Navy Integrated Bridge Systems Market Size (2024 – 2030)

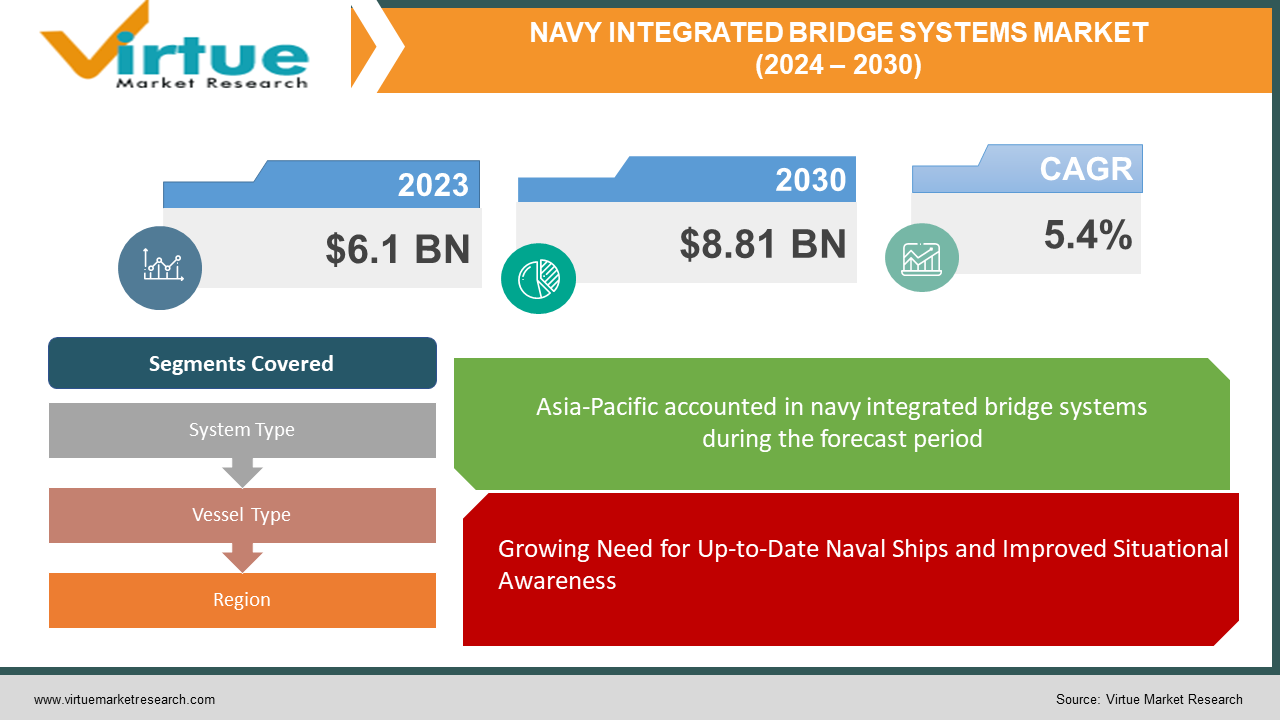

The Global Navy Integrated Bridge Systems Market was valued at USD 6.1 billion and is projected to reach a market size of USD 8.81 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.4%.

The brains of a modern warship are found in the Navy Integrated Bridge System (NIBS). It combines multiple functions into one system, such as ship control (propulsion, machinery) and navigation (radar, ECDIS). The bridge crew's capacity to oversee and control the ship is enhanced by this one, cohesive vision. NIBS further improves situational awareness by providing a thorough image of the environment gathered from several sensors. Better decision-making and safer navigation result from this. Special military capabilities like tactical route planning and warnings for risks like mines and torpedoes are included in NIBS built for marine applications. NIBS simplifies bridge operations by centralising information and controls, increasing productivity and freeing up crew members to concentrate on important duties. To put it simply, NIBS is essential to the modern warship's ability to operate safely, effectively, and in line with its purpose.

Key Market Insights:

According to SIPRI's Military Expenditure Database, global military spending is expected to exceed $2.1 trillion by the year 2024. Modernising naval fleets will involve spending some of this money, which will increase demand for sophisticated NIBS because these ships need them to operate safely and effectively.

The significance of situational awareness for marine safety is emphasised in research conducted by the National Academies of Sciences, Engineering, and Medicine in the United States (National Academies Press, Enhancing Marine Situational Awareness). By giving a clear image of the environment, NIBS technologies like integrated sensor displays and collision avoidance systems directly answer this demand and promote safer navigation and better decision-making at sea.

By 2030, the Asia-Pacific area is anticipated to hold the biggest market share for naval shipbuilding worldwide. By 2030, Asia Pacific will dominate the world market for naval shipbuilding. Because of the shipbuilding boom, sophisticated NIBS will be needed for these new vessels, which will further cement Asia-Pacific's leadership position in the market. Modern technology offers a 30% efficiency boost in navigation tasks.

