Natural Fibre Based Geotextiles Market Size (2024 – 2030)

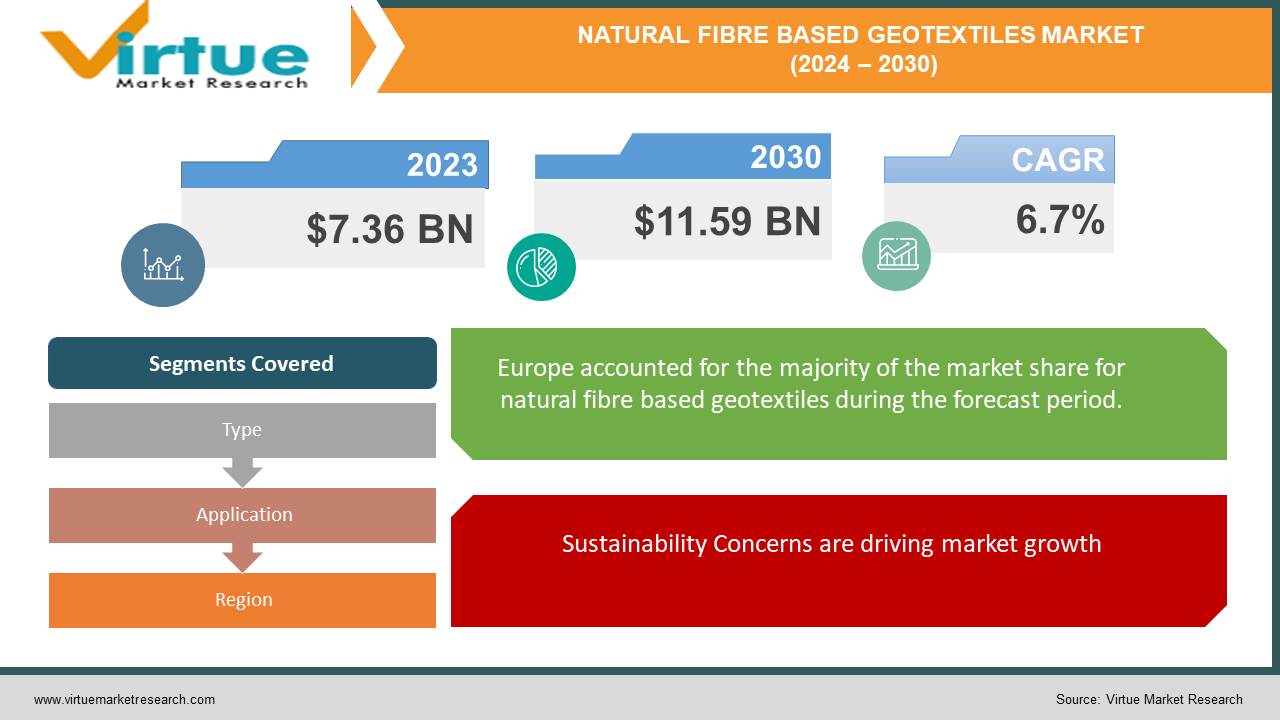

The Global Natural Fibre Based Geotextiles Market was valued at USD 7.36 billion in 2023 and will grow at a CAGR of 6.7% from 2024 to 2030. The market is expected to reach USD 11.59 billion by 2030.

The natural fiber-based geotextiles market uses eco-friendly materials like jute, coir, and wool for soil erosion control, filtration, and separation in construction projects. While it's a smaller segment within the overall geotextiles market, it's gaining traction due to its affordability and sustainability, and could grow significantly as environmental concerns rise.

Key Market Insights:

Natural fibers like jute, coir, and wool represent a niche segment within the geotextiles market compared to synthetics like polyester. Growing environmental concerns are pushing demand for eco-friendly alternatives in construction. Natural fibers are biodegradable and have a lower carbon footprint compared to synthetics.

The increasing focus on sustainability and potential government regulations favoring eco-friendly materials are expected to propel the growth of the natural fiber-based geotextiles market in the coming years. However, overcoming limitations like raw material price fluctuations and developing high-performance natural fiber options will be crucial for wider adoption.

Global Natural Fibre Based Geotextiles Market Drivers:

Sustainability Concerns are driving market growth:

As environmental consciousness takes root in the construction industry, a shift towards sustainable solutions is gaining momentum. Natural fiber-based geotextiles, crafted from eco-friendly materials like jute, coir, and wool, are emerging as a compelling alternative to traditional synthetic options. Unlike synthetics, which can take centuries to decompose and contribute to greenhouse gas emissions during production, natural fibers are biodegradable and boast a significantly lower carbon footprint. This environmental advantage makes them highly attractive to environmentally responsible companies and governments seeking to minimize their ecological impact. From a sustainability standpoint, natural fiber geotextiles represent a significant leap forward, offering comparable functionality for erosion control, filtration, and separation in construction projects while adhering to a greener approach. This eco-friendly appeal positions natural fiber geotextiles to play a key role in shaping a more sustainable future for the construction industry.

