Next-Generation Battery Market Size (2025 – 2030)

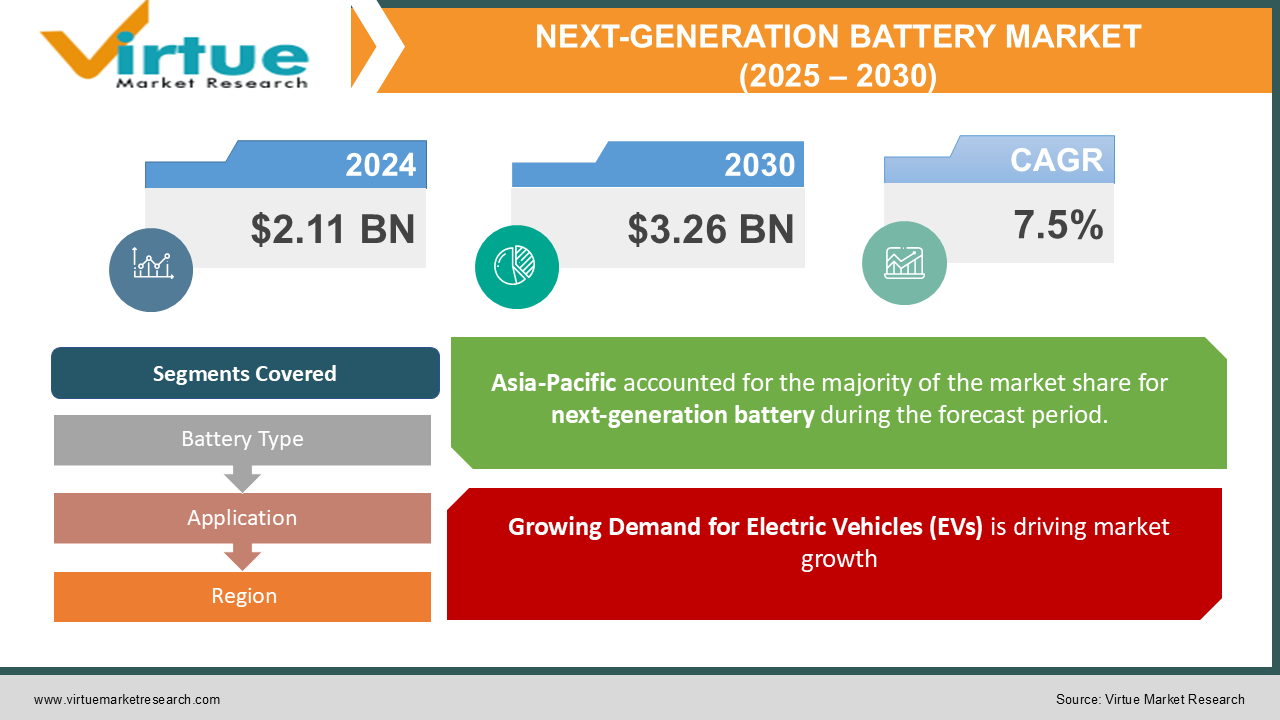

The Global Next-Generation Battery Market was valued at USD 2.11 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 7.5% from 2025 to 2030. The market is expected to reach USD 3.26 billion by 2030.

The Next-Generation Battery Market focuses on advanced energy storage solutions that outperform traditional lithium-ion batteries in terms of efficiency, energy density, lifecycle, and safety. Innovations such as solid-state batteries, lithium-sulfur batteries, and flow batteries are transforming industries like consumer electronics, electric vehicles (EVs), renewable energy, and aerospace. This market is driven by the growing demand for sustainable energy storage solutions, spurred by increasing electrification, renewable energy integration, and technological advancements.

Key Market Insights

-

The adoption of next-generation batteries in electric vehicles (EVs) is projected to grow by 45% annually from 2025 to 2030, driven by government subsidies and stringent emissions regulations.

-

The renewable energy sector accounted for 25% of the market demand in 2024, with applications in solar and wind energy storage systems growing rapidly.

-

Asia-Pacific is the fastest-growing region, with a CAGR of 29% from 2025 to 2030, fueled by investments in battery manufacturing and EV infrastructure in countries like China, Japan, and South Korea.

-

Research and development funding for next-generation batteries surpassed USD 10 billion globally in 2024, led by initiatives to improve energy efficiency and reduce production costs.

-

Emerging battery chemistries like lithium-sulfur and zinc-air are gaining traction, offering a 2–3 times higher energy density than conventional lithium-ion batteries.

