Network Equipment-Building System (NEBS) Testing and Certification Services Market Size (2023 - 2030)

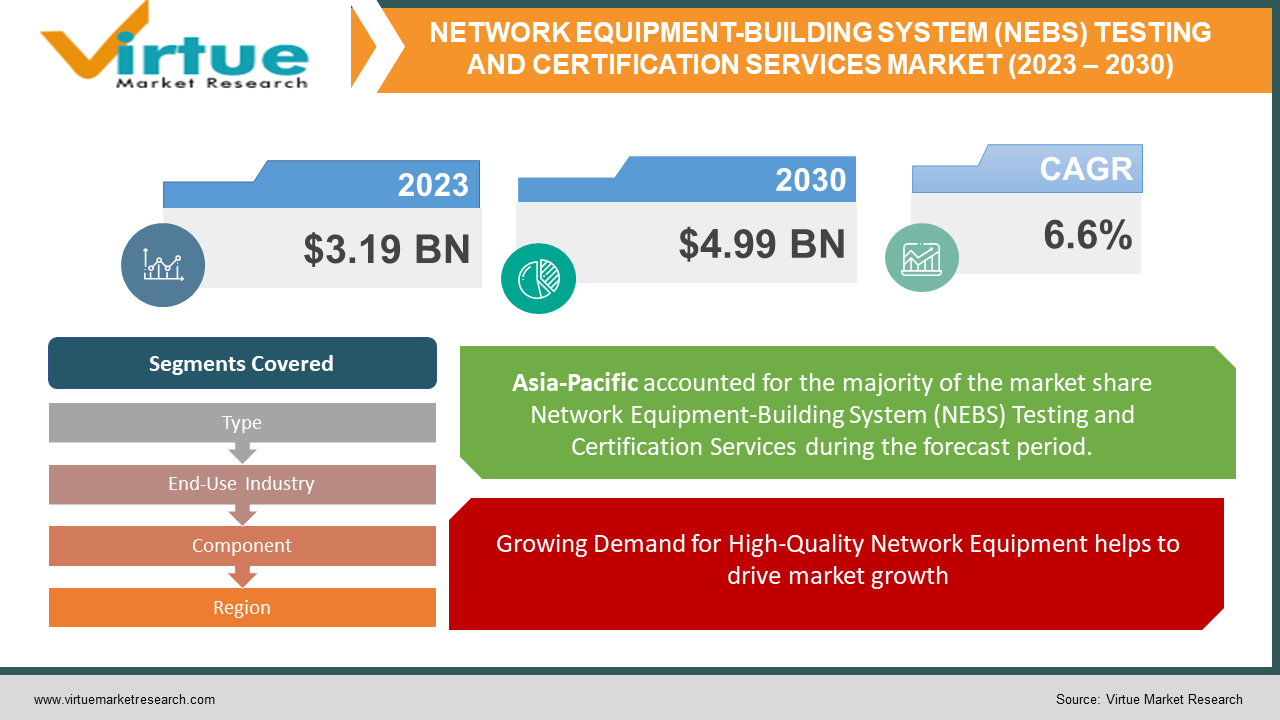

The Global Network Equipment-Building System (NEBS) Testing and Certification Services Market was valued at USD 3.19 billion and is projected to reach a market size of USD 4.99 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.6%.

The market growth can be attributed to the increasing demand for NEBS-compliant equipment from telecom service providers due to the rising adoption of cloud services, the internet of things (IoT), and 5G technology. The growing awareness regarding NEBS standards and certifications and the increasing need to minimize network downtime and reduce operational costs are also contributing to market growth. The Asia Pacific region is projected to witness the highest growth rate during the forecast period due to the rapid expansion of the telecom industry in countries like China and India. The ongoing technological advancements and the development of new and improved NEBS testing and certification services are also projected to drive market growth in the coming years.

