NGS Diagnostics For Rare Diseases Market Size (2024 – 2030)

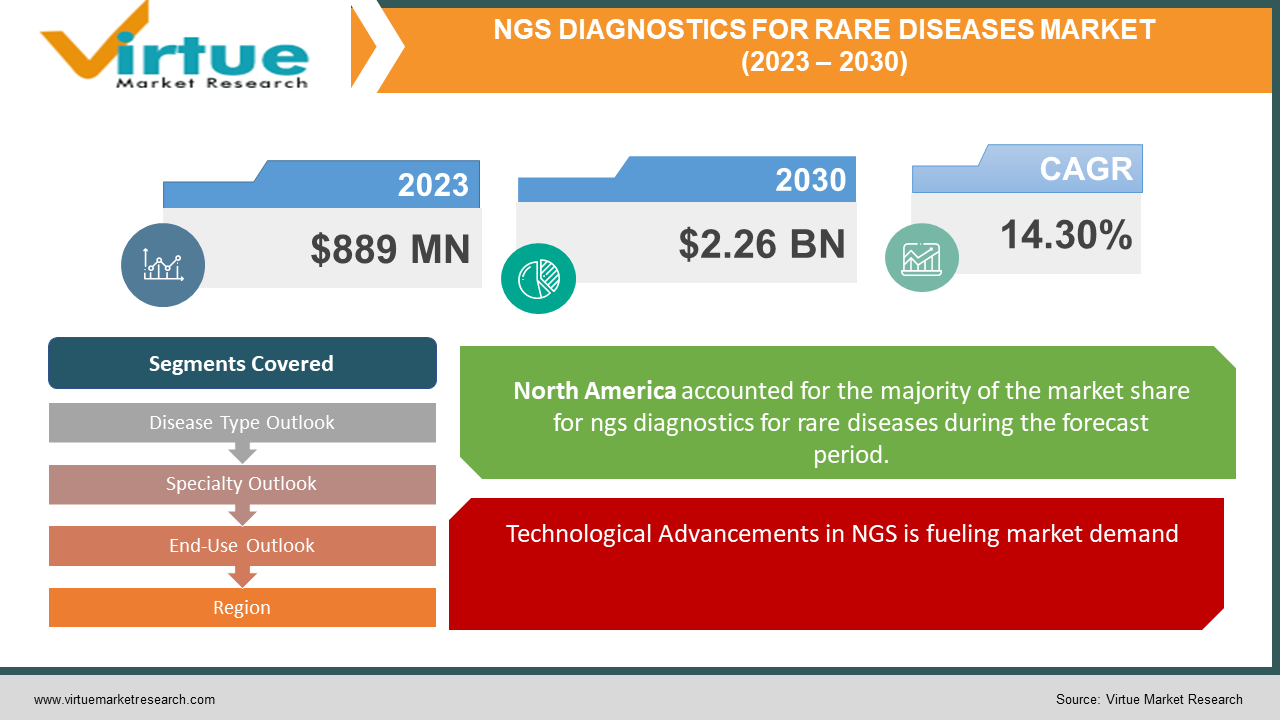

The Global NGS Diagnostics For Rare Diseases Market was valued at USD 889 million in 2023 and is projected to reach a market size of USD 2.26 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 14.30%.

The Global NGS Diagnostics for Rare Diseases Market exhibits a robust landscape driven by key factors such as continuous technological advancements in Next-Generation Sequencing (NGS) technologies, cost reduction in sequencing, and escalating demand for early and rapid diagnosis, particularly heightened by the challenges of the COVID-19 pandemic. The market faces challenges related to diagnostic uncertainties and disruptions in clinical trials, alongside complexities in disease management with NGS specialties. The segmentation emphasizes dominant forces in the Endocrine & Metabolism Diseases segment, with Molecular Genetic Tests leading the diagnostics landscape. North America leads regionally, while Asia Pacific emerges as the fastest-growing region. The market showcases resilience through ongoing technological advancements, strategic initiatives, and collaborations. Key players like Quest Diagnostics Inc. and Centogene N.V. play pivotal roles, marking strategic acquisitions and reflecting the industry's dynamic evolution.

