Non-Metallic Aircraft Materials Market Size (2024-2030)

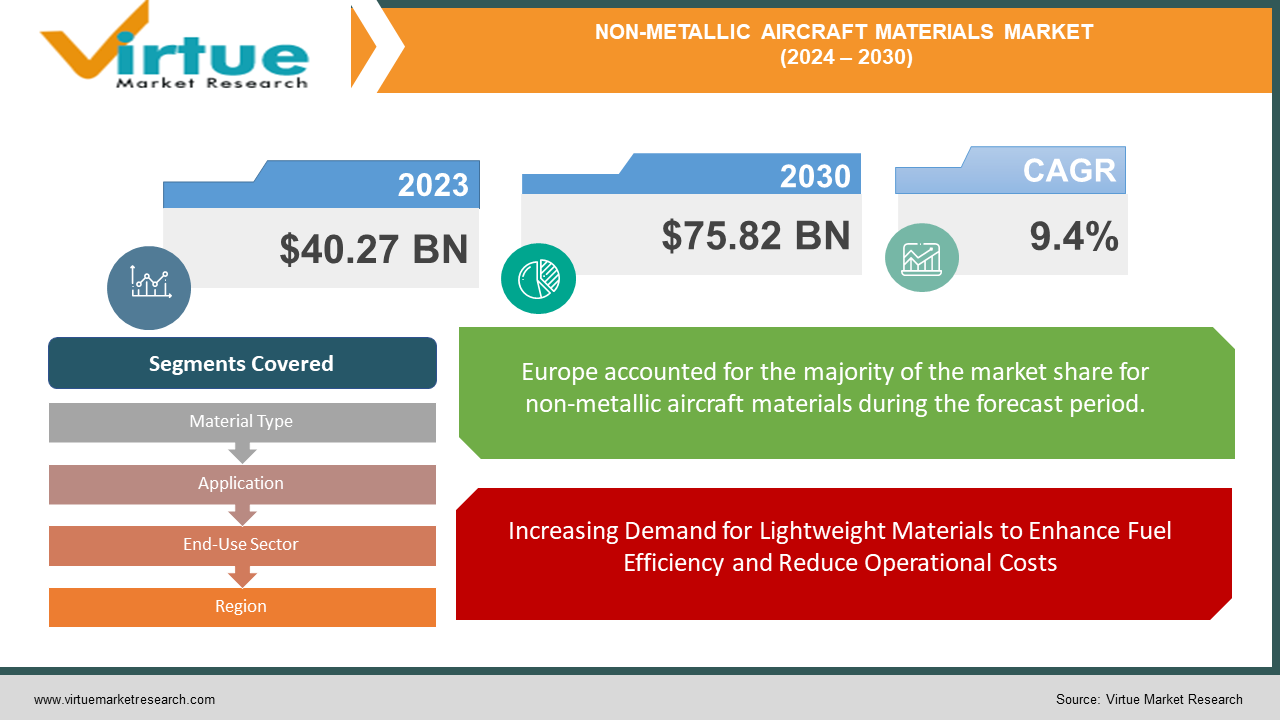

The Non-Metallic Aircraft Materials Market was valued at USD 40.27 billion in 2023 and is projected to reach a market size of USD 75.82 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 9.4%.

The Non-Metallic Aircraft Materials Market is witnessing robust growth due to the aerospace industry's focus on enhancing aircraft performance and efficiency. Materials such as composites, polymers, and advanced ceramics are increasingly utilized for their lightweight, high-strength, and corrosion-resistant properties. This shift is driven by the need to reduce fuel consumption and emissions, thereby meeting stringent environmental regulations. Additionally, the ongoing innovations in material science are broadening the applications of these non-metallic materials across various aircraft components, contributing to lower operational costs and extended aircraft lifespan. The growing emphasis on sustainable aviation and the integration of these advanced materials into next-generation aircraft designs are key factors propelling the market forward.