Industry Overview:

Network Equipment-Building System (NEBS) testing and certification services refer to a set of standards that are used for testing and certifying telecommunications instrumentality. These standards are founded by the telecommunications industry to ensure that the equipment is safe, reliable, & operates under various environmental conditions. NEBS testing and certification services are crucial for telecom equipment manufacturers and service providers who must comply with industry standards and regulations to ensure customer satisfaction and maintain their market position. NEBS testing and certification services cover various aspects of telecom equipment such as reliability, environmental conditions, and safety. The testing process evaluates the equipment's ability to operate in different conditions such as temperature, humidity, and electromagnetic interference. It also evaluates the equipment's durability, resistance to shock & vibration, and fire resistance. NEBS testing and certification services are essential for telecom equipment manufacturers and service providers, as they enable them to meet industry standards and regulations, ensure equipment reliability and safety, and provide customers with high-quality and dependable telecom equipment. The NEBS testing and certification market is projected to grow due to the increasing demand for reliable and safe telecom equipment, the rise of cloud computing, and the growing need for high-speed and efficient telecom services.

COVID-19 impact on the Network Equipment-Building System (NEBS) Testing and Certification Services Market:

As Network Equipment-Building System (NEBS) Testing and Certification Services primarily deal with the telecommunication industry, the COVID-19 pandemic had a mixed impact on the market. On one hand, the increased demand for connectivity due to remote working & online learning led to a surge in demand for telecommunication services and equipment, which indirectly benefited the NEBS testing and certification services market. On the other hand, the pandemic also resulted in supply chain disruptions and delays, which impacted the production and testing of network equipment. The pandemic also led to changes in the work environment, with many testing and certification service providers adopting remote and virtual testing methods. This helped to ensure safety and minimize the risk of exposure to the virus. However, this also posed some challenges, as virtual testing may not be as effective as in-person testing, and there may be concerns about data security and privacy. Overall, while the pandemic had some impact on the NEBS testing and certification services market, the long-term effects are yet to be fully understood.

Market Drivers:

Growing Demand for High-Quality Network Equipment helps to drive market growth:-

As the demand for reliable & high-quality network equipment continues to increase, there is a corresponding need for testing and certification services to ensure that the equipment meets industry standards and regulations. NEBS testing and certification services help to provide assurance to customers that the network equipment they are purchasing is safe and reliable.

Increased Focus on Data Center Optimization helps to drive market growth:-

With the growth of cloud computing & the increasing demand for data centre services, there is a greater focus on optimizing data centre infrastructure. NEBS testing and certification services can help data centre operators to ensure that their equipment is reliable, safe, and optimized for efficient operation. This is particularly important in industries such as telecommunications, where downtime can have a significant impact on business operations.

Market Restraints:

The Network Equipment-Building System (NEBS) Testing and Certification Services Market's growth is being stifled by High Cost:

The NEBS testing and certification process can be expensive, which can act as a major restraint for the growth of the market. The cost affected in testing & certification services can be a significant burden for small & medium-sized enterprises, restricting their ability to participate in the market.

The Network Equipment-Building System (NEBS) Testing and Certification Services Market's growth is being hampered by Complexity:

NEBS testing and certification services can be a complex process that requires narrowed knowledge and equipment. As a result, only a limited number of companies have the expertise & resources to offer these services. This can create a barrier to entry for new players in the market and limit the overall growth potential of the industry.

Market Segments:

NETWORK EQUIPMENT-BUILDING SYSTEM (NEBS) TESTING AND CERTIFICATION SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6.6% |

|

Segments Covered |

By Type, End-Use Industry, Component, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

UL LLC, TUV Rheinland AG, Intertek Group plc, Bureau Veritas SA, CSA Group, DEKRA Certification B.V., Eurofins Scientific SE, SGS SA, Element Materials Technology Ltd., Cetecom GmbH. |

Network Equipment-Building System (NEBS) Testing and Certification Services Market—By Type

