Non-Ferrous Metal Powder Market Size (2023 – 2030)

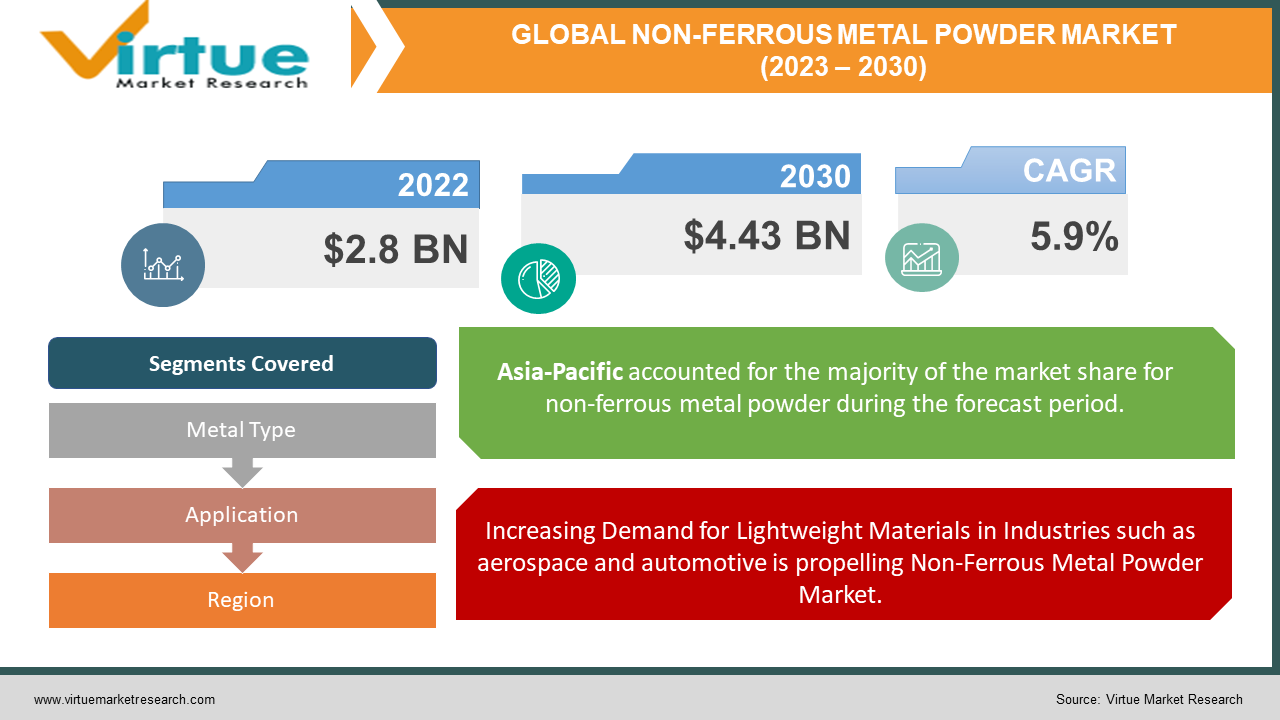

The Global Non-Ferrous Metal Powder Market was valued at USD 2.8 billion and is projected to reach a market size of USD 4.43 billion by the end of 2030. Over the forecast period of 2023-2030, the market is expected to grow at a CAGR of 5.9%.

Over the years, the non-ferrous metal powder industry has evolved into a pivotal force across sectors such as aerospace, automotive, and electronics. Its historical role was rooted in providing essential materials, but today, it stands at the forefront of innovation. The ever-increasing demand for lightweight and high-performance materials has propelled this market forward. As we look to the future, it's clear that the non-ferrous metal powder market is poised for continued growth, fuelled by advancements in technology and the quest for superior materials. Challenges and opportunities will shape its trajectory, making it a dynamic force in the years to come.

Key Market Insights:

In terms of regional dynamics, Asia-Pacific continues to dominate the non-ferrous metal powder market. China, in particular, stands out as a major player in both production and consumption of these powders. The region's rapid industrialization, urbanization, and infrastructure development have fuelled the demand for non-ferrous metal powders in applications ranging from automotive manufacturing to electronics. Moreover, India's growing manufacturing sector is also contributing significantly to the market's expansion in the Asia-Pacific region.

