GLOBAL NICKEL ALLOYS MARKET (2024 - 2030)

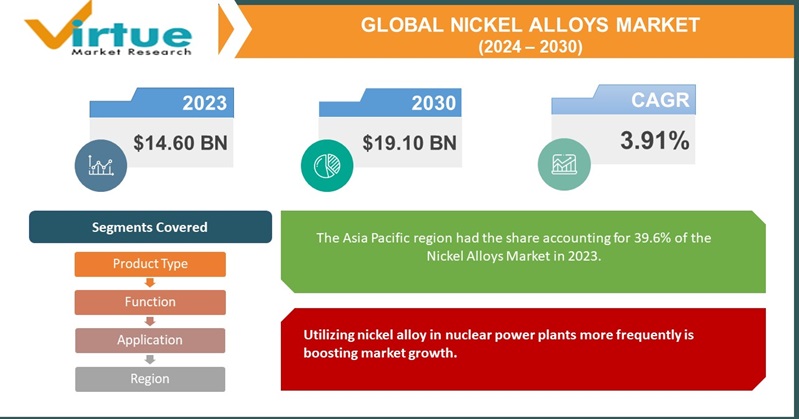

The Global Nickel Alloys Market was valued at USD 14.60 billion and is projected to reach a market size of USD 19.10 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.91%.

The market, for Nickel Alloys has seen growth recently thanks to factors such as the expansion of aerospace and power generation industries and the increasing demand for high-performance materials. Nickel Alloys have strength, resistance to corrosion, creep, and thermal stability, which makes them highly suitable for critical applications in industries like aerospace, power generation, and automotive. With advancements in metallurgy and manufacturing techniques, there are growth opportunities for nickel alloys in the market. In terms of dominance, the Asia Pacific region holds the share in the global nickel alloys market with around one-third of the market share. The region’s abundant mineral reserves and rapid growth in end-user verticals like automotive and aerospace contribute to this dominance. The Asia Pacific region has witnessed trends and increased participation in the nickel alloy industry due to expanding power requirements and generation. This dominance is primarily driven by their utilization in sectors such, as automotive and aerospace.

Key Market Insights:

Nickel alloys typically consist of 72-83% of materials, with strong magnetic properties. These alloys find application in transformers, inductors, and electrical amplifiers well as, for electrical shielding and memory storage systems.

In December 2022 the China Association of Automobile Manufacturing (CAAM) reported a 96.9% year-on-year growth in the production of electric vehicles (NEVs) in China. As a result, it is anticipated that the rising popularity of vehicles will lead to an increased demand for nickel alloys, in the market.

In 2021 the US airline industry saw a boost, in passenger fare revenue reaching a total of 86.7 billion dollars, which was an increase of nearly 73.7% compared to the previous year. This surge in revenue further reinforces the growing demand, for nickel alloys.

As per the Federal Aviation Administration (FAA), the number of aircraft in the aviation fleet in the United States reached a total of 204,405 in 2021. This substantial growth has consequently driven up the need, for nickel alloys.

Nickel Alloys Market Drivers:

Utilizing nickel alloy in nuclear power plants more frequently is boosting market growth.

Nickel-based alloys that are resistant, to corrosion and heat play a role in ensuring the durability, integrity, and long-term performance of nuclear power plants. These alloys are used in systems within the reactor vessel, including heat transfer and cooling systems. Additionally, Hastelloy is employed to withstand salts used as fuel and coolant in the stages of developing molten salt nuclear reactors for propulsion and power generation. In both fossil-fired power plants, several heat transfer processes are utilized to generate energy, such as steam engines, heat exchangers, coolers, condensers, reservoirs, pipework, valves, and fittings. For these applications, copper-nickel alloys are particularly suitable. Nickel-based alloys have also found use, in cooling water systems that employ seawater as process water or where corrosion is a significant concern. Moreover, these alloys are commonly utilized in waste storage containers and glove boxes alongside heat exchangers and other transportation equipment.

Growing demand from the aviation sector is driving market sales.

Nickel alloys find use in the aerospace sector for engine production. The remarkable properties of Nickel Alloy make it a preferred choice, over materials like steel and stainless steel enabling the production of aircraft engine components. Specifically, Inconel alloy, a type of nickel alloy is extensively employed in turbine engines due to its strength retention and resistance to corrosion at extremely high temperatures. The utilization of Inconel alloy in aerospace manufacturing not only reduces the weight of the aircraft but also enhances fuel efficiency. As air travel continues to witness a surge in passenger numbers the global aerospace industry is experiencing growth. Airlines are introducing aircraft models to expand their operations and cater to the increasing demand for air transport. This rising demand is expected to drive growth for companies involved in supplying aerospace components to aviation manufacturers. As per data, from the International Civil Aviation Organization major global manufacturers produced 1606 aircraft in 2018.

