Neuro-Oncology Diagnostics Market Size (2024 – 2030)

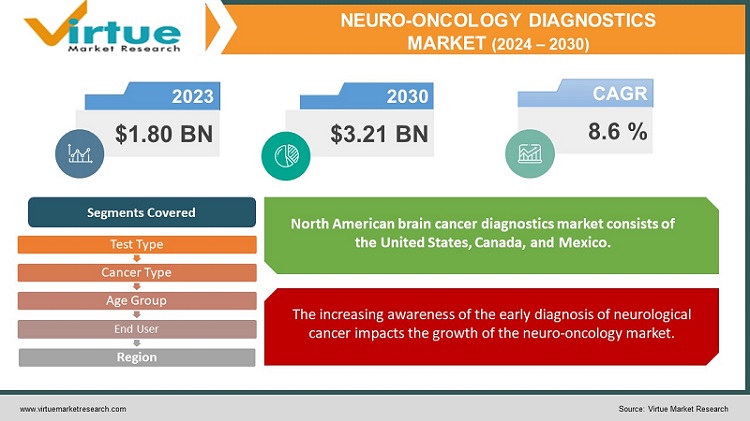

The Global Neuro-Oncology Diagnostics Market was valued at USD 1.80 Billion and is projected to reach a market size of USD 3.21 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.6%.

Previously, neuro-oncology diagnostics focused solely on traditional imaging modalities such as CT scans and MRI. The market was limited because of a lack of knowledge and exact information on tumor characterization and molecular information. The neuro-oncology diagnostic market has recently evolved greatly due to the introduction of modern imaging technologies such as functional MRI, PET scans, diffusion tensor imaging, and so on. Precision medicine, in which therapies are adjusted based on the unique genetic and molecular characteristics of each patient's tumor, will most certainly drive the future of neuro-oncology diagnostics. One of the important reasons driving the growth of the Neuro-Oncology diagnostic market is the rising global prevalence of brain cancer. The market size currently is driven by rising awareness and benefits of early neuro-oncology diagnostics. Better drug delivery technology to treat brain or neural cancers/tumors also is expected to enhance the market size.

Key Market Insights:

The global brain cancer/tumor diagnostics market is predicted to grow at a significant CAGR during the forecast period. Technological breakthroughs and diagnostic machine advancements are expected to increase the market size drivers for the expansion of brain cancer diagnostics. Furthermore, the global relevance of brain cancer growth is expected to expand in the approaching years. According to the American Society of Clinical Oncology (ASCO), about 24,530 people (13,840 men and 10,690 women) will be diagnosed with primary malignant tumors of the brain and spinal cord in the United States in 2021. Brain tumors account for 85% to 90% of all primary CNS malignancies. Brain tumors are potentially fatal and have a significant influence on quality of life.

In the same way, according to estimates from Cancer Research UK (2016–2018), 34 new instances of brain, other CNS, and intracranial tumors are diagnosed in the UK per day. This figure is based on estimates for the years 2016–2018. With 3% of all new cancer cases (2016–2018), brain tumors, other central nervous system, and intracranial tumors rank tenth among all cancer types in the UK. With over 6,400 new cases between 2016 and 2018, it is also the seventh most prevalent malignancy in women in the UK. The same is true for men, where 5,800 new instances of brain, other CNS, and intracranial tumors were reported in the UK between 2016 and 2018. They are the 11th most prevalent malignancy in men. In the UK (2016–2018), adults 85–89 years old had the greatest incidence rates of brain tumors.

Global Neuro-Oncology Diagnostic Market Drivers:

The ever-rising cases of brain or neurological cancer worldwide are the primary driver for the global neuro-oncology market.

Over the world, there are more cases of brain cancer. According to research from the National Cancer Institute, 176,566 persons were predicted to be battling brain and other nervous system cancers in the United States in 2019. Additionally, based on statistics from 2017 to 2019, it has been estimated that 0.6% of men and women will receive a lifetime diagnosis of brain or another type of nervous system cancer. A secondary brain tumor or brain metastasis is cancer that starts elsewhere in the body and subsequently travels to the brain. Breast cancer, lung cancer, colon cancer, and kidney cancer are among tumors that can spread to the brain. Brain cancer cells seldom spread outside of the brain. Rather, they can travel small distances within the brain. Some of the key causes of brain cancer include genetic linkages inherited via family ancestors, chemical exposure to specific industrial chemicals or solvents, a damaged immune system, and past radiation treatments.

