Non-Alcoholic Margarita Market Size (2024 – 2030)

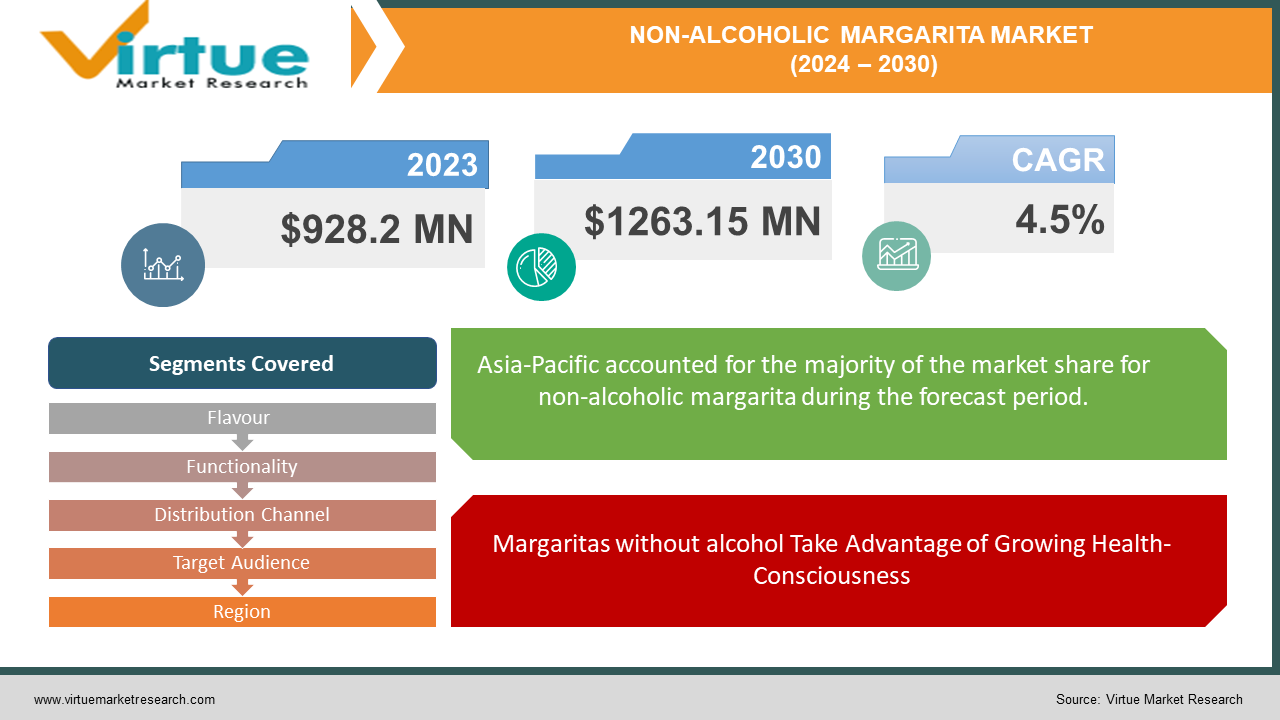

The Global Non-Alcoholic Margarita Market was valued at USD 928.2 million in 2023 and is projected to reach a market size of USD 1263.15 million by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.5%.

The demand for tasty, refreshing beverages and growing health consciousness are projected to boost the non-alcoholic margarita market globally. Innovative flavour combinations and useful components are being embraced by consumers, which presents exciting prospects for new product creation. Instead of sipping tequila, users try a mocktail, which is essentially a non-alcoholic margarita. Its alcoholic cousin's flavour is captured in this delightful drink but without the alcohol. For pregnant ladies, trying to avoid alcohol, or just looking for a tasty substitute, this is a great option for anybody who enjoys a flavoured beverage. A classic non-alcoholic margarita balances the tartness of citrus liquids, such as lime, with a small amount of sugar. A dash of sparkle comes from sparkling water or club soda, and other recipes add a twist with freshly blended fruit or a burst of spiciness from jalapeño slices. There's a non-alcoholic margarita out there just ready to become your new favourite beverage because they come in so many varieties.