Nickel Alloys Market Restraints and Challenges:

10 20% of the population today has an allergy, to nickel. Allergic reactions are the health risks associated with nickel exposure. Prolonged contact between nickel and the skin can result in skin reactions, such as eczema or dermatitis appearing as a rash at the point of contact. Some individuals may develop asthma due to inhaling nickel particles. Whether it’s through breathing dust drinking water consuming food or smoking tobacco humans may unintentionally consume amounts of nickel into their bodies. Nickel particles can irritate the lungs. Potentially cause pneumonitis. Long-term exposure, to nickel poses health hazards including bronchitis, reduced lung function, and an increased risk of lung and nasal sinus cancer.

Nickel Alloys Market Opportunities:

The Unique Characteristics of Nickel Alloys Expand Their Use in Exploration for Oil and Gas.

The growth and advancements, in industries, are driving the demand for nickel alloys that are both high-performance and resistant to corrosion. For instance, in the aerospace sector as aircraft sizes continue to increase and performance requirements become more demanding there are expanding opportunities for the utilization of nickel alloys. As new aircraft models undergo testing and production the demand for quality high-performance nickel alloys also grows. Additionally, with increased investments in defense, the use of nickel alloys is experiencing growth due to additional funding. In fact, according to a report, it is projected that by 2026 the aerospace and defense sector alone will reach a market value of $6.66 billion (USD). Similarly, the oil and gas industry is expected to witness an increase in its usage of nickel alloys, throughout the forecast period mentioned in the report.

At Corrotherm International we understand the significance of monitoring forecasts and trends. It allows us to effectively supply products to meet the demand while adapting to industry changes and growth. With our teams spread across parts of the world, we are, in a position to address the rising global need, for top-quality nickel alloys.

NICKEL ALLOYS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.91% |

|

Segments Covered |

By Product Type, Function, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

HAYNES INTERNATIONAL, Aperam S.A. Alloys International, Inc., Sandvik AB, VDM Metals, Rolled Alloys Inc. , Voestalpine AG Allegheny Technologies Incorporated CarpenterTechnologyCorporation, Precision Castparts Corporation |

Nickel Alloys Market Segmentation:

Market Segmentation: By Product Type:

- Nickel-Chromium-Cobalt

- Nickel-Copper

- Nickel-Silicon

- Nickel-Chromium

- Nickel-Chromium-Iron

- Nickel-Molybdenum & Nickel-Chromium-Molybdenum

- Others

In 2023 the Nickel Copper Alloy segment dominated the Nickel Alloys Market. These alloys are popular, for their qualities such as strength, excellent resistance, to corrosion, flexibility, and a low-temperature coefficient of resistance. They find applications in industries. The increasing use of Nickel Copper Alloy in manufacturing cooling circuits, ammunition, corrosion assemblies for seawater, and condenser tubes is expected to drive market demand over the coming years. The nickel silicon segment is experiencing growth with a CAGR of 5%. This growth is attributed to the growing demand for high-temperature alloys, in the aerospace industry.

Market Segmentation: By Function:

- Corrosion Resistant

- Heat Resistant

- Electronic Alloy

- High Performance

The Corrosion Resistance category had the market share, in the Nickel Alloys Market in 2023. The marine industry focuses on producing Nickel Alloy piping that's resistant to barnacles making it ideal for seawater applications. Nickel Copper Alloys are known for their resistance to corrosion making them reliable for seawater desalination, water systems, and firefighting systems. By incorporating Copper Nickel Alloys in products like valves, pumps, fittings, and ship hull sheathing they can maintain corrosion resistance even in challenging environments. The electronic alloys segment is experiencing growth with an annual growth rate (CAGR) of approximately 6%. This surge is driven by the rising demand for high-performance alloys, in the electronics industry.

Market Segmentation: By Application:

- Aerospace & Defense

- Chemical

- Oil & Gas

- Electrical & Electronics

- Automotive

- Energy & Power

- Others

The aerospace and defense industry is predicted to have the market share, for nickel alloys in the coming years. This is due to the increasing number of air travelers in emerging countries like Asia Pacific and the Middle East, which leads to a demand for aircraft. As a result, this segment experiences growth. Additionally, the automotive sector is expected to be one of the growing markets for nickel alloys during the forecast period. In this industry, nickel alloys are commonly used due to their resistance, against corrosion and their appealing visual appearance when polished, such as car trims.

Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

The Asia Pacific region had the share accounting for 39.6% of the Nickel Alloys Market in 2023. There are factors contributing to the increased demand, for nickel alloys in this region. One is the growth in production within the manufacturing sector, which is driven by the need to meet transportation requirements for high-quality goods and increasing exports from the country. Additionally, China and India are expected to experience market growth due to their rising populations and growing consumer preferences for products. The market is also expected to benefit from increased passenger traffic, which will drive demand for materials in the coming years. In North America nickel alloys have maintained a market presence. Continue to grow. While the chemical industry is emerging as a player, end-use industries such as automotive, electronics, aerospace, and defense are also experiencing consistent growth year, after year.

