Non-Hodgkin Lymphoma Therapeutics Market Size (2025-2030)

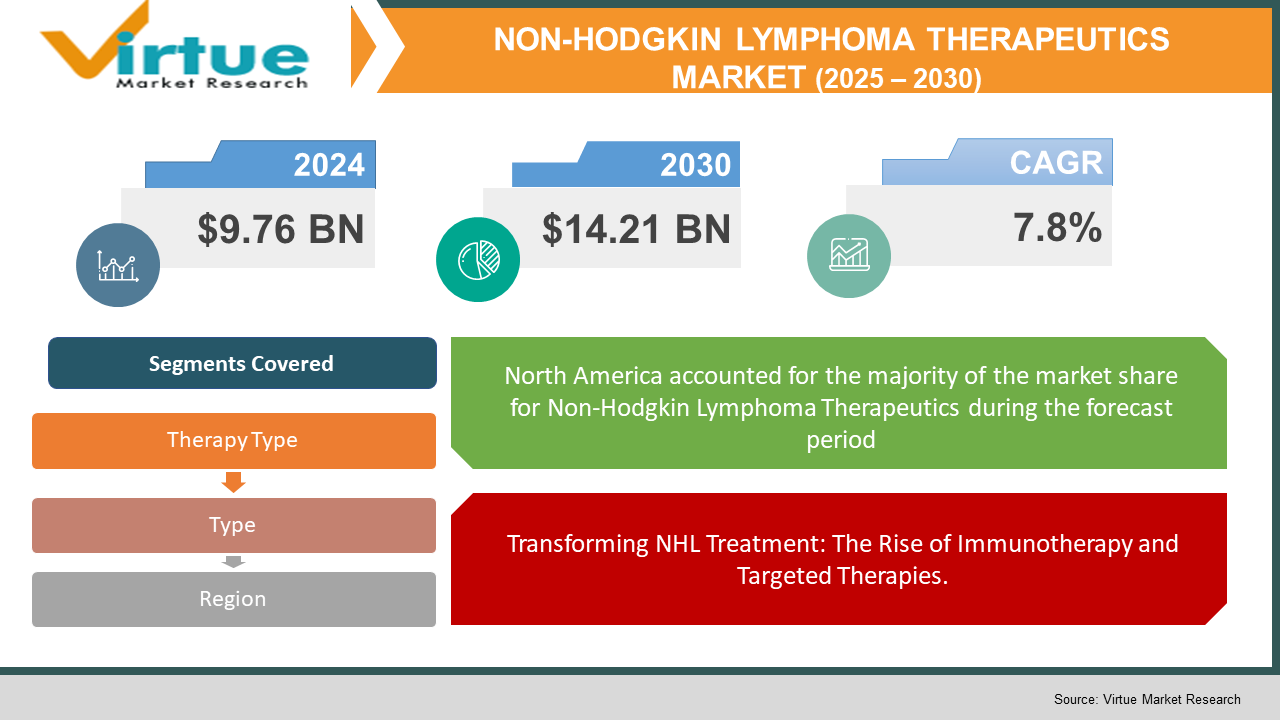

The Non-Hodgkin Lymphoma (NHL) Therapeutics Market was valued at USD 9.76 billion and is projected to reach a market size of USD 14.21 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.8%.

The market is driven by rising incidence rates of NHL, advancements in targeted therapies and immunotherapy, and increasing R&D investments. The introduction of CAR-T cell therapy and monoclonal antibodies is transforming treatment outcomes, providing personalised and highly effective treatment options. According to the Leukaemia & Lymphoma Society, over 80,000 new NHL cases were diagnosed globally in 2023. The adoption of combination therapies, including chemo-immunotherapy regimens, has significantly improved overall survival rates and reduced relapse risks in patients with aggressive NHL subtypes. Pharmaceutical companies are investing in pipeline drugs, next-generation biologics, and biosimilars to enhance treatment accessibility. The expansion of clinical trials and regulatory approvals for novel therapies is further propelling market growth, with key players focusing on precision medicine and immune-modulating agents.

Key Market Insights:

- A 2023 report by the American Cancer Society estimated that NHL accounts for 4% of all cancers, with over 500,000 people living with the disease in the U.S. alone. Early diagnosis and improved therapeutics have increased five-year survival rates to nearly 75% in developed countries.