The increasing cybersecurity threats in the marine sector are highlighted in a report published by the Cybersecurity and Infrastructure Security Agency (CISA) (CISA, Alert AA20-292A - Russian General Purpose Marine Administration Targets Operational Technologies). The growing dependence of NIBS on digital technology gives rise to exploitable weaknesses. These dangers can be reduced, nevertheless, by ongoing investments in crew training and cybersecurity safeguards.

Global Navy Integrated Bridge Systems Market Drivers:

Growing Need for Up-to-Date Naval Ships and Improved Situational Awareness

The market for global navy integrated bridge systems (NIBS) is driven by the growing need for cutting-edge, contemporary naval vessels. Investments in these warships are being driven by the need to replace ageing fleets and geopolitical tensions. Agility, accuracy, and superior operating capabilities are necessary in today's battle. This indicates that there is a high need for sophisticated NIBS. The effective, secure, and combat-ready operation of these boats is greatly dependent on these NIBS. Serving as the nerve centre, NIBS integrates a few functions, including sensor data, propulsion control, and navigation. Better decision-making, quicker reaction times, and ultimately a big advantage on the high seas are made possible by this integrated strategy. In addition, contemporary NIBS frequently have state-of-the-art capabilities including combat management system integration and tactical route planning. Because of the importance of these features for contemporary naval operations, improved NIBS are in high demand as navies look to modernise their fleets globally.

The Emphasis on Improved Navigation Safety and Situational Awareness

The increased focus on improved situational awareness and navigation safety is another important factor propelling the global market for Navy Integrated Bridge Systems. Effective and safe operations at sea are top priorities for modern fleets, and NIBS are essential to reaching these objectives. These sophisticated systems combine information from multiple sensors, such as sonar and radar, to present a complete image of the environment. This gives the bridge crew the confidence to manage complex situations and make well-informed decisions.

Integrated navigation tools and collision avoidance systems are further features included in NIBS. These characteristics guarantee the crew's and the ship's safety by reducing the possibility of mishaps. Better decision-making results from increased situational awareness, which makes route planning and navigation more effective. NIBS enable sailors to respond swiftly and efficiently to shifting circumstances in the fast-paced world of naval operations, thereby enhancing mission performance. It is anticipated that demand for upgraded NIBS with improved situational awareness capabilities will continue to rise as navies place a higher priority on crew safety and operational effectiveness.

Global Navy Integrated Bridge Systems Market Restraints and Challenges:

The Global Navy Integrated Bridge Systems (NIBS) industry has some challenges despite its benefits. The intricacy of NIBS components, such as sophisticated sensors and navigational aids, poses a significant challenge because of high development costs. Moreover, the failure of even a single component may need the replacement of the entire system, resulting in a large increase in expenses. Furthermore, the increasing digitization of NIBS creates openings for hackers. Potential points of entry for hackers are created by integrated navigation systems and shore communication. Investing in strong cybersecurity and crew training is necessary to combat these cyber threats. The NIBS market cannot grow unless these obstacles are removed.

Global Navy Integrated Bridge Systems Market Opportunities:

There are a tonne of prospects in the global market for naval integrated bridge systems (NIBS). First, the market is expanding due to the rising need for contemporary warships outfitted with state-of-the-art NIBS for effective operation. Second, NIBS with automation characteristics offer a compelling way to optimise crew effort, a problem that navies around the world are pursuing. Moreover, NIBS integration opens the door to increased operational efficiency by facilitating communication and battle networks as well as other onboard systems. Finally, developments in cybersecurity, big data, and AI present fascinating opportunities for NIBS in the future, improving decision-making, situational awareness, and overall capabilities. Making the most of these changes will guarantee the NIBS market's success in the upcoming years.

NAVY INTEGRATED BRIDGE SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.4% |

|

Segments Covered |

By System Type, Vessel Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Furuno Electric Co. Ltd. (Japan), Kongsberg (Norway), Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), Wärtsilä Corporation (Finland) |

Global Navy Integrated Bridge Systems Market Segmentation: By System Type

-

Hardware

-

Software

By system type, the Navy Integrated Bridge Systems (NIBS) market may be split into two primary segments: software and hardware. Although both are essential to the operation of NIBS, software is expected to grow at the highest rate. This increase is the result of multiple factors. First, new features like artificial intelligence and large data analysis are continuously added to NIBS software, which is always changing. These improvements improve situational awareness among crew members, facilitate better decision-making, and eventually raise overall NIBS performance. Second, the software has scalability and flexibility built right in. Updates can bring in new features, enabling NIBS to adjust to shifting needs without requiring total hardware upgrades. This is particularly helpful given how quickly naval technology is developing.

