GLOBAL NATURAL PROGESTERONE TEST MARKET (2024 - 2030)

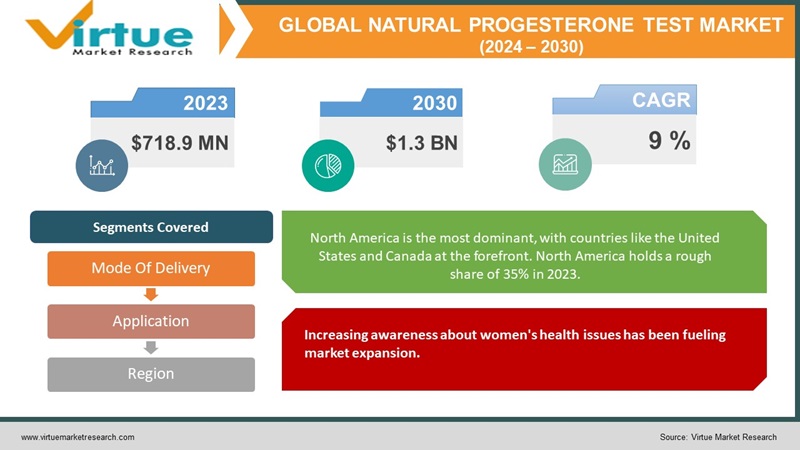

The global natural progesterone test market was valued at USD 718.9 million in 2023 and is projected to reach a market size of USD 1.3 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 9%.

A progesterone test can assist in determining whether low progesterone levels are contributing to complications during pregnancy or female infertility. Additionally, the test could aid in the diagnosis of specific adrenal gland issues that could be the source of elevated progesterone levels in both males and females. In the past, there was very limited awareness about hormones. Besides, there were inadequate healthcare facilities to assist with advanced technologies. Presently, this market has seen a good expansion owing to diverse testing methods and knowledge. In the future, with a growing focus on technology and advanced testing facilities as well as solutions, this market will experience an upsurge. During the forecast period, a considerable growth rate is anticipated.

Key Market Insights:

According to a study on the effects of progesterone and estradiol applied topically to human breast tissue, progesterone treatment 400% reduces the multiplication of breast cells generated by estrogen.

Forecasts indicated that the subchapter about chronic illnesses affecting women would have the largest worldwide value of 218 billion U.S. dollars by 2027. In addition, it was predicted that by 2027, the market for women's reproductive health will be worth 171 billion US dollars.

As of Q2 2022, the majority of global investment in the femtech sector had been concentrated in the US. With more than 11.2 billion dollars invested, the United States ranked first.

52 percent of Vietnamese respondents to a study of women in Southeast Asia conducted in February 2022 said they utilized femtech goods or services.

One in six adults globally, or 17.5% of the population, suffers from infertility, demonstrating the critical need to expand access to high-quality, reasonably priced reproductive care for those who require it. Therefore, measures are being taken to make sure that everybody has equal access to healthcare products.

Natural Progesterone Test Market Drivers:

Increasing awareness about women's health issues has been fueling market expansion.

There have been many lifestyle changes that have led to an increasing incidence of various chronic and reproductive illnesses. Many surveys and statistics have revealed that a greater percentage of the population has been diagnosed with infertility. This has led to a higher demand for diagnostics and testing solutions. Social media has played a crucial role in shedding light on symptoms, warnings, treatments, etc. Progesterone plays a part in overall fertility health by aiding in the uterus's preparation for pregnancy. The ovaries begin producing progesterone, which the uterus needs, after ovulation. The endometrium, or uterine lining, thickens as a result of progesterone. ART (Assisted Reproductive Technologies) has played an important role in aiding couples to conceive. Besides, it plays a role in the regulation of the menstrual cycle. A greater understanding of hormonal and reproductive health has been boosting market growth. Women are becoming proactive in monitoring hormonal levels and ovulation through various health and wellness apps. Furthermore, quarterly and yearly checkups have been facilitating the augmentation.

Rising breast cancer prevalence has been accelerating market growth.

According to the American Cancer Society, in 2023, 297,790 women will receive an invasive breast cancer diagnosis, 55,720 will have a ductal carcinoma in situ (DCIS) diagnosis, and 43,700 deaths might occur from breast cancer. Progesterone levels play an important role in understanding breast cancer levels. High levels of estrogen without the proper counterbalance of progesterone can increase the risk of breast cancer. Few research studies have shown that progesterone has the potential to prevent and protect against breast cancer. Progesterone helps with the differentiation of breast cells, promoting the development of specialized cells. This reduces the risk of cancer. Therefore, proper assessment of hormonal levels helps in the prevention of this disease, thereby increasing the demand for the market.