- According to the World Health Organization (WHO), NHL is one of the top 10 most commonly diagnosed cancers globally, with lymphoid malignancies contributing significantly to cancer-related deaths. The increasing use of CD19-targeted therapies and bispecific antibodies is revolutionizing patient outcomes.

- A recent survey by the Global Burden of Disease Study found that diffuse large B-cell lymphoma (DLBCL) accounts for nearly 30% of all NHL cases, with a growing preference for CAR-T cell therapy in relapsed or refractory cases due to its superior response rates.

- The expansion of biosimilars is lowering treatment costs, with companies focusing on cost-effective alternatives for Rituximab and other biologics. Regulatory agencies are streamlining approval processes to accelerate market entry for novel therapeutics.

Non-Hodgkin Lymphoma Therapeutics Market Drivers:

Transforming NHL Treatment: The Rise of Immunotherapy and Targeted Therapies.

The growing adoption of immunotherapy and targeted therapies is revolutionizing the treatment landscape for non-Hodgkin lymphoma (NHL). Traditional chemotherapy is being replaced by precision medicine approaches, including monoclonal antibodies, immune checkpoint inhibitors, and CAR-T cell therapies, which offer higher efficacy and fewer side effects. Researchers are also exploring RNA-based therapeutics and gene-editing techniques to enhance treatment precision. Combination approaches, such as CAR-T with checkpoint inhibitors, are being investigated to overcome resistance mechanisms and improve remission rates in aggressive NHL subtypes Recent breakthroughs in bispecific antibodies and small-molecule inhibitors are improving patient responses by targeting cancer-specific pathways and enhancing immune system activation. Immunomodulatory agents such as lenalidomide and checkpoint inhibitors provide durable remissions, especially in relapsed and refractory NHL cases. Pharmaceutical companies are expanding their biologic drug pipelines, focusing on therapies that minimize toxicity and improve long-term survival rates. Advances in genomic profiling and biomarker-driven therapies are enabling personalized treatment strategies, ensuring that patients receive the most effective regimen for their specific NHL subtype.

There were regulatory issues earlier with these therapies but as advancements in the therapeutics market have taken place regulatory bodies are warming up to the idea of these techniques being used for patients in need.

The increasing global incidence of non-Hodgkin lymphoma is a significant market driver, fuelled by aging populations, environmental factors, and genetic predisposition. Early diagnosis and enhanced screening techniques are leading to higher detection rates, ensuring timely intervention with advanced therapeutics. Regulatory agencies such as the FDA and EMA are expediting drug approvals and expanding access to breakthrough therapies. The introduction of orphan drug designations and fast-track approvals for novel NHL treatments is encouraging pharmaceutical companies to accelerate clinical trials and bring innovative drugs to market. Collaborations between biotech firms, research institutions, and healthcare providers are promoting new treatment protocols, increasing patient access to next-generation therapies. With government funding and nonprofit organizations supporting cancer research and treatment affordability, the market for NHL therapeutics continues to expand.

Non-Hodgkin Lymphoma Therapeutics Restraints and Challenges:

These therapies are expensive and, in some cases, not covered by insurance companies, there can also be side effects which can lead to relapse and other problems.

Despite advancements in NHL therapeutics, challenges remain, including high treatment costs, adverse side effects, and limited access to innovative therapies in low-income regions. Targeted treatments like CAR-T cell therapy come with significant expenses, making affordability a major concern for patients and healthcare systems. While immunotherapy and biologics have shown promising results, some patients develop treatment resistance over time, leading to disease relapse and the need for alternative treatment options. Managing side effects such as cytokine release syndrome (CRS) and neurotoxicity in CAR-T therapy also presents clinical challenges. Regulatory hurdles and stringent clinical trial requirements can delay the approval of emerging therapies, slowing down market expansion. Additionally, disparities in healthcare infrastructure across developing regions limit the widespread adoption of advanced NHL treatments, underscoring the need for affordable biosimilars and cost-effective therapeutics.

Non-Hodgkin Lymphoma Therapeutics Market Opportunities:

Advancements in AI-driven drug discovery and biomarker-based treatment selection are enabling more precise, tailored NHL therapies. Personalised medicine approaches, supported by genomic profiling and AI-powered diagnostics, are improving treatment outcomes and minimizing toxicity. Companies investing in AI-driven clinical trials and digital health innovations are well-positioned for growth. With high treatment costs being a barrier, pharmaceutical companies are focusing on biosimilar development to expand access to NHL therapeutics. The launch of biosimilars for monoclonal antibodies like Rituximab is increasing affordability, particularly in developing markets. Regulatory agencies are streamlining approval processes, allowing more cost-effective targeted therapies to enter the market.