Key Market Insights:

The Global NGS Diagnostics for Rare Diseases Market is significantly influenced by key drivers, including continuous technological advancements in Next-Generation Sequencing (NGS) technologies, leading to improved genomic profiling precision and enhanced diagnostic capabilities. The reduction in sequencing costs has transformed genetic testing accessibility, ensuring financial viability for a broader patient demographic. The heightened demand for early and rapid diagnosis, exacerbated by the challenges of the COVID-19 pandemic, positions NGS as a vital tool in addressing urgent healthcare needs. Additionally, the essential role of translational research and genomic technologies contributes to diagnostic workflow advancement and the identification of novel disease-associated genes. Despite the promising landscape, the market faces challenges, particularly in the uncertainty introduced by the ongoing COVID-19 pandemic. Diagnostic and prognostic uncertainties, disruptions in clinical trials for rare diseases, high healthcare expenditure for specific diagnoses, and complexities in disease management with NGS specialties pose significant hurdles. The market segmentation reveals dominant forces in the Endocrine & Metabolism Diseases segment, with emerging trends in Immunological Disorders. Molecular Genetic Tests dominate, while Diagnostic Laboratories show the fastest growth, underscoring the importance of partnerships and collaborations.

Regionally, North America leads the market, driven by a high incidence of rare diseases and substantial investment in disease diagnosis. In contrast, Asia Pacific emerges as the fastest-growing region, with initiatives like India's National Policy for Rare Diseases contributing to its increasing significance. The COVID-19 impact analysis highlights challenges in diagnostic uncertainty and clinical trial disruptions but also emphasizes the increased demand for early diagnosis. The market's resilience is showcased through continuous technological advancements, strategic initiatives, and collaborations during the pandemic era. The latest trends and developments showcase a dynamic evolution marked by continuous advancements in NGS technologies, particularly in Whole Exome Sequencing (WES) and Whole Genome Sequencing. Companies, exemplified by Bionano Genomics, actively contribute to refining clinical and translational research, emphasizing a commitment to advancing rare disease diagnostics. Key players in the industry, including Quest Diagnostics Inc., Centogene N.V., and Invitae Corp., play pivotal roles, while strategic acquisitions, such as Reliance Strategic Business Ventures Ltd's acquisition of Strand Life Sciences, signify significant industry moves.

Global NGS Diagnostics For Rare Diseases Market Drivers:

Technological Advancements in NGS is fueling market demand.

The continuous evolution of Next-Generation Sequencing (NGS) technologies stands as a fundamental driver for the NGS diagnostics market. Advancements, including improved sequencing platforms and enhanced data analysis algorithms, contribute to the market's growth. The adoption of NGS enables more comprehensive and precise genomic profiling, allowing for the identification of rare disease-associated variants with increased accuracy. Moreover, the integration of microarray technologies further refines diagnostic capabilities, fostering the development of cutting-edge diagnostic tools.

Cost Reduction in Sequencing is adding to market expansion.

The substantial reduction in the cost of sequencing procedures has been a transformative factor propelling the widespread adoption of NGS diagnostics for rare diseases. The diminishing cost barrier ensures broader accessibility to genetic testing, reaching a larger patient demographic. This cost-effectiveness not only benefits individual patients but also healthcare systems, making genetic testing for rare diseases a financially viable and sustainable option. The resulting increase in testing rates positively influences the market's expansion.

Demand for Early and Rapid Diagnosis is augmenting market demand.

The escalating demand for early and rapid diagnosis, exacerbated by the challenges faced during the COVID-19 pandemic, plays a pivotal role in driving the NGS diagnostics market. Patients with undiagnosed and rare diseases require timely and accurate diagnostics to initiate appropriate treatment strategies. NGS technologies, with their ability to swiftly analyze vast genomic data, cater to this demand by providing rapid and precise diagnostic insights. This factor positions NGS as a crucial tool in addressing the urgent healthcare needs of affected individuals.

