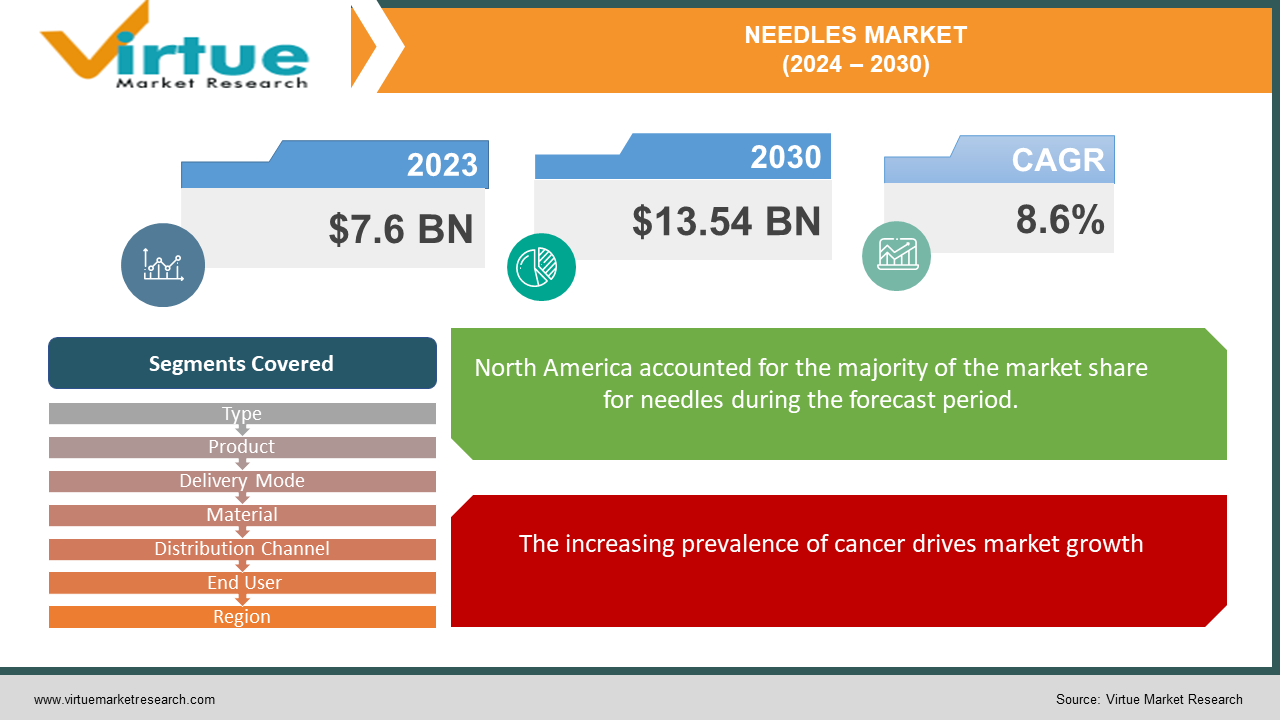

Needles Market Size (2024 – 2030)

The Needles Market was valued at USD 7.6 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 13.54 billion by 2030, growing at a CAGR of 8.6%.

A needle is a slender, solid tool with a pointed end utilized for puncturing tissues in various medical procedures. Its applications range from blood sample collection to drug administration. Despite their utility, healthcare professionals face heightened risks of accidental skin punctures, resulting in needlestick injuries. To address this, safety needles incorporate features like protective sheaths to prevent such injuries. These needles come in different types, including active, requiring manual activation, and passive, which activate automatically. The implementation of safety features has increased their adoption among hospitals, ambulatory surgery centers, diabetic patients, and other end users.

Global growth in needlestick injuries and the prevalence of chronic and infectious diseases are driving factors for the expansion of the safety needles market. Furthermore, the widespread adoption of safety needles worldwide and supportive government initiatives are contributing to market growth. Nonetheless, challenges such as the availability of alternative drug delivery methods and the high cost of safety needles restrain the market growth.

Key Market Insights:

The increasing favorability towards injectable medications, driven by advantages such as precise dosage control and rapid onset of action, stands as a significant driver in the market. The heightened risk of infections linked with needle-based drug delivery underscores the need for safety features. Continuous advancements in needle technology, particularly in safety features, present opportunities for improving healthcare practices and safety standards.

Needles Market Drivers:

The increasing prevalence of cancer drives market growth

The escalating incidence of cancer worldwide is a pivotal factor driving market growth. Additionally, the rising prevalence of other chronic and acute diseases contributes to increased demand and supply within the market. Furthermore, the growing occurrence of diseases in pets serves as an additional determinant influencing market dynamics.

