Nitrogen-Based Flame Retardant Market Size (2024 – 2030)

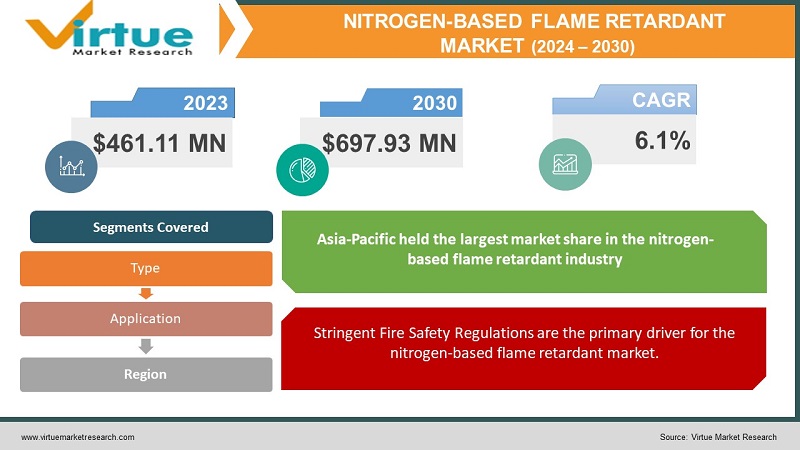

The Global Nitrogen-Based Flame Retardant Market was valued at USD 461.11 million and is projected to reach a market size of USD 697.93 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.1%.

In the realm of fire safety, flame retardants have long been integral to safeguarding a wide range of materials and products used across industries. Over time, nitrogen-based flame retardants have emerged as a prominent choice, celebrated for their exceptional efficacy and environmentally responsible attributes. As industries increasingly prioritize fire safety measures, the demand for nitrogen-based flame retardants has experienced notable growth. This trend is poised to continue, with these eco-friendly solutions expected to play an even more pivotal role in enhancing fire resistance across diverse sectors, ensuring both safety and sustainability in the evolving market landscape.

Key Market Insights:

Regionally, North America has stood out as a major market player, contributing to the market's dominance. The implementation of strict fire safety regulations, particularly in industries like construction, electronics, and automotive, has fuelled the demand for nitrogen-based flame retardants in this region. Furthermore, the Asia-Pacific region is emerging as a significant growth driver, with rapid industrialization and construction activities propelling market expansion.

Looking ahead, the future of the nitrogen-based flame retardant market appears promising. The market is expected to maintain its growth trajectory, with a projected CAGR of 6.1% from 2023 to 2030. As environmental concerns continue to grow, the demand for these eco-friendly flame retardants is set to surge further, especially in emerging markets where fire safety regulations are evolving. Innovation and product development remain essential as the industry aims to enhance the efficiency and cost-effectiveness of nitrogen-based flame retardants to meet evolving industry needs.

Market Drivers:

Stringent Fire Safety Regulations are the primary driver for the nitrogen-based flame retardant market.

Stringent fire safety regulations stand as a pivotal driving force behind the thriving nitrogen-based flame retardant market. Governments and regulatory bodies worldwide have increasingly enforced stringent standards to enhance fire safety across industries, ranging from construction to electronics and automotive. These regulations mandate the use of flame retardants to mitigate fire-related risks. Nitrogen-based flame retardants, known for their efficacy in inhibiting flames and reducing fire hazards, have become a go-to solution for industries looking to comply with these rigorous safety measures. As such regulations continue to evolve and expand, the demand for nitrogen-based flame retardants is expected to persist and grow.

Nitrogen-based flame retardants are preferred for their lower environmental impact thus augmenting the demand.

The preference for nitrogen-based flame retardants is strongly fuelled by their lower environmental impact, setting them apart from traditional halogenated alternatives. With a growing global awareness of environmental concerns and the need for sustainable solutions, industries are increasingly shifting towards eco-friendly flame retardant options. Nitrogen-based flame retardants offer an effective and responsible choice, as they not only enhance fire resistance but also align with sustainability goals. This eco-conscious approach not only drives demand but also positions nitrogen-based flame retardants as a more responsible and forward-looking solution.