Key Market Insights:

In the upcoming year, majority chunk of respondents want to cut back on their alcohol intake, suggesting a developing market for healthy substitutes. Customers are choosing non-alcoholic margaritas instead of sugary beverages as they adopt better lifestyles.

The market for non-alcoholic beverages is dominated by online platforms because they provide convenient access and a larger selection of products. Online merchants are the emerging stars in the non-alcoholic margarita sector, taking the largest share and growing at the quickest rate.

Global Non-Alcoholic Margarita Market Drivers:

Margaritas without alcohol Take Advantage of Growing Health-Consciousness

The global trend towards a healthier lifestyle is driving up demand for non-alcoholic drinks. Customers are choosing drinks that are less sweet and, most importantly, alcohol-free in place of sugary sodas. The market for non-alcoholic margaritas is primed for success because of this shift in preferences. Mocktails provide a tasty and refreshing substitute for classic margaritas, without the added calories or health hazards of alcohol. They are a guilt-free way to satisfy your thirst and experience the taste of a traditional margarita because they may be made with natural ingredients, have less sugar, and even have functional advantages. The non-alcoholic margarita industry is mostly driven by this emphasis on health and well-being, which positions it as a competitive alternative for consumers looking for a tasty and healthful beverage option.

Innovation in Flavour and Premiumization Enhance the Experience of Non-Alcoholic Margaritas

The days of having to limit your non-alcoholic beverage options to sugary sodas are long gone. Today's consumers have sophisticated tastes, and they actively search for novel and interesting options. This change in preferences offers the non-alcoholic margarita sector a fantastic chance to flourish. Real fruit juices, herbal extracts, and handcrafted syrups take the front stage in place of artificial sweeteners. Beyond the traditional lime, flavour creativity soars, with intriguing concoctions like mango habanero or blood orange rosemary enticing palates. The packaging is also redesigned, moving away from plastic bottles and towards elegant glass containers with striking patterns that would not seem out of place on a high-end bar shelf. The non-alcoholic margarita is now a refined and delightful experience thanks to the premiumization trend, which perfectly suits today's health-conscious customers.

Global Non-Alcoholic Margarita Market Restraints and Challenges:

The non-alcoholic margarita market worldwide has many of the same difficulties as the non-alcoholic beverage sector. Its competitors, both new and old, are fierce as they fight for a share of the market. The regulatory scrutiny pertaining to safety, labelling, and substances keeps producers alert. Possibly the most difficult obstacle is the erratic customer. To satisfy the need for thrilling new non-alcoholic margarita experiences, there must be continual innovation to keep up with the ever-evolving health trends and palates.

Global Non-Alcoholic Margarita Market Opportunities:

The market for margaritas without alcohol has a promising future. Customers are choosing non-alcoholic margaritas instead of sugary beverages as they adopt better lifestyles. This movement opens the door to guilt-free snacking. Beyond flavour, functional margaritas with vitamins, electrolytes, or botanicals are one option. High-quality ingredients, intriguing flavour combinations, and elegant packaging combine to provide a premium drinking experience; innovation is essential. An additional possibility is the growth of internet sales, which lets customers choose from a greater selection of non-alcoholic margaritas that are delivered straight to their houses.

