GLOBAL NATURAL SWEETENERS MARKET (2024 - 2030)

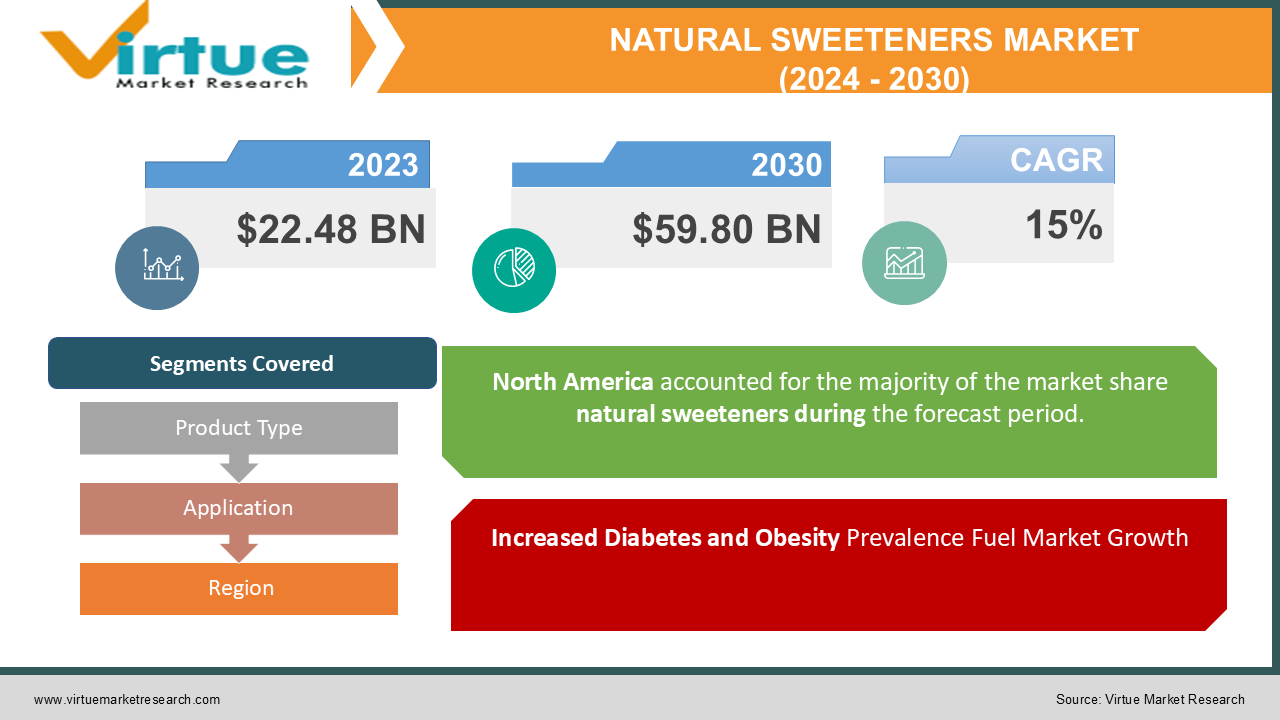

The Global Natural Sweeteners Market is valued at USD 22.48 billion in 2023 and is projected to reach a market size of USD 59.80 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 15%.

Growing trends have been observed in the natural sweeteners sector globally in recent years. Natural sources and ingredients are used to make natural sweeteners. Because they are low in calories and produced from plant sources, they are a better alternative to normal sugar or artificial sweeteners. Natural sweeteners don't contain any carbs and don't cause the body's blood sugar levels to rise. Natural sweeteners that are utilised in commercial settings include mannitol, erythritol, xylitol, honey, maple syrup, and stevia. As customers grow more conscious of their diets and overall health, there is a growing demand for items with zero or low calories. As per the 2021 Global Health Monitor survey, 52% of the population in Mexico is obese, while 13% of people worldwide suffer from diabetes. Additionally, the increased consumer awareness of the need to limit sugar intake and government initiatives to that effect are supporting market expansion. For example, the National Salt and Sugar Reduction Initiative (NSSRI) of the United States was established by the government to reduce sugar and salt as diet-related diseases have become a major cause of death in the country. The initiative released its goals for reducing sugar in 15 different categories of foods and beverages in February 2021, which helped to boost the natural sweetener industry.