Global NGS Diagnostics For Rare Diseases Market Restraints and Challenges:

Clinical trials focused on rare diseases have encountered substantial challenges due to the COVID-19 pandemic. The difficulties associated with finding, recruiting, and retaining patients with rare diseases have become pronounced. The pandemic-induced disruptions have adversely affected the progress of clinical trials, creating obstacles in gathering essential data for the development and validation of NGS diagnostics for rare diseases. Additionally, the establishment of a specific diagnosis for rare diseases remains one of the primary challenges for clinicians, incurring significant healthcare expenditure globally. Although NGS technologies have driven advancements in research and diagnosis, the costs associated with these specialized tests may still pose a barrier. The high healthcare expenditure required for specific rare disease diagnoses could limit the widespread adoption of NGS diagnostics, especially in regions with resource constraints.

NGS DIAGNOSTICS FOR RARE DISEASES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

14.30% |

|

Segments Covered |

By Disease Type Outlook, Specialty Outlook, End-Use Outlook, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Quest Diagnostics Inc., Centogene N.V., Invitae Corp., 3billion, Inc., Arup Laboratories, Eurofins Scientific,Strand Life Sciences, Ambry Genetics, Perkin Elmer, Inc., Macrogen, Inc. |

NGS Diagnostics For Rare Diseases Market Segmentation: By Disease Type Outlook

-

Neurological Disease

-

Immunological Disorders

-

Hematology Diseases

-

Endocrine & Metabolism Diseases

-

Cancer

-

Musculoskeletal Disorders

-

Cardiovascular Disorders (CVDs)

-

Others

The Endocrine & Metabolism Diseases segment emerges as the dominant force, registering the fastest growth rate of more than 21.0% during the forecast period. This dominance can be attributed to the heightened understanding of molecular and genetic causes of endocrine diseases, driving the adoption of genetic testing. The identification of inherited mutations in conditions such as Cushing’s syndrome and advancements in tools for genetic testing contribute to the accelerated growth in this segment.

Immunological Disorders, including diseases like Multiple Sclerosis (MS), represent an emerging segment with the second-highest revenue share. The prevalence of MS as one of the most common rare diseases in this category fuels the growth. Collaboration among research groups, such as the Australian and New Zealand MS Genetics Consortium, enhances focus on the genetic profiles of immunological disorders, leading to increased research and diagnostic activities.

NGS Diagnostics For Rare Diseases Market Segmentation: By Specialty Outlook

-

Molecular Genetic Tests

-

Chromosomal Genetic Tests

-

Biochemical Genetic Tests

-

Others

Molecular Genetic Tests emerge as the dominant segment, accounting for the highest share of more than 41.10% of global revenue. The dominance is fueled by rapid technological advancements and expertise in handling high-throughput technologies within clinical settings. Molecular genetic tests enable the investigation of single genes or short lengths of DNA, providing a comprehensive and precise analysis for various diseases.

Chromosomal Genetic Tests represent an emerging segment addressing genetic aberrations at the chromosomal level. The understanding of complex chromosomal variations associated with rare diseases drives the growth in this segment. The application of NGS technologies enhances the capabilities of chromosomal genetic tests, contributing to their increasing significance in the diagnostic landscape.

NGS Diagnostics For Rare Diseases Market Segmentation: By End-Use Outlook

-

Research Laboratories & CROs

-

Hospitals & Clinics

-

Diagnostic Laboratories

Research Laboratories & CROs lead the global industry, accounting for over 46.93% of overall revenue. These entities play a crucial role in extensive research activities, utilizing NGS diagnostics for rare diseases. The dominance of this segment is facilitated by its central role in advancing scientific knowledge and driving innovations in diagnostic approaches.