The increasing awareness of the early diagnosis of neurological cancer impacts the growth of the neuro-oncology market.

Brain Cancer Awareness Month is nationally recognized in the United States during the month of May. This awareness month focuses on bringing together the brain tumor community to increase awareness among the patient population. Brain cancer is not a common type of cancer like other types. As per research studies, 1.4 million patients worldwide are suffering from malignant brain tumors, and another 2, 56,000 people will be diagnosed with a malignant brain tumor by the end of the year.

Global Neuro-Oncology Diagnostics Market Restraints and Challenges:

High costs associated with diagnosis & treatment for neurological cancer may challenge the market growth.

The brain is the most significant component of the human body since it is the organ responsible for memory, emotion, and the storage of knowledge and skills. Consequently, brain cancer is particularly damaging. High economic costs—borne by people, healthcare systems (direct medical expenses), and the general public budget (direct non-medical expenditures and indirect costs)—are associated with the cognitive, behavioral, and personality alterations a brain tumor might engender. In Western nations, brain tumor surgery has a relatively high average cost. Depending on the precise technique, location, and tumor severity, different treatments have different costs. According to a study that appeared in the journal Cancer, families and patients with brain cancer faced a much greater financial burden than those with other cancers. Patients with brain cancer incurred the highest indirect costs, with an average annual cost of USD 64,790. Therefore, the high price of diagnosing and treating brain cancer may limit market expansion.

Operational barriers faced in conducting diagnostics tests may affect the market.

The most recent developments in the field of brain cancer diagnostics could be in the form of kits, tools, reagents, controls, or anything else. The ability of healthcare personnel to adapt to new technologies is not a simple thing to do. Organizations must offer training sessions for the medical staff to help them overcome and prevent diagnostic errors and produce precise results. The infrastructure required to maintain the new kits and store the samples is insufficient in rural, low-income, and emerging nations in the various regions. This is due to a lack of knowledge and awareness among medical personnel regarding the proper handling of novel kits and reagents, as well as the limited energy supply. This can result in inaccurate diagnosis results, certain fatalities, and even present a hazard to the test-takers carrier. The lives of the populace may be impacted by these obstacles to performing the cancer diagnostic test. In terms of low-income countries, this is one of the hardest obstacles to overcome. As a result, the diagnostics industry is being impacted, and the market for diagnosing brain cancer is being challenged.

Global Neuro-Oncology Diagnostics Market Opportunities:

Increasing investment and funding by emerging players will expand the market.

The market for brain cancer is enormous, and the growing number of people who are impacted by it is luring additional firms to engage in the field of diagnostics. Although it is a difficult effort, early diagnosis of brain cancer may be possible with the new product line for illness diagnosis. There are several prospects for growth in the sector. As a result, the industry has seen the entry of several start-ups offering cutting-edge goods and technologies. The field of brain cancer is attracting a lot of new businesses and start-ups. They want to grow their company and spread the word about their just launched product. The following businesses are some of those that could potentially offer a diagnosis of brain cancer.

Government initiatives toward cancer diagnostics can unlock new market opportunities.

Because cancer is a leading disease worldwide, the government plays a significant role in taking the initiative to combat the disease. People's rates of cancer have risen sharply in recent decades. In 2018, there were 9,555,027 cases of fatalities attributed to cancer worldwide, with 241,037 (2.71%) of those cases being brain cancer. Governments all around the world are actively implementing several steps to combat cancer, notably brain cancer diagnostics, to raise public awareness of the condition. Government and non-government organizations provided 57% of the funding for therapy-oriented biology and drug development; the remaining 33% went to early detection, diagnosis, and prognosis of cancer disease. These government programs aimed at cancer diagnoses are increasing consumer demand.

NEURO-ONCOLOGY DIAGNOSTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.6% |

|

Segments Covered |

By Test Type, Cancer Type, Age Group, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

NIHON KOHDEN CORPORATION., FUJIFILM Holdings Corporation, GE HealthCare, Koninklijke Philips N.V., BD, Siemens Healthcare GmbH, Others |

Global Neuro-Oncology Diagnostics Market Segmentation: By Test Type

-

Imaging Tests

-

Biopsy

-

Lumbar Puncture

-

Molecular Testing

-

Electroencephalography (EEG)

-

Platform and Services

-

Others

The imaging test segment is anticipated to hold the highest proportion of the market in 2022. The platform and services category, however, is predicted to experience the highest CAGR in the market from 2023 to 2030. The brain cancer diagnostics market is divided into several categories depending on the diagnostic method used, including electroencephalography (EEG), lumbar puncture, biopsy, molecular testing, platform and services, cerebral arteriogram, and others. Additionally, the imaging test is divided into sub-segments for MRI, CT scan, PET, and others. The platform and services segment is divided into four sub-segments: sample slide, autosampler unit, solutions, and platform and services.

