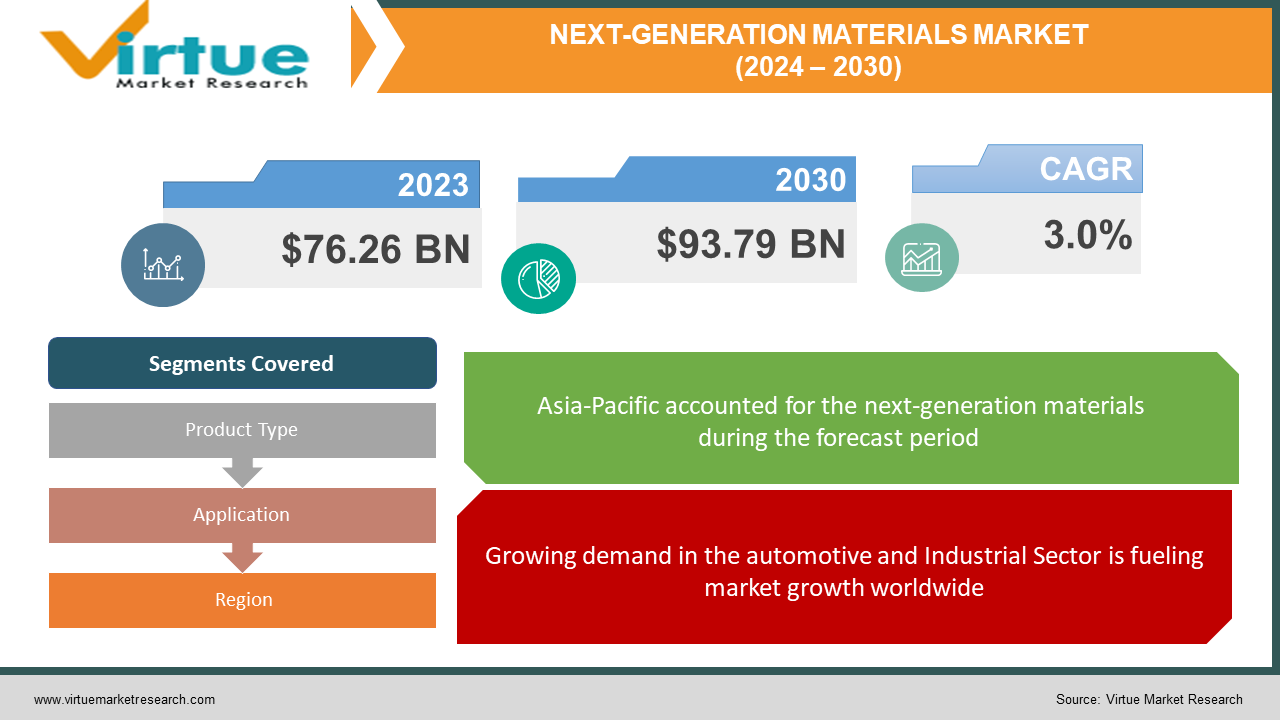

Next-Generation Materials Market Size (2024 – 2030)

The Global Next- Generation Materials Market was valued at USD 76.26 Billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 93.79 Billion by 2030, growing at a CAGR of 3.0%.

Next-generation materials are advanced composites, hybrid materials, engineered polymers, and low-density/high-strength metals or alloys. Hybrid materials are composed of two or more different types of materials, which can be organic, inorganic, or a combination of both.

Light alloys and metals have low density and high strength-to-weight ratios. They are characterized by low toxicity in comparison to heavy metals, although beryllium is an exception. Lightweight metals consist of aluminum, magnesium, titanium, and beryllium alloys.

Advanced composite materials also known as advanced polymer matrix composites are lightweight materials with high strength and elasticity. These products are manufactured using fibrous material embedded in different resin matrices. These advanced materials are widely utilized in the aerospace and defense, automotive, marine, and wind energy sectors.

Key Market Insights

The hybrid materials market is expected to grow significantly in the forecasted years, followed by increasing demand from various industries such as automotive, aerospace, construction, healthcare, electronics, etc The global high-performance alloys market is projected to grow a size of USD 15.64 billion by 2030 and increase at a CAGR of 5.3% during the forecast period. The market growth is driven by the increasing demand for lightweight materials in the aerospace and automotive industries, attributed to strict emission norms and the need for higher fuel efficiency. The growth of the market is also influenced by the demand from industries and technological advancements. In addition, economic development and the demand for sustainable products are significant factors that are driving market growth in developing countries.