Key Market Insights:

Bio-based composites are becoming increasingly popular due to environmental regulations and the increased emphasis on eco-friendly solutions. As a sign of the growing need for sustainable alternatives, the market for bio-based resins in aircraft is predicted to reach USD 2.1 billion by 2027.

It is essential to make advances in non-metallic materials. When compared to conventional materials, new composites offer better strength-to-weight ratios and functions. For instance, carbon fiber is a great option for lightweight and effective airplane structures because it can reduce weight by 70% when compared to steel.

The need for non-metallic replacement parts is being driven by the aging fleet of commercial airplanes. It is anticipated that this market will expand steadily, with annual global demand predicted to reach USD 5 billion by 2025.

Beyond the major players, the Non-Metallic Aircraft Materials Market is projected to generate USD 3 billion in revenue annually by 2030 because of rising demand for commercial aircraft from developing nations like China and India.

Non-Metallic Aircraft Materials Market Drivers:

Increasing Demand for Lightweight Materials to Enhance Fuel Efficiency and Reduce Operational Costs

The aerospace industry's drive for fuel efficiency has significantly boosted the demand for lightweight materials. Non-metallic materials such as composites and polymers are essential for reducing aircraft weight, leading to lower fuel consumption and extended flight ranges. This demand is propelled by the need to cut operational costs and improve aircraft performance, making lightweight materials a cornerstone in modern aircraft design.

Growing Emphasis on Environmental Sustainability and Stringent Emission Regulations in the Aviation Sector

The aviation sector faces mounting pressure to meet stringent environmental regulations aimed at reducing greenhouse gas emissions. Non-metallic materials, especially advanced composites, play a crucial role in this effort by enabling the creation of more fuel-efficient aircraft. Their lightweight nature contributes to lower fuel consumption and emissions, aligning with the industry's sustainability goals and regulatory requirements.

Continuous Advancements in Material Science Leading to Superior Performance and Broader Applications in Aviation

Ongoing advancements in material science are driving the development of non-metallic materials with enhanced properties such as improved thermal resistance, durability, and corrosion resistance. These improvements allow for the use of non-metallic materials in a wider range of aircraft components, from structural elements to interior fittings. The capability to tailor materials to specific performance needs is expanding their application, fostering innovation in aircraft design.

Rising Adoption of Non-Metallic Materials in Both Commercial and Military Aviation for Enhanced Performance and Durability

The adoption of non-metallic materials is accelerating in both commercial and military aviation sectors due to their superior performance and durability. In commercial aviation, these materials help reduce maintenance costs and increase aircraft lifespan, while in military applications, they enhance operational capabilities and resilience. The versatile nature of non-metallic materials makes them ideal for various applications, driving their growing use across different segments of the aviation industry.

Non-Metallic Aircraft Materials Market Restraints and Challenges:

The significant cost associated with advanced non-metallic materials presents a major challenge for the market. The manufacturing and processing of composites and polymers involve sophisticated technologies and specialized equipment, driving up their price compared to traditional metals. This high cost can limit adoption, particularly among smaller manufacturers or those with budget constraints. Additionally, substantial investments in research and development are required to advance new materials, which can further strain financial resources and impact market growth.

Another challenge facing the Non-Metallic Aircraft Materials Market is ensuring the long-term durability and reliability of these materials under harsh operational conditions. Non-metallic materials may experience performance degradation due to environmental factors such as temperature extremes, moisture, and UV radiation. Rigorous testing and validation are necessary to ensure these materials remain effective throughout their lifecycle. Moreover, the complexity of repairing and maintaining non-metallic components can lead to increased downtime and higher costs, presenting additional hurdles for widespread adoption.