Global Neuro-Oncology Diagnostics Market Segmentation: By Cancer Type

-

Acoustic Neuroma

-

Astrocytomas

-

Glioblastoma Multiforme

-

Meningiomas

-

Oligodendroglioma

-

Others

The market segment that will likely have the biggest share in 2022 is glioblastoma multiforme. Additionally, the same market sector is anticipated to experience demand development at the quickest CAGR from 2023 to 2030 as a result of the increase in glioblastoma multiforme occurrence across the globe. The most frequent malignant brain tumor and other CNS tumor, accounting for 47.7% of cases overall, is glioblastoma, which has an incidence of 3.21 per 100,000 people, according to the American Association of Neurological Surgeons. The acoustic neuroma, astrocytomas, craniopharyngiomas, ganglioneuromas, glioblastoma multiforme, ganglioneuroma, meningiomas, ependymomas, oligodendroglioma, low-grade tumors, and other brain cancer kinds are the different cancer types that are divided into the global market for brain cancer diagnostics.

Global Neuro-Oncology Diagnostics Market Segmentation: By Age Group

-

0-15

-

15-39

-

40-65

-

65 and above

Adults (age 40 and over) account for approximately 81.7% of all primary brain tumors. In the United States, an estimated 79,340 persons aged 40 and over will be diagnosed with a primary brain tumor in 2023. The age group 65 and up is expected to have the highest number of new occurrences in 2023. This is also the category that is predicted to increase the highest throughout the forecasted period, propelling the neuro-oncology diagnostics market.

Global Neuro-Oncology Diagnostics Market Segmentation: By End User

-

Hospitals

-

Specialty clinics

-

Diagnostic centers and research institutes

-

Ambulatory surgical centers

-

Others

Due to the implementation of cutting-edge technology for brain cancer diagnostics by hospitals throughout the world, the specialty clinics segment is anticipated to experience an increase in demand at the fastest CAGR of 29.4% from 2023 to 2030. The brain cancer diagnostic market is divided based on the end user into hospitals, specialty clinics, ambulatory surgery centers, diagnostic centers & research institutes, and others. Hospitals are probably going to have the greatest market share in 2021. During the projection period, the market's greatest CAGR is anticipated to be recorded by the specialty clinics segment.

Global Neuro-Oncology Diagnostics Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The North American brain cancer diagnostics market consists of the United States, Canada, and Mexico. The United States is the leading market for brain cancer diagnostics, followed by Canada and Mexico. North America is predicted to dominate the global brain cancer diagnostic market in 2022 as consumer awareness of the benefits of a brain cancer diagnosis grows. An increase in demand for brain cancer diagnostics products, as well as an increase in research and development activities in the industry, are projected to drive the market over the forecasted period. The brain cancer diagnostics market in North America is predicted to rise because of an aging population and an increasing number of product approvals and advances, which will provide growth prospects for the industry. According to the American Society of Clinical Oncology (ASCO), an estimated 24,530 persons (13,840 men and 10,690 women) will be diagnosed with primary malignant tumors of the brain and spinal cord in the United States in 2021. However, Asia Pacific is the fastest-growing area. The Asia Pacific brain cancer diagnostics market is also assessed for the other Asia Pacific nations. Factors such as increased government and private sector investment in the region's different countries drive the market.

COVID-19 Impact Analysis on the Global Neuro-Oncology Diagnostics Market:

The COVID-19 pandemic has had a significant impact on the brain cancer diagnostics and surgical industry. Cancer diagnostic product trade associations argue that the worldwide supply chain for diagnostic products has been considerably harmed, affecting end-user consumption in the brain cancer diagnostic market. Diagnostics product sales in the first quarter of 2020 were severely delayed due to logistical and shipping challenges. On the demand side, the market is growing since people need to be diagnosed following the lockdown scenario. Furthermore, the market's supply growth is negative. This is owing to the lockdown conditions in many nations that manufacture diagnostic, surgical, and cancer care tools.

