Netherlands IT services Market Size (2024-2030)

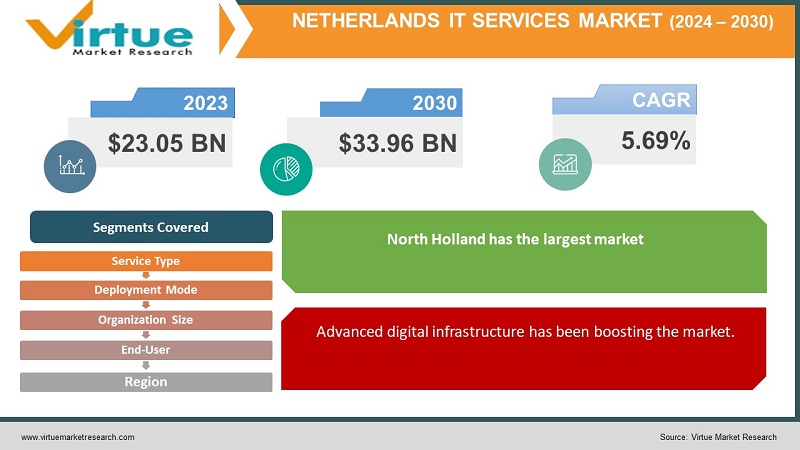

The Netherlands IT services market was valued at USD 23.05 billion and is projected to reach a market size of USD 33.96 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5.69%.

The use of technical and commercial skills to assist organizations in managing, creating, and optimizing access to information and business processes is known as information technology services. Any information technology system or component's design, installation, upkeep, or optimization can be included in IT services. In the past, there was a notable expansion in this country. Dutch companies were outsourcing services. Presently, with the rapid digital transformation and governmental initiatives, the market has seen considerable growth. In the future, with a focus on cybersecurity and technological innovations, immense acceleration is anticipated.

Key Market Insights:

- The Netherlands is renowned for its quick inventions and technological uptake. With 98% of homes having broadband, the nation has a robust digital infrastructure and ranks second in the world for internet connection.

- In the IT services industry in the Netherlands, the average spend per employee is expected to reach US$2.67k by 2024.

- The European IT services market is expected to expand by 27.75% until 2028, reaching $526.17 billion, according to Statista.

- The European IT services sector generated $389.3 billion in sales in total in 2022, representing a compound annual growth rate (CAGR) of 11.1%.

- Over the past several years, there has been a declining trend in the profit margins of IT service providers in the Netherlands, with an average yearly decline of 2-3%. To tackle this, companies are streamlining internal processes and increasing operational efficiency to reduce costs.

Netherlands IT Services Market Drivers:

Advanced digital infrastructure has been boosting the market.

The Netherlands is well known for having a sophisticated digital infrastructure, which includes widely used digital technology, dependable telecommunications networks, and fast internet access. This solid infrastructure offers a solid platform on which to supply IT services, facilitating easy data interchange, communication, and access to cloud-based solutions. Efficient connections and digital platforms are advantageous for businesses in the Netherlands since they enable the adoption of new IT solutions, remote work arrangements, and e-commerce operations. Strong digital infrastructure stimulates demand for traditional IT services as well as for newer technologies like big data analytics, the Internet of Things (IoT), and smart city projects. To improve operational efficiency, customer experience, and innovation, businesses are investing in modernizing their IT infrastructure, embracing cutting-edge technologies like blockchain, the Internet of Things (IoT), and artificial intelligence, and utilizing digital solutions.

Strong governmental policies have been contributing to the success.

The Dutch government is essential in creating an atmosphere that is favorable to the expansion of the IT services industry. The government fosters innovation, entrepreneurship, and digitization through a range of laws, initiatives, and investments. This includes giving money to R&D initiatives, helping small and medium-sized businesses, encouraging foreign investment, and improving digital infrastructure. Furthermore, legal frameworks like the GDPR (General Data Protection Regulation) guarantee data security and privacy, which increases consumer and company confidence in IT services. The government's robust backing and advantageous policies are major factors propelling the growth of the Netherlands' IT services sector.