The Diagnostic Laboratories segment is poised to register the fastest CAGR of 16.1% over the study period. The rising number of partnerships and collaborations of diagnostic laboratories with genetic testing companies contribute to this growth. Initiatives aiming to make important information for the treatment and diagnosis of rare diseases more readily available underscore the increasing significance of diagnostic laboratories in the NGS diagnostics market.

NGS Diagnostics For Rare Diseases Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America dominates the global industry with a share of more than 47.2% in 2023. The region's leadership is attributed to a high incidence of rare diseases, the presence of numerous disease registries, and substantial investment in disease diagnosis. The concentration of R&D facilities for ultra-rare diseases further solidifies North America's dominant position.

Asia Pacific is estimated to be the fastest-growing region at a CAGR of 18.1% during the forecast years. The increasing awareness, improving diagnosis capabilities, and the introduction of policies and frameworks to promote disease management contribute to the region's emerging significance. Initiatives like India's National Policy for Rare Diseases and the establishment of a National Registry for Rare Diseases in 2017 underscore the region's growing role in the NGS diagnostics market.

COVID-19 Impact Analysis on the Global NGS Diagnostics For Rare Diseases Market:

The COVID-19 pandemic has profoundly shaped the trajectory of the Global NGS Diagnostics for Rare Diseases Market. One significant impact is the heightened diagnostic and prognostic uncertainty for individuals with undiagnosed and rare diseases. Disruptions in routine healthcare services, delays in diagnostic procedures, and challenges in obtaining accurate prognoses have impeded the seamless integration of NGS diagnostics into clinical practices, affecting the timely diagnosis and management of rare diseases. Clinical trials focused on rare diseases have faced substantial disruptions due to pandemic-related challenges, including difficulties in finding, recruiting, and retaining patients. The strain on healthcare systems and limitations associated with physical distancing measures have led to delays and complications in gathering essential data for the development and validation of NGS diagnostics for rare diseases.

On a positive note, the pandemic has spurred an increased demand for early and rapid diagnosis, emphasizing the significance of NGS technologies. Despite challenges, technological advancements in NGS have remained resilient drivers of market growth, highlighting the crucial role of continued innovation in addressing rare disease diagnostics. Strategic initiatives and collaborations between diagnostic laboratories and genetic testing companies have gained prominence during the COVID-19 era, reflecting a collective effort to make important information for the treatment and diagnosis of rare diseases more readily available. The pandemic has also heightened the focus on regulatory and ethical considerations within the NGS diagnostics market. Ensuring compliance with ethical standards and navigating complex regulatory landscapes has become crucial as the industry expands. Balancing the imperative for innovation with ethical practices, especially concerning patient data and consent, has gained prominence in the post-pandemic era. In conclusion, while the COVID-19 pandemic has presented challenges, it has also underscored the resilience and adaptability of the NGS diagnostics market, positioning it to play a pivotal role in addressing unique healthcare challenges posed by rare diseases in a post-pandemic world.

Latest Trends/ Developments:

The Global NGS Diagnostics for Rare Diseases Market is witnessing a dynamic evolution marked by several noteworthy trends and developments. Continuous advancements in Next-Generation Sequencing (NGS) technologies, particularly in Whole Exome Sequencing (WES) and Whole Genome Sequencing, are significantly enhancing diagnostic workflows, providing a more comprehensive understanding of genetic factors contributing to rare diseases. Notably, molecular genetic tests have taken center stage, dominating the market with rapid technological advancements, enabling in-depth investigations into single genes or short lengths of DNA.

Strategic initiatives for new product development are a driving force within the industry. Companies, exemplified by Bionano Genomics and its Rare Undiagnosed Genetic Disease (RUGD) initiative, are actively contributing to refining clinical and translational research. These initiatives encompass cutting-edge products for diagnosis, educational awareness, research grant expansion, and support for expert societies, reflecting a commitment to advancing rare disease diagnostics.

Key Players:

-

Quest Diagnostics Inc.

-

Centogene N.V.

-

Invitae Corp.

-

3billion, Inc.

