Natural Fragrance Ingredients Market Size (2024 – 2030)

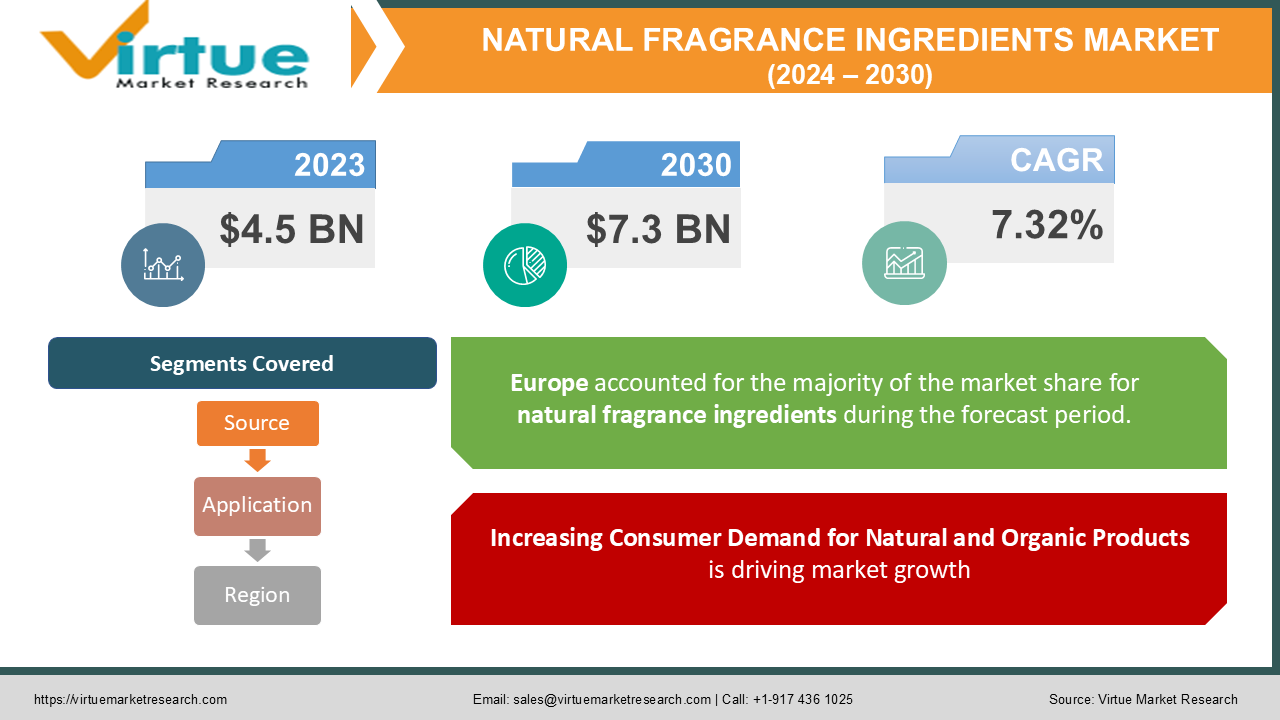

The Global Natural Fragrance Ingredients Market was valued at USD 4.5 billion in 2023 and is projected to grow at a CAGR of 7.32% from 2024 to 2030. The market is expected to reach USD 7.3 billion by 2030.

The Natural Fragrance Ingredients Market comprises naturally derived aromatic compounds extracted from plants, flowers, spices, and other botanical sources. These ingredients are used in various applications such as perfumes, cosmetics, and personal care products. The growing consumer preference for organic and eco-friendly products is a key driver for this market, as natural fragrance ingredients are perceived as safer alternatives to synthetic fragrances, which may contain harmful chemicals.

Key Market Insights:

The personal care and cosmetics industry is the largest end-user of natural fragrance ingredients, accounting for over 40% of the market share in 2023.

Regulatory bodies like the FDA and the European Union have imposed stringent regulations on synthetic fragrances, favoring the adoption of natural ingredients in various formulations.

The Asia-Pacific region, especially countries like India and China, is emerging as a key supplier of raw materials for natural fragrance ingredients due to their rich biodiversity.

Innovations in extraction technologies, such as supercritical CO2 extraction, are enabling higher yield and purity of natural fragrance ingredients, further fueling market growth. Despite the high cost of natural fragrance ingredients compared to synthetic counterparts, the premium pricing is justified by the increasing consumer inclination towards natural and organic products.

Global Natural Fragrance Ingredients Market Drivers:

Increasing Consumer Demand for Natural and Organic Products is driving market growth: The global consumer trend is shifting towards natural and organic products, driven by a growing awareness of health and environmental issues. Consumers are becoming more conscious of the ingredients in the products they use daily, especially in personal care and cosmetic items. Natural fragrance ingredients, free from synthetic chemicals and toxins, align perfectly with this trend. These ingredients are perceived as safer, non-allergenic, and environmentally friendly. The rise in e-commerce platforms and social media influence has further heightened consumer awareness, with a preference for brands that promote transparency and sustainability. This increased demand is not only from niche markets but also mainstream consumers, making natural fragrance ingredients a vital component for product formulations across various industries.

