Global Non-Anticoagulant Rodenticides Market Size (2024-2030)

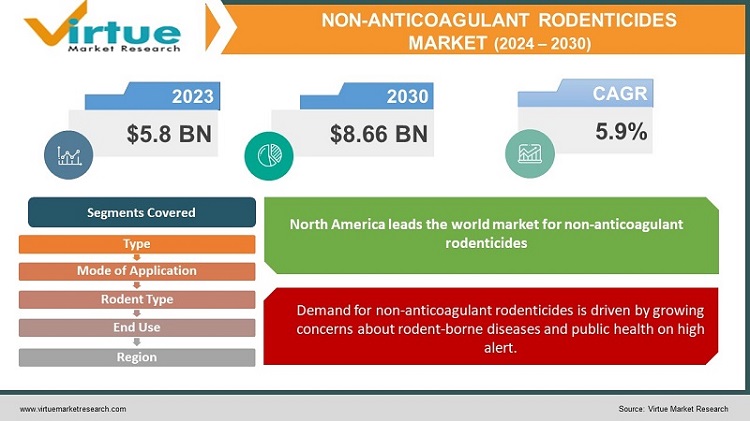

The Global Non-Anticoagulant Rodenticides Market was valued at USD 5.8 billion in 2023 and is projected to reach a market size of USD 8.66 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.9%.

Acting more quickly than blood-thinning anticoagulants, non-anticoagulant rodenticides kill rodents by causing nervous system disruption (bromethalin), interference with calcium regulation (cholecalciferol based on vitamin D3), respiratory harm (zinc phosphide), or muscle spasms (strychnine, now rarely used). However, because they can cause secondary poisoning, these rodenticides are more dangerous for pets and animals, and huge infestations may need repeated feedings. To prevent unintentional poisoning, always handle them with caution and according to the label's instructions.

Key Market Insights:

According to UN predictions, 68% of people on Earth would reside in cities by the year 2050. Because they can easily acquire food and shelter, rats have perfect habitats thanks to the rising urbanization. According to 56% of pest control experts, calls about rodents have increased in metropolitan areas. As cities look for efficient control methods, the rising number of urban rodents is a key factor driving the market for non-anticoagulant rodenticides.

Due to safety concerns for non-target species, the European Union outlawed the use of certain second-generation anticoagulant rodenticides outdoors in 2016. An increase in anticoagulant restrictions worries 63% of pest control enterprises. Non-anticoagulant rodenticides, which have distinct modes of action, can fill the market vacuum left by tighter restrictions and mounting safety concerns.

By 2027, it is anticipated that the worldwide market for encapsulated rodenticides—a safer delivery method—will have grown to USD 2.2 billion. When compared to conventional bait, timed-release rodenticides can drastically lower the exposure of non-target species. In order to address safety concerns and draw in new consumers, the non-anticoagulant rodenticide market is seeing a significant trend toward the development of safer formulations and creative delivery methods including encapsulation and timed-release mechanisms.

By 2050, more than 90% of population increase worldwide will occur in emerging nations. Due to increased disposable incomes and rapid urbanization, the Asia Pacific area is predicted to have the fastest-growing market for non-anticoagulant rodenticides. The market for non-anticoagulant rodenticides is expected to rise in emerging areas with rising urbanization and rising rodent issues as laws tighten in wealthier nations.

Global Non-Anticoagulant Rodenticides Market Drivers:

A Problem for Cities, a Benefit for Rodents Why Non-Anticoagulant Insecticides Provide a Focused Approach

Global urbanization is causing large towns to unwittingly become rat havens. Rats have a lot of food options in these concrete jungles, from overflowing dumpsters to an excess of leftovers from street vendors. There are many places to nest and burrow due to the intricate building network's winding alleys, storm drains, and secret areas behind walls. This sets up the ideal environment for rodent numbers to soar. Rodents may multiply quickly when they have easy access to food and shelter nearby, which exacerbates the issue. Conventional approaches to rodent management, such as maintaining a clean home, are far less successful in these metropolitan settings. Herein lies the use of non-anticoagulant rodenticides, which provide a focused approach to managing these rapidly increasing urban rodent populations.

Demand for non-anticoagulant rodenticides is driven by growing concerns about rodent-borne diseases and public health on high alert.

The risks of rodent-borne illnesses are becoming more widely known, which is spurring investment in more effective control measures. From rat-bite fever and salmonellosis to hantavirus and leptospirosis, rodents may spread a horrifying variety of diseases to people. Contact with rodent droppings, urine, or even bites can transmit these illnesses. The public's knowledge of these health dangers has increased due to the advent of social media and news coverage of epidemics, which has increased demand for efficient rodent control methods. As a result, more money is being spent on product development and research, including the creation of non-anticoagulant rodenticides. These quicker-acting rodenticides are an essential weapon in the battle to stop the spread of illnesses carried by rodents, safeguarding public health and safety.