Global Next-Generation Battery Market Drivers

Growing Demand for Electric Vehicles (EVs) is driving market growth:

The shift towards electric mobility is a key driver for the next-generation battery market. Governments worldwide are implementing policies to reduce greenhouse gas emissions, including subsidies, tax benefits, and mandates for automakers to produce EVs. Next-generation batteries, such as solid-state and lithium-sulfur, offer higher energy density and faster charging times, addressing critical challenges in EV adoption. By 2030, the global EV fleet is expected to surpass 300 million units, significantly boosting the demand for advanced batteries. Furthermore, the expansion of charging infrastructure and advancements in battery recycling techniques are supporting this growth trajectory.

Integration of Renewable Energy Sources is driving market growth:

The increasing integration of renewable energy sources like solar and wind into power grids is driving the need for efficient energy storage systems. Next-generation batteries are ideal for stabilizing grid operations, storing excess energy, and ensuring reliable power supply during periods of low renewable generation. For instance, flow batteries, known for their scalability and long lifecycle, are being deployed in large-scale renewable energy projects. As countries transition towards net-zero carbon goals, the demand for advanced batteries to complement renewable energy systems is expected to rise exponentially.

Technological Advancements and Investment Surge is driving market growth:

The development of innovative battery chemistries, such as solid-state, lithium-sulfur, and metal-air, is revolutionizing energy storage capabilities. These technologies promise higher energy densities, enhanced safety, and longer lifespans compared to traditional batteries. The surge in investments from both public and private sectors is accelerating research and commercialization of these technologies. For example, solid-state batteries are being backed by major automotive and technology companies for applications in EVs and consumer electronics. As production scales up and costs decline, next-generation batteries are set to gain significant market share across multiple industries.

Global Next-Generation Battery Market Challenges and Restraints

High Manufacturing Costs and Limited Scalability is restricting market growth:

One of the significant challenges in the next-generation battery market is the high cost associated with developing and manufacturing advanced batteries. Materials like lithium-sulfur and solid-state electrolytes are expensive and require specialized equipment for production. Additionally, scaling these technologies for mass production poses technical and logistical challenges. For example, achieving uniformity in solid-state batteries during large-scale manufacturing is difficult, leading to inconsistencies in performance and safety. These high costs and scalability issues can deter adoption, particularly in price-sensitive markets like consumer electronics and renewable energy storage systems.

Supply Chain Constraints and Material Availability is restricting market growth:

The availability of raw materials, such as lithium, cobalt, and nickel, is a critical factor affecting the production of next-generation batteries. Geopolitical tensions and trade restrictions in key resource-rich regions can disrupt supply chains, leading to material shortages and price volatility. For instance, the rising demand for lithium, a key component in advanced battery chemistries, has resulted in significant price hikes in recent years. Furthermore, the reliance on rare and geographically concentrated materials raises concerns about sustainability and environmental impact. Addressing these supply chain challenges through recycling, alternative materials, and diversification of sourcing strategies is imperative for the market's growth.

Market Opportunities

The next-generation battery market offers immense opportunities for growth and innovation across multiple sectors. Electric vehicles (EVs) remain a primary area of opportunity, as automakers increasingly focus on improving battery performance to enhance driving range and reduce charging times. Solid-state batteries, with their higher energy densities and safety features, are poised to become the preferred choice for premium EVs. The commercialization of these batteries could potentially revolutionize the automotive industry by 2030. The renewable energy sector also presents significant opportunities, with the need for efficient energy storage solutions to support the integration of solar and wind power into the grid. Flow batteries and lithium-sulfur batteries are gaining traction as cost-effective options for large-scale storage projects. Additionally, the consumer electronics industry is transitioning towards high-capacity batteries to meet the demand for longer-lasting and compact devices, creating a lucrative market for advanced battery technologies. Another area of opportunity lies in battery recycling and sustainability practices. With growing environmental concerns, the development of efficient recycling methods for next-generation batteries can help recover valuable materials, reduce waste, and lower production costs. Companies that invest in closed-loop recycling systems and sustainable battery designs are likely to gain a competitive edge in the market.

NEXT-GENERATION BATTERY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Battery Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Panasonic, Tesla, Inc., QuantumScape, Solid Power, CATL, Samsung SDI, LG Energy Solution, BYD Company, Sion Power, Redflow |

Next-Generation Battery Market Segmentation - By Battery Type

-

Solid-State Batteries

-

Lithium-Sulfur Batteries

-

Flow Batteries

-

Metal-Air Batteries

Solid-state batteries are the most dominant product type, accounting for over 35% of the market share in 2024. Their superior energy density, safety, and durability make them ideal for applications in electric vehicles and consumer electronics.

Next-Generation Battery Market Segmentation - By Application

-

Electric Vehicles (EVs)

-

Consumer Electronics

-

Renewable Energy Storage

-

Aerospace and Defense

Electric vehicles (EVs) dominate the application segment, contributing to over 40% of market revenue. The growing demand for efficient and high-performance batteries to enhance vehicle range and reduce charging times is driving adoption in the automotive sector.

