Nisin Market Size (2025 – 2030)

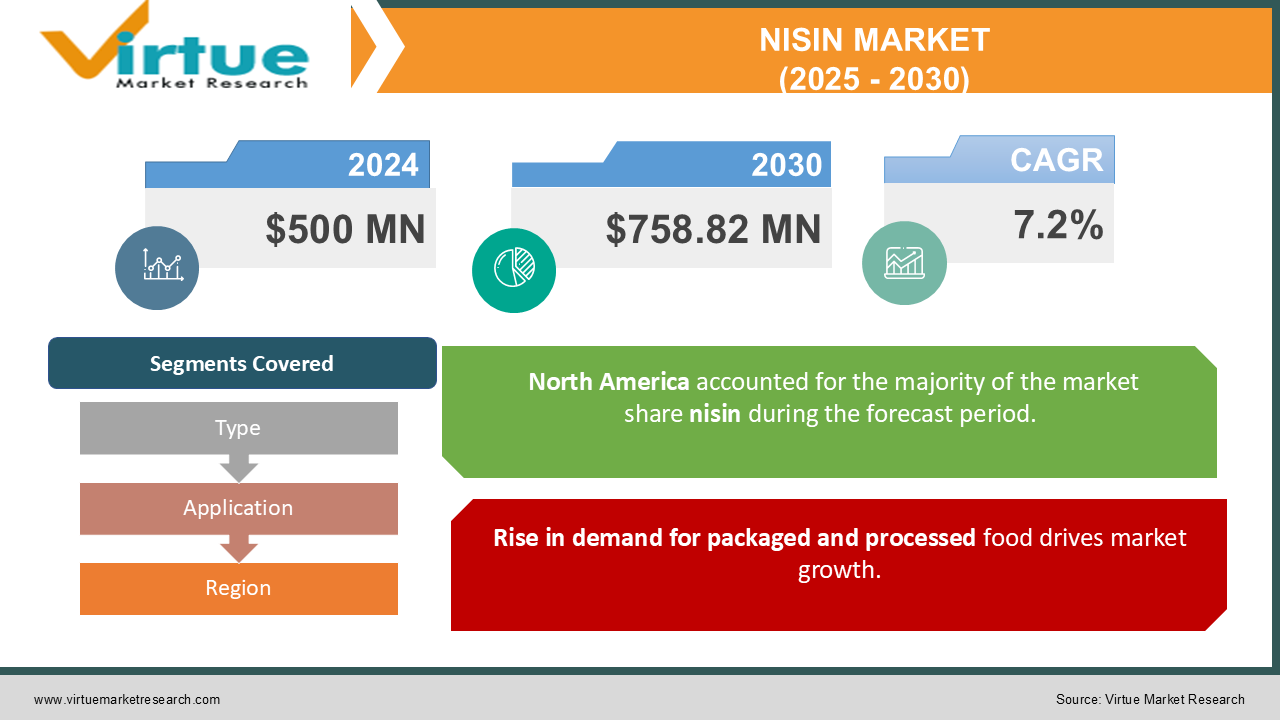

The Nisin Market was valued at USD 500 million in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 758.82 million by 2030, growing at a CAGR of 7.2%.

Nisin is a bactericidal food preservative, classified as a polycyclic peptide, derived from the bacterium Lactococcus lactis. It is known for its effectiveness against various food-spoiling, gram-positive bacteria, including Bacillus subtilis, Staphylococcus aureus, Listeria, Clostridium botulinum, and their respective spores. Nisin eliminates the need for heat sterilization in packaged food products, as it can effectively control microbial growth in both regular and frozen conditions. When consumed, Lactococcus lactis is broken down into amino acids by the protease enzymes in the human digestive system. As a natural antimicrobial agent, nisin has been extensively researched for its applications in preserving food, particularly in dairy products. Nisin has found widespread use in a variety of processed foods, including cured meats, dairy items, plant-based protein foods, canned goods, and foods that are heat-treated or sealed in air-tight packaging.

Key Market Insights:

- As awareness of the negative effects of chemical preservatives rises, the demand for natural preservatives like nisin has seen significant growth. Nisin is effective in controlling a broad spectrum of microbes and can be conveniently applied to food products during the packaging process. The expansion of the canned food industry has further fueled the demand for nisin, particularly for its ability to control Clostridium botulinum, a major concern in canned food safety.

- The increasing use of nisin as a natural preservative to protect a variety of food items, including canned goods, baked products, meats, poultry, and dairy, is a key driver of the growth of the global nisin market. Additionally, rising consumer preference for natural food preservatives, along with a higher consumption of packaged, pre-processed, and frozen foods, is expected to contribute to strong demand for nisin in the coming years.