Non-Metallic Aircraft Materials Market Opportunities:

The Non-Metallic Aircraft Materials Market benefits from the ongoing advancements in technology, which open up opportunities for developing new and innovative materials. Research into advanced composites and high-performance polymers is enhancing material properties such as strength and durability, which are crucial for creating more efficient and lightweight aircraft. This innovation aligns with the aerospace industry's objectives of improving fuel efficiency and reducing emissions, thus expanding the applications and adoption of non-metallic materials in various aircraft components.

The rise of electric and hybrid aircraft technologies offers significant opportunities for non-metallic materials. These materials are essential for meeting the performance and efficiency requirements of next-generation aircraft designs, as they contribute to reducing weight and increasing strength. As the aviation industry transitions towards more sustainable and energy-efficient solutions, the demand for non-metallic materials is expected to grow. This shift creates new market segments and opportunities for manufacturers, positioning non-metallic materials as a key component in the future of aviation technology.

NON-METALLIC AIRCRAFT MATERIALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.4% |

|

Segments Covered |

By Material Type, Application, End-Use Sector, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Toray Industries , Solvay, Hexcel Corporation , BASF, DuPont de Nemours, Mitsubishi Chemical Corporation, Airbus, Boeing |

Non-Metallic Aircraft Materials Market Segmentation: By Material Type

-

Composites

-

Polymers

-

Ceramics

-

Others

Composites represent the largest segment due to their extensive use in aircraft structures, such as fuselage, wings, and tail sections, driven by their high strength-to-weight ratio and durability. Polymers are the fastest-growing segment, bolstered by advancements in thermoplastic and thermosetting plastic technologies, which offer enhanced flexibility, thermal stability, and cost-effectiveness, making them increasingly popular for various interior and non-structural applications. This growth is propelled by the industry's continuous push for fuel efficiency and performance optimization.

Non-Metallic Aircraft Materials Market Segmentation: By Application

-

Structural Components

-

Interior Components

-

Engine Components

-

Others

Structural components constitute the largest segment, as non-metallic materials like composites and polymers are extensively used in critical parts of the aircraft, including fuselages, wings, and tail sections, due to their superior strength-to-weight ratio. Interior components are the fastest-growing segment, driven by the increasing demand for lightweight, durable, and aesthetically pleasing materials that enhance passenger comfort and reduce overall aircraft weight, thereby contributing to fuel efficiency and operational cost savings.

Non-Metallic Aircraft Materials Market Segmentation: By End-Use Sector

-

Commercial Aviation

-

Military Aviation

-

General Aviation

-

Space Aviation

In the Non-Metallic Aircraft Materials Market, commercial aviation represents the largest segment due to the extensive fleet sizes and high demand for fuel-efficient, lightweight materials to reduce operational costs and improve performance. Military aviation is the fastest-growing segment, driven by increased defense budgets and the need for advanced, durable materials that enhance the performance and resilience of military aircraft in demanding environments. This growth is fueled by the ongoing modernization and procurement of next-generation military aircraft worldwide.

Non-Metallic Aircraft Materials Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Because of rules encouraging lighter, greener aircraft, a strong emphasis on material research, and the presence of major aircraft manufacturers like Airbus, Europe currently dominates the non-metallic aircraft materials market. The demand for commercial aircraft is surging, domestic manufacturing capabilities are growing, and government investments in aerospace technology are increasing, but the Asia-Pacific area is growing at the highest rate.

COVID-19 Impact Analysis on the Non-Metallic Aircraft Materials Market:

The market for non-metallic airplane materials was greatly impacted by the COVID-19 pandemic disturbance. The precipitous drop in new aircraft orders that followed the collapse in air travel demand resulted in a severe reduction in demand for carbon fiber, composites, and other essential materials. Price variations and shortages were caused by disruptions in global supply chains, which introduced an additional layer of complexity. It's possible that this climate encouraged manufacturers to put off using more sophisticated, but maybe more expensive, non-metallic materials.