Global Next-Generation Materials Market Drivers:

Growing demand in the automotive and Industrial Sector is fueling market growth worldwide:

The high demand from the aerospace and automotive industries is one of the primary factors driving market growth, along with the rising chemical industry's demand for high-performance alloys in constructing infrastructure and equipment. The automotive industry application segment is also expected to witness notable growth at a CAGR of 8.9% owing to rising penetration of the product in the vehicles. The demand for durable, lightweight, and conductive raw materials in the automotive industry is expected to raise the advanced composites market over the forecast period.

Global Next-Generation Materials Market Restraints and Challenges:

Many factors like COVID-19, and Russia Russia-Ukraine Crisis led to an increase in the cost of many things and materials are also part of that. An increase in the cost of raw materials has led to an increase in the price of finished goods. Hybrid materials markets are high in cost of production, which can limit their use in certain applications. However, recent research and development efforts are focused on finding ways to reduce the cost and improve the performance of the materials. The market is expected to face challenges like high initial investment and fluctuation of raw material prices, which could affect revenue growth.

Opportunities for the Global Next-Generation Materials Market

Advanced materials are expected to reduce the use of Plastic and metals

Advanced materials like advanced composites, hybrid materials, engineered polymers, and low-density/high-strength metals or alloys are expected to reduce or partially replace the use of plastic and metals. Correcting materials and manufacturing challenges for decarbonization and clean energy by developing novel materials with innovative properties, For Example materials for tough environments, advanced composites, and lightweight materials.

The demand for Engineered Polyester is high in the electric & electronic industry due to the increase in sales of appliances like Televisions, iron machines, refrigerators, etc. With the growth of demand for the appliance, many active players are increasing the competition and market segments.

NEXT-GENERATION MATERIALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.0% |

|

Segments Covered |

By Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M Company, Akzo Nobel N.V., BASF SE, Cerion LLC, DuPont de Nemours, Inc., ExxonMobil Corp., Hanwha Group, Huntsman Corp., INEOS Group Ltd., LG Chem Ltd. |

Next-Generation Materials Market segmentation: By Product Type

-

Polymer

-

Metal & Alloys

-

Glasses

-

Composites

-

Ceramics

The Alloy market is expected to have a CAGR of less than 5% during the forecasted year. In modern times, people are going to use smart glasses for architectural purposes. The residential and commercial facilities are considered to depend upon comfort, aesthetics, or interior design. The architecture of smart glass includes doors, skylights, and windows. Smart glass is projected to increase in the market growth. The Ceramic market size was valued at USD 239.53 billion in 2023 and is expected to grow at a CAGR of 5.2% from 2023 to 2030. As one can see the Ceramic market will grow more as compared to other markets like Alloy and Polyester.

Next-Generation Materials Market Segmentation: By Application

-

Automotive

-

Aerospace

-

Electricals & Electronics

-

Industrial

-

Power

-

Others

The aerospace industry dominates the Market. Alloys are used in various purposes such as automotive, gas & oil, and Aerospace as well due to their high mechanical strength, resistance, and stability. The increase in demand for lightweight equipment and the growth in demand for new-generation aircraft in the aerospace industry are likely to drive the market forward. Fluctuations in the price of the raw material can likely affect the market growth.

Next-Generation Materials Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region has the biggest share of the Alloy market and is expected to grow during the next few years. Next-generation aircraft and rotorcraft will have strict requirements for lightweight, visual, and thermal signatures, increased speed, etc.

Even in the Ceramic Sector, the Asia Pacific region is dominating with a market share above 39.8% in 2023. The growth is due to the rapid expansion of the manufacturing sector in developing economies of the region. In 2023, Taiwan-based UMC announced to investment of USD 5 billion in the expansion of its chip production capacity in Singapore. North America has a CAGR of 4.2% during the forecast period. Domestic and international investors for residential/commercial construction activities in North America are anticipated to fuel the requirements for hardware and tableware in the region.

Europe is also another prominent market for ceramics, where the demand for tiles is high. Around 28% of the overall employee strength is engaged in tile manufacturing. The region consumes approx. 1.8 million units of ceramic roof tiles every year. Europe holds a strong position in the global tiles industry with Italy, Germany, France, and Spain leading exporters of ceramic tiles.