North America and Europe are witnessing substantial growth as well. The adoption of 3D printing technology, especially in industries like aerospace and healthcare, is driving the demand for high-quality non-ferrous metal powders. This technology allows for the production of complex, lightweight, and customized components, furthering the market's growth potential. Additionally, stringent environmental regulations and the increasing focus on sustainability are pushing manufacturers in these regions to explore innovative methods of recycling and reusing non-ferrous metal powders, which will likely play a pivotal role in shaping the market's future.

Market Drivers:

Increasing Demand for Lightweight Materials in Industries such as aerospace and automotive is propelling Non-Ferrous Metal Powder Market.

The non-ferrous metal powder market is experiencing significant growth due to the increasing demand for lightweight materials in key industries like aerospace and automotive. As these sectors strive for improved fuel efficiency and enhanced performance, non-ferrous metal powders are being used to create lightweight components. These powders offer a high-strength-to-weight ratio, making them ideal for applications such as aircraft and automobile parts. This trend aligns with global efforts to reduce carbon emissions and improve sustainability in transportation, further driving the adoption of non-ferrous metal powders.

Growing Adoption of Additive Manufacturing has boosted the demand for non-ferrous metal powders.

The rise of additive manufacturing, commonly known as 3D printing, has been a major driver of the non-ferrous metal powder market. This technology relies heavily on non-ferrous metal powders to produce intricate and customized components with high precision. Industries ranging from healthcare to aerospace are increasingly adopting additive manufacturing for prototyping and production, thereby boosting the demand for these powders. This trend not only accelerates production processes but also opens up new design possibilities and cost efficiencies.

Expanding Electronics Industry utilizes non-ferrous metal powders in the production of conductive pastes and components, thus augmenting the growth.

The electronics industry plays a pivotal role in driving the demand for non-ferrous metal powders. These powders are vital in the production of conductive pastes and components used in electronic devices. With the continuous growth in consumer electronics, renewable energy technologies, and the Internet of Things (IoT), the demand for non-ferrous metal powders, particularly in applications like printed circuit boards and semiconductor packaging, is on the rise. This expansion in the electronics sector is a significant market driver, underscoring the versatile utility of non-ferrous metal powders in modern technology.

Market Restraints and Challenges:

Price Volatility in metals can affect the cost of non-ferrous metal powders, posing challenges for manufacturers and end-users.

One of the key challenges facing the non-ferrous metal powder market is the inherent price volatility in metals. The cost of non-ferrous metal powders is closely linked to the prices of raw materials like aluminum, copper, and titanium. Fluctuations in metal prices can significantly impact the production costs, profitability, and pricing strategies of manufacturers. This volatility can pose challenges for both manufacturers and end-users as they must navigate uncertain pricing landscapes. Effective supply chain management and hedging strategies are essential to mitigate the impact of these price fluctuations and maintain market competitiveness.

The extraction and processing of non-ferrous metals can have environmental impacts, leading to stricter regulations and sustainability concerns.

The extraction and processing of non-ferrous metals have come under scrutiny due to their environmental impacts. The industry's energy-intensive processes and potential for habitat disruption have led to stricter environmental regulations and heightened sustainability concerns. Compliance with these regulations requires investments in cleaner technologies and practices, which can add to production costs. Additionally, consumers and businesses increasingly prioritize environmentally responsible products and suppliers, putting pressure on non-ferrous metal powder manufacturers to adopt eco-friendly practices. Balancing the need for resource-efficient production with environmental sustainability presents a significant challenge in this market, necessitating innovative solutions and industry-wide commitment to sustainable practices.

Market Opportunities:

Emerging Applications in industries such as renewable energy, healthcare, and 3D printing, create opportunities for market expansion.

The non-ferrous metal powder market is poised to capitalize on emerging applications in various industries, including renewable energy, healthcare, and 3D printing. In the renewable energy sector, non-ferrous metal powders are used in the production of components for solar panels, wind turbines, and energy storage systems, contributing to the transition to clean energy sources. Furthermore, in healthcare, these powders play a vital role in producing medical devices and implants with superior biocompatibility and performance. The expanding utilization of non-ferrous metal powders in these industries presents significant growth opportunities for manufacturers and suppliers.

Investments in research and development to develop advanced metal powders with enhanced properties can open up new markets and applications.