-

Arup Laboratories

-

Eurofins Scientific

-

Strand Life Sciences

-

Ambry Genetics

-

Perkin Elmer, Inc.

-

Macrogen, Inc.

- Reliance Strategic Business Ventures Ltd (RSBVL), a wholly-owned subsidiary of Reliance Industries Ltd (RIL), has acquired about 22.8 million equity shares of ₹10 each of Strand Life Sciences Pvt. Ltd for a cash consideration of ₹393 crore.

Chapter 1. NGS Diagnostics For Rare Diseases Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. NGS Diagnostics For Rare Diseases Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. NGS Diagnostics For Rare Diseases Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. NGS Diagnostics For Rare Diseases Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. NGS Diagnostics For Rare Diseases Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. NGS Diagnostics For Rare Diseases Market – By Disease Type Outlook

6.1 Introduction/Key Findings

6.2 Neurological Disease

6.3 Immunological Disorders

6.4 Hematology Diseases

6.5 Endocrine & Metabolism Diseases

6.6 Cancer

6.7 Musculoskeletal Disorders

6.8 Cardiovascular Disorders (CVDs)

6.9 Others

6.10 Y-O-Y Growth trend Analysis By Disease Type Outlook

6.11 Absolute $ Opportunity Analysis By Disease Type Outlook, 2024-2030

Chapter 7. NGS Diagnostics For Rare Diseases Market – By Specialty Outlook

7.1 Introduction/Key Findings

7.2 Molecular Genetic Tests

7.3 Chromosomal Genetic Tests

7.4 Biochemical Genetic Tests

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Specialty Outlook

7.7 Absolute $ Opportunity Analysis By Specialty Outlook, 2024-2030

Chapter 8. NGS Diagnostics For Rare Diseases Market – By End-Use Outlook

8.1 Introduction/Key Findings

8.2 Research Laboratories & CROs

8.3 Hospitals & Clinics

8.4 Diagnostic Laboratories

8.5 Y-O-Y Growth trend Analysis By End-Use Outlook

8.6 Absolute $ Opportunity Analysis By End-Use Outlook, 2024-2030

Chapter 9. NGS Diagnostics For Rare Diseases Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Specialty Outlook

9.1.3 By End-Use Outlook

9.1.4 By Disease Type Outlook

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Specialty Outlook

9.2.3 By End-Use Outlook

9.2.4 By Disease Type Outlook

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Specialty Outlook

9.3.3 By End-Use Outlook

9.3.4 By Disease Type Outlook

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Specialty Outlook

9.4.3 By End-Use Outlook

9.4.4 By Disease Type Outlook

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Specialty Outlook

9.5.3 By End-Use Outlook

9.5.4 By Disease Type Outlook

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. NGS Diagnostics For Rare Diseases Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Quest Diagnostics Inc.

10.2 Centogene N.V.

10.3 Invitae Corp.

10.4 3billion, Inc.

10.5 Arup Laboratories

10.6 Eurofins Scientific

10.7 Strand Life Sciences

10.8 Ambry Genetics

10.9 Perkin Elmer, Inc.

10.10 Macrogen, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global NGS Diagnostics For Rare Diseases Market was valued at USD 889 million in 2023 and is projected to reach a market size of USD 2.26 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 14.30%.

The Global NGS Diagnostics For Rare Diseases Market drivers include continuous technological advancements in NGS, cost reduction in sequencing, the demand for early and rapid diagnosis, and the pivotal role of translational research and genomic technologies.

The segments under the Global NGS Diagnostics For Rare Diseases Market by End-Use Outlook include Research Laboratories & CROs, Hospitals & Clinics, and Diagnostic Laboratories.

The most dominant region for the Global NGS Diagnostics For Rare Diseases Market is North America.

Leading players in the Global NGS Diagnostics For Rare Diseases Market include Quest Diagnostics Inc., Centogene N.V., Invitae Corp., 3billion, Inc., Arup Laboratories, Eurofins Scientific, Strand Life Sciences, Ambry Genetics, Perkin Elmer, Inc., and Macrogen, Inc.