Stringent Regulatory Standards on Synthetic Fragrances is driving market growth: Regulatory bodies across the globe are implementing stringent standards on the use of synthetic fragrances due to their potential health hazards, such as allergies and hormonal disruptions. The European Union's REACH regulations and the US FDA's guidelines on cosmetic ingredients are examples of such regulatory frameworks that limit the use of certain synthetic substances. As a result, manufacturers are increasingly turning towards natural alternatives to meet compliance requirements and cater to the growing demand for clean-label products. This regulatory shift is a significant driver for the natural fragrance ingredients market, as companies seek to reformulate their products with natural and safe ingredients to avoid penalties and maintain consumer trust.

Advancements in Extraction and Processing Technologies is driving market growth: The development of innovative extraction and processing technologies has significantly enhanced the efficiency and quality of natural fragrance ingredients. Techniques such as supercritical CO2 extraction, cold pressing, and molecular distillation have made it possible to extract natural aromatic compounds with greater purity and stability. These advancements have not only improved the yield and quality of natural ingredients but have also reduced the environmental impact associated with traditional extraction methods. Enhanced technological capabilities are encouraging more manufacturers to invest in the natural fragrance ingredients market, as they can now produce high-quality products at a competitive cost. This has opened up new opportunities for product development and customization, further driving market growth.

Global Natural Fragrance Ingredients Market Challenges and Restraints:

High Cost of Natural Fragrance Ingredients is restricting market growth: One of the primary challenges facing the Natural Fragrance Ingredients Market is the high cost associated with these products. Natural ingredients, particularly those sourced from rare or seasonal plants, can be significantly more expensive than synthetic alternatives. The cost of cultivation, harvesting, and extraction of these ingredients adds to their overall price. Additionally, the yield from natural sources can be low, requiring large quantities of raw materials to produce a small amount of fragrance. This high cost can be a deterrent for small and medium-sized companies looking to enter the market, limiting the availability of natural fragrance products in lower-cost segments. As a result, the high price point of natural fragrance ingredients may hinder their adoption in price-sensitive markets and product categories.

Limited Availability and Supply Chain Constraints is restricting market growth: The availability of natural fragrance ingredients is often constrained by factors such as climate conditions, geopolitical issues, and agricultural practices. Many natural fragrances are derived from specific regions where certain plants are cultivated. For example, rose oil is predominantly sourced from Bulgaria and Turkey, while sandalwood is native to India and Australia. Any disruption in these regions, such as adverse weather conditions, political instability, or trade restrictions, can impact the supply chain, leading to volatility in prices and availability. Moreover, the seasonal nature of some plant-based ingredients poses additional challenges, making it difficult for manufacturers to maintain a consistent supply throughout the year. This limited availability can lead to increased production costs and potential shortages, impacting the market growth of natural fragrance ingredients.

Market Opportunities:

The growing trend towards wellness and self-care presents significant opportunities for the Natural Fragrance Ingredients Market. As consumers become more focused on holistic health and well-being, products that offer both sensory and therapeutic benefits are in high demand. Natural fragrance ingredients such as essential oils are not only used for their pleasant scents but also for their potential health benefits, including stress relief, improved mood, and enhanced sleep quality. This has led to the increased use of natural fragrances in aromatherapy, wellness products, and home care solutions like candles and diffusers. Additionally, the clean beauty movement, which advocates for transparency and the use of non-toxic ingredients in personal care products, is gaining momentum. This movement is encouraging brands to reformulate their products using natural fragrance ingredients to meet consumer expectations. Furthermore, innovations in product formulations, such as the development of sustainable and eco-friendly packaging, offer new avenues for market growth. Collaborations between fragrance ingredient suppliers and product manufacturers to create customized natural fragrances tailored to specific brand identities also represent a lucrative opportunity for market expansion.

NATURAL FRAGRANCE INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.32% |

|

Segments Covered |

By Source, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Givaudan, Firmenich, International Flavors & Fragrances (IFF), Symrise, Robertet Group, Mane SA, Takasago International Corporation, Sensient Technologies Corporation, T. Hasegawa Co., Ltd., Bell Flavors & Fragrances |

Natural Fragrance Ingredients Market Segmentation: By Source

-

Essential Oils

-

Natural Extracts

-

Aroma Chemicals

-

Others

Essential Oils dominate the market due to their versatility and wide application in personal care, cosmetics, and aromatherapy. Their therapeutic properties and high consumer preference for organic products make them the most sought-after segment.