IT Services Market Restraints and Challenges:

Data privacy, a shortage of expertise, and associated costs are the main issues that the market is currently facing.

There have been numerous cases of cybercrime that have led to significant amounts of money being lost. Sensitive data is stored by the companies. The misuse and mishandling of this information is a major barrier. Secondly, a skilled workforce is required to handle the operations. Good knowledge in fields like artificial intelligence, blockchain, machine learning, cybersecurity, and data science is required. The skill gap is often faced while recruiting, posing complexities. Thirdly, the initial expenses that are required are very high. Companies that offer these services need to invest in advanced technologies that include hardware and software. Additionally, upgrades and maintenance charges add up. Smaller firms and other startups might face difficulties in this regard.

IT Services Market Opportunities:

Technological advancements have been providing the market with an ample number of possibilities. Data analytics is one such emerging field. This helps in gaining insights to get a deeper understanding. Through the insights that are provided, it is possible to predict failures and outcomes. This helps streamline the process and reduce operational costs. Cybersecurity is another important field. The security of data has become very vital. Services in the fields of threat detection and security consulting are in high demand. Furthermore, robotic process automation (RPA) technologies are also being encouraged to avoid repetitive tasks. This allows workers to concentrate on other core functions. Secondly, providing industry-specific solutions is beneficial. Services are catered to the needs of the industry. Specialized solutions are being developed to address the problems faced by different sectors. Thirdly, R&D activities are being prioritized. By studying and conducting experiments in fields like big data and blockchain, the existing technology can be improved. To support this, governmental agencies and academic institutes are providing grants as well as funds.

NETHERLANDS IT SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.69% |

|

Segments Covered |

By Service Type, deployment, mode, organization size, end user, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Netherlands |

|

Key Companies Profiled |

Capgemini , Atos , CGI , ASML , Accenture , Wipro , Tata Consultancy Services (TCS) , Infosys , HCL Technologies , IBM |

IT Services Market Segmentation:

IT Services Market Segmentation: By Service Type:

- Project-oriented Services

- Managed Services

- Support Services

Managed services are both the largest and fastest-growing service type. The process of contracting out the upkeep and foresight of many processes and operations is known as managed services. Information technology activities are supported by a third-party organization known as a managed service provider (MSP). An organization's whole IT operation, including security, data backups, round-the-clock monitoring, and on-demand help, is handled by MSPs. Additionally, some businesses supply the hardware, including desktop computers, servers, networks, and other storage systems. By lowering directly engaged staffing levels, managed services may enhance operations and save on budgetary costs. Third-party organizations frequently manage essential tasks daily, freeing up the employing company to concentrate on enhancing its other offerings or lightening the workloads of its staff. Financial crimes, internal audit services, enterprise risk and controls, cybersecurity, regulatory operations, and reporting compliance are a few examples of managed services.

IT Services Market Segmentation: By Deployment Mode:

- Cloud-based

- On-premise

The cloud-based category is both the largest and fastest-growing, depending on the deployment method. Because these solutions are automated, IT teams will handle the deployment, security, and monitoring of apps. Employers may gain from employee data by employing cloud-based solutions to centralize different data sources. Advanced security features and controlled access are also provided by these solutions. Every update is carried out automatically. Its adaptability, scalability, and flexibility aid in attracting a larger client base.

IT Services Market Segmentation: By Organization Size:

- Large-Scale Organization

- Small and medium-scale organizations

Large-scale organizations represent the largest category holding the highest market share in 2023. They have the requisite funding and contingency. These companies use machine learning to analyze bigger, more complicated data sets and provide faster, more accurate responses. To enhance the current algorithms, these organizations are also funding research and development projects. The fastest-growing organizations are small and medium-sized. These businesses work with bigger organizations by offering distinctive solutions. These firms are receiving assistance from the government in the form of grants, cash, and different initiatives. In addition, several businesses have begun selling pre-built models that come with a variety of services, such as management and training. This lowers the price, which makes it a desirable choice.