-

Tier 1

-

Tier 2

-

Tier 3

The Network Equipment-Building System (NEBS) Testing and Certification Services market can be segmented by the type of NEBS certification & on the basis of Tier 1, Tier 2, & Tier 3 NEBS certifications. The type of NEBS certification considers physical, electrical, & environmental. The physical certification guarantees that the equipment is built to withstand physical shocks & vibrations, whereas the electrical certification guarantees that the equipment is electrically safe and does not interfere with other equipment. The environmental certification ensures that the equipment can operate in harsh environments. In terms of Tier certifications, Tier 1 certification ensures that the equipment is suitable for use in a standard data centre environment, while Tier 2 certification asks for higher levels of redundancy and a higher level of reliability. Tier 3 certification requires no single point of failure, redundant components, and 99.982% availability. In recent years, there has been a growing demand for higher levels of NEBS certification, particularly Tier 3, due to the increasing need for data centre reliability & uptime. This has led to the development of new testing and certification standards to meet these requirements. The market is projected to continue to grow as more companies seek to comply with NEBS standards and improve the reliability of their network equipment.

Network Equipment-Building System (NEBS) Testing and Certification Services Market – End-Use Industry

-

Telecommunications

-

Aerospace and defense

-

Healthcare

-

Energy and utilities

-

Others

The Network Equipment-Building System (NEBS) Testing and Certification Services market can be segmented based on the end-use industry into telecommunications, aerospace and defense, healthcare, energy and utilities, and others. The telecommunications sector is the largest end-use industry for NEBS testing and certification services due to the increasing adoption of cloud-based services and the need for efficient and secure communication networks. The aerospace and defense industry is also a significant end-user of NEBS testing and certification services due to the need for reliable and secure communication networks in critical applications. The healthcare sector is witnessing an increasing adoption of connected medical devices and telemedicine, driving the demand for NEBS testing and certification services to ensure the safety and reliability of these devices. The energy and utilities industry is also adopting NEBS testing and certification services to ensure the reliability and safety of their communication networks. The increasing focus on compliance and safety standards is projected to drive the demand for NEBS testing and certification services in various end-use industries.

Network Equipment-Building System (NEBS) Testing and Certification Services Market – Component

-

Switches

-

Routers

-

Servers

-

Storage devices

-

Others

The Network Equipment-Building System (NEBS) Testing and Certification Services market can be segmented by component type, including switches, routers, servers, storage devices, and others. The increasing demand for high-performance and reliable network equipment has driven the growth of the NEBS testing and certification services market for various component types. The stringent regulatory requirements for telecommunication instrumentality have resulted in the acceptance of NEBS-certified components in the telecommunications industry, forcing the growth of the market. The switch component type segment is projected to hold a major share in the NEBS testing and certification services market due to the growing demand for high-speed and secure data communication in various end-use industries. The growing adoption of cloud computing & big data analytics has further increased the demand for switches, which is driving the growth of the NEBS testing and certification services market. Moreover, the increasing adoption of advanced technologies such as 5G, IoT, and AI has also boosted the petition for NEBS-certified servers, storage devices, and routers. These factors are projected to drive the growth of the NEBS testing and certification services market for various component types in the forecast period.

Network Equipment-Building System (NEBS) Testing and Certification Services Market – By Region

-

North America

-

Europe

-

Asia-Pacific

-

Rest of the World

The global Network Equipment-Building System (NEBS) Testing and Certification Services market is segmented into several regions such as North America, Europe, Asia-Pacific, the Middle East and Africa, and South America. North America is projected to hold a major share of the market owing to the presence of major players & high adoption of NEBS standards in the region. The Asia-Pacific region is anticipated to witness substantial growth in the market owing to the increasing adoption of advanced technologies, rising demand for cloud-based services, and growing investments in the telecom industry. The Middle East and Africa and South America are also projected to witness significant growth due to the increasing adoption of NEBS standards by telecom operators and the rapid growth of the telecom industry in these regions. The increasing demand for high-speed internet connectivity and the growing adoption of advanced technologies such as 5G is projected to drive the growth of the NEBS testing and Certification Services market in these regions. Overall, the global NEBS Testing and Certification Services market is projected to witness significant growth in the coming years owing to the increasing demand for NEBS-compliant network equipment and the growing focus on ensuring network reliability and uptime.