Key Market Insights:

The market for natural sweeteners is expanding significantly right now and will continue to do so throughout the next years. The market is growing at a critical rate as a result of the global increase in demand. Rising per capita income and growing consumer knowledge of the harmful health effects of conventional sugar consumption are expected to have a favourable impact on the industry in the upcoming years. The market for natural sweeteners is expected to grow significantly in the next years due to the increased demand for natural and sugar-free components brought on by the rising incidence of diseases like diabetes and other cardiovascular disorders. The introduction of high-quality natural sweeteners by industry players that can mimic the flavour of real sugar, along with the rising use of natural sweeteners because of their low-calorie content and health advantages, is anticipated to accelerate the growth of the natural sweeteners market globally. Due in large part to their low-calorie content and inherent sweetening qualities, natural sweeteners are becoming more and more popular, particularly in the food and beverage industry in developing and underdeveloped nations where consumers are seeking healthier food options. The market for natural sweeteners is also expanding as a result of strict government regulations prohibiting the use of artificial substances in goods. Various sweeteners are being produced by market players in response to industrial demand. In May 2022, for example, Oy Karl Fazer Ab produced xylitol from oat nulls. The xylitol that was created contained 40% fewer calories than ordinary sugar.

Global Natural Sweeteners Market Drivers:

The market is being driven by consumers' increasing inclination towards preventative healthcare measures and their growing awareness of healthy eating options.

Consumers' understanding of their nutritional needs has grown over the past several years due to the introduction of new products and increased knowledge of alternatives to preventative healthcare. As a result, consumers are making healthier decisions when it comes to the consumption of different food and beverage products due to rising health consciousness. Consumer demand for low-calorie, low-sugar, and all-natural & organic ingredient-based products has been increasing recently due to the numerous health benefits associated with them as well as the growing global prevalence of chronic diseases brought on by unhealthy eating habits. Obesity and the rising use of high-calorie drinks and baked goods are well-established relationships. An individual's risk of coronary heart disease (CHD) can rise by up to 28% if they are overweight or obese, according to a 2020 study conducted by "Imperial College London."

Increased Diabetes and Obesity Prevalence Fuel Market Growth

Diabetes is one of the main illnesses that is on the rise and is equally chronic in people. It is the outcome of consuming sugar in excess, which has a high calorie content and exacerbates obesity. In 2018, 10.5% of US adults were estimated to have diabetes, 13.0% of all US adults had diabetes, 2.8% of all US adults who met laboratory criteria for diabetes were unaware of their condition or did not report it, and 21.4% of all US adults had a diagnosis of diabetes, according to a 2020 National Diabetes Statistics Report published by the US Department of Health & Human Services. Additionally, 40.0% of young adults aged 20 to 39, 44.8% of middle-aged adults aged 40 to 59, and 42.8% of individuals aged 60 and beyond were obese, according to the US Department of Health & Human Services.

Many people are restricted from consuming sugar due to the rising rates of diabetes and obesity. 442 million people worldwide suffer from diabetes, according to the World Health Organisation. Because of the health dangers associated with obesity, diabetes, and other conditions, most individuals choose natural sugar over table sugar or cane sugar. The Natural Sweetener Industry is expected to develop between 2022 and 2027 due to the introduction of new sweetener products by Luker Chocolate, such as erythritol & stevia 40% no-added-sugar milk chocolate and erythritol & stevia 70% sugar-free dark chocolate, which were introduced in July 2022.

Global Natural Sweeteners Market Restraints and Challenges:

The greater production costs of natural sweeteners are driving up their premium pricing, which is impeding the market's expansion.

The growth of the natural sweeteners business worldwide is probably going to be hampered by the fact that natural sweeteners are more expensive to manufacture than conventional sugar. The two main types of sweeteners found on the international market are artificial and natural. Artificial sweeteners can be produced chemically via synthesis or by making plant extracts. On the other hand, natural sweeteners are carbohydrates found in roots, nuts, seeds, vegetables, and trees. Natural sweeteners like honey, molasses, maple syrup, coconut sugar, agave nectar, date sugar, and xylitol are frequently obtained. These natural raw ingredients typically carry a greater price tag than the chemicals used to produce fake sweeteners. Furthermore, processing artificial sweeteners takes less time and effort than processing natural sweeteners. For natural sweeteners to be labelled as such, they must pass a number of tests, trials, and labelling standards and regulations. The manufacturing costs are the result of all these elements added together, which eventually raises the cost price. As a result, natural sweeteners are more expensive than artificial sweeteners. This could provide a barrier to the market for natural sweeteners' expansion during the projected period.

The market is being hampered by customer ambiguity on the use of natural sweeteners and their detrimental impacts on human health.