Global Non-Anticoagulant Rodenticides Market Restraints and Challenges:

Acting more quickly than blood-thinning anticoagulants, non-anticoagulant rodenticides kill rodents by causing nervous system disruption (bromethalin), interference with calcium regulation (cholecalciferol based on vitamin D3), respiratory harm (zinc phosphide), or muscle spasms (strychnine, now rarely used). However, because they can cause secondary poisoning, these rodenticides are more dangerous for pets and animals, and huge infestations may need repeated feedings. To prevent unintentional poisoning, always handle them with caution and according to the label's instructions.

Global Non-Anticoagulant Rodenticides Market Opportunities:

The market for non-anticoagulant rodenticides presents encouraging prospects despite obstacles. Safer formulations that specifically target rodents may be able to relax regulatory constraints and win over wary customers. Further innovation in delivery methods, such as targeted bait stations, might reduce injury to animals that are not the intended targets. Additionally, the industry can extend into emerging areas where there are increasing urbanization and rodent issues. In addition to improving market acceptance, public education on safe usage can help resolve resistance to non-anticoagulant medications by combining them with anticoagulant mechanisms.

NON-ANTICOAGULANT RODENTICIDES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Type, mode of application, end user, rodent type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Bayer AG, Bell Laboratories, Ecolab, JT Eaton & Co., Liphatech Inc., Rentokil Initial plc, Rollins Inc., Senestech Inc., Syngenta AG, UPL Limited |

Global Non-Anticoagulant Rodenticides Market Segmentation:

Global Non-Anticoagulant Rodenticides Market Segmentation: By Type:

- Bromethalin

- Cholecalciferol

- Zinc phosphide

- Strychnine

It's difficult to pinpoint the precise biggest and fastest-growing market categories by kind for non-anticoagulant rodenticides. Because of its widespread efficacy and low cost, methylphenylamine is probably the most popular. On the other hand, cholecalciferol, or vitamin D3, may expand at the quickest rate because of its reputation for safety and continuous studies to improve rodent palatability. Regulations, new technology, and the release of innovative rodenticides, however, have the potential to alter market dynamics.

Global Non-Anticoagulant Rodenticides Market Segmentation: By Mode of Application:

- Pellets

- Blocks

- Powders

- Sprays

Because they are inexpensive, simple to apply, and appealing to mice, pellets are perhaps the most used administration technique for non-anticoagulant rodenticides. With its capacity to target several rodent species, weather durability for outdoor usage, and the possibility for delayed release (limiting unintentional exposure), blocks may be the fastest-growing sector. However, when new technology and market demands emerge, application technique trends may also shift.

Global Non-Anticoagulant Rodenticides Market Segmentation: By Rodent Type:

- Rats

- Mice

- Chipmunks

- Hamsters

Because of their widespread distribution, health hazards, and destructive nature, rats are the clear market leaders for non-anticoagulant rodenticides. The market targets particular geographical challenges, therefore, locations with chipmunk difficulties may experience an increase in demand for chipmunk-targeted rodenticides, even though there isn't a single fastest-growing sector by species of rodent.

Global Non-Anticoagulant Rodenticides Market Segmentation: By End Use:

- Agricultural fields

- Warehouses

- Homes

- Commercial buildings

- Urban centers with high rodent populations

Because so many areas need to be protected from rats that damage crops, agricultural fields account for most of the market for non-anticoagulant rodenticides. Urban regions, on the other hand, are growing at the highest rate because expanding cities provide perfect habitats for rodents and increase public health concerns, which in turn drives demand for control methods in these highly populated areas.

Global Non-Anticoagulant Rodenticides Market Segmentation: By Region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America leads the world market for non-anticoagulant rodenticides because of its well-established agriculture industry and stringent pest management laws. However, because of reasons including increased disposable incomes, quick urbanization, and rising awareness of cleanliness, particularly in the food business, the Asia Pacific area is predicted to develop at the highest rate.

COVID-19 Impact Analysis on the Global Non-Anticoagulant Rodenticides Market:

The COVID-19 pandemic had a mixed effect on the market for non-anticoagulant rodenticides. Positively, increased demand in industries like food processing and warehousing may have resulted from lockdowns' increased awareness of hygiene. Temporary increases in rodent populations may have resulted from disturbances in trash collection, necessitating control efforts. However, the epidemic had unfavorable consequences as well. Travel bans and lockdowns caused supply chain disruptions, which affected the availability of products in some areas. The need for rodenticides in industries like restaurants was probably lowered by business closures in such sectors. Spending on pest management, especially rodenticides, may have decreased because of budgetary constraints placed on handling the epidemic. Long-term development factors for this industry, such as urbanization and worries about rodent-borne illnesses, are anticipated to stay robust and drive market expansion in the upcoming years, despite these brief hurdles.