The market can leverage R&D investments to develop advanced non-ferrous metal powders with enhanced properties. These innovations can open up new markets and applications. For instance, the development of metal powders with improved conductivity, strength, or corrosion resistance can lead to breakthroughs in the electronics, aerospace, and automotive industries. Furthermore, ongoing research into novel additive manufacturing techniques and materials can expand the horizons of 3D printing applications. Manufacturers and investors in the non-ferrous metal powder sector who commit to innovation and R&D are well-positioned to tap into these evolving opportunities and stay at the forefront of technological advancements.

NON-FERROUS METAL POWDER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Metal Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Rio Tinto, Alcoa Corporation, Norsk Hydro, BASF SE, GKN Hoeganaes, ATI Powder Metals, Praxair Surface Technologies, AMG Advanced Metallurgical Group, Carpenter Technology Corporation, Sandvik AB |

Non-Ferrous Metal Powder Market Segmentation: By Metal Type

-

Aluminium

-

Copper

-

Nickel

-

Titanium

-

Others

In 2022, Aluminium held the largest market share of 42.8% in the Non-Ferrous Metal Powder market and a CAGR of 3.6%. This dominance stems from aluminum's versatility and wide-ranging applications across numerous sectors. Its lightweight nature, combined with excellent corrosion resistance, makes it a preferred choice in industries like automotive, aerospace, construction, and packaging. For instance, in the automotive sector, aluminum powders are extensively used in the production of lightweight components to enhance fuel efficiency.

Moreover, the Titanium-based non-ferrous metal powders emerged as the fastest-growing segment with a CAGR of 3.8% within the market. This remarkable growth can be attributed to titanium's exceptional properties, including a high strength-to-weight ratio, exceptional corrosion resistance, and biocompatibility. These characteristics have made titanium indispensable in critical industries like aerospace, medical, and chemical processing. The aerospace sector, in particular, relies on titanium powders to produce lightweight yet robust components, thereby improving fuel efficiency and performance.

Non-Ferrous Metal Powder Market Segmentation: By Application

-

Automotive

-

Aerospace

-

Electronics

-

Healthcare

-

Energy

-

Others

In 2022, Automotive held the largest market share of 37.4% in the non-ferrous metal powder market. This dominance can be attributed to the extensive use of non-ferrous metal powders in various aspects of automotive manufacturing. Non-ferrous metal powders, such as aluminum and copper, are widely used in the production of lightweight components and parts, contributing to improved fuel efficiency and reduced emissions. Additionally, they are utilized in the manufacturing of engine components, transmission systems, and brake parts.

Moreover, The Aerospace sector emerged as the fastest-growing application segment in the non-ferrous metal powder market with a CAGR of 6.2%. This rapid growth is underpinned by several factors, including the increasing demand for lightweight materials to improve aircraft fuel efficiency and reduce carbon emissions. Non-ferrous metal powders, especially titanium, are crucial in the aerospace industry for producing components that offer high strength-to-weight ratios and corrosion resistance. Moreover, advancements in additive manufacturing techniques have opened up new opportunities for non-ferrous metal powders in aerospace, allowing for the production of complex, lightweight, and high-performance parts.

Non-Ferrous Metal Powder Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2022, Asia-Pacific held the largest market share of 37.7% in the non-ferrous metal powder market. This dominant position can be attributed to the region's robust industrialization, rapid economic growth, and diverse manufacturing sectors. China and India, in particular, have emerged as major consumers and producers of non-ferrous metal powders due to their booming automotive, electronics, and construction industries. The region's increasing demand for non-ferrous metal powders in various applications, coupled with its manufacturing prowess, contributed to this significant market share.

Moreover, North America is the fastest-growing region in the non-ferrous metal powder market with a CAGR of 5.1%. This growth was driven by several factors, including the expanding adoption of advanced manufacturing technologies, such as additive manufacturing (3D printing). Additionally, the region's aerospace and automotive industries were actively seeking innovative solutions to enhance performance and fuel efficiency, increasing the demand for non-ferrous metal powders.

COVID-19 Impact Analysis on the Global Non-Ferrous Metal Powder Market:

The global Non-Ferrous Metal Powder Market experienced a significant impact from the COVID-19 pandemic. The outbreak led to disruptions in supply chains, and manufacturing operations, and reduced consumer demand, affecting various industries that rely on non-ferrous metal powders, such as automotive and aerospace. Lockdowns and restrictions impeded production and logistics, causing delays and supply shortages. Furthermore, the economic uncertainty during the pandemic prompted businesses to reassess their expenditures, potentially impacting investments in non-ferrous metal powders. However, as the world adapted to new realities, the market displayed resilience, with a gradual recovery witnessed in 2021 as industries resumed operations and investments in areas like 3D printing and renewable energy continued to drive demand for these powders.