COVID-19 Impact Analysis on the Global Next-Generation Materials Market

Due to COVID-19, the fall in shipment and slow domestic supply of next-generation material hurts the Market. Raw materials are exported and imported from different regions of the country due to the lockdown, it was difficult to get raw materials. Even after COVID-19, it's difficult as many rules and regulations have to be followed. Post-COVID-19 the price of Materials has also increased, which has led to an increase in the price of other industrial materials also. North America's market weakness is dominated by ongoing supply issues. Many companies have introduced short-term plans to keep the operation running during Covid-19. The companies also started selling through online platforms following social distancing norms. Asia Pacific was more resilient, with China’s market holding up reasonably well. However, lockdowns in Shanghai due to increasing Covid-19 rates threaten that resilience and will also have economic implications for China and the rest of the world given the city’s role as a trade and economic hub.

Latest Trends/ Developments:

Increasing Next Generation Material manufacturers are approaching to improve functionality and reduce costs and lifecycle impacts throughout manufacturing. Advanced materials with increased functionality can improve productivity. Advanced materials that are more durable in high-temperature than traditional materials will improve productivity, avoid downtime, and increase energy productivity. Development and manufacture of advanced materials that offer improved functional properties at low cost can reduce the cost of finished products by half.

Key Players:

These are the Top 10 players in the Market—

-

3M Company

-

Akzo Nobel N.V.

-

BASF SE

-

Cerion LLC

-

DuPont de Nemours, Inc.

-

ExxonMobil Corp.

-

Hanwha Group

-

Huntsman Corp.

-

INEOS Group Ltd.

-

LG Chem Ltd.

Chapter 1. Next-Generation Materials Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Next-Generation Materials Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Next-Generation Materials Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Next-Generation Materials Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Next-Generation Materials Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Next-Generation Materials Market – By Product Type

6.1 Introduction/Key Findings

6.2 Polymer

6.3 Metal & Alloys

6.4 Glasses

6.5 Composites

6.6 Ceramics

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Next-Generation Materials Market – By Application

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Aerospace

7.4 Electricals & Electronics

7.5 Industrial

7.6 Power

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Next-Generation Materials Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Next-Generation Materials Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 3M Company

9.2 Akzo Nobel N.V.

9.3 BASF SE

9.4 Cerion LLC

9.5 DuPont de Nemours, Inc.

9.6 ExxonMobil Corp.

9.7 Hanwha Group

9.8 Huntsman Corp.

9.9 INEOS Group Ltd.

9.10 LG Chem Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

There are various factors for the growth of the Global Next-Generation Materials Market. Growing demand in the automotive and Industrial sectors. The increase in demand for lightweight equipment and the growth in demand for new-generation aircraft in the aerospace industry are likely to drive the market forward. The residential and commercial facilities are considered to depend upon comfort, aesthetics, or interior design.

3M Company, Akzo Nobel N.V., BASF SE, Cerion LLC, DuPont de Nemours, Inc., ExxonMobil Corp., Hanwha Group, Huntsman Corp., INEOS Group Ltd., and LG Chem Ltd. are a few players that are operating in the Global Next-Generation Materials Market.

Due to COVID-19, the fall in shipment and slow domestic supply of next-generation material hurts the Market. Raw materials are exported and imported from different regions of the country due to the lockdown, it was difficult to get raw materials.

Advanced materials with increased functionality can improve productivity. Advanced materials that are more durable in high-temperature than traditional materials will improve productivity, avoid downtime, and increase energy productivity. Advanced materials like advanced composites, hybrid materials, engineered polymers, and low-density/high-strength metals or alloys are expected to reduce or partially replace the use of plastic and metals

It is difficult to tell which region is growing fast as every region has a segment that is better than the other regions. For Example- The Asia-Pacific region has the biggest share of the Alloy market and is expected to grow during the next few years. Next-generation aircraft and rotorcraft will have strict requirements for lightweight, visual, and thermal signatures, increased speed, etc. Europe holds a strong position in the global tiles industry with Italy, Germany, France, and Spain leading exporters of ceramic tiles. Even in the Ceramic Sector, the Asia Pacific region is dominating with a market share above 39.8% in 2022. The growth is due to the rapid expansion of the manufacturing sector in developing economies of the region.