Natural Progesterone Test Market Restraints and Challenges:

Limited comprehension, confined access, expenses, and hormonal variation are the main issues that the market is currently experiencing.

A lack of awareness can hinder market growth significantly. In many underdeveloped and rural areas, people might not have exact information about the importance of balancing hormonal levels. This leads to serious consequences for female health. Secondly, inadequate infrastructure in remote areas is a huge barrier. Specialized technologies are required for testing. Additionally, it is crucial to ensure that they work with utmost precision and accuracy. Thirdly, associated costs can be an obstacle. A few diagnostics and methods are very expensive. This can be a hurdle for smaller clinics and centers. Furthermore, interpretation of the hormone can be difficult because the levels vary throughout the menstrual cycle.

Natural Progesterone Test Market Opportunities:

Technological advancements have been providing the market with an ample number of possibilities. R&D activities are being carried out to make the technologies user-friendly and easy to understand. Additionally, improvements are being made to improve efficiency and precision. Secondly, educational campaigns have been contributing to the success. Awareness and understanding are essential for this market to grow. Besides, this helps in preventing various disorders. Governmental initiatives are being taken through investments and training programs. Furthermore, telemedicine has been a boon for the market. Integrating services virtually has been facilitated to cut costs and ensure equal access.

NATURAL PROGESTERONE TEST MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9 % |

|

Segments Covered |

By Mode Of Delivery, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Abbott Laboratories, Thermo Fisher Scientific Siemens Healthineers, Bio-Rad Laboratories QuestDiagnostics, RocheDiagnostics, PerkinElmer AgilentTechnologies, BeckmanCoulter, BioMérieux |

Natural Progesterone Test Market Segmentation:

Market Segmentation: By Mode of Delivery:

- Injectable

- Suspended Form

- Oral

Based on the mode of delivery, the oral form is the largest in the market in 2023. Factors like convenience, familiarity, acceptance, dosage, accessibility, and wider availability are responsible for this. The injectable form is considered to be the fastest-growing segment. This is widely used during IVF, ART, and other hormonal treatments. The medications and drugs are easily absorbed and offer a higher bioavailability. Apart from this, they aid in the determination of consistent levels. Furthermore, they are used for medical procedures where oral forms might not be effective.

Market Segmentation: By Application:

- Regulation of Menstrual Cycle

- Dysfunctional Uterine Bleeding

- Cancer (Breast, Cervical, and Endometrial)

- Conception

- Hyperplastic Precursor Lesions

Based on application, the cancer segment will be the largest in this market in 2023. Oncologists can ascertain if hormone-based therapy could be efficacious in treating certain hormone receptor-positive malignancies by doing progesterone testing as part of the hormone receptor status evaluation process. It influences treatment choices and may lead to better results by helping to identify people who could benefit from hormone therapy. Furthermore, increasing cases of cancer have been contributing to the segment expansion. The regulation of the menstrual cycle is one of the fastest-growing categories. Over the years, many environmental changes along with the standard of living have increased the prevalence of diseases. This growing percentage of menstrual abnormalities has been boosting the growth rate. Besides, social media, educational programs, and other initiatives have been guiding the public about various types of disorders. The conception category is also emerging rapidly owing to increased infertility issues.

Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Based on region, North America is the most dominant, with countries like the United States and Canada at the forefront. North America holds a rough share of 35% in 2023. This is because of technological advancements, healthcare evolution, the economy, the presence of key players, infrastructure and resource availability, investments, and the increased prevalence of reproductive issues. Asia-Pacific is the fastest-growing region, with countries like China, India, Japan, and Singapore at the top. This region holds an approximate share of 23%. Reasons like demand, awareness, funds, emerging players, R&D activities, rapid adoption of hormonal treatments, rising life expectancy, increasing availability of diagnostic tools, economic stability, and growing emphasis on healthcare have paved the way for the market.