COVID-19 Impact Analysis on the Global Nickel Alloys Market:

The COVID-19 pandemic that emerged in part of 2020 has had an impact, on various industries worldwide and the market for nickel alloys is no exception. Nickel alloys, renowned for their resistance to corrosion and high strength at temperatures are widely used in sectors such as aerospace, automotive, oil and gas, and chemical processing. As a result of the downturn caused by the pandemic, there has been a fluctuation in the demand for nickel alloys across industries. The aerospace sector, which is a consumer of nickel alloys has experienced a decline due to reduced air travel and aircraft production.

According to data provided by the International Air Transport Association (IATA) global air passenger traffic plummeted by 65.9% in 2020 compared to the year. This decrease in air travel has directly impacted aircraft orders as well as maintenance and repair activities leading to reduced demand, for nickel alloys. The automotive sector also experienced a drop, in both vehicle manufacturing and sales which had an impact on the demand for nickel alloys that are commonly used in engine parts and exhaust systems. However, the ability of the nickel alloys industry to bounce back and adjust will be essential, in overcoming the difficulties caused by the pandemic and shaping its development.

Latest Trends/ Developments:

During the projected timeframe it is expected that nickel alloys will continue to have a presence, in the aerospace sector. The aircraft industry has a demand for these alloys because they possess resistance against high temperatures, pressure, and corrosion. This makes them crucial in the manufacturing of aviation machinery. As the number of air travelers increases in emerging countries there is a growing need for aircraft, which further drives the demand, for nickel alloys and consequently contributes to market growth.

Key Players:

- HAYNES INTERNATIONAL

- Aperam S.A.

- Alloys International, Inc.

- Sandvik AB

- VDM Metals

- Rolled Alloys Inc.

- Voestalpine AG

- Allegheny Technologies Incorporated

- Carpenter Technology Corporation

- Precision Castparts Corporation

In September 2022 Proterial Ltd., formerly known as Hitachi Metals, Ltd. In Japan introduced a nickel-based alloy powder called ADMUSTER C21P, for metal Additive Manufacturing. This groundbreaking development enables the production of shapes that exhibit strength and resistance to corrosion. The ADMUSTER series, which includes this alloy is renowned for its capability to create products with corrosion resistance surpassing that of 316L steel by, over 100 times.

April 2022 marks another milestone for Sandvik as they introduce the performing nickel alloy, Sanicro 625 bar (UNS 06625) to their expanding collection. This specific bar is designed to be used in the machining of components that are exposed to challenging conditions such, as acids, alkalis, seawater, and other corrosive elements. It can withstand both environments and temperatures reaching, up to 593°C (1100°F).

Chapter 1. Global Nickel Alloys Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Nickel Alloys Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Global Nickel Alloys Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Nickel Alloys Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Nickel Alloys Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Nickel Alloys Market – By Product Type

6.1. Nickel-Chromium-Cobalt

6.2. Nickel-Copper

6.3. Nickel-Silicon

6.4. Nickel-Chromium

6.5. Nickel-Chromium-Iron

6.6. Nickel-Molybdenum & Nickel-Chromium-Molybdenum

6.7. Others

Chapter 7. Global Nickel Alloys Market – By Function

7.1. Corrosion Resistant

7.2. Heat Resistant

7.3. Electronic Alloy

7.4. High Performance

Chapter 8. Global Nickel Alloys Market – By Application

8.1. Aerospace & Defense

8.2. Chemical

8.3. Oil & Gas

8.4. Electrical & Electronics

8.5. Automotive

8.6. Energy & Power

8.7. Others

Chapter 9. Global Nickel Alloys Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Product Type

9.1.3. By Function

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Product Type

9.2.3. By Function

9.2.4. By Application

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By Product Type

9.3.3. By Function

9.3.4. By Application

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By Product Type

9.4.3. By Function

9.4.4. By Application

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By Product Type

9.5.3. By Function

9.5.4. By Application

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Global Nickel Alloys Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. HAYNES INTERNATIONAL

10.2. Aperam S.A.

10.3. Alloys International, Inc.

10.4. Sandvik AB

10.5. VDM Metals

10.6. Rolled Alloys Inc.

10.7. Voestalpine AG

10.8. Allegheny Technologies Incorporated

10.9. Carpenter Technology Corporation

10.10. Precision Castparts Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Nickel Alloys Market was valued at USD 14.60 billion and is projected to reach a market size of USD 19.10 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.91%.

Utilizing nickel alloy in nuclear power plants more frequently and Growing demand from the aviation sector.

Based on Function, the Global Nickel Alloys Market is segmented by Corrosion Resistant, Heat Resistant, Electronic Alloy, and High Performance.

Asia Pacific is the most dominant region for the Global Nickel Alloys Market.

HAYNES INTERNATIONAL, Alloys International, Inc., Sandvik AB, VDM Metals, and Aperam S.A. are the key players operating in the Global Nickel alloy market.