Non-Dairy Creamer Market Size (2024 – 2030)

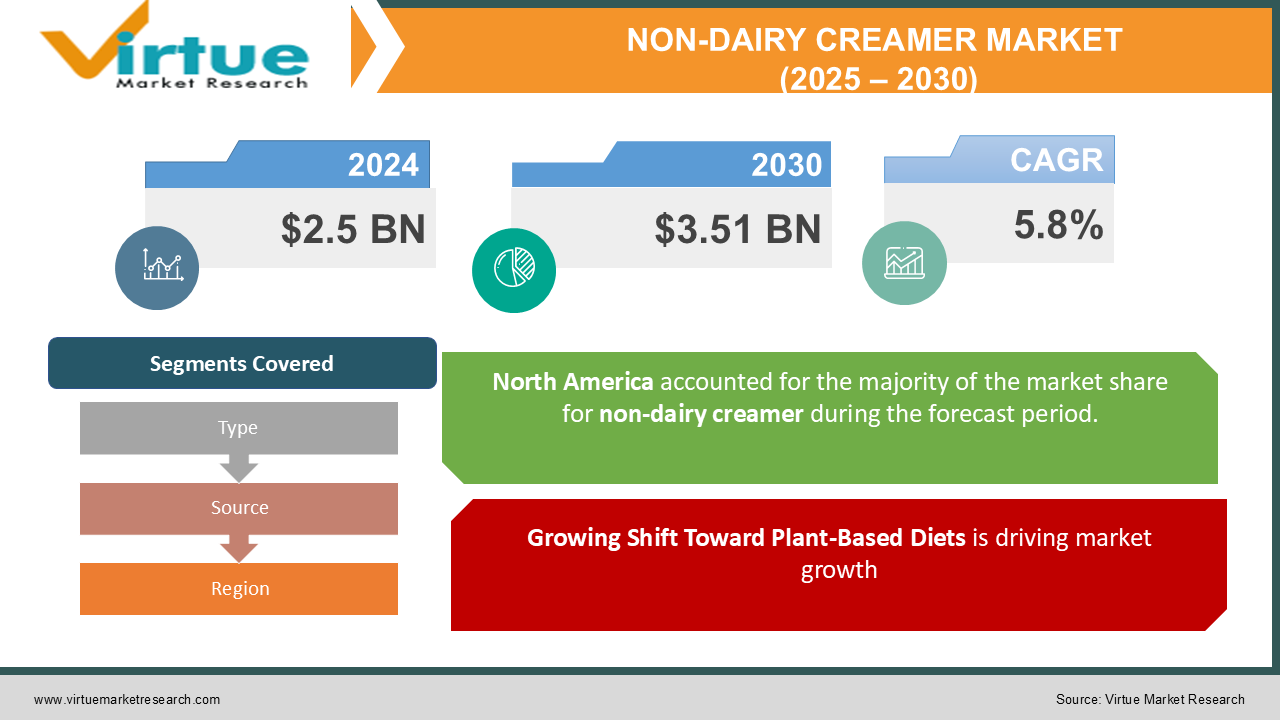

The Global Non-Dairy Creamer Market was valued at USD 2.5 billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2030. The market is expected to reach USD 3.51 billion by 2030.

The Non-Dairy Creamer Market comprises alternatives to traditional dairy-based creamers, designed primarily for consumers who are lactose intolerant, vegan, or seeking healthier lifestyle choices. These products, made from plant-based ingredients such as soy, almond, coconut, or oats, are increasingly popular due to growing awareness of dairy-related health issues and a global shift toward plant-based diets. Non-dairy creamers are used in beverages like coffee and tea and find applications in baking and cooking, driving their demand across multiple sectors.

Key Market Insights:

-

Rising lactose intolerance worldwide has contributed significantly to the demand for non-dairy creamers, with nearly 65% of the global population reported to have some degree of lactose sensitivity.

-

The market is driven by increasing veganism trends, particularly in North America and Europe, where plant-based alternatives have grown by over 15% annually.

-

Coconut-based creamers dominate the market, holding a 40% share in 2024, due to their versatility, flavor, and creaminess.

-

Sugar-free and low-calorie non-dairy creamers are experiencing a surge in demand, representing a 12% growth rate year-over-year, driven by health-conscious consumers.

-

E-commerce channels have emerged as a key distribution platform, with online sales contributing to 30% of the market in 2024.

-

Asia-Pacific is witnessing rapid growth, fueled by a rise in coffee consumption and growing awareness of plant-based products, recording a CAGR of 7.2% from 2025 to 2030.

-

The foodservice industry is a significant end-user, with over 35% of market demand attributed to cafes, restaurants, and beverage chains.