Recent Trends and Developments in the Global Non-Anticoagulant Rodenticides Market:

Innovation in non-anticoagulant rodenticides is booming. Manufacturers are working to create rodenticides that are less harmful to animals and pets in order to solve safety concerns. This might entail novel compounds or focused delivery techniques like poisons that are encapsulated. If this venture is successful, it may draw in more clients and possibly loosen rules. There is also innovation taking place in delivery methods. Consider rodenticides with timed release mechanisms, species-specific attractants, or bait stations that are enticing to rodents but off-limits to pets. These developments can lessen the harm done to animals that are not the focus. Lastly, the market is focusing on emerging economies that are rapidly urbanizing and seeing an increase in rodent problems due to the stronger laws in established nations. For this development to be successful in these new areas, specialized marketing and distribution plans will be needed.

Key Players:

- BASF SE

- Bayer AG

- Bell Laboratories

- Ecolab

- JT Eaton & Co.

- Liphatech Inc.

- Rentokil Initial plc

- Rollins Inc.

- Senestech Inc.

- Syngenta AG

- UPL Limited

Chapter 1. Global Non-Anticoagulant Rodenticides Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Non-Anticoagulant Rodenticides Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Non-Anticoagulant Rodenticides Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Non-Anticoagulant Rodenticides Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Non-Anticoagulant Rodenticides Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Non-Anticoagulant Rodenticides Market– By Type

6.1. Introduction/Key Findings

6.2. Bromethalin

6.3. Cholecalciferol

6.4. Zinc phosphide

6.5. Strychnine

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Global Non-Anticoagulant Rodenticides Market– By Mode of Application

7.1. Introduction/Key Findings

7.2 Pellets

7.3. Blocks

7.4. Powders

7.5. Sprays

7.6. Y-O-Y Growth trend Analysis By Mode of Application

7.7. Absolute $ Opportunity Analysis By Mode of Application , 2024-2030

Chapter 8. Global Non-Anticoagulant Rodenticides Market– By End-User

8.1. Introduction/Key Findings

8.2. Agricultural fields

8.3. Warehouses

8.4. Homes

8.5. Commercial buildings

8.6. Urban centers with high rodent populations

8.7. Y-O-Y Growth trend Analysis End-User

8.8. Absolute $ Opportunity Analysis Type, 2024-2030

Chapter 9. Global Non-Anticoagulant Rodenticides Market– By Rodent Type

9.1. Introduction/Key Findings

9.2. Rats

9.3. Mice

9.4. Chipmunks

9.5. Hamsters

9.6. Y-O-Y Growth trend Analysis Rodent Type

9.7. Absolute $ Opportunity Analysis Rodent Type , 2024-2030

Chapter 10. Global Non-Anticoagulant Rodenticides Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Type

10.1.3. By Mode of Application

10.1.4. By Rodent Type

10.1.5. End-User

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Type

10.2.3. By Mode of Application

10.2.4. By Rodent Type

10.2.5. End-User

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Type

10.3.3. By Mode of Application

10.3.4. By Rodent Type

10.3.5. End-User

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By Type

10.4.3. By Mode of Application

10.4.4. By Rodent Type

10.4.5. End-User

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Type

10.5.3. By Mode of Application

10.5.4. By Rodent Type

10.5.5. End-User

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Non-Anticoagulant Rodenticides Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 BASF SE

11.2. Bayer AG

11.3. Bell Laboratories

11.4. Ecolab

11.5. JT Eaton & Co.

11.6. Liphatech Inc.

11.7. Rentokil Initial plc

11.8. Rollins Inc.

11.9. Senestech Inc.

11.10. Syngenta AG

11.11. UPL Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Non-Anticoagulant Rodenticides Market was valued at USD 5.8 billion in 2023 and is projected to reach a market size of USD 8.66 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.9%.

The worldwide Global Non-Anticoagulant Rodenticides Market growth is estimated to be 5.9% from 2024 to 2030

The Global Non-Anticoagulant Rodenticides Market is segmented By Type (Bromethalin, Cholecalciferol, Zinc phosphide, Strychnine); By Mode of Application (Pellets, Blocks, Powders, Sprays); By Rodent Type (Rats, Mice, Chipmunks, Hamsters ); By End Use (Agricultural fields, Warehouses, Homes, Commercial buildings, Urban centers with high rodent populations) and by region.

It is anticipated that the non-anticoagulant rodenticide industry will concentrate on developing safer formulations, and creative delivery methods, and breaking into new markets in the future. One major trend is the development of rodenticides that are less hazardous to animals and pets. Further investigation into species-specific attractants and focused delivery strategies may help reduce the dangers to non-target animals.

The market for non-anticoagulant rodenticides was affected by the COVID-19 epidemic in a variety of ways. Hygiene concerns led to a surge in demand in certain industries, although supply chain interruptions and company closures resulted in short-term losses. In general, it is anticipated that the market's long-term growth factors will continue to be robust.