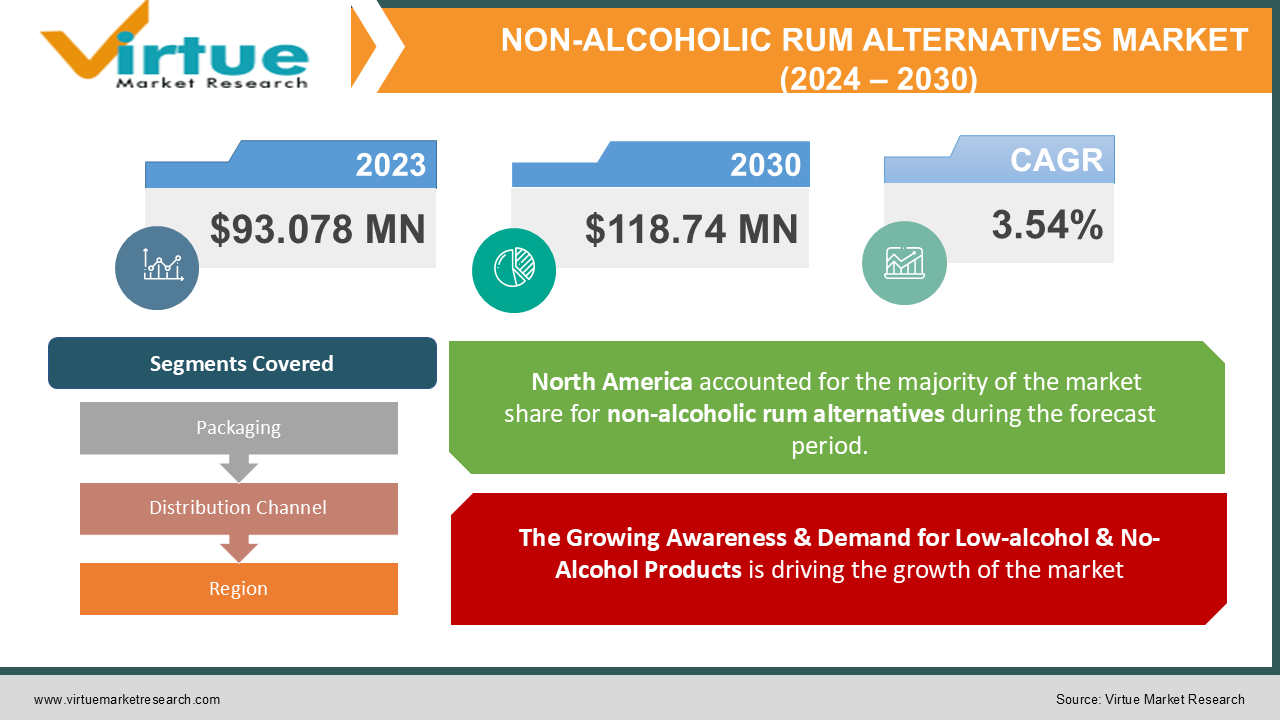

Global Non-Alcoholic Rum Alternatives Market size (2024 – 2030)

In 2023, the Global Non-Alcoholic Rum Alternatives Market was valued at $93.078 million, and is projected to reach a market size of $118.74 million by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 3.54%. The Growing Awareness & Demand for Low-alcohol & Non-Alcohol Products is the major factor that is driving the growth of the industry.

Industry Overview:

A non-alcoholic rum substitute is a drink that has all the characteristics of rum, such as color and molasses flavor, but does not contain alcohol. The alcohol is removed by distillation and maceration in the same way as rum. Demand for non-alcoholic rum alternatives such as mocktails, ginger beer, and spiced rum is increasing due to the consumer shift to non-alcoholic beverages such as sugar cane juice and other fruit juices. Additionally, consumers are becoming increasingly aware of alcohol consumption, its negative health effects, and alcoholism. According to the World Health Organization (WHO), alcohol consumption is responsible for more than 200 illnesses, injuries, and other health conditions worldwide. Soft drinks, also known as 'fresh drinks', 'mocktails', and 'closed beers', are beverages containing less than 0.5% alcohol. The soft drink market includes a wide range of soft drinks such as energy drinks, juices, soft drinks, coffee and tea, mineral waters, probiotics, etc. The beverage industry has seen a dramatic shift in consumer preferences over the past decade.