NON-ALCOHOLIC MARGARITA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Flavour, Functionality, Distribution Channel, Target Audience, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Coca-Cola Company, Nestlé S.A., PepsiCo Inc., Red Bull GmbH |

Global Non-Alcoholic Margarita Market Segmentation: By Flavour

-

Classic Lime

-

Fruity Fusion

-

Spicy Margarita

-

Herbal Infused

Herbal infusions are taking over the non-alcoholic margarita industry; forget traditional lime! There's a reason why this market is the fastest growing. Consumers who are health-conscious and adventurous are looking for novel flavour sensations, and herbal-infused margaritas satisfy their cravings. Consider using mint, basil, or rosemary to create cool takes on the traditional dish. In addition to being sophisticated, these plants may also have sedative or digestive effects. Furthermore, users may discover their ideal flavour combination via limitless experimentation thanks to the diversity of herbs available. Herbal-infused margaritas are a refreshing force to be reckoned with in a market hungry for innovation.

Global Non-Alcoholic Margarita Market Segmentation: By Functionality

-

Hydrating Margaritas

-

Relaxation Focuses

-

Vitamin Fortified

The next generation of non-alcoholic margaritas is loaded with vitamins forget about just being thirst-quenching! The fastest increase is seen in this area as customers who are health-conscious look for beverages that have an extra functional benefit. Targeted advantages, such as immune-supporting Vitamin C or energy-boosting B vitamins, are made possible via vitamin fortification. Vitamin-fortified margaritas top the non-alcoholic beverage industry due to their wide appeal to those looking for a healthy edge in everything from general well-being to post-workout recovery. This opens the door for innovative new products that meet our changing demands.

Global Non-Alcoholic Margarita Market Segmentation: By Distribution Channel

-

Supermarkets and Hypermarkets

-

Convenience Stores

-

Online Retailers

-

Specialty Beverage Stores

Online merchants are the emerging stars in the non-alcoholic margarita sector, taking the largest share and growing at the quickest rate. Convenience is the main driver of this spike in internet purchases. Picture ordering a wide variety of non-alcoholic margaritas from distinctive, tiny producers while lounging on your couch and having them delivered right to your door! Online vendors promise a limitless variety to satisfy your hunger for the ideal non-alcoholic margarita flavour, so forget about the restricted shelf space at traditional stores. Online merchants are in a great position to become the go-to resource for anything related to non-alcoholic margaritas as e-commerce keeps growing.

Global Non-Alcoholic Margarita Market Segmentation: By Target Audience

-

Health-Conscious Consumers

-

Party Mocktails

-

Adventurous Drinkers

Fans of non-alcoholic margaritas, get comfortable adventurous drinkers are at the forefront! This market is the fastest growing since its members demand unusual experiences. These customers desire inventive concoctions that elevate the margarita above the standard; forget about the same old flavours. Consider blood orange rosemary or mango habanero! They value premium products and elegant packaging and are prepared to pay more for it. The non-alcoholic margarita industry is kept lively and interesting by their never-ending search for fresh flavour profiles and creative tweaks. Put simply, daring drinkers are like gastronomic explorers; they push the envelope and guarantee that the world of non-alcoholic margaritas is full of delectable options in the future.

Global Non-Alcoholic Margarita Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the emerging star of non-alcoholic margaritas move over, North America! This area is seeing growing urbanisation, a flourishing economy, and health-conscious customers giving up sugary drinks. All these factors make handy beverages necessary. Considering that the non-alcoholic margarita industry in Asia-Pacific is less developed than in the West, there is ample opportunity for innovation and future expansion in this market.

COVID-19 Impact Analysis on the Global Non-Alcoholic Margarita Market:

The worldwide market for non-alcoholic margaritas has been affected in a mixed way by the COVID-19 epidemic. Although the closing of restaurants, a vital sales channel, may have slowed overall growth, the emphasis on health and replicating restaurant experiences at home may have increased the number of non-alcoholic margaritas consumed at home. It's hard to pinpoint the precise impact due to the absence of precise sales statistics for this specialised sector, but it's possible that COVID-19 gave a little lift.