Cost-Effectiveness are driving market growth:

Cost-effectiveness plays a crucial role in driving the adoption of natural fiber geotextiles, particularly in developing countries and regions with budgetary limitations on infrastructure projects. Unlike synthetic geotextiles, which are often derived from petroleum and subject to global price fluctuations, natural fibers like jute, coir, and wool can be a more affordable option, especially in regions where they are cultivated locally. This readily available local supply chain translates to reduced transportation costs and eliminates dependence on volatile international markets. This cost advantage becomes a significant factor for developing economies striving to balance infrastructure development needs with budgetary constraints. By opting for natural fiber geotextiles, these regions can achieve their infrastructure goals in a more cost-effective manner, utilizing readily available resources and stimulating their local agricultural economies. The affordability factor makes natural fibers a game-changer, particularly in areas where every penny counts, paving the way for sustainable and budget-friendly infrastructure development.

Government Regulations are driving market growth:

The regulatory landscape is shifting in favor of natural fiber geotextiles, with a growing number of developed countries implementing policies that promote the use of bio-based and sustainable materials in construction projects. These regulations act as a powerful incentive for the adoption of natural fibers. Traditionally, construction relied heavily on materials like concrete and steel, which have significant carbon footprints. New regulations are pushing the industry to embrace greener alternatives, creating a fertile ground for natural fiber geotextiles. This policy shift not only benefits the environment by reducing the embodied carbon in construction projects, but also fosters innovation within the natural fiber geotextiles industry. As the demand for these sustainable materials rises due to regulations, research and development efforts will likely intensify, leading to advancements in performance and broader applicability. This positive feedback loop, fueled by regulations and market demand, can significantly stimulate the growth of the natural fiber geotextiles market, paving the way for a more sustainable future for the construction sector.

Global Natural Fibre Based Geotextiles Market challenges and restraints:

Limited Strength is a significant hurdle for Natural Fibre Based Geotextiles:

A significant hurdle for natural fiber geotextiles is their inherent trade-off between sustainability and raw strength. While their eco-friendly nature is a major advantage, natural fibers like jute and coir typically possess lower tensile strength compared to commonly used synthetics like polypropylene. This translates to limitations in high-stress applications. For instance, heavy-duty erosion control scenarios involving steep slopes or fast-moving water require geotextiles with exceptional tensile strength to effectively anchor soil and prevent erosion. Similarly, soil reinforcement walls often rely on geotextiles with high tensile capacity to distribute loads and maintain structural integrity. In these demanding scenarios, natural fibers might not be suitable due to the risk of failure under significant pressure. Therefore, addressing this strength limitation is crucial for expanding the applicability of natural fiber geotextiles. Research efforts focused on innovative treatment methods or the development of fiber composites that combine the benefits of natural fibers with the strength of synthetics could be potential solutions for unlocking their full potential in high-stress construction applications.

Fluctuating Raw Material Prices are throwing a curveball at Natural Fibre Based Geotextiles market:

Unlike synthetic geotextiles derived from petroleum with a relatively stable global market price, natural fibers like jute and coir present a challenge for project budgeting and planning due to their price volatility. This instability stems from their dependence on agricultural factors like weather conditions and crop yields. A particularly harsh drought or unexpected pest infestation can significantly impact the supply of these natural fibers, leading to price spikes. This unpredictability can disrupt project timelines and budgets. Contractors relying on natural fiber geotextiles might struggle to secure them at a pre-determined cost, potentially leading to project delays or exceeding allocated budgets. To mitigate this risk, project managers might need to factor in buffer zones for cost fluctuations or explore alternative sourcing options. Additionally, forging strong partnerships with reliable suppliers who can offer price stability mechanisms could be beneficial. Addressing this price volatility through improved agricultural practices, diversified sourcing strategies, and innovative pricing models is crucial for ensuring the wider adoption of natural fiber geotextiles in construction projects.

Durability and Biodegradation are a growing nightmare for Natural Fibre Based Geotextiles:

The double-edged sword of biodegradability presents a unique challenge for natural fiber geotextiles. While it boasts environmental benefits by decomposing naturally, this very characteristic can be a drawback in terms of longevity. Unlike synthetic geotextiles, which can endure for decades, natural fibers like jute and coir are susceptible to faster degradation, especially in harsh environments. Exposure to intense sunlight, extreme temperatures, or high microbial activity in the soil can accelerate their breakdown. This translates to a shorter lifespan and the need for more frequent replacements. This can be a significant concern for applications where long-term performance is crucial, such as erosion control on slopes or filtration systems with extended lifespans. The increased replacement frequency not only adds to project costs over time but also negates some of the environmental benefits of biodegradability. Finding a balance between biodegradability and sufficient longevity is key. Research on improving the durability of natural fibers through treatments or exploring natural fiber blends that offer a slower degradation rate in specific environments could be potential solutions for maximizing the benefits of natural fiber geotextiles.