Research and development proficiencies increase the demand

The increasing investment in research and development capabilities, particularly in both developed and developing economies, focused on medical instruments and devices, is poised to generate significant market growth opportunities. Moreover, ongoing research and development endeavors aimed at integrating advanced technologies into healthcare facilities and enhancing infectious disease detection further accelerate the market growth rate.

Needles Market Restraints and Challenges:

Stringent regulatory requirements and quality standards hinder market growth

The global needles market is governed by stringent regulatory requirements and quality standards set forth by regulatory bodies. Adhering to these rigorous regulations poses a notable challenge for market participants. Compliance necessitates extensive testing, documentation, and adherence to quality management systems, thereby potentially elongating the time and escalating the costs associated with introducing new needle products to the market.

Increasing competition and pricing hinder market growth

The global needles market is characterized by high competitiveness, featuring a multitude of manufacturers and suppliers competing for market dominance. This fierce competition often results in pricing pressures as companies endeavor to provide competitive pricing to entice customers. Moreover, the presence of low-cost manufacturers in specific regions exacerbates price competition. Addressing this challenge necessitates companies to prioritize cost optimization, differentiation, and innovation strategies to sustain profitability and secure market share amidst escalating competition.

Needles Market Opportunities:

Increasing healthcare expenditure creates opportunities

The escalating global healthcare expenditure, propelled by factors like population expansion, aging demographics, and the growing incidence of chronic diseases, is anticipated to fuel the demand for needles across diverse healthcare environments. This heightened investment in healthcare facilities and services is expected to contribute to the increased utilization of needles in settings such as hospitals, clinics, and diagnostic centers.

Growing demand for injectable drugs increasing demand

The global demand for injectable drugs is on the rise, propelled by factors like the increasing incidence of chronic diseases, the necessity for targeted therapies, and the expanding geriatric demographic. Needles serve as integral components of injectable drug delivery systems, and the growing demand for injectable drugs is anticipated to spur the demand for needles accordingly.

NEEDLES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.6% |

|

Segments Covered |

By Type, Product, Delivery Mode, Material, Distribution Channel, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Medtronic, Thermo Fisher Scientific Inc. ,Ethicon US, LLC. , Novo Nordisk A/S , Boston Scientific Corporation , Shimadzu Corporation, Stryker, Bio-Rad Laboratories, Inc., Luminex Corporation , Merck KGaA |

Needles Market Segmentation: By Type

-

Conventional Needles

-

Safety Needles

The safety needle segment is poised to experience the highest growth rate during the forecast period. This growth is primarily driven by the reduced risk of needlestick injuries associated with these products, which can lead to the transmission of bloodborne pathogens such as HIV, hepatitis B, and hepatitis C viruses. Healthcare organizations and stakeholders need to prioritize addressing specific issues contributing to the ongoing risk of injury to better comprehend challenges related to product limitations and hospital environments.

Safety needles not only lower the incidence of infection and associated costs but also offer enhanced convenience and usability. The NMT type of safety syringe, for instance, employs automatic retraction technology upon pressing the plunger for medication injection. The single-step activation of the safety mechanism is universally easy to activate across all models of syringes with safety needles. Factors such as accuracy, operation time, and user-friendly design are favorable aspects, with the majority of healthcare personnel expressing a preference for safety needle technology over conventional devices.

Needles Market Segmentation: By Product

-

Suture Needles

-

Blood Collection Needles

-

Ophthalmic Needles

-

Dental Needles

-

Insufflation Needles

-

Pen Needles

-

Other Needles

Pen needles have emerged as the market leader, primarily driven by factors like the increasing prevalence of diabetes. Furthermore, this segment is projected to experience the most rapid growth throughout the forecast period. Insulin pen needles are offered in a range of lengths and widths. Previously, conventional pen needles were long and sharp; however, advancements in technology have led to the availability of small, thin, and pain-free needles, which are now widely accessible globally.

Needles Market Segmentation: By Delivery Mode

-

Hypodermic Needles

-

Intravenous Needles

-

Intramuscular Needles

-

Intraperitoneal Needles

The hypodermic segment has taken the lead in the global needles market, propelled by increasing instances of chronic diseases like diabetes and the introduction of needles compatible with high-power injectable technology, capable of withstanding high pressure.

In contrast, the intravenous segment is anticipated to experience the most rapid growth in the forthcoming years. Intravenous needles, hollow in structure, are affixed to IV syringes to inject and extract samples, thereby minimizing contamination during the inoculation process. The rising per capita healthcare expenditure is expected to be a key driver for this segment.