Next-Generation Battery Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific leads the next-generation battery market, accounting for over 40% of global revenue in 2024. The region’s dominance is driven by the presence of leading battery manufacturers in countries like China, Japan, and South Korea. These countries are investing heavily in R&D and expanding battery production capacities to meet the growing demand for EVs and renewable energy storage systems. Additionally, government initiatives to promote clean energy and electrification further bolster market growth in the Asia-Pacific region.

COVID-19 Impact Analysis on the Next-Generation Battery Market

The COVID-19 pandemic had a complex impact on the next-generation battery market. In the early stages, the pandemic caused significant disruptions in supply chains and manufacturing operations, leading to delays in production and project timelines. These setbacks created challenges for battery manufacturers and the broader energy sector, slowing down the progress of some key projects. However, as the pandemic progressed, it also acted as a catalyst for the accelerated adoption of renewable energy and electric vehicles (EVs). Governments and businesses around the world increasingly prioritized sustainability and energy resilience in response to the crisis. This shift in focus fueled a surge in demand for advanced battery technologies, particularly those that support the growth of EVs and renewable energy solutions. During the recovery phase, investments in next-generation battery technologies grew substantially. Companies and governments alike focused on improving energy storage capacity and efficiency, essential for both renewable energy integration and the expansion of EV infrastructure. Research into solid-state batteries, lithium-ion enhancements, and other next-gen battery solutions gained momentum, positioning the industry for long-term growth. The pandemic also underscored the need for more localized supply chains and sustainable practices, especially concerning raw materials. With disruptions in the global supply chain, there was an increased emphasis on reducing dependency on imported materials by improving recycling processes and developing alternative sources for essential battery components. These efforts are expected to strengthen the resilience and sustainability of the battery supply chain in the future. Overall, despite the initial setbacks, the pandemic spurred innovation and long-term growth in the next-generation battery market, reinforcing its crucial role in shaping a sustainable and energy-efficient future.

Latest Trends/Developments

The next-generation battery market is witnessing several transformative trends. Solid-state batteries are nearing commercialization, with major automakers and technology companies planning to launch products featuring these batteries by 2025. Flow batteries are gaining attention for their scalability and cost-effectiveness in large-scale renewable energy projects. Innovations in battery chemistries, such as lithium-sulfur and zinc-air, are addressing challenges related to energy density and sustainability. Another noteworthy trend is the integration of advanced battery technologies in emerging applications like drones, electric vertical takeoff and landing (eVTOL) aircraft, and wearable devices. Companies are also focusing on developing recycling systems and sustainable battery designs to address environmental concerns. The growing use of AI and machine learning in battery management systems (BMS) is further enhancing performance and safety, marking a significant development in the industry.

Key Players

-

Panasonic

-

Tesla, Inc.

-

QuantumScape

-

Solid Power

-

CATL

-

Samsung SDI

-

LG Energy Solution

-

BYD Company

-

Sion Power

-

Redflow

Chapter 1. Next-Generation Battery Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Next-Generation Battery Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Next-Generation Battery Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Next-Generation Battery Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Next-Generation Battery Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Next-Generation Battery Market – By Battery Type

6.1 Introduction/Key Findings

6.2 Solid-State Batteries

6.3 Lithium-Sulfur Batteries

6.4 Flow Batteries

6.5 Metal-Air Batteries

6.6 Y-O-Y Growth trend Analysis By Battery Type

6.7 Absolute $ Opportunity Analysis By Battery Type, 2025-2030

Chapter 7. Next-Generation Battery Market – By Application

7.1 Introduction/Key Findings

7.2 Electric Vehicles (EVs)

7.3 Consumer Electronics

7.4 Renewable Energy Storage

7.5 Aerospace and Defense

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Next-Generation Battery Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Battery Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Battery Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Battery Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Battery Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Battery Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Next-Generation Battery Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Panasonic

9.2 Tesla, Inc.

9.3 QuantumScape

9.4 Solid Power

9.5 CATL

9.6 Samsung SDI

9.7 LG Energy Solution

9.8 BYD Company

9.9 Sion Power

9.10 Redflow

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Next-Generation Battery Market was valued at USD 2.11 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 7.5% from 2025 to 2030. The market is expected to reach USD 3.26 billion by 2030.from 2025 to 2030.

Key drivers include growing demand for electric vehicles (EVs), integration of renewable energy sources, and technological advancements coupled with increased investments.

Segments include battery types (solid-state, lithium-sulfur, flow, and metal-air batteries) and application (EVs, consumer electronics, renewable energy, aerospace, and defense).

Asia-Pacific is the dominant region, contributing over 40% of the market revenue in 2024, driven by strong investments in battery manufacturing and EV infrastructure.

Leading players include Panasonic, Tesla, Inc., QuantumScape, Solid Power, CATL, Samsung SDI, LG Energy Solution, BYD Company, Sion Power, and Redflow.