Global Non-Dairy Creamer Market Drivers:

Growing Shift Toward Plant-Based Diets is driving market growth:

The global shift toward plant-based diets is a primary driver of the non-dairy creamer market. Consumers are increasingly embracing veganism or adopting plant-based diets for health, ethical, and environmental reasons. As awareness about the adverse environmental impact of dairy farming grows, plant-based alternatives have become a preferred choice. Non-dairy creamers cater to this demand by offering creamy textures and rich flavors without the use of animal-derived ingredients. This trend is especially pronounced in North America and Europe, where the plant-based food market is expanding at a CAGR of 9%. Additionally, the availability of diverse options, such as almond, soy, and oat-based creamers, ensures a wider reach among consumers with varied taste preferences and dietary requirements.

Rising Cases of Lactose Intolerance and Dairy Allergies is driving market growth:

An estimated 68% of the global population suffers from some degree of lactose malabsorption, making dairy products difficult to digest. The prevalence of dairy allergies, particularly among children, has further increased the demand for non-dairy creamers. These products offer a safe, digestible alternative for individuals seeking to avoid discomfort and potential health risks associated with lactose consumption. With greater medical awareness and diagnostic tools available, the number of diagnosed cases of lactose intolerance continues to rise. Non-dairy creamers, made from plant-based or synthetic ingredients, meet the dietary needs of this growing demographic while offering a range of flavors and textures comparable to traditional creamers.

Innovation in Non-Dairy Creamer Products is driving market growth:

Innovation has played a pivotal role in driving the non-dairy creamer market forward. Companies are investing heavily in research and development to enhance the nutritional profile and taste of their products. Fortification with vitamins, minerals, and functional ingredients like probiotics has allowed brands to cater to the health-conscious segment. Additionally, advancements in production processes have enabled manufacturers to create creamers with improved stability, creaminess, and shelf life. Innovations such as powdered non-dairy creamers for instant beverages and flavored creamers for diverse taste preferences are attracting a wide consumer base. The introduction of organic and clean-label products is another key trend, aligning with consumer demand for transparency and sustainability.

Global Non-Dairy Creamer Market Challenges and Restraints:

High Cost of Production and Premium Pricing is restricting market growth:

One of the most significant challenges for the non-dairy creamer market is its high production cost, which translates to premium pricing for consumers. The sourcing of high-quality plant-based ingredients such as almonds, coconuts, or oats is often more expensive than traditional dairy-based alternatives. Additionally, the processing and formulation technologies required to achieve the desired creaminess and flavor in non-dairy creamers add to production costs. While affluent consumers in developed regions are willing to pay a premium for health and sustainability, price sensitivity in emerging markets poses a restraint to market growth. Brands are compelled to strike a balance between quality and affordability to penetrate diverse markets effectively.

Taste and Texture Challenges Compared to Dairy Creamers is restricting market growth:

Despite significant advancements, non-dairy creamers often face criticism for not fully replicating the taste and texture of traditional dairy-based creamers. The creaminess, mouthfeel, and aftertaste of dairy products are difficult to achieve using plant-based ingredients, particularly in lower-cost formulations. This challenge is exacerbated for consumers accustomed to dairy products who may find the transition to non-dairy alternatives less satisfying. Moreover, certain plant-based options like soy can have strong flavors that may not appeal to all consumers. Overcoming these sensory challenges requires continuous innovation, which can be resource-intensive for manufacturers.

Market Opportunities:

The increasing adoption of flexitarian diets, which emphasize reducing meat and dairy consumption without eliminating them entirely, opens a large and lucrative demographic for non-dairy creamers. Expanding product portfolios to include allergen-free, gluten-free, and low-sugar options can further enhance market appeal. Emerging markets such as Asia-Pacific and Latin America represent untapped potential, driven by rising disposable incomes, urbanization, and growing coffee culture. Collaboration with foodservice providers and cafes to offer customized non-dairy options can bolster market presence and drive sales. Additionally, investments in sustainability, such as sourcing organic and fair-trade ingredients or utilizing eco-friendly packaging, align with consumer demand for ethical consumption and provide a competitive edge.

NON-DAIRY CREAMER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Type, Source, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nestlé, Danone, Califia Farms, Silk, Coffee-Mate Natural Bliss, Nutpods, So Delicious Daily Free, Alpro, Ripple Foods, Laird Superfood |

Non-Dairy Creamer Market Segmentation: By Type

-

Liquid Non-Dairy Creamers

-

Powdered Non-Dairy Creamers

Powdered non-dairy creamers dominate this segment, accounting for 55% of the market share in 2024. Their longer shelf life and convenience for both home and commercial use make them the preferred choice across regions.

Non-Dairy Creamer Market Segmentation: By Source

-

Almond-Based Creamers

-

Soy-Based Creamers

-

Coconut-Based Creamers

-

Oat-Based Creamers

-

Others

Coconut-based creamers lead the source segmentation with 40% market share. Their versatility, rich flavor, and compatibility with a wide range of beverages and culinary applications make them the top choice among consumers.