IT Services Market Segmentation: By End-User:

- BFSI

- Healthcare & Life Sciences

- Retail

- IT & Telecommunications

- Government and Defense

- Manufacturing

- Energy and Utilities

- Agriculture

- Automotive

- Others

BFSI is the largest end-user dominating the market share in 2023. IT services are used by the banking, financial services, and insurance (BFSI) industry to modernize processes, enhance client satisfaction, and safeguard financial data. BFSIs employ centralized systems to deploy AI chatbots that can converse in multiple languages and AI-driven autonomic systems that analyze financial transactions in real-time. These systems recommend customized financial plans, insurance policies, automated lending options, credit reports, and self-governing debt management systems. The healthcare sector is the fastest-growing. IT services are used in healthcare to enhance data administration, communication, and patient care. Healthcare practitioners can also benefit from IT services by having rapid access to test findings, medical histories, and patient information, which can aid in decision-making. Healthcare workers may find it simpler to interact and exchange important information with one another. Besides, IT services can support data dissemination and storage. Furthermore, patient portals, particularly for those with chronic conditions, can lower expenses and increase efficiency. In addition to curing illnesses and lowering healthcare expenses, data analytics can help stop epidemics.

Market Segmentation: Regional Analysis:

North Holland has the largest market. Amsterdam, Haarlem, and Hilversum are in the lead. The infrastructure and other resources are very advanced in this area due to the economy. Entrepreneurship is very popular in this region and draws in a wide spectrum of IT firms, startups, and investments in digital infrastructure. Furthermore, a lot of prestigious research organizations and academic institutes are present here. This creates a superior workforce. South Holland is the fastest-growing market. Rotterdam, The Hague, and Delft are at the forefront. The province's economy and technical innovation environment are responsible for the progress. IT service companies serving the logistics, manufacturing, and maritime industries are drawn here due to their advantageous location, international trade linkages, and industrial players. Governmental bodies are helping with the development of this region by creating employment opportunities. Security measures and digital advancements are some of the other reasons for the immense growth.

COVID-19 Impact Analysis on the Netherlands IT Services Market:

The viral epidemic affected the market positively. Lockdowns, social isolation, and restrictions on movement were put into place. To stop the virus from spreading, the majority of the businesses had to be closed. Since the COVID-19 epidemic began, there has been a surge in demand for remote work and remote information access, which has accelerated digitization processes. 78% of the companies reported significant advancements in digital transformation (DX) as a result of the COVID-19 pandemic, as per Statista. Due to work-from-home policies, virtual collaborations were facilitated through cloud-based solutions. Most of the sensitive data was shared through the Internet. This led to an elevation in cybersecurity solutions. IT service providers witnessed an upsurge in their services to support remote work. These services provided suitable solutions for carrying out the normal functioning of operations, planning strategies, backups, deployments, disaster recovery solutions, and other cloud-sharing tools. Investments increased, especially in the healthcare sector, to advance infrastructure and other resources. Telehealth solutions gained prominence. These services were used for providing remote monitoring services, securing sensitive patient information, maintaining electronic health records, and managing the supply chain of various medical components. Post-pandemic, the market has continued to grow rapidly owing to the demand.

Latest Trends/ Developments:

Sustainability is being emphasized in every industry. In this regard, businesses have been seeking green solutions. One such area is energy-efficient hardware. Energy-efficient hardware is made to consume less energy while still serving the same purpose. Selecting components like CPUs, GPUs, RAM, storage, and displays that consume less power results in technology that is energy-efficient.

This can lessen the requirement for cooling systems, the production of heat, and the amount of power used. Hardware that uses less energy may also reduce carbon footprints and promote environmental preservation. Furthermore, gear that uses less energy may frequently perform better.