Three million people die each year from alcohol consumption. For these reasons, most consumers preferred to drink non-alcoholic beverages instead. Due to these factors, major market players are focusing on research and development, expansion, and relaunch of their products to conquer the market. The high demand for non-alcoholic beverages and the presence of major market players helps propel the alternative non-alcoholic rum industry during the forecast period 2023 - 2030

COVID-19 impact on the Non-Alcoholic Rum Alternatives Market

The outbreak of the COVID-19 pandemic has negatively impacted the consumption of non-alcoholic beverages. Soft drinks accounted for the largest share in 2019 due to their very high availability in the market. However, the global soft drink market experienced a sharp decline in soft drink sales and distribution.

The alcohol market faced a downfall during the pandemic because the supply was dead and the alcohol which is stored in the containers in big warehouses was not sent to other places that is why this market was badly affected during the pandemic. After that, the market recovered a lot in the last couple of months after Covid restrictions have been removed and the bars and places where this has been served is opened in many areas which have helped this market grow during the forecast period.

MARKET DRIVERS:

The Growing Awareness & Demand for Low-alcohol & No-Alcohol Products is driving the growth of the market

In the beverage industry, the trend toward low-alcohol and non-alcoholic beverages is growing significantly. More and more health-conscious consumers are driving a massive shift to healthier, more nutritious beverages. This is illustrated by the fact that major manufacturers in the beverage industry are shifting their portfolios towards products such as non-alcoholic rum alternatives, which contribute significantly to the growth of the non-alcoholic rum alternative market.

MARKET RESTRAINTS:

Growing Consumer Preference for Organic Additive Free Food and Beverages is restraining the growth of the market

In the beverage industry, the trend toward low-alcohol and non-alcoholic beverages is growing significantly. More and more health-conscious consumers are driving a massive shift to healthier, more nutritious beverages. This is illustrated by the fact that major manufacturers in the beverage industry are shifting their portfolios towards products such as non-alcoholic rum alternatives, which contribute significantly to the growth of the non-alcoholic rum alternative market.

NON-ALCOHOLIC RUM ALTERNATIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.54 % |

|

Segments Covered |

By Packaging, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profile |

A.G. Barr, Dr. Pepper Snapple Group, DydoDrinco, Attitude Drinks, Co., Livewire Energy; Calcol, Inc., Danone, Nestlé S.A., PepsiCo, Inc., Coca-Cola Company |

This research report on the global Non-Alcoholic Rum Alternatives Market has been segmented and sub-segmented based on the Packaging, Distribution Channel, and region.

Non-Alcoholic Rum Alternatives Market - By Packaging:

-

-

Metal Cans

-

Plastic Bottle

-

Others

-

Based on Packaging, The Glass Bottles phase held a dominant market share in the year 2021. The glass bottle is the most famous packaging fabric used for alcoholic and non-alcoholic liquids throughout the world. Manufacturers agree that ingesting drinks in glass bottles provides a greater top-class attraction to shoppers than the usage of metallic cans. In non-alcoholic rum alternatives, it is in most cases used for ginger beer, spiced rum, and others. Also, glass is reliable, sustainable, recyclable, and reusable metal. Such attributes force the glass phase and force the Non-Alcoholic Rum Alternatives Market Size.

However, the Cans phase is estimated to develop by way of 12.1% in the forecast length of 2023 - 2030, owing to the superb preservative abilities of cans with the assistance of can coatings, ease to elevate and preserving and popularize can section amongst consumers. It is broadly speaking used for mocktails, cocktails, sugarcane juice, and different fruit juice. Compared to glass, cans are unbreakable and compact in measurement which is handy for transport. Such attributes assist in gas the increase of the Non-Alcoholic Rum Alternatives Market over the forecast duration of 2023 - 2030.

Non-Alcoholic Rum Alternatives Market - By Distribution Channel:

-

Cooking

-

Cocktails

-

Bakery

-

Cosmetics

-

Others

Based on Distribution Channel The grocery store phase held a dominant market share in the year 2021. This is owing to a massive chain of supermarkets unfolding over the world. In Japan, income of supermarkets was hiked by USD 8.1 trillion in accordance with the International Trade Administration. According to the meals industry, almost 4412 grocery store stores, warehouses, and membership shops are placed in the U.S. owing to such a growing range of grocery store shops in all regions, the section is estimated to develop at a fast rate.

However, the Specialty Stores phase is estimated to develop with the quickest CAGR of 11.8% over the forecast duration of 2023 - 2030. This is owing to a number of strong point shops opened by way of key market gamers by using taking into account rising patron demand for non-alcoholic drinks such as mocktails, ginger beer, and spiced rum. Specialty shops provide a range of manufacturers of non-alcoholic drinks beneath one save and beautify consumer ride with the carrier which makes it famous amongst consumers. Various key market gamers opening their strong point shops to serve consumers, such as in January 2021, Boisson open its strong point keep in New York and they served in-store pickup, neighborhood shipping, and countrywide online shipping. Owing to such reasons, most shoppers decide on forte shops that force the Non-Alcoholic Rum Alternatives Industry over the forecast length of 2023 - 2030.