The construction industry's growth, especially in emerging economies, is boosting the demand for nitrogen-based flame.

The robust growth of the construction industry, particularly in emerging economies, is a significant catalyst for the rising demand for nitrogen-based flame retardants. In the construction sector, fire safety is a paramount consideration. As emerging markets experience increased urbanization and infrastructure development, the need for fire-resistant materials and coatings in buildings, wiring, insulation, and more has surged. Nitrogen-based flame retardants have become an essential component in meeting these safety requirements, contributing to the industry's growth. As construction activities continue to expand globally, the demand for these flame retardants is expected to remain on an upward trajectory.

Market Challenges:

Some nitrogen-based flame retardants can be relatively expensive than traditional alternatives, posing a challenge to their widespread adoption.

Nitrogen-based flame retardants, while effective and environmentally friendly, can sometimes be more expensive than conventional alternatives. This cost differential poses a significant challenge to their widespread adoption in various industries. Manufacturers and consumers often weigh the benefits of improved fire safety against the higher initial costs, making it crucial for the industry to find ways to reduce production expenses and improve cost-efficiency to enhance the affordability of nitrogen-based flame retardants.

Technological Advancements are required to enhance the efficiency and cost-effectiveness of nitrogen-based flame retardants.

To overcome the cost challenges, continuous technological advancements are necessary to enhance the efficiency and cost-effectiveness of nitrogen-based flame retardants. Research and development efforts should focus on refining production processes, reducing material costs, and improving the performance of these flame retardants. Innovations may also involve developing synergistic combinations with other chemicals or materials to optimize fire protection capabilities while maintaining competitive pricing. Achieving these advancements is essential to encourage broader adoption and make nitrogen-based flame retardants a more attractive choice for various applications.

Market Opportunities:

The growth of construction and manufacturing industries in emerging markets presents significant opportunities for nitrogen-based flame retardants.

The expansion of construction and manufacturing sectors in emerging markets offers promising prospects for nitrogen-based flame retardants. As these economies continue to develop and urbanize, there is a heightened demand for fire safety solutions in buildings, infrastructure, and industrial processes. Nitrogen-based flame retardants, known for their effectiveness and eco-friendliness, can capitalize on this growth by providing essential fire protection measures, thereby creating a substantial market opportunity in these regions.

Investment in research and development to create new formulations of nitrogen-based flame retardants can open doors to new applications and markets.

Investing in research and development efforts to innovate and create novel formulations of nitrogen-based flame retardants holds immense potential. Such endeavors can lead to the discovery of improved, more efficient, and environmentally friendly flame retardant solutions. These new formulations can find applications not only in traditional industries but also in emerging sectors such as electric vehicles, electronics, and renewable energy systems, opening up diverse markets and enhancing the competitiveness of these fire safety products in the global landscape.

NITROGEN-BASED FLAME RETARDANT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Clariant AG, Israel Chemicals Ltd., LANXESS AG, J.M. Huber Corporation, Italmatch Chemicals S.p.A., Nabaltec AG, Albemarle Corporation, Akzo Nobel N.V., Budenheim |

Nitrogen-Based Flame Retardant Market Segmentation: By Type

-

Melamine

-

Dicyandiamide

-

Guanidine Salts

-

Melamine Cyanurate (MCA)

-

Others

In 2022, melamine accounted for the largest share of 48.4% in the nitrogen-based flame retardant market since it has been a staple in the flame retardant industry for many years due to its excellent fire-suppressing properties and versatility. Melamine-based flame retardants are commonly used in a wide range of applications, including textiles, plastics, and coatings. Their popularity is bolstered by their cost-effectiveness and well-established regulatory approvals across various industries.