NON-HODGKIN LYMPHOMA THERAPEUTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.8% |

|

Segments Covered |

By Type, theraphy type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Gilead Sciences, Inc. (Kite Pharma), Novartis AG, F. Hoffmann-La Roche Ltd. (Genentech, Inc.), Bristol-Myers Squibb Company, Johnson & Johnson (Janssen Pharmaceuticals), AbbVie Inc., Amgen Inc., Eli Lilly and Company, AstraZeneca PLC, Takeda Pharmaceutical Company Limited |

Non-Hodgkin Lymphoma Therapeutics Market Segmentation;

Non-Hodgkin Lymphoma Therapeutics Market Segmentation: By Therapy Type:

- Targeted Therapy

- Chemotherapy

- Radiation Therapy

- Others

Targeted therapy has emerged as a cornerstone in NHL treatment, offering higher efficacy and fewer side effects than traditional options. Monoclonal antibodies, tyrosine kinase inhibitors (TKIs), and bispecific antibodies are being widely adopted to target specific cancer pathways. Meanwhile, chemotherapy remains a standard approach, especially in combination regimens like R-CHOP, which continue to show effectiveness in treating aggressive NHL subtypes.

Radiation therapy is commonly used for localized NHL cases, either alone or as part of multi-modal treatment plans. Advances in precision radiation techniques, such as proton therapy, are improving outcomes while minimizing damage to healthy tissues. The "Others" category includes stem cell transplants, CAR-T cell therapy, and immunotherapy innovations, which are becoming essential for relapsed or refractory NHL cases, offering longer-lasting remissions and new treatment possibilities.

Non-Hodgkin Lymphoma Therapeutics Market Segmentation: By Type

- B-Cell Lymphoma

- T-Cell Lymphoma

B-cell lymphoma is the most prevalent form of NHL, accounting for the majority of cases worldwide. Diffuse large B-cell lymphoma (DLBCL) and follicular lymphoma are among the most common subtypes, with Rituximab-based immunotherapy and CAR-T cell therapy being key treatment options.

T-cell lymphomas are rarer but often more aggressive than B-cell subtypes, requiring specialized treatment strategies. Chemotherapy remains a primary treatment, but newer targeted therapies, such as histone deacetylase (HDAC) inhibitors and immune checkpoint inhibitors, are showing promise. Ongoing research in genetic profiling and novel immunotherapies is helping to identify better treatment options for T-cell lymphomas, particularly for peripheral T-cell lymphoma (PTCL) and cutaneous T-cell lymphoma (CTCL).

Non-Hodgkin Lymphoma Therapeutics Market Segmentation: By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

North America dominates the NHL therapeutics market, driven by advanced healthcare infrastructure, high adoption of immunotherapy, and strong research funding. The U.S. and Canada have widespread access to CAR-T cell therapies, monoclonal antibodies, and clinical trials, ensuring better patient outcomes. Similarly, Europe is a key market, with Germany, the UK, and France leading in biosimilar adoption, government-backed cancer research programs, and early diagnosis initiatives. Regulatory support and faster drug approvals are accelerating the availability of next-generation NHL treatment.

The Asia-Pacific region is witnessing rapid growth, with increasing NHL cases and expanding healthcare investments in China, India, and Japan. The rise of biosimilars and cost-effective therapies is improving treatment accessibility. South America and the Middle East & Africa are emerging markets, with countries like Brazil, Mexico, and the UAE focusing on enhancing oncology care through public-private partnerships and cancer research collaborations. However, limited access to advanced therapies remains a challenge in certain areas.

COVID-19 Impact Analysis on the Non-Hodgkin Lymphoma Therapeutics Market

The COVID-19 pandemic disrupted NHL treatment protocols, causing delays in diagnosis, postponed therapies, and reduced hospital visits. Many patients faced treatment interruptions, impacting disease progression and overall survival outcomes. Healthcare providers prioritized telemedicine consultations and home-based care strategies to ensure continuity of treatment. The pandemic also accelerated innovations in digital health, with remote patient monitoring and AI-driven analytics improving NHL management. Pharmaceutical companies adapted by fast-tracking clinical trials and expanding drug supply chains to minimize disruptions. As post-pandemic recovery continues, the NHL therapeutics market is witnessing a resurgence in research funding, increased clinical trial participation, and greater focus on immunotherapy advancements.