Latest Trends/ Developments:

Siemens Healthcare GmbH unveiled two new magnetic resonance tomographs for clinical and scientific applications in November 2022. Because of their high field strengths and great gradient performance, both scanners will be ideal for identifying the finest structures in the body more clearly.

Bio Reference Laboratories, Inc., an OPKO Health company, and its specialty oncology division, Gen Path, announced the launch of OnkoSight AdvancedTM, a next-generation sequencing (NGS) assay that enables revolutionary deoxyribonucleic acid (DNA) mutational profiling of tumor samples, in September 2021.

Siemens Healthineers AG finalized the acquisition of Varian Medical Systems, Inc. in April 2020. The United firm has a one-of-a-kind, highly integrated portfolio for imaging, laboratory diagnostics, and cancer therapy.

Key Players:

-

NIHON KOHDEN CORPORATION.

-

FUJIFILM Holdings Corporation

-

GE HealthCare

-

Koninklijke Philips N.V.

-

BD

-

Siemens Healthcare GmbH

-

Others

Chapter 1. Neuro-Oncology Diagnostics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Neuro-Oncology Diagnostics Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Neuro-Oncology Diagnostics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Neuro-Oncology Diagnostics Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Neuro-Oncology Diagnostics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Neuro-Oncology Diagnostics Market – By Test Type

6.1 Introduction/Key Findings

6.2 Imaging Tests

6.3 Biopsy

6.4 Lumbar Puncture

6.5 Molecular Testing

6.6 Electroencephalography (EEG)

6.7 Platform and Services

6.8 Others

6.9 Y-O-Y Growth trend Analysis By Test Type

6.10 Absolute $ Opportunity Analysis By Test Type, 2023-2030

Chapter 7. Neuro-Oncology Diagnostics Market – By Cancer Type

7.1 Introduction/Key Findings

7.2 Acoustic Neuroma

7.3 Astrocytomas

7.4 Glioblastoma Multiforme

7.5 Meningiomas

7.6 Oligodendroglioma

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Cancer Type

7.9 Absolute $ Opportunity Analysis By Cancer Type, 2024-2030

Chapter 8. Neuro-Oncology Diagnostics Market – By Age Group

8.1 Introduction/Key Findings

8.2 0-15

8.3 15-39

8.4 40-65

8.5 65 and above

8.6 Y-O-Y Growth trend Analysis By Age Group

8.7 Absolute $ Opportunity Analysis By Age Group, 2023-2030

Chapter 9. Neuro-Oncology Diagnostics Market – By End-User

9.1 Introduction/Key Findings

9.2 Hospitals

9.3 Specialty clinics

9.4 Diagnostic centers and research institutes

9.5 Ambulatory surgical centers

9.6 Others

9.7 Y-O-Y Growth trend Analysis End-User

9.8 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Neuro-Oncology Diagnostics Market , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Test Type

10.1.2.1 By Cancer Type

10.1.3 By Age Group

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Test Type

10.2.3 By Cancer Type

10.2.4 By Age Group

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Test Type

10.3.3 By Cancer Type

10.3.4 By Age Group

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Test Type

10.4.3 By Cancer Type

10.4.4 By Age Group

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Test Type

10.5.3 By Cancer Type

10.5.4 By Age Group

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Neuro-Oncology Diagnostics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 NIHON KOHDEN CORPORATION.

11.2 FUJIFILM Holdings Corporation

11.3 GE HealthCare

11.4 Koninklijke Philips N.V.

11.5 BD

11.6 Siemens Healthcare GmbH

11.7 Others

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Neuro-Oncology Diagnostics Market was valued at USD 1.80 Billion and is projected to reach a market size of USD 3.21 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.6%.

The worldwide global neuro-oncology diagnostics market growth is estimated to grow by around 8.6% from 2023 to 2030.

The Global NeuroOncology Diagnostics Market is segmented by Test Type, by Cancer Type, by Age Group, and by End User.

The market is expected to see growth through rising awareness of early diagnosis of brain cancer, advancements in technologies like improved imaging techniques, along innovation in drug delivery to brain cancer increasing the size of the market.

The COVID-19 pandemic disrupted the supply chain of the diagnostic market reducing the overall market size in 2020. However, the market is increasing as people have to get diagnosed after the lockdown scenario.