Needles Market Segmentation: By Material

-

Glass Needles

-

Plastic Needles

-

Stainless Steel Needles

-

Polyether Ether Ketone Needles

Glass syringes play a pivotal role in patient care by facilitating the delivery of drugs or biologics. Typically, these syringes are designed to interface with various devices such as needles for injection, intravenous (IV) line luer connections, needleless luer locks, adapters, and transfer units. Their durability allows for sterilization for reuse, distinguishing them from metal syringes which are frequently employed for specialized applications. In modern medicine, disposable syringes are extensively utilized for administering drugs and vaccines or extracting blood. They are preferred over reusable syringes to mitigate the risk of disease transmission.

Needles Market Segmentation: By Distribution Channel

-

Direct Tenders

-

Retail

Hospitals and clinics typically procure needles through direct tenders, given the necessity for bulk quantities. Retail outlets are also prevalent choices, as they enable direct sales to customers. Many individuals utilize needles independently for purposes such as managing diabetes, often without direct supervision from healthcare professionals.

Needles Market Segmentation: By End User

-

Hospitals and Diagnostic Center

-

Home Healthcare

-

Others

The hospitals and diagnostic centers segment secured the largest share in the safety needles market, primarily due to the extensive utilization of these devices in drug administration and blood sample collection, tasks predominantly carried out by highly trained medical personnel in hospital and surgical settings. However, the psychiatry segment is anticipated to witness substantial growth during the forecast period, driven by increased awareness regarding the importance of safe needles in psychiatric procedures. This heightened awareness is attributed to the elevated risk of needlestick injuries among healthcare workers in psychiatric settings.

Needles Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America is poised to dominate the market, buoyed by its robust healthcare infrastructure, substantial investments from key industry players in advanced devices, well-established distribution networks for needle product manufacturers, and increasing research endeavors in the region.

Meanwhile, Asia-Pacific is expected to experience significant growth, driven by government initiatives aimed at raising awareness, the burgeoning medical tourism sector, escalating research activities, and the growing demand for quality healthcare services. Additionally, factors such as a large patient population affected by chronic and infectious diseases, along with escalating healthcare expenditure, contribute to market growth in the region. Moreover, the dynamic life science industry, particularly in developing economies like India, China, and Malaysia, is anticipated to offer lucrative opportunities for market expansion.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic triggered an unprecedented global demand for vaccines, consequently leading to a significant upsurge in the need for needles, particularly for vaccination purposes. To address this surge, numerous medical device manufacturers reprioritized their production to meet the heightened demand for critical healthcare supplies, including needles. However, the pandemic disrupted global supply chains, posing challenges in the procurement and distribution of medical supplies, including needles, resulting in temporary shortages or delays in certain regions.

The pandemic underscored the paramount importance of healthcare worker safety, prompting an increased emphasis on the utilization of safety needles to mitigate the risk of needlestick injuries and potential exposure to infectious diseases. Moreover, the shift towards telemedicine and remote monitoring during the pandemic diminished the immediate requirement for certain types of needles typically used in traditional in-person healthcare settings. Conversely, there was a surge in demand for needles associated with self-administration of medications at home, reflecting evolving healthcare delivery trends during the pandemic

Latest Trends/ Developments:

In May 2022, Roche Diabetes Care India (RDC India) unveiled Accu-Fine, a range of premium pen needles tailored to enhance the insulin delivery process for individuals managing diabetes. This latest addition to Roche Diabetes Care's product portfolio, renowned for its Accu-Chek brand, is specifically engineered to streamline insulin delivery, thereby fostering improved diabetes management for patients.

Key Players:

These are the top 10 players in the Needles Market:-

-

Medtronic

-

Thermo Fisher Scientific Inc.

-

Ethicon US, LLC.

-

Novo Nordisk A/S

-

Boston Scientific Corporation

-

Shimadzu Corporation

-

Stryker

-

Bio-Rad Laboratories, Inc.

-

Luminex Corporation

-

Merck KGaA

Chapter 1. Needles Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Needles Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Needles Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Needles Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Needles Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Needles Market – By Type

6.1 Introduction/Key Findings

6.2 Conventional Needles

6.3 Safety Needles

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Needles Market – By Product

7.1 Introduction/Key Findings

7.2 Suture Needles

7.3 Blood Collection Needles

7.4 Ophthalmic Needles

7.5 Dental Needles

7.6 Insufflation Needles

7.7 Pen Needles

7.8 Other Needles

7.9 Y-O-Y Growth trend Analysis By Product

7.10 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 8. Needles Market – By Delivery Mode