- Nisin has proven to be an effective preservative for temperature-sensitive foods, such as dairy and frozen items, due to its safety and efficacy. Its inclusion in food products eliminates the need for heat sterilization, making it a popular choice among manufacturers looking to extend product shelf life. This trend is anticipated to drive the continued growth of nisin sales in the forecast period.

- Nisin Market Drivers:

Rise in demand for packaged and processed food drives market growth.

The increasing popularity of these food products, coupled with higher disposable incomes, is creating a favorable environment for the expansion of the market. Additionally, growing concerns about the negative health impacts of chemical preservatives are encouraging a shift towards natural alternatives, further boosting the demand for natural preservatives like nisin. As a highly effective and safe natural preservative, nisin is gaining significant traction across various food industries, contributing to its growing demand in the market.

Increase in the standard of living increases the demand of the market.

The increase in disposable income is driving a demand for higher living standards, which in turn is fueling the need for convenient, nutritious, and high-quality food options. This trend is further amplified by urbanization, a growing working population, and the fast-paced lifestyles of individuals who have limited time for home-cooked meals. Products such as instant noodles, frozen meals, packaged snacks, dairy items, soft drinks, energy drinks, and baked goods have become essential parts of daily life.

As the consumption of processed and packaged foods continues to rise, the demand for food preservatives like nisin is also expected to grow. These foods often contain various additives and preservatives to extend shelf life, preserve quality, and prevent spoilage caused by microorganisms. Nisin, being a highly effective natural preservative, plays a significant role in meeting these needs, contributing to the growing demand for food preservation solutions in the food and beverage sector.

Nisin Market Restraints and Challenges:

Alternative preservation techniques can hinder market growth.

Alternative preservation methods are becoming increasingly important in reducing dependence on nisin as a food preservative. Techniques such as high-pressure processing, pulsed electric fields, and ultraviolet light treatment effectively control microbial growth without the use of antimicrobial peptides. Additionally, using fermentation with cultures other than Lactococcus lactis can naturally extend the shelf life of foods, while also enhancing their flavor profiles and nutritional content. By adopting these innovative preservation methods, food safety and quality can be maintained, while lessening the reliance on nisin and encouraging more sustainable and diverse approaches to food preservation.

In the brewing industry, the adoption of alternative preservation techniques could greatly improve both product quality and sustainability. High-pressure processing could extend the shelf life of beer while preserving its taste and aroma, offering a natural alternative to traditional chemical preservatives. Pulsed electric fields and ultraviolet light treatment could provide non-thermal pasteurization, ensuring microbial safety without compromising sensory characteristics. Moreover, exploring fermentation with different cultures could introduce unique flavors and potential health benefits to beers. These innovative approaches could reduce the industry's reliance on conventional preservatives like nisin, aligning with consumer demand for naturally preserved, flavorful, and healthier beer options.

Nisin Market Opportunities:

Growing Inclination Toward Clean Label Products creates opportunities in the market.

The growing consumer awareness of the health benefits associated with products containing natural ingredients, coupled with strong backing from multinational ingredient manufacturers for the development of such products, is driving the demand for clean label ingredients. As a result, the need for natural food preservatives that help extend the shelf life of products, such as nisin, is also on the rise. Additionally, consumer purchasing decisions are increasingly influenced by the ingredients listed on product labels, which is encouraging the use of nisin as a preferred food preservative. Nisin is also recognized for its unique properties as a bacteriocin, particularly in its ability to combat dental caries. The absence of viable substitutes for nisin in the market further contributes to the growth of its demand. As a highly effective and natural preservative, nisin's continued relevance and lack of direct alternatives position it as a key player in the evolving food preservation landscape.

NISIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DSM, DuPont Galactic, Shandong Freda Biotechnology , Cayman Chemicals, Zhejiang Silver-Elephant Bioengineering , Siveele B.V., Chihon Biotechnology , Mayasan Biotech, Handary S.A. |

Nisin Market Segmentation: By Type

-

Powder

-

Liquid

Powdered nisin is increasingly being used in a variety of processed foods, including cheese, bakery products, flavored milk, canned goods, and dairy items. The growing production and consumption of these food products is expected to drive a significant demand for powdered nisin over the forecast period.

However, the liquid form of nisin is also experiencing substantial growth, primarily due to its ease of application compared to the powdered form. Since nisin is typically added in small doses, around 20-25 ppm, it is more challenging to accurately measure such small quantities in powder form. The liquid version offers greater precision and convenience, making it a preferred choice in many food processing applications.