Key Players:

- Capgemini

- Atos

- CGI

- ASML

- Accenture

- Wipro

- Tata Consultancy Services (TCS)

- Infosys

- HCL Technologies

- IBM

In January 2024, the national MDT service in the Netherlands was supported by a partnership between Open Line Launch and VECOZO. The partnership intends to provide Vitaly MDT sessions as a digital multidisciplinary consulting service available across the country. With the MDT service, VECOZO is dedicated to achieving national standardization at socially appropriate pricing and guarantees that interoperability in-network care is set up quickly throughout the Netherlands.

In May 2023, to better serve its clients in the European Union, SHI International announced that SHI International B.V. will be established in Amsterdam, Netherlands. Along with complementing SHI's current warehouse and Integration Center facilities in Tiel, Netherlands, and other EU-based activities in Dublin and Paris, the new subsidiary will create employment in sales, finance, and technology.

In August 2023, to assist Athora Netherlands, a Dutch provider of life insurance and pensions, in adopting a business and IT operating model that will improve customer experience, operational resilience, and business agility, Tata Consultancy Services (TCS) extended its long-standing partnership with the latter. Athora Netherlands' Ambition 2025 program, which aims to position the firm as a leading provider of life insurance and pensions, will benefit from this relationship with TCS.

Chapter 1. Netherlands IT Services Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Netherlands IT Services Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Netherlands IT Services Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Netherlands IT Services Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Netherlands IT Services Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Netherlands IT Services Market – By Service Type

6.1. Introduction/Key Findings

6.2. Project-oriented Services

6.3. Managed Services

6.4. Support Services

6.5. Y-O-Y Growth trend Analysis By Service Type

6.6. Absolute $ Opportunity Analysis By Service Type , 2024-2030

Chapter 7. Netherlands IT Services Market – By Deployment Mode

7.1. Introduction/Key Findings

7.2 Cloud-based

7.3. On-premise

7.4. Y-O-Y Growth trend Analysis By Deployment Mode

7.5. Absolute $ Opportunity Analysis By Deployment Mode , 2024-2030

Chapter 8. Netherlands IT Services Market – By Organization Size

8.1. Introduction/Key Findings

8.2 Large-Scale Organization

8.3. Small and medium-scale organizations

8.4. Y-O-Y Growth trend Analysis Organization Size

8.5. Absolute $ Opportunity Analysis Organization Size , 2024-2030

Chapter 9. Netherlands IT Services Market – By End-Use Industry

9.1. Introduction/Key Findings

9.2 BFSI

9.3. Healthcare & Life Sciences

9.4. Retail

9.5. IT & Telecommunications

9.6. Government and Defense

9.7. Manufacturing

9.8. Energy and Utilities

9.9. Agriculture

9.10. Automotive

9.11. Others

9.12. Y-O-Y Growth trend Analysis End-Use Industry

9.13. . Absolute $ Opportunity Analysis End-Use Industry , 2024-2030

Chapter 10. Netherlands IT Services Market , By Geography – Market Size, Forecast, Trends & Insights

10.1. Netherlands

10.1.1. By Country

10.1.1.1. Netherlands

10.1.2. By Service Type

10.1.3. By Deployment Mode

10.1.4. By Organization Size

10.1.5. End-Use Industry

10.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Netherlands IT Services Market – Company Profiles – (Overview, Service Type Portfolio, Financials, Strategies & Developments)

11.1 Capgemini

11.2. Atos

11.3. CGI

11.4. ASML

11.5. Accenture

11.6. Wipro

11.7. Tata Consultancy Services (TCS)

11.8. Infosys

11.9. HCL Technologies

11.10. IBM

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Netherlands IT services market was valued at USD 23.05 billion and is projected to reach a market size of USD 33.96 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5.69%.

Advanced digital infrastructure and strong governmental policies are the main factors propelling the Netherlands IT services market

Based on deployment mode, the Netherlands IT services market is segmented into cloud-based and on-premise

North Holland is the most dominant region for the Netherlands IT services market.

Capgemini, Atos, and CGI are the key players operating in the Netherlands IT services market.