But there were bright spots as well. Airlines began to concentrate more on maintaining their current fleets and less on making new purchases. This might have increased demand for replacement non-metallic parts for maintenance and restoration. Additionally, unrelenting research and development efforts cleared the path for the release of next-generation composites, which are stronger, lighter, and more fire-resistant. The market for non-metallic aircraft materials is expected to grow in the long run due to the continued demand for fuel-efficient aircraft and advances in material science, even though the short-term forecast is still impacted by the epidemic.

Latest Trends/ Developments:

Innovation in non-metallic aircraft materials is booming, with the goal of creating airplanes that are stronger, lighter, and more efficient. One important factor is sustainability, where bio-based composites are showing promise as a substitute. Research on bio-derived resins and natural fibers like flax offers a way to potentially lessen the environmental impact of building airplanes. Multifunctional materials development is another important trend. Envision a single substance that offers fire resistance, structural strength, and even de-icing properties! As a result, designs become lighter and more straightforward. Another trend that is gaining traction is 3D printing, which makes it possible to create complex structures and forms with little waste. Reducing dependence on conventional manufacturing techniques and increasing efficiency is made possible by the capacity to 3D print replacement parts on demand. These patterns highlight the market's promising future for non-metallic aircraft materials, where developments could completely alter the way aircraft are constructed.

Key Players:

-

Toray Industries

-

Solvay

-

Hexcel Corporation

-

BASF

-

DuPont de Nemours

-

Mitsubishi Chemical Corporation

-

Airbus

-

Boeing

Chapter 1. Non-Metallic Aircraft Materials Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Non-Metallic Aircraft Materials Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Non-Metallic Aircraft Materials Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Non-Metallic Aircraft Materials Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Non-Metallic Aircraft Materials Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Non-Metallic Aircraft Materials Market – By Material Type

6.1 Introduction/Key Findings

6.2 Composites

6.3 Polymers

6.4 Ceramics

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Material Type

6.7 Absolute $ Opportunity Analysis By Material Type, 2024-2030

Chapter 7. Non-Metallic Aircraft Materials Market – By Application

7.1 Introduction/Key Findings

7.2 Structural Components

7.3 Interior Components

7.4 Engine Components

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Non-Metallic Aircraft Materials Market – By End-Use Sector

8.1 Introduction/Key Findings

8.2 Commercial Aviation

8.3 Military Aviation

8.4 General Aviation

8.5 Space Aviation

8.6 Y-O-Y Growth trend Analysis By End-Use Sector

8.7 Absolute $ Opportunity Analysis By End-Use Sector, 2024-2030

Chapter 9. Non-Metallic Aircraft Materials Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Material Type

9.1.3 By Application

9.1.4 By End-Use Sector

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Material Type

9.2.3 By Application

9.2.4 By End-Use Sector

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Material Type

9.3.3 By Application

9.3.4 By End-Use Sector

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Material Type

9.4.3 By Application

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Material Type

9.5.3 By Application

9.5.4 By End-Use Sector

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Non-Metallic Aircraft Materials Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Toray Industries

10.2 Solvay

10.3 Hexcel Corporation

10.4 BASF

10.5 DuPont de Nemours

10.6 Mitsubishi Chemical Corporation

10.7 Airbus

10.8 Boeing

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Non-Metallic Aircraft Materials Market was valued at approximately USD 40.27 billion in 2023. It is projected to reach around USD 75.82 billion by 2030, growing at a CAGR of 9.4% during the forecast period.

Technological Advancements, Additive Manufacturing Integration, Rising Demand for New Aircraft, Enhanced Fuel Efficiency, Sustainability Push.

Commercial Aviation, Military Aviation, General Aviation, Space Aviation.

Europe is currently in the lead due to things like the existence of large aircraft manufacturers Airbus and a heavy emphasis on material technology research.

Toray Industries, Solvay, Hexcel Corporation, BASF, DuPont de Nemours, Mitsubishi Chemical Corporation, Airbus, Boeing.