Trends/Developments:

Pharmaceutical companies are developing bispecific antibodies that target multiple immune pathways, enhancing treatment responses and reducing disease relapse rates. Biotech firms are refining CAR-T cell therapies to improve efficacy and reduce side effects such as cytokine release syndrome and neurotoxicity.

Artificial intelligence (AI) is accelerating drug discovery and biomarker-driven treatment selection, enabling faster clinical trials and precision medicine approaches. AI-powered genomic profiling is helping identify the most effective therapy for individual NHL subtypes, improving treatment outcomes and reducing unnecessary side effects.

Novartis is expanding its portfolio with Kymriah (tisagenlecleucel), a CAR-T therapy approved for aggressive B-cell lymphoma. The company is also conducting clinical trials on novel PI3K inhibitors and immune checkpoint inhibitors to provide more targeted and less toxic treatment options for NHL patients.

Key Players:

- Gilead Sciences, Inc. (Kite Pharma)

- Novartis AG

- F. Hoffmann-La Roche Ltd. (Genentech, Inc.)

- Bristol-Myers Squibb Company

- Johnson & Johnson (Janssen Pharmaceuticals)

- AbbVie Inc.

- Amgen Inc.

- Eli Lilly and Company

- AstraZeneca PLC

- Takeda Pharmaceutical Company Limited

Chapter 1. NON-HODGKIN LYMPHOMA THERAPEUTICS MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. NON-HODGKIN LYMPHOMA THERAPEUTICS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

b 3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. NON-HODGKIN LYMPHOMA THERAPEUTICS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. NON-HODGKIN LYMPHOMA THERAPEUTICS MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. NON-HODGKIN LYMPHOMA THERAPEUTICS MARKET – By Type

6.1 Introduction/Key Findings

6.2 B-Cell Lymphoma

6.3 T-Cell Lymphoma

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. NON-HODGKIN LYMPHOMA THERAPEUTICS MARKET – By Therapy Type

7.1 Introduction/Key Findings

7.2 Targeted Therapy

7.3 Chemotherapy

7.4 Radiation Therapy

7.5 Others Y-O-Y Growth trend Analysis By Therapy Type

7.6 Absolute $ Opportunity Analysis By Therapy Type , 2025-2030

Chapter 8. NON-HODGKIN LYMPHOMA THERAPEUTICS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Therapy Type

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Therapy Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Therapy Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Therapy Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Therapy Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. NON-HODGKIN LYMPHOMA THERAPEUTICS MARKET – Company Profiles – (Overview, Packaging Type, Portfolio, Financials, Strategies & Developments)

9.1 Gilead Sciences, Inc. (Kite Pharma)

9.2 Novartis AG

9.3 F. Hoffmann-La Roche Ltd. (Genentech, Inc.)

9.4 Bristol-Myers Squibb Company

9.5 Johnson & Johnson (Janssen Pharmaceuticals)

9.6 AbbVie Inc.

9.7 Amgen Inc.

9.8 Eli Lilly and Company

9.9 AstraZeneca PLC

9.10 Takeda Pharmaceutical Company Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The primary treatments for NHL include chemotherapy, targeted therapy, immunotherapy, radiation therapy, and CAR-T cell therapy. Combination approaches, such as R-CHOP (Rituximab + Chemotherapy), are commonly used for aggressive subtypes, while monoclonal antibodies and bispecific antibodies are advancing treatment outcomes.

CAR-T cell therapy is revolutionizing NHL treatment by using genetically modified T cells to target cancer cells, particularly in relapsed or refractory cases. It has shown high response rates and long-term remissions, with companies developing next-generation CAR-T therapies to improve accessibility and reduce side effects.

Bispecific antibodies work by simultaneously binding to cancer cells and activating the immune system, making them a promising alternative to traditional therapies. They are gaining traction for relapsed and refractory NHL cases, with drugs like mosunetuzumab and glofitamab showing strong clinical responses

Advancements in genomic profiling and biomarker-driven therapies are enabling tailored treatment plans based on individual tumour characteristics. AI-powered diagnostics and targeted drug development are leading to more effective, customized treatment approaches with fewer side effects.

North America and Europe dominate the market due to high healthcare investments, strong regulatory support, and access to advanced treatments. Asia-Pacific is emerging as a fast-growing region, with increased clinical trials, biosimilar adoption, and expansion of immunotherapy-based treatments.