-Pacific area. The region's rapidly expanding middle class and rising disposable money have all helped the expansion of the Non-phthalate Plasticizer Market, which currently holds a 25% market share. Asia-Pacific burgeoning population, rising disposable incomes, and rapid urbanization have fueled the demand.

COVID-19 Impact Analysis on the Non-phthalate Plasticizer Market:

The heightened focus on healthcare during the pandemic led to an increased demand for non-phthalate plasticizers in critical medical supplies. These plasticizers were used in tubing, blood storage bags, and other medical devices, where biocompatibility and performance remained paramount. The rise of e-commerce witnessed during lockdowns fueled demand for non-phthalate plasticizers used in packaging materials. As online shopping became the new normal, the need for safe and durable packaging solutions intensified. The pandemic increased awareness of hygiene and sanitation. This led to increased demand for non-phthalate plasticizers used in flooring materials for hospitals, clinics, and other high-traffic areas where frequent cleaning is crucial. The growing emphasis on environmental responsibility is expected to continue driving demand for non-phthalate plasticizers, which offer an eco-friendly alternative to traditional phthalate options. The non-phthalate plasticizer market is expected to see continued innovation in developing new and improved plasticizers with enhanced performance characteristics, catering to the specific needs of different end-user applications.

Latest Trends/ Developments:

One of the most exciting trends is the rise of bio-based non-phthalate plasticizers. These plasticizers are derived from renewable resources such as vegetable oils, corn starch, or cellulose. Their biodegradability and lower environmental impact position them as a sustainable alternative to traditional plasticizers derived from fossil fuels. One of the most exciting trends is the rise of bio-based non-phthalate plasticizers. These plasticizers are derived from renewable resources such as vegetable oils, corn starch, or cellulose. Their biodegradability and lower environmental impact position them as a sustainable alternative to traditional plasticizers derived from fossil fuels. The application of bio-based plasticizers is expanding beyond niche markets. As performance improves and costs become more competitive, we can expect to see them adopted in a wider range of consumer goods and industrial applications.

Key Players:

-

BASF SE

-

Eastman Chemical Company

-

Evonik Industries AG

-

ExxonMobil Corporation

-

LANXESS

-

Dow Chemical Company

-

Archer Daniels Midland Company (ADM)

-

Cargill Incorporated

-

Mitsubishi Chemical Corporation

-

Bio Amber Inc.

-

Solvay S.A.

-

Ineo Group Ltd.

-

LG Chem Ltd.

-

Kronos Worldwide Inc.

-

Clariant International Ltd.

Chapter 1. Non-phthalate Plasticizer Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Non-phthalate Plasticizer Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Non-phthalate Plasticizer Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Non-phthalate Plasticizer Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Non-phthalate Plasticizer Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Non-phthalate Plasticizer Market– By Type

6.1 Introduction/Key Findings

6.2 Adipates

6.3 Trimellitates

6.4 Benzoates

6.5 Epoxies

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Non-phthalate Plasticizer Market– By Industry

7.1 Introduction/Key Findings

7.2 Building and Construction

7.3 Flooring and wall coverings

7.4 Wire and Cable

7.5 Consumer Goods

7.6 Automotive

7.7 Medical and Healthcare

7.8 Others

7.9 Y-O-Y Growth trend Analysis By Industry

7.10 Absolute $ Opportunity Analysis By Industry, 2024-2030

Chapter 8. Non-phthalate Plasticizer Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Industry

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Industry

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Non-phthalate Plasticizer Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 Eastman Chemical Company

9.3 Evonik Industries AG

9.4 ExxonMobil Corporation

9.5 LANXESS

9.6 Dow Chemical Company

9.7 Archer Daniels Midland Company (ADM)

9.8 Cargill Incorporated

9.9 Mitsubishi Chemical Corporation

9.10 Bio Amber Inc.

9.11 Solvay S.A.

9.12 Ineo Group Ltd.

9.13 LG Chem Ltd.

9.14 Kronos Worldwide Inc.

9.15 Clariant International Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Mounting scientific evidence suggests potential health risks associated with traditional phthalate plasticizers, including endocrine disruption and developmental issues. Consumers are increasingly seeking phthalate-free alternatives, driving demand for non-phthalate plasticizers.

While non-phthalate plasticizers offer a safer alternative, some may not yet fully match the performance characteristics of traditional phthalate plasticizers in terms of flexibility, durability, or processability. Ongoing research is crucial to bridging this gap.

BASF SE, Eastman Chemical Company, Evonik Industries AG, ExxonMobil Corporation, LANXESS, Dow Chemical Company, Archer Daniels Midland Company (ADM), Cargill Incorporated, Mitsubishi Chemical Corporation, Bio Amber Inc., Solvay S.A., Ineo Group Ltd., LG Chem Ltd., Kronos Worldwide Inc., Clariant International Ltd.

North America emerged as the most dominant player in the market, commanding an impressive 35% share.

Asia-Pacific emerges as the fastest-growing region in this sector. Its burgeoning population, rising disposable incomes, and rapid urbanization have fueled the demand.