Major Key Players in the Market

-

UL LLC

-

TUV Rheinland AG

-

Intertek Group plc

-

Bureau Veritas SA

-

CSA Group

-

DEKRA Certification B.V.

-

Eurofins Scientific SE

-

SGS SA

-

Element Materials Technology Ltd.

-

Cetecom GmbH.

Market Insights and Developments:

In September 2020, Intertek announced the expansion of its NEBS testing capabilities in North America with the opening of a new laboratory in California. The new lab will provide testing and certification services for network equipment manufacturers seeking to enter the US and Canadian markets, catering to the growing demand for NEBS compliance.

In November 2021, Bureau Veritas, a global testing and certification provider, acquired Advanced Compliance Solutions, a US-based NEBS testing and certification company. The acquisition expands Bureau Veritas’ capabilities in North America and strengthens its position in the telecom market, offering customers a more comprehensive range of testing and certification services for their network equipment.

Chapter 1. NETWORK EQUIPMENT-BUILDING SYSTEM (NEBS) TESTING AND CERTIFICATION SERVICES MARKET- Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. NETWORK EQUIPMENT-BUILDING SYSTEM (NEBS) TESTING AND CERTIFICATION SERVICES MARKET- Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. NETWORK EQUIPMENT-BUILDING SYSTEM (NEBS) TESTING AND CERTIFICATION SERVICES MARKET- Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. NETWORK EQUIPMENT-BUILDING SYSTEM (NEBS) TESTING AND CERTIFICATION SERVICES MARKET- Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. NETWORK EQUIPMENT-BUILDING SYSTEM (NEBS) TESTING AND CERTIFICATION SERVICES MARKET- Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. NETWORK EQUIPMENT-BUILDING SYSTEM (NEBS) TESTING AND CERTIFICATION SERVICES MARKET- By Type

6.1 Tier 1

6.2 Tier 2

6.3 Tier 3

Chapter 7. NETWORK EQUIPMENT-BUILDING SYSTEM (NEBS) TESTING AND CERTIFICATION SERVICES MARKET- End-Use Industry

7.1 Telecommunications

7.2 Aerospace and defense

7.3 Healthcare

7.4 Energy and utilities

7.5 Others

Chapter 8. NETWORK EQUIPMENT-BUILDING SYSTEM (NEBS) TESTING AND CERTIFICATION SERVICES MARKET- By Component

8.1 Switches

8.2 Routers

8.3 Servers

8.4 Storage devices

8.5 Others

Chapter 9. NETWORK EQUIPMENT-BUILDING SYSTEM (NEBS) TESTING AND CERTIFICATION SERVICES MARKET– By Region

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Latin America

9.5 The Middle East

9.6 Africa

Chapter 10. NETWORK EQUIPMENT-BUILDING SYSTEM (NEBS) TESTING AND CERTIFICATION SERVICES MARKET– Key players

10.1 UL LLC

10.2 TUV Rheinland AG

10.3 Intertek Group plc

10.4 Bureau Veritas SA

10.5 CSA Group

10.6 DEKRA Certification B.V.

10.7 Eurofins Scientific SE

10.8 SGS SA

10.9 Element Materials Technology Ltd.

10.10 Cetecom GmbH.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Network Equipment-Building System (NEBS) testing and certification is a set of requirements and standards for telecommunications equipment to ensure safety, reliability, and quality in their deployment in telecommunication networks.

NEBS testing and certification is important because it helps telecommunication companies to ensure that their equipment meets industry standards and can operate safely and reliably in a variety of environmental conditions.

Several independent organizations provide NEBS testing and certification services, including UL LLC, Intertek Group plc, and TUV Rheinland AG.

NEBS testing and certification requirements typically include environmental testing, such as temperature and humidity, seismic testing, electromagnetic compatibility testing, and safety testing.

NEBS testing and certification is primarily required in the telecommunications industry for equipment used in network infrastructure, data centers, and other telecommunications applications.