Nisin Market Segmentation: By Application

-

Food & Beverages

-

Meat and Poultry Products

-

Dairy Products

-

Beverages

-

Canned Products

-

Others

-

Pharmaceuticals

-

Cosmetics & Personal Care

Dairy products hold a dominant share in the market for nisin usage. Nisin is widely recognized as a natural preservative due to its strong antimicrobial properties against spoilage organisms and pathogens, especially Gram-positive bacteria. Its application helps prevent the growth of harmful bacteria without altering the taste, aroma, or nutritional value of the products. Additionally, nisin’s use aligns with the increasing consumer preference for clean-label ingredients and natural preservation methods.

Nisin is also highly beneficial in the meat, poultry, and seafood industries, where it serves as a natural preservative that protects against spoilage and pathogenic bacteria, particularly Gram-positive ones. Its effectiveness in prolonging the shelf life of these products ensures that they remain fresh and safe for consumption for a longer period. By using nisin, producers in these sectors can maintain the quality and safety of their products, responding to the growing consumer demand for natural, clean-label ingredients. This not only enhances the marketability of the products but also supports public health by reducing the risk of foodborne illnesses.

Nisin Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America holds the largest share of the global nisin market, driven by the significant demand for packaged and pre-prepared food products, which fuels the need for natural preservatives. Additionally, factors such as high disposable income and the adoption of fast-paced lifestyles indirectly contribute to the growth of the nisin market in this region, as consumers increasingly seek convenient, long-lasting food options.

Europe ranks as the second-largest market, with growing demand for natural and healthy preservatives driving the adoption of nisin. The rising consumption of dairy products, frozen foods, and canned goods is expected to further support market growth in the region.

The Asia-Pacific region is the fastest-growing market segment, driven by a rapidly expanding food processing industry. Increasing awareness about the benefits of natural preservatives, coupled with rising disposable incomes and a large population base, are key factors contributing to the region's strong market growth.

In contrast, the Latin American, Middle Eastern, and African markets are expected to grow at a more moderate pace over the forecast period, as these regions gradually adopt natural food preservation solutions in response to changing consumer preferences and increasing food safety standards.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic significantly impacted the global nisin market. The closure of packaged food production facilities, aimed at controlling the virus's spread, led to a sharp decline in the demand for preservatives like nisin. Although the demand for packaged products increased during the pandemic, the supply was unable to meet this rise due to disruptions in production and logistics. Restrictions on the movement of goods and transportation services further strained the supply chain, hindering the global availability of nisin. Additionally, stringent regulations on laboratory operations slowed down nisin production. The downturn in the tourism and hospitality sectors also had an indirect negative effect on the market. However, the market has shown signs of rapid recovery as restrictions have been eased, and it is expected to surpass pre-pandemic growth rates in the near future.

Latest Trends/ Developments:

In January 2022, DSM introduced a new integrated Food & Beverage business group designed to offer a comprehensive range of solutions focused on taste, texture, and health to a wide variety of end users.

Key Players:

These are top 10 players in the Nisin Market :-

-

DSM

-

DuPont Galactic

-

Shandong Freda Biotechnology

-

Cayman Chemicals

-

Zhejiang Silver-Elephant Bioengineering

-

Siveele B.V.

-

Chihon Biotechnology

-

Mayasan Biotech

-

Handary S.A.

Chapter 1. Nisin Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Nisin Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Nisin Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Nisin Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Nisin Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Nisin Market – By Type

6.1 Introduction/Key Findings

6.2 Powder

6.3 Liquid

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Nisin Market – By Application

7.1 Introduction/Key Findings

7.2 Food & Beverages

7.3 Meat and Poultry Products

7.4 Dairy Products

7.5 Beverages

7.6 Canned Products

7.7 Others

7.8 Pharmaceuticals

7.9 Cosmetics & Personal Care

7.10 Y-O-Y Growth trend Analysis By Application

7.11 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Nisin Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Nisin Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 DSM

9.2 DuPont

9.3 Galactic

9.4 Shandong Freda Biotechnology

9.5 Cayman Chemicals

9.6 Zhejiang Silver-Elephant Bioengineering

9.7 Siveele B.V.

9.8 Chihon Biotechnology

9.9 Mayasan Biotech

9.10 Handary S.A.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The increasing use of nisin as a natural preservative to protect a variety of food items, including canned goods, baked products, meats, poultry, and dairy, is a key driver of the growth of the global nisin market.

The top players operating in the Nisin Market are - Galactic, Shandong Freda Biotechnology, Cayman Chemicals, Zhejiang Silver-Elephant Bioengineering and Siveele B.V.

The COVID-19 pandemic significantly impacted the global nisin market. The closure of packaged food production facilities, aimed at controlling the virus's spread, led to a sharp decline in the demand for preservatives like nisin.

In January 2022, DSM introduced a new integrated Food & Beverage business group designed to offer a comprehensive range of solutions focused on taste, texture, and health to a wide variety of end users.

The Asia-Pacific region is the fastest-growing region in the Nisin Market.