Global Navy Integrated Bridge Systems Market Segmentation: By Vessel Type

-

Commercial Ships

-

Defence ships

The defence ship segment dominates the Navy Integrated Bridge Systems (NIBS) market when it comes to vessel type segmentation. This supremacy is the result of numerous important causes. When it comes to features and complexity, NIBS for defence applications are far more advanced than those for commercial use. These military-grade systems incorporate features designed especially for use in combat situations, such as interaction with combat management systems, mine and torpedo alarms, and tactical route planning. The cost of NIBS for defence ships is greatly increased by these cutting-edge characteristics. The expansion and modernization of naval fleets are given top priority in military expenditures. When compared to the budget allotted for NIBS in commercial ships, this amounts to a substantially greater pool of resources devoted to the acquisition of modern NIBS for warships.

Global Navy Integrated Bridge Systems Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Based on market segmentation by region, Asia-Pacific is expected to lead and hold the greatest market share for Navy Integrated Bridge Systems (NIBS). This supremacy is a result of the swift development of their navies and economies in nations such as China and India, which has increased demand for sophisticated NIBS in their modernising fleets. But it could be a closer contest for the title of the fastest-growing region. These same reasons make Asia-Pacific a formidable competitor, but North America's established naval presence and ongoing investments in NIBS technology could make it a formidable foe.

COVID-19 Impact Analysis on the Global Navy Integrated Bridge Systems Market:

The effects of the COVID-19 pandemic on the market for global Navy Integrated Bridge Systems (NIBS) are multifaceted. Lockdowns that hampered the supply chains for NIBS components and possible delays in military spending because of economic downturns caused short-term problems. The long-term picture could be favourable, though. The pandemic's emphasis on resilience may spur initiatives to strengthen NIBS supply chains and increase supplier diversity. Furthermore, the emphasis on remote operations may hasten the automation of NIBS for jobs like navigation, hence lowering the need for crew.

Recent Trends and Developments in the Global Navy Integrated Bridge Systems Market:

Alongside its expansion, the Global Navy Integrated Bridge Systems (NIBS) industry is seeing a surge in innovation. To increase cooperation and decision-making at sea, e-navigation technologies including better digital charts and communication are being added to NIBS. Another development is advanced sensor integration, with possibilities being investigated such as 5G connectivity for faster data transfer, 3D-printed components, and 3D sonar for improved underwater awareness. Better situational awareness and operational capabilities are promised by these developments. Ultimately, there is a trend in the market towards NIBS designs with open architecture. In the long run, this standardisation makes NIBS more versatile and adaptive by facilitating the simpler incorporation of future technologies from different manufacturers.

Key Players:

-

Furuno Electric Co. Ltd. (Japan)

-

Kongsberg (Norway)

-

Northrop Grumman Corporation (US)

-

Raytheon Technologies Corporation (US)

-

Wärtsilä Corporation (Finland)

Chapter 1. Navy Integrated Bridge Systems Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Navy Integrated Bridge Systems Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Navy Integrated Bridge Systems Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Navy Integrated Bridge Systems Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Navy Integrated Bridge Systems Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Navy Integrated Bridge Systems Market – By System Type

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Software

6.4 Y-O-Y Growth trend Analysis By System Type

6.5 Absolute $ Opportunity Analysis By System Type, 2024-2030

Chapter 7. Navy Integrated Bridge Systems Market – By Vessel Type

7.1 Introduction/Key Findings

7.2 Commercial Ships

7.3 Defence ships

7.4 Y-O-Y Growth trend Analysis By Vessel Type

7.5 Absolute $ Opportunity Analysis By Vessel Type, 2024-2030

Chapter 8. Navy Integrated Bridge Systems Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By System Type

8.1.3 By Vessel Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By System Type

8.2.3 By Vessel Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By System Type

8.3.3 By Vessel Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By System Type

8.4.3 By Vessel Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By System Type

8.5.3 By Vessel Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Navy Integrated Bridge Systems Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Furuno Electric Co. Ltd. (Japan)

9.2 Kongsberg (Norway)

9.3 Northrop Grumman Corporation (US)

9.4 Raytheon Technologies Corporation (US)

9.5 Wärtsilä Corporation (Finland)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Navy Integrated Bridge Systems Market size is valued at USD 6.1 billion in 2023.

The worldwide Global Navy Integrated Bridge Systems Market growth is estimated to be 5.4% from 2024 to 2030.

The Global Navy Integrated Bridge Systems Market is segmented By System Type (Hardware, Software); By Vessel Type (Commercial Ships, defence Ships) and by region.

Future trends in NIBS are probably going to feature more automation for jobs like route planning and navigation, along with more integration with other shipboard systems for higher efficiency. This is because automation and integration are becoming more and more important in naval operations.

Although the full effect of COVID-19 on the Navy Integrated Bridge Systems Market is still unknown, supply chain interruptions and possible pauses in naval investment most certainly resulted in short-term difficulties.