Non-Alcoholic Rum Alternatives Market - By Region:

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East

-

Africa

Geographically, North America held a dominant market share of 34% in the year 2021. This is owing to the growing demand for non-alcoholic drinks by way of millennials. Consumers are greater conscious of the influence of alcohol on the fitness and wealth of a man or woman with a family. According to the Centers for Disease Control and Prevention (CDC), immoderate alcohol consumption is linked to 95,000 fatalities in the United States each year. Additionally, it has been estimated that alcohol abuse fees the United States billions of greenbacks in misplaced place of work productiveness and more healthcare prices each year. Owing to such elements most human beings in North America pick non-alcoholic drinks like mocktails, ginger beer, spiced rum, sugarcane juice, and different fruit juice which assist to develop the Non-Alcoholic Rum Alternatives Market Size in this region.

Furthermore, Asia-Pacific is estimated to develop with the quickest CAGR over the forecast duration of 2023 - 2030. This is owing to rising per capita profits and mounting the trend of dwelling amongst health-conscious buyers supporting to development of the Asia-Pacific Non-Alcoholic Rum Alternatives Market. In nations like India and China, the demand for non-alcoholic liquids is on the surge as an end result of the growing incidence of a variety of continual diseases, such as cardiac arrest, cirrhosis, and neurological dysfunction has created a consumption shift toward non-alcoholic drinks. Cardiac arrest was once accountable for 544,000 deaths in China in 2021 as per a lookup paper posted in National Center for Biotechnology Information (NCBI). Owing to such motives consumption of alcoholic drinks receives diminished and consumer-preferred non-alcoholic drinks such as no–alcohol cocktails, mocktails, spiced rum, sugarcane juice, and different fruit juice in this location gasoline the boom of the Non-Alcoholic Rum Alternatives Industry over the forecast length 2023 - 2030.

Non-Alcoholic Rum Alternatives Market Share by Company

Companies like

-

A.G. Barr

-

Dr. Pepper Snapple Group

-

DydoDrinco

-

Attitude Drinks, Co.

-

Livewire Energy

-

Calcol, Inc.

-

Danone

-

Nestlé S.A.

-

PepsiCo, Inc.

-

Coca-Cola Company

Recently, Lyre’s finished the largest funding round for low and no-alcohol products. The £20m fundraising values the business at £270m, up from £100m after a smaller £5m round in May.

Blue marble expands from 181000 sq. ft to 425000 sq. ft with multiple new canning lines, In-house sleeving, and a variety of packaging systems to increase the production of alcoholic & non-alcoholic based products.

Many key players customize their product’s flavors in accordance with the nearby patron preferences. In addition, some producers furnish modern packaging, thereby growing their market share. Many producers are projected to provide new merchandise to the goal area of interest market and turn out to be the key player. Furthermore, extended fitness & health tendencies have raised the demand for healthful drinks. For instance, awesome top-class juices, crafted soda, top-rate hydration, and probiotics are projected to exhibit splendid increase as they use resources in weight loss, and detoxification, furnish nutritional vitamins & different diet supplements and enhance digestion.

NOTABLE HAPPENINGS IN THE GLOBAL NON-ALCOHOLIC RUM ALTERNATIVE MARKET IN THE RECENT PAST:

-

Partnership - In Jan 2022, Spiritless Kentucky partnered with Republic National Distributing Company (RNDC) to distribute its products, including its reverse-distilled Kentucky 74, across the U.S. Louisville-based RNDC

Chapter 1. Non-Alcoholic Rum Alternatives Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Non-Alcoholic Rum Alternatives Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Non-Alcoholic Rum Alternatives Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Non-Alcoholic Rum Alternatives Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Non-Alcoholic Rum Alternatives Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Non-Alcoholic Rum Alternatives Market – By Packaging

6.1. Metal Cans

6.2. Plastic Bottle

6.3. Others

Chapter 7. Non-Alcoholic Rum Alternatives Market – By Distribution Channel

7.1. Cooking

7.2. Cocktails

7.3. Bakery

7.4. Cosmetics

7.5. Others

Chapter 8. Non-Alcoholic Rum Alternatives Market- By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Non-Alcoholic Rum Alternatives Market – key players

9.1 A.G. Barr

9.2 Dr. Pepper Snapple Group

9.3 DydoDrinco

9.4 Attitude Drinks, Co.

9.5 Livewire Energy

9.6 Calcol, Inc.

9.7 Danone

9.8 Nestlé S.A.

9.9 PepsiCo, Inc.

9.10 Coca-Cola Company

Download Sample

Choose License Type

2500

4250

5250

6900