Natural Fragrance Ingredients Market Segmentation: By Application

-

Personal Care & Cosmetics

-

Food & Beverages

-

Home Care

-

Others

Personal Care & Cosmetics is the leading segment, accounting for the largest share in the market. The demand for natural fragrances in skincare, haircare, and makeup products is driven by the growing consumer inclination towards clean and natural beauty products.

Natural Fragrance Ingredients Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Europe leads the Natural Fragrance Ingredients Market, driven by a strong regulatory framework supporting natural and organic products, along with high consumer awareness and demand for sustainable and eco-friendly products. The presence of key market players and a well-established cosmetic and personal care industry further contribute to the region's dominance.

COVID-19 Impact Analysis on the Natural Fragrance Ingredients Market:

The COVID-19 pandemic had a multifaceted impact on the Natural Fragrance Ingredients Market. On one hand, the disruption of global supply chains due to lockdowns and restrictions led to shortages of raw materials and delays in production. This resulted in increased prices and limited availability of natural fragrance ingredients, affecting the overall market growth. On the other hand, the pandemic also heightened consumer awareness about health and wellness, leading to a surge in demand for natural and safe products. As people spent more time at home, there was an increased interest in personal care and home care products that use natural fragrances for relaxation and stress relief. Additionally, the clean beauty trend gained momentum during the pandemic, as consumers became more concerned about the ingredients in their personal care products. Brands responded by launching new products with natural and organic ingredients, further driving the demand for natural fragrance ingredients. Despite initial challenges, the market is expected to recover and grow as consumer preferences continue to shift towards natural and sustainable options in the post-pandemic era.

Latest Trends/Developments:

Several key trends are shaping the Natural Fragrance Ingredients Market. Firstly, the rising popularity of multifunctional products is driving innovation in the use of natural fragrance ingredients. Manufacturers are exploring new combinations of essential oils and botanical extracts to create unique scents that offer both olfactory pleasure and additional benefits such as mood enhancement and skin nourishment. Secondly, the increasing focus on sustainability is influencing the development of eco-friendly sourcing and production practices. Companies are investing in sustainable agriculture, ethical sourcing, and biodegradable packaging to meet consumer demand for environmentally responsible products. Thirdly, the trend towards personalization is gaining traction, with brands offering customized fragrance solutions tailored to individual preferences and needs. This is particularly evident in the luxury fragrance segment, where consumers are willing to pay a premium for bespoke products. Lastly, the use of natural fragrance ingredients in non-traditional categories, such as pet care and home cleaning products, is expanding, reflecting the broader acceptance and application of natural scents across various consumer goods sectors. These trends indicate a dynamic and evolving market landscape, with ample opportunities for innovation and growth.

Key Players:

-

Givaudan

-

Firmenich

-

International Flavors & Fragrances (IFF)

-

Symrise

-

Robertet Group

-

Mane SA

-

Takasago International Corporation

-

Sensient Technologies Corporation

-

T. Hasegawa Co., Ltd.

-

Bell Flavors & Fragrances

Chapter 1. Natural Fragrance Ingredients Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Natural Fragrance Ingredients Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Natural Fragrance Ingredients Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Natural Fragrance Ingredients Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Natural Fragrance Ingredients Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Natural Fragrance Ingredients Market – By Source

6.1 Introduction/Key Findings

6.2 Essential Oils

6.3 Natural Extracts

6.4 Aroma Chemicals

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Source

6.7 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. Natural Fragrance Ingredients Market – By Application

7.1 Introduction/Key Findings

7.2 Personal Care & Cosmetics

7.3 Food & Beverages

7.4 Home Care

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Natural Fragrance Ingredients Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Source

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Source

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Source

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Source

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Source

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Natural Fragrance Ingredients Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Givaudan

9.2 Firmenich

9.3 International Flavors & Fragrances (IFF)

9.4 Symrise

9.5 Robertet Group

9.6 Mane SA

9.7 Takasago International Corporation

9.8 Sensient Technologies Corporation

9.9 T. Hasegawa Co., Ltd.

9.10 Bell Flavors & Fragrances

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Natural Fragrance Ingredients Market was valued at USD 4.5 billion in 2023 and is expected to reach USD 7.3 billion by 2030, growing at a CAGR of 7.32% from 2024 to 2030.

The key drivers include increasing consumer demand for natural and organic products, stringent regulatory standards on synthetic fragrances, and advancements in extraction and processing technologies.

The market is segmented by product into Essential Oils, Natural Extracts, Aroma Chemicals, and Others, and by application into Personal Care & Cosmetics, Food & Beverages, Home Care, and Others.

Europe is the dominant region due to strong regulatory support, high consumer demand for natural and organic products, and a well-established personal care and cosmetic industry.

Leading players include Givaudan, Firmenich, International Flavors & Fragrances (IFF), Symrise, Robertet Group, Mane SA, Takasago International Corporation, Sensient Technologies Corporation, T. Hasegawa Co., Ltd., and Bell Flavors & Fragrances.