COVID-19 Impact Analysis on the Global Natural Progesterone Test Market:

The pandemic had a mixed impact on the market. As per a research paper titled “COVID-19 and Progesterone: Part 1. SARS-CoV-2, Progesterone, and its Potential Clinical Use," published by the National Library of Medicine, progesterone served a variety of purposes. Potential mechanisms of involvement included antiviral efficacy against SARS-CoV-2, disruption of SARS-CoV-2 binding to ACE2, pathogenesis recovery, viral load decrease, immunological modulation, and accelerated COVID-19 recovery. In COVID-19, progesterone might have had a therapeutic regulatory effect on immune dysregulation and the severe inflammatory morbidity that results from it. Secondly, the telemedicine concept gained prominence owing to lockdowns, social isolation, and movement restrictions. According to Statista, a survey conducted between March and May 2020 found that 85% of practitioners in India used digital platforms and teleconsultation during the pandemic lockdown. However, fertility issues were put on hold during this period. Due to uncertainty, layoffs, and financial restraints, people were contemplating conceiving. Besides, most of the funds were shifted towards coronavirus applications. Research and developmental activities were focused on the drug and vaccine development of the virus. Post-pandemic, the market has seen a good elevation owing to awareness and improved access.

Latest Trends/ Developments:

Companies are also spending heavily to improve existing creations while maintaining competitive pricing. This has further resulted in increased enlargement.

The concept of personalized healthcare has been a recent trend in the market. This involved tailoring medications and treatments based on the genetic makeup of an individual. Biomarkers are being used for this purpose. They provide information about all the activities that take place in our cells. With this, it is possible to recognize drug targets, monitor safety, and diagnose the disease at the starting stage.

Key Players:

- Abbott Laboratories

- Thermo Fisher Scientific

- Siemens Healthineers

- Bio-Rad Laboratories

- Quest Diagnostics

- Roche Diagnostics

- PerkinElmer

- Agilent Technologies

- Beckman Coulter

- BioMérieux

In July 2023, Proov, which makes at-home fertility and hormone tests, partnered with Quest Diagnostics to offer the Proov Confirm PdG test, which is the first and only FDA-approved PdG (progesterone metabolite) home test kit to confirm successful ovulation. The Proov Confirm PdG home collection kit for determining fertility was launched for women wishing to establish or grow a family at questhealth.com.

In April 2023, Eli, a healthcare technology startup dedicated to improving women's long-term health using saliva-based hormone testing, announced that it has received an additional 5 million Canadian dollars to fund its next stage of expansion. Hormonal fluctuations are important for women's health, yet most women are still unable to obtain this information. Eli wants to close this gap by giving women access to daily hormonal data via real-time saliva analysis, enabling them to monitor changes in their hormone levels throughout their lifetimes and obtain a more comprehensive understanding of their health.

Chapter 1. GLOBAL NATURAL PROGESTERONE MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL NATURAL PROGESTERONE MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL NATURAL PROGESTERONE MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL NATURAL PROGESTERONE MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL NATURAL PROGESTERONE MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL NATURAL PROGESTERONE MARKET – By Mode Of Delivery

6.1. Injectable

6.2. Suspended Form

6.3. Oral

Chapter 7. GLOBAL NATURAL PROGESTERONE MARKET – By Applications

7.1. Regulation of Menstrual Cycle

7.2. Dysfunctional Uterine Bleeding

7.3. Cancer (Breast, Cervical, and Endometrial)

7.4. Conception

7.5. Hyperplastic Precursor Lesions

Chapter 8. GLOBAL NATURAL PROGESTERONE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Mode Of Delivery

8.1.3. By Applications

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Mode Of Delivery

8.2.3. By Applications

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Mode Of Delivery

8.3.3. By Applications

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.. Rest of South America

8.4.2. By Mode Of Delivery

8.4.3. By Applications

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Mode Of Delivery

8.5.3. By Applications

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL NATURAL PROGESTERONE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Abbott Laboratories

9.2. Thermo Fisher Scientific

9.3. Siemens Healthineers

9.4. Bio-Rad Laboratories

9.5. Quest Diagnostics

9.6. Roche Diagnostics

9.7. PerkinElmer

9.8. Agilent Technologies

9.9. Beckman Coulter

9.10. BioMérieux

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global natural progesterone test market was valued at USD 718.9 million in 2023 and is projected to reach a market size of USD 1.3 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 9%.

Increasing awareness about women’s health issues and rising breast cancer prevalence are the main factors propelling the Global Natural Progesterone Test Market.

Based on Application, the Global Natural Progesterone Test Market is segmented into Regulation of Menstrual Cycle, Dysfunctional Uterine Bleeding, Cancer (Breast, Cervical, and Endometrial), Conception, and Hyperplastic Precursor Lesions.

North America is the most dominant region for the Global Natural Progesterone Test Market.

Abbott Laboratories, Thermo Fisher Scientific, and Siemens Healthineers are the key players operating in the Global Natural Progesterone Test Market.