Many health problems, such as elevated triglycerides, kidney damage, tooth decay, weight gain, endocrine disruption, and hypoglycemia, can result from overindulging in natural sweets. Stevia is made from steviol glycosides and is a low-calorie, non-nutritive sweetener. Currently, the US Food and Drug Administration (FDA) only considers high-purity steviol glycosides to be safe for human consumption. Since the FDA has not approved stevia leaves or crude stevia extracts for use as sweeteners, businesses are not allowed to offer them as food additives. According to the FDA, an individual can ingest up to 4 milligrammes of stevia glycosides per kilogramme of body weight per day. Use of highly purified stevia as a flavouring or sweetener is believed to have no adverse effects

Stevia has been associated with a number of potential side effects during the previous few decades, most of which have subsequently been shown to be unfounded. Laboratory animals were used in the majority of these investigations. The availability of artificial sweeteners and the intricate manufacturing procedure are expected to restrict the expansion of the natural sweetener industry worldwide. On the other hand, it is projected that rising health consciousness would drive up demand for natural sweeteners.

Natural Sweeteners Market Opportunities:

Researchers are creating new product lines of natural sweeteners in response to the growing consumer demand for products that support health. For instance, because monk fruit has higher safety requirements and several health benefits, some of the biggest names in the food and beverage industry are introducing this sweetener. Three types of monk fruit sweeteners are available from ADM under the Sweet Right brand. These monk fruit sweeteners were released in 2017 by ADM and GLG Life Tech Corporation (Canada). Because monk fruit sweeteners are 150–200 times sweeter than sugar, they provide sweetness to food and beverage goods without gaining calories. Monk fruit sweeteners find extensive usage in dairy products, candies, juices, soft drinks, desserts, and sauces, among other culinary and beverage applications. Because monk fruits don't deteriorate at high temperatures, they can be used in baked goods. The market for sweeteners, and consequently the market for natural sweeteners, is expected to grow significantly in the coming years as a result of the industry's successful research and development efforts aimed at producing safer and better products to satisfy consumers' increasing demands for safe and health-promoting goods.

GLOBAL SWEETNERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

15 % |

|

Segments Covered |

By Product Type, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DuPont de Nemours Inc., Archer-Daniels-Midland Company, Tate & Lyle PLC., Cargill, Incorporated, Ingredion Incorporated, Roquette Frères, FoodChem International Corporation, PureCircle Ltd. MacAndrews & Forbes Holdings Inc., Ecogreen Oleochemicals Pvt. Ltd. |

Natural Sweeteners Market Segmentation:

Market Segmentation: By Product Type:

- High-Intensity Sweeteners

- Stevia

- Low-Intensity Sweeteners

- Xylitol

- Erythritol

- Others

- Others

The market for natural sweeteners worldwide has been divided into two segments based on product type: high-intensity sweeteners and low-intensity sweeteners. Because high-intensity natural sweeteners like stevia have so many health benefits, they are predicted to increase at the fastest rate and earn the largest market share over the course of the forecast period. Over the course of the forecast period (2024–2030), the stevia segment of the natural sweeteners market is anticipated to develop at the quickest rate. Steviol glycosides are the naturally occurring sweet-tasting substances found in stevia leaves. In stevia, there are eleven main steviol glycosides. The two most prevalent steviol glycosides among these eleven are stevioside and rebaudioside A. One of the top exporters of stevia products worldwide is China. Additionally, kaempferol and other antioxidant chemicals are present in stevia. By 23%, kaempferol can lower the risk of pancreatic cancer. Because stevia is so widely accepted and accessible, it is anticipated to experience significant growth in the years to come.

Market Segmentation: By Application:

- Food & Beverages

- Baked Goods

- Confectionery Products

- Dairy Products

- Fruit Juices

- Carbonated Drinks

- Others

- Pharmaceuticals

- Personal Care

- Others

The natural sweeteners market has been divided into segments based on applications, including food and beverage, pharmaceutical, personal care, and others. During the forecast years, the food and beverage industry is expected to generate the majority of the revenue share. Most food and beverage products, including baked goods, fruit juices, and numerous confectionary items, use erythritol and stevia as sweetening ingredients. Growing public knowledge of the detrimental effects of sugar consumption on one's health is predicted to increase demand for natural sweeteners in the food and beverage industries. As a result, the food and beverage industry, which is always innovating and developing novel products, including diverse natural sweeteners along with other products to cater to the growing demand for new products, is also witnessing the use of natural sweeteners. In the upcoming years, it is anticipated that the food and beverage industry will see significant global investment advances from major players. Manufacturers of natural sweeteners are attempting to concentrate primarily on this market in order to take advantage of the demand and investment prospects.

*Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Due to the rising number of obese and diabetic people in this region, which is boosting the size of the natural sweeteners market there, North America maintained a significant market share in 2023. In 2017, the Centres for Disease Control and Prevention (CDC) reported that over 100 million Americans had either prediabetes or diabetes. Except for Japan, Asia Pacific is anticipated to lead the world market for natural sweeteners throughout the forecast years due to the region's rapidly increasing need for preparing Asian culinary products including pastes, sauces, pickles, and other items. The market is expanding as a result of consumer changes in lifestyle and growing health consciousness. Rising rates of urbanisation, sharp increases in household incomes, and shifts in consumer nutrition and lifestyle are all occurring in developing nations like China and India. As a result, there is a strong demand that is predicted to grow quickly in the upcoming years.