8.1 Introduction/Key Findings

8.2 Hypodermic Needles

8.3 Intravenous Needles

8.4 Intramuscular Needles

8.5 Intraperitoneal Needles

8.6 Y-O-Y Growth trend Analysis Delivery Mode

8.7 Absolute $ Opportunity Analysis Delivery Mode, 2024-2030

Chapter 9. Needles Market – By Material

9.1 Introduction/Key Findings

9.2 Glass Needles

9.3 Plastic Needles

9.4 Stainless Steel Needles

9.5 Polyether Ether Ketone Needles

9.6 Y-O-Y Growth trend Analysis Material

9.7 Absolute $ Opportunity Analysis Material, 2024-2030

Chapter 10. Needles Market – By Distribution Channel

10.1 Introduction/Key Findings

10.2 Direct Tenders

10.3 Retail

10.4 Y-O-Y Growth trend Analysis By Distribution Channel

10.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 11. Needles Market – By End User

11.1 Introduction/Key Findings

11.2 Hospitals and Diagnostic Center

11.3 Home Healthcare

11.4 Others

11.5 Y-O-Y Growth trend Analysis By End User

11.6 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 12. Needles Market, By Geography – Market Size, Forecast, Trends & Insights

12.1 North America

12.1.1 By Country

12.1.1.1 U.S.A.

12.1.1.2 Canada

12.1.1.3 Mexico

12.1.2 By Type

12.1.2.1 By Product

12.1.3 By Delivery Mode

12.1.4 By Distribution Channel:

12.1.5 Countries & Segments - Market Attractiveness Analysis

12.2 Europe

12.2.1 By Country

12.2.1.1 U.K

12.2.1.2 Germany

12.2.1.3 France

12.2.1.4 Italy

12.2.1.5 Spain

12.2.1.6 Rest of Europe

12.2.2 By Type

12.2.3 By Product

12.2.4 By Delivery Mode

12.2.5 By Material

12.2.6 By Distribution Channel:

12.2.7 Countries & Segments - Market Attractiveness Analysis

12.3 Asia Pacific

12.3.1 By Country

12.3.1.1 China

12.3.1.2 Japan

12.3.1.3 South Korea

12.3.1.4 India

12.3.1.5 Australia & New Zealand

12.3.1.6 Rest of Asia-Pacific

12.3.2 By Type

12.3.3 By Product

12.3.4 By Delivery Mode

12.3.5 By Material

12.3.6 By Distribution Channel:

12.3.7 Countries & Segments - Market Attractiveness Analysis

12.4 South America

12.4.1 By Country

12.4.1.1 Brazil

12.4.1.2 Argentina

12.4.1.3 Colombia

12.4.1.4 Chile

12.4.1.5 Rest of South America

12.4.2 By Type

12.4.3 By Product

12.4.4 By Delivery Mode

12.4.5 By Material

12.4.6 By Distribution Channel:

12.4.7 Countries & Segments - Market Attractiveness Analysis

12.5 Middle East & Africa

12.5.1 By Country

12.5.1.1 United Arab Emirates (UAE)

12.5.1.2 Saudi Arabia

12.5.1.3 Qatar

12.5.1.4 Israel

12.5.1.5 South Africa

12.5.1.6 Nigeria

12.5.1.7 Kenya

12.5.1.8 Egypt

12.5.1.9 Rest of MEA

12.5.2 By Type

12.5.3 By Product

12.5.4 By Delivery Mode

12.5.5 By Material

12.5.6 By Distribution Channel:

12.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 13. Needles Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

13.1 Medtronic

13.2 Thermo Fisher Scientific Inc.

13.3 Ethicon US, LLC.

13.4 Novo Nordisk A/S

13.5 Boston Scientific Corporation

13.6 Shimadzu Corporation

13.7 Stryker

13.8 Bio-Rad Laboratories, Inc.

13.9 Luminex Corporation

13.10 Merck KGaA

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The escalating incidence of cancer worldwide is a pivotal factor driving market growth. Additionally, the rising prevalence of other chronic and acute diseases contributes to increased demand and supply within the market.

The top players operating in the Needles Market are - Medtronic, Thermo Fisher Scientific Inc., Ethicon US, LLC., Novo Nordisk A/S, Boston Scientific Corporation, Shimadzu Corporation, Stryker, Bio-Rad Laboratories, Inc., Luminex Corporation, Merck KGaA.

The COVID-19 pandemic triggered an unprecedented global demand for vaccines, consequently leading to a significant upsurge in the need for needles, particularly for vaccination purposes.

The heightened investment in healthcare facilities and services is expected to contribute to the increased utilization of needles in settings such as hospitals, clinics, and diagnostic centers.

Asia-Pacific is expected to experience significant growth, driven by government initiatives aimed at raising awareness, the burgeoning medical tourism sector, escalating research activities, and the growing demand for quality healthcare services.