Moreover, Dicyandiamide is the fastest-growing segment with a CAGR of 4.1% under nitrogen-based flame retardants. Dicyandiamide-based flame retardants are gaining traction due to their low toxicity, high efficiency in fire prevention, and compatibility with various materials. The demand for eco-friendly and sustainable flame retardant solutions has driven the growth of dicyandiamide-based products. As industries increasingly prioritize environmental concerns and stringent fire safety standards, dicyandiamide flame retardants have seen a surge in adoption, making them the fastest-growing segment in the market.

Nitrogen-Based Flame Retardant Market Segmentation: By Application

-

Building and Construction

-

Electronics and Appliances

-

Transportation

-

Wire & Cable

-

Textile

-

Others

In 2022, Building and Construction held the largest market share in nitrogen-based flame retardants. This dominance is driven by the stringent fire safety regulations in the construction industry, which mandate the use of effective flame retardants in building materials. Flame retardants are extensively used in insulation, flooring, roofing, and other construction materials to enhance fire resistance. Also, the global construction industry is experiencing steady growth, contributing to the sustained demand for flame retardants in this sector.

Moreover, Electronics and Appliances represent the fastest-growing segment in the nitrogen-based flame retardant market. The rapid proliferation of electronics, including smartphones, laptops, and consumer appliances, has led to an increased need for fire safety measures in these products. With the constant evolution of technology and the miniaturization of electronic components, the demand for efficient and compact flame retardants has surged. This trend is expected to continue as the electronics and appliances industry continues to innovate and expand. The integration of flame retardants in electronic circuit boards and components is a critical safety measure, contributing to the remarkable growth of this segment.

Nitrogen-Based Flame Retardant Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, Asia-Pacific held the largest market share in the nitrogen-based flame retardant industry. Asia-Pacific's dominance can be attributed to the region's robust manufacturing sector, rapid urbanization, and increasing awareness of fire safety standards in construction and electronics. China, in particular, is a major contributor to this market, both in terms of production and consumption of nitrogen-based flame retardants.

Moreover, Asia-Pacific is also the fastest-growing region in the nitrogen-based flame retardant market. With a high compound annual growth rate (CAGR) of 5.8%, this region has been witnessing significant demand due to the flourishing manufacturing, construction, and electronics sectors, this growth was driven by the region's economic expansion, infrastructure development, and increasing regulatory emphasis on fire safety.

COVID-19 Impact Analysis on the Global Nitrogen-Based Flame Retardant Market:

The COVID-19 pandemic significantly impacted the global nitrogen-based flame retardant market. During the initial phases of the pandemic, disruptions in supply chains, labor shortages, and reduced manufacturing capacities led to a temporary slowdown in production. The construction and manufacturing sectors, which are key consumers of flame retardants, experienced a contraction due to lockdowns and restrictions. However, as safety measures were implemented and economic activities gradually resumed, the market witnessed a resurgence. The pandemic highlighted the importance of fire safety in various industries, leading to increased awareness and adoption of flame retardant solutions. Additionally, the accelerated shift towards remote work and increased demand for electronic devices further fuelled the market. Overall, while the pandemic initially posed challenges, the resilience of the nitrogen-based flame retardant market demonstrated its crucial role in ensuring safety across diverse industries.

Latest Trends/ Developments:

In recent years, there has been a notable shift toward sustainable and eco-friendly flame retardant solutions. Manufacturers are increasingly developing nitrogen-based flame retardants with reduced environmental impact. This trend aligns with stricter regulations and growing consumer preferences for sustainable products. For instance, phosphorus-based nitrogen flame retardants have gained popularity due to their lower toxicity and reduced environmental footprint. As environmental concerns continue to rise, the adoption of such sustainable flame retardants is expected to grow significantly.