Non-Dairy Creamer Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America holds the largest share of the non-dairy creamer market, contributing over 35% in 2024. The region's dominance is attributed to high consumer awareness of plant-based products, a well-established coffee culture, and the presence of key industry players. The U.S. drives the regional market, with strong demand for organic and clean-label creamers. E-commerce growth and the popularity of health-conscious diets like keto and paleo further bolster sales in this region.

COVID-19 Impact Analysis on the Non-Dairy Creamer Market:

The COVID-19 pandemic had a mixed impact on the non-dairy creamer market, presenting both challenges and opportunities. On the downside, global supply chain disruptions led to raw material shortages and delays in product launches. Lockdowns and limited operations in manufacturing facilities further exacerbated supply constraints, creating obstacles for brands. However, the pandemic also accelerated several positive trends in the market. The increase in at-home coffee consumption during lockdowns played a significant role in driving the demand for retail non-dairy creamer products, with e-commerce sales surging by 40% between 2020 and 2021. Furthermore, the pandemic underscored the importance of product safety and traceability, leading many brands to prioritize clean-label and organic offerings. Consumers became more selective about the products they purchased, opting for those with transparent ingredient lists and assurances of safety and quality. As the market began to recover, brands responded with innovations that catered to the growing demand for health-conscious and sustainability-focused products. These innovations helped maintain the market's growth momentum as it adapted to shifting consumer preferences. Ultimately, while the pandemic posed several challenges, it also accelerated key trends that continue to shape the future of the non-dairy creamer market.

Latest Trends/Developments:

The non-dairy creamer market is experiencing significant innovation and diversification as it evolves to meet changing consumer demands. One notable trend is the rise of plant-based alternatives made from novel ingredients like pea protein and cashew. These options are gaining popularity as they offer unique flavors and nutritional benefits, appealing to consumers who seek variety in their non-dairy choices. Another emerging trend is the introduction of functional non-dairy creamers, infused with ingredients such as adaptogens, collagen, and probiotics, which cater to health-conscious consumers looking for added wellness benefits. Sustainability is becoming a major focus for companies within the industry, with many brands adopting recyclable or biodegradable packaging. Additionally, there is a growing emphasis on sourcing fair-trade and organic ingredients to appeal to environmentally conscious and ethical consumers. The digital landscape is also playing a pivotal role in reshaping consumer engagement. Brands are leveraging online platforms to offer personalized services, such as subscription-based delivery and customization options, enabling customers to tailor their purchases to their specific preferences and needs. Furthermore, partnerships with cafes, restaurants, and foodservice chains are providing new avenues for growth. By integrating non-dairy options into their menus, these collaborations are helping to expand the reach of non-dairy creamers and make them more accessible to a wider audience. As these trends continue to gain momentum, the non-dairy creamer market is set to undergo further transformation, driven by innovation, sustainability, and a growing emphasis on health and personalized consumer experiences.

Key Players:

-

Nestlé

-

Danone

-

Califia Farms

-

Silk

-

Coffee-Mate Natural Bliss

-

Nutpods

-

So Delicious Dairy Free

-

Alpro

-

Ripple Foods

-

Laird Superfood

Chapter 1. Non-Dairy Creamer Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Non-Dairy Creamer Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Non-Dairy Creamer Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Non-Dairy Creamer Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Non-Dairy Creamer Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Non-Dairy Creamer Market – By Type

6.1 Introduction/Key Findings

6.2 Liquid Non-Dairy Creamers

6.3 Powdered Non-Dairy Creamers

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Non-Dairy Creamer Market – By Source

7.1 Introduction/Key Findings

7.2 Almond-Based Creamers

7.3 Soy-Based Creamers

7.4 Coconut-Based Creamers

7.5 Oat-Based Creamers

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Source

7.8 Absolute $ Opportunity Analysis By Source, 2025-2030

Chapter 8. Non-Dairy Creamer Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Source

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Source

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Source

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Source

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Source

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Non-Dairy Creamer Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Nestlé

9.2 Danone

9.3 Califia Farms

9.4 Silk

9.5 Coffee-Mate Natural Bliss

9.6 Nutpods

9.7 So Delicious Dairy Free

9.8 Alpro

9.9 Ripple Foods

9.10 Laird Superfood

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Non-Dairy Creamer Market was valued at USD 2.5 billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2030. The market is expected to reach USD 3.51 billion by 2030.

The key drivers include the growing adoption of plant-based diets, rising lactose intolerance cases, and innovations in non-dairy formulations.

The market is segmented by product (liquid and powdered) and source (almond, soy, coconut, oat, and others).

North America is the most dominant region, contributing over 35% of the market share due to high consumer awareness and demand for premium non-dairy products.

Leading players include Nestlé, Danone, Califia Farms, and Alpro.