COVID-19 Impact Analysis on the Global Natural Sweeteners Market:

Every industry has been affected by the COVID-19 pandemic's emergence. The raw material supply chain that is necessary for the manufacturing of natural sweeteners is disrupted. Due to severe lockout and societal estrangement, the major producers of natural sweeteners have ceased operations. The World Health Organisation claims that this pandemic affected normal economies throughout the world. The market for natural sweeteners is heavily influenced by the North American, European, and Asia Pacific regions, as a result of the concentration of major businesses operating in these areas. Because natural sweeteners made by numerous major companies in these regions serve end customers worldwide, supply bottlenecks are anticipated in the industry. Natural sweetener use has increased after COVID-19 because people are becoming more interested in eating a healthy diet. Furthermore, it is anticipated that the growing demand for low-calorie foods would present a sizable opportunity for natural sweetener manufacturers operating on the international market.

Latest Trends/ Developments:

The well-known multinational Indian corporation Tata Chemicals, which has interests in consumer goods, chemicals, and crop nutrition, unveiled its new brand, TataNx, in February 2019. The first product released under the previously mentioned brand is called Zero Sugar, and it is a 100% natural sweetener made with stevia herb extracts and lactose.

The commercialization of Amyris, Inc.'s novel sugarcane derived sweetener was announced in December 2018. Amyris, Inc. is a leading innovator and producer of sustainable ingredients for the flavours and aroma, clean cosmetics, and health and wellness markets. The product describes itself as a natural sweetener with no calories.

Tate & Lyle introduced the VANTAGE sweetener solution design tools in July 2020. It is a collection of cutting-edge tools for designing sweetener solutions and an educational programme for making low-calorie, sugar-reduced foods and beverages.

Key Players:

- DuPont de Nemours Inc.

- Archer-Daniels-Midland Company

- Tate & Lyle PLC.

- Cargill, Incorporated

- Ingredion Incorporated

- Roquette Frères

- FoodChem International Corporation

- PureCircle Ltd.

- MacAndrews & Forbes Holdings Inc.

- Ecogreen Oleochemicals Pvt. Ltd.

Chapter 1. GLOBAL NATURAL SWEETENERS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL NATURAL SWEETENERS MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL NATURAL SWEETENERS MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL NATURAL SWEETENERS MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL NATURAL SWEETENERS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL NATURAL SWEETENERS MARKET – By Product Type

6.1. High-Intensity Sweeteners

6.2. Stevia

6.3. Low-Intensity Sweeteners

6.4. Xylitol

6.5. Erythritol

6.6. Others

6.7. Others

Chapter 7. GLOBAL NATURAL SWEETENERS MARKET – By Application

7.1. Food & Beverages

7.2. Baked Goods

7.3. Confectionery Products

7.4. Dairy Products

7.5. Fruit Juices

7.6. Carbonated Drinks

7.7. Others

7.8. Pharmaceuticals

7.9. Personal Care

7.10. Others

Chapter 8. GLOBAL NATURAL SWEETENERS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Process

8.1.3. By Product

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL NATURAL SWEETENERS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. DuPont de Nemours Inc.

9.2. Archer-Daniels-Midland Company

9.3. Tate & Lyle PLC.

9.4. Cargill, Incorporated

9.5. Ingredion Incorporated

9.6. Roquette Frères

9.7. FoodChem International Corporation

9.8. PureCircle Ltd.

9.9. MacAndrews & Forbes Holdings Inc.

9.10. Ecogreen Oleochemicals Pvt. Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Natural Sweeteners Market size was valued at USD 22.48 billion in 2023 in 2023.

The worldwide Natural Sweeteners Market growth is estimated to grow by around 15% from 2024 to 2030.

The Natural Sweeteners Market is segmented by Product Type (High-Intensity Sweeteners, Low-Intensity Sweeteners), and by Application (Food & Beverages, Pharmaceuticals, Personal Care).

The demand for plant-based choices is expected to soar, along with chances for innovation in personalized nutrition to meet the needs of a varied range of dietary preferences and health-conscious customers. These trends are expected to manifest in the global market for natural sweeteners.

The global market for natural sweeteners has grown as a result of the COVID-19 pandemic as consumers look for healthier options. Demand has been stimulated by a shift towards better lifestyles and heightened awareness of wellness, highlighting the market's resiliency and development potential.