The integration of smart technologies and IoT (Internet of Things) capabilities into flame-retardant materials is another emerging trend. These smart flame retardants can provide real-time data on fire risks, enabling proactive fire prevention measures. For instance, sensors embedded in flame-resistant materials can detect temperature changes or smoke and trigger automated responses like fire suppression systems. This innovative approach enhances fire safety measures, particularly in critical applications like aerospace, where early detection and rapid response are crucial.

The nitrogen-based flame retardant market, like many industries, has been affected by global supply chain disruptions. The COVID-19 pandemic exposed vulnerabilities in supply chains, leading to shortages of key raw materials and disruptions in production. These challenges have prompted manufacturers to diversify their supplier base and invest in building more resilient supply chains. Additionally, geopolitical factors and trade tensions have contributed to supply chain uncertainties, underscoring the need for adaptability and strategic planning within the industry.

Key Players:

-

BASF SE

-

Clariant AG

-

Israel Chemicals Ltd.

-

LANXESS AG

-

J.M. Huber Corporation

-

Italmatch Chemicals S.p.A.

-

Nabaltec AG

-

Albemarle Corporation

-

Akzo Nobel N.V.

-

Budenheim

In April 2022, BASF expanded its polyphthalamide (PPA) portfolio by introducing new flame retardant grades that offer high thermal stability, excellent electrical insulation, and low water uptake. These non-halogenated PPAs prevent corrosion and failure of electrical components in moist conditions while allowing for better colorability. The materials are suitable for applications like connectors in vehicles, appliances, consumer electronics, and e-mobility parts. The PPA portfolio includes products with electrical relative thermal index (RTI) values above 140°C and meets market standards for flame resistance.

Chapter 1. Nitrogen-Based Flame Retardant Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Nitrogen-Based Flame Retardant Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Nitrogen-Based Flame Retardant Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Nitrogen-Based Flame Retardant Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Nitrogen-Based Flame Retardant Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Nitrogen-Based Flame Retardant Market– By Type

6.1 Introduction/Key Findings

6.2 Melamine

6.3 Dicyandiamide

6.4 Guanidine Salts

6.5 Melamine Cyanurate (MCA)

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis by By Type, 2024-2030

Chapter 7. Nitrogen-Based Flame Retardant Market– By Application

7.1 Introduction/Key Findings

7.2 Building and Construction

7.3 Electronics and Appliances

7.4 Transportation

7.5 Wire & Cable

7.6 Textile

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Nitrogen-Based Flame Retardant Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By APPLICATION

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By APPLICATION

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By APPLICATION

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By APPLICATION

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By APPLICATION

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Nitrogen-Based Flame Retardant Market– Company Profiles – (Overview, Nitrogen-Based Flame Retardant Market Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 Clariant AG

9.3 Israel Chemicals Ltd.

9.4 LANXESS AG

9.5 J.M. Huber Corporation

9.6 Italmatch Chemicals S.p.A.

9.7 Nabaltec AG

9.8 Albemarle Corporation

9.9 Akzo Nobel N.V.

9.10 Budenheim

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Nitrogen-Based Flame Retardant Market was valued at USD 461.11 million and is projected to reach a market size of USD 697.93 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.1%.

Multiple industries are contributing to the growth of the RaaS market, with manufacturing being a key driver. Robots are used in manufacturing for tasks like assembly and quality control, improving operational efficiency. Additionally, healthcare is another major contributor, employing robots in surgeries and patient care to enhance precision and safety.

In 2022, North America held the largest market share, primarily driven by high adoption rates in manufacturing and healthcare. However, the Asia-Pacific region, particularly countries like China and Japan, is expected to witness the fastest growth due to its rapidly expanding economy and increasing demand for automation.

The growth of the RaaS market is propelled by several factors, including cost-effective robotic solutions, scalability through subscription-based models, and the improved operational efficiency offered by robots, resulting in reduced errors and increased productivity.

The RaaS market presents opportunities in healthcare, where precision and efficiency are essential, and in the construction industry, which is undergoing automation transformation. Furthermore, global expansion into emerging markets with a growing demand for automation is a promising avenue for RaaS providers.