Recent Trends and Developments in the Global Non-Alcoholic Margarita Market:

Two key developments in the non-alcoholic margarita business are causing a stir throughout the world. First, people are switching from sugary drinks to high-end mocktails. This implies that to offer a more refined drinking experience, non-alcoholic margaritas are receiving a makeover with premium ingredients, intriguing flavour combinations like spicy or fruity twists, and stylish packaging. Second, the method we purchase these beverages is evolving. People are seeking the convenience of accessing a greater range of non-alcoholic products delivered directly to their homes, which has led to a surge in online platforms and direct-to-consumer sales.

Key Players:

-

Coca-Cola Company

-

Nestlé S.A.

-

PepsiCo Inc.

-

Red Bull GmbH

Chapter 1. Non-Alcoholic Margarita Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Non-Alcoholic Margarita Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Non-Alcoholic Margarita Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Non-Alcoholic Margarita Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Non-Alcoholic Margarita Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Non-Alcoholic Margarita Market – By Flavour

6.1 Introduction/Key Findings

6.2 Classic Lime

6.3 Fruity Fusion

6.4 Spicy Margarita

6.5 Herbal Infused

6.6 Y-O-Y Growth trend Analysis By Flavour

6.7 Absolute $ Opportunity Analysis By Flavour, 2024-2030

Chapter 7. Non-Alcoholic Margarita Market – By Functionality

7.1 Introduction/Key Findings

7.2 Hydrating Margaritas

7.3 Relaxation Focuses

7.4 Vitamin Fortified

7.5 Y-O-Y Growth trend Analysis By Functionality

7.6 Absolute $ Opportunity Analysis By Functionality, 2024-2030

Chapter 8. Non-Alcoholic Margarita Market – By Target Audience

8.1 Introduction/Key Findings

8.2 Health-Conscious Consumers

8.3 Party Mocktails

8.4 Adventurous Drinkers

8.5 Y-O-Y Growth trend Analysis By Target Audience

8.6 Absolute $ Opportunity Analysis By Target Audience, 2024-2030

Chapter 9. Non-Alcoholic Margarita Market – By Distribution Channel

9.1 Introduction/Key Findings

9.2 Supermarkets and Hypermarkets

9.3 Convenience Stores

9.4 Online Retailers

9.5 Specialty Beverage Stores

9.6 Y-O-Y Growth trend Analysis By Distribution Channel

9.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 10. Non-Alcoholic Margarita Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Flavour

10.1.3 By Distribution Channel

10.1.4 By Target Audience

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Flavour

10.2.3 By Flavour

10.2.4 By Target Audience

10.2.5 By Distribution Channel

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Flavour

10.3.3 By Flavour

10.3.4 By Target Audience

10.3.5 By Distribution Channel

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Flavour

10.4.3 By Flavour

10.4.4 By Target Audience

10.4.5 By Distribution Channel

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Flavour

10.5.3 By Flavour

10.5.4 By Target Audience

10.5.5 By Distribution Channel

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Non-Alcoholic Margarita Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Coca-Cola Company

11.2 Nestlé S.A.

11.3 PepsiCo Inc.

11.4 Red Bull GmbH

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Non-Alcoholic Margarita Market size is valued at USD 928.2 million in 2023.

The worldwide Global Non-Alcoholic Margarita Market growth is estimated to be 4.5% from 2024 to 2030.

The Global Non-Alcoholic Margarita Market is segmented By Flavour (Classic Lime, Fruity Fusion, Spicy Margarita, Herbal Infused); By Functionality (Hydrating Margaritas, Relaxation Focuses, Vitamin Fortified); By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retailers, Specialty Beverage Stores); By Target Audience (Health-Conscious Consumers, Party Mocktails, Adventurous Drinkers) and by region.

The demand for tasty, refreshing beverages and growing health consciousness are projected to boost the non-alcoholic margarita market globally. Innovative flavour combinations and useful components are being embraced by consumers, which presents exciting prospects for new product creation.

Although it's unclear how the COVID-19 epidemic will affect the non-alcoholic margarita business globally, restaurant closures and health concerns may have encouraged at-home consumption. It's possible that consumers looking for healthier choices helped this niche business flourish in certain ways.