Latest Trends/Developments:

One prominent trend in the non-ferrous metal powder market is the increasing emphasis on sustainable manufacturing practices. Environmental concerns and regulatory pressures have prompted manufacturers to adopt cleaner production techniques, reduce waste, and recycle materials. This trend aligns with the broader sustainability goals of industries utilizing non-ferrous metal powders, such as aerospace and automotive, where eco-friendly supply chains are becoming a priority.

The growth of additive manufacturing (3D printing) continues to drive developments in non-ferrous metal powders. Research and innovation are focusing on creating advanced powders with tailored properties to meet the demanding requirements of additive manufacturing processes. These developments expand the scope of 3D printing applications, including in healthcare for personalized implants and aerospace for lightweight components.

The integration of digital technologies and Industry 4.0 concepts into non-ferrous metal powder production is becoming more prevalent. Data analytics, IoT devices, and automation are enhancing production efficiency, quality control, and supply chain management. This trend is not only optimizing processes but also facilitating customization and rapid response to market demands, especially in applications where precision and consistency are critical, such as electronics and healthcare.

Key Players:

-

Rio Tinto

-

Alcoa Corporation

-

Norsk Hydro

-

BASF SE

-

GKN Hoeganaes

-

ATI Powder Metals

-

Praxair Surface Technologies

-

AMG Advanced Metallurgical Group

-

Carpenter Technology Corporation

-

Sandvik AB

In November 2022, Sandvik, a Swedish materials expert with extensive experience in powder atomization, pre-launched an online ordering 'webshop' called Osprey® online for its Additive Manufacturing of metal powders. Additionally, the company is showcasing marketing steels and newly announced copper powder, highlighting the benefits of sustainability and shipping in their materials. These powders are manufactured in-house and offer greater control over various component properties.

In May 2021, Researchers at the Critical Minerals and Technology Centre in Sorel-Tracy, Canada, developed water atomized steel powder for 3D printing. The powder can be used in various industries, and its production is feasible at an industrial scale using North America's largest water atomizer. The team is also exploring other powders with unique properties for diverse 3D printing applications, enabling quicker, more sustainable, and customizable manufacturing solutions.

Chapter 1. Non-Ferrous Metal Powder Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Non-Ferrous Metal Powder Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Non-Ferrous Metal Powder Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Non-Ferrous Metal Powder Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Non-Ferrous Metal Powder Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Non-Ferrous Metal Powder Market – By Metal Type

6.1 Introduction/Key Findings

6.2 Aluminium

6.3 Copper

6.4 Nickel

6.5 Titanium

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Metal Type

6.8 Absolute $ Opportunity Analysis By Metal Type, 2023-2030

Chapter 7. Non-Ferrous Metal Powder Market – By Application

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Aerospace

7.4 Electronics

7.5 Healthcare

7.6 Energy

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 8. Non-Ferrous Metal Powder Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.1.4 By Metal Type

8.1.2 By Application

8.1.3 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Metal Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Metal Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Metal Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Metal Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Non-Ferrous Metal Powder Market – Company Profiles – (Overview, Non-Ferrous Metal Powder Market Portfolio, Financials, Strategies & Developments)

9.1 Rio Tinto

9.2 Alcoa Corporation

9.3 Norsk Hydro

9.4 BASF SE

9.5 GKN Hoeganaes

9.6 ATI Powder Metals

9.7 Praxair Surface Technologies

9.8 AMG Advanced Metallurgical Group

9.9 Carpenter Technology Corporation

9.10 Sandvik AB

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Non-Ferrous Metal Powder Market was valued at USD 2.8 billion and is projected to reach a market size of USD 4.43 billion by the end of 2030. Over the forecast period of 2023-2030, the market is expected to grow at a CAGR of 5.9%

Key drivers include the demand for lightweight materials and the growing adoption of additive manufacturing.

Aluminum, copper, nickel, titanium, and others are prominently used in the market.

Asia-Pacific held the largest market share of 37.7% in the non-ferrous metal powder market. This dominant position can be attributed to the region's robust industrialization, rapid economic growth, and diverse manufacturing sectors.

Rio Tinto, Alcoa Corporation, Norsk Hydro, BASF SE, GKN Hoeganaes, and ATI Powder Metals are some of the key players in the Global Non-Ferrous Metal Powder Market.