Market Opportunities:

The natural fiber-based geotextiles market presents a compelling opportunity for sustainable construction practices. Growing environmental awareness is driving demand for eco-friendly alternatives, and natural fibers like jute, coir, and wool offer a significant advantage with their biodegradability and lower carbon footprint compared to traditional synthetics. This resonates with environmentally conscious companies and governments seeking to minimize their ecological impact. Furthermore, in regions where natural fibers are readily available, they can be a more cost-effective option compared to petroleum-derived synthetics, making them attractive for developing economies with budgetary constraints on infrastructure projects. Additionally, a growing number of developed countries are implementing regulations that favor bio-based materials, creating a fertile ground for natural fiber geotextiles. This regulatory push, coupled with increasing market demand, is expected to stimulate research and development efforts, potentially leading to advancements in performance and broader applicability of these sustainable materials. However, there are challenges to address. Natural fibers generally have lower tensile strength compared to synthetics, limiting their use in high-stress applications. The cost of these fibers can also be volatile due to their dependence on agricultural factors, posing a challenge for project budgeting. While biodegradability is a positive for sustainability, it can also lead to a shorter lifespan in harsh environments, requiring more frequent replacements. Overcoming these limitations through research on improving strength, durability, and consistency, along with increased awareness and education about their benefits, can unlock the full potential of natural fiber-based geotextiles and pave the way for a more sustainable future for the construction industry.

NATURAL FIBRE BASED GEOTEXTILES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.7% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Hague CMC (Netherlands), Texo Geotextiles Pvt. Ltd. (India), Dril-Quip, Inc. (US), Maharaja Fibre Glass Pvt. Ltd (India), Natural Fibres (New Zealand), EcoCoir (Sri Lanka), Zhejiang Ruoer Textile Co., Ltd (China), TerraGreen (Australia), Jutefabrics.com (Bangladesh), GreenMat Technologies Pvt. Ltd (India) |

Natural Fibre Based Geotextiles Market segmentation - By Type

-

Woven Geotextiles

-

Non-woven Geotextiles

Currently, non-woven geotextiles are the more prominent sector within the natural fiber-based geotextiles market. They offer superior drainage properties due to their looser structure, making them ideal for erosion control applications where efficient water flow is crucial. Additionally, their ability to conform to uneven surfaces is advantageous for these scenarios. While woven geotextiles provide high filtration capacity, their tighter structure can limit water flow in some applications. However, advancements in treatment methods for woven natural fibers could potentially shift the balance in the future.

Natural Fibre Based Geotextiles Market segmentation - By Application

-

Erosion Control

-

Filtration

Erosion control is currently the most prominent application sector for natural fiber-based geotextiles. Their ability to filter water while creating a barrier against wind and rain makes them ideal for stabilizing soil structures on slopes, riverbanks, and channels. This combats soil erosion, a major concern in construction and environmental protection. While natural fibers can also be used for filtration applications like drainage systems, their primary strength lies in erosion control due to their focus on preventing soil movement rather than just separating particles.

Natural Fibre Based Geotextiles Market segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

While specific data for natural fibers alone is limited, Asia Pacific is currently the frontrunner in the global geotextiles market, and this dominance is likely mirrored in the natural fiber segment. This region's strength stems from its major natural fiber producers like India and China, coupled with booming infrastructure development projects that create significant demand for these eco-friendly construction materials.

COVID-19 Impact Analysis on the Global Natural Fibre Based Geotextiles Market

The COVID-19 pandemic's impact on the natural fiber-based geotextiles market was a double-edged sword. Disruptions in the global supply chain initially hampered the availability of raw materials like jute and coir, impacting production and potentially causing project delays. Additionally, lockdowns and stalling infrastructure projects likely led to a temporary decrease in demand. However, the pandemic also heightened awareness of sustainability, potentially positioning natural fiber geotextiles for future growth. As environmental concerns gained traction, the eco-friendly nature of these materials compared to synthetics might have resonated with environmentally conscious companies and governments. This, coupled with a potential rebound in construction activities post-pandemic, could propel the market forward in the long run. The true impact of COVID-19 might not be fully realized for some time, but it has the potential to both challenge and create opportunities for the natural fiber-based geotextiles market, with its long-term prospects hinging on its ability to address temporary disruptions and capitalize on growing environmental consciousness.

Latest trends/Developments

The natural fiber-based geotextiles market is witnessing exciting trends that position it for a promising future. Firstly, a focus on bio-based and sustainable materials in construction regulations is driving innovation in natural fiber treatments. Research is exploring methods to improve strength, durability, and weather resistance, potentially expanding their applicability into high-stress applications. Secondly, advancements in blending natural fibers with synthetics are being explored. This could combine the eco-friendliness of natural fibers with the strength of synthetics, creating new high-performance options. Thirdly, there's a growing interest in utilizing local, readily available natural fibers like bamboo or hemp. This reduces reliance on traditional fibers and transportation costs, promoting regional sustainability. Finally, there's a rise in collaborations between research institutions, manufacturers, and construction companies. This collaborative approach can accelerate the development and adoption of natural fiber geotextiles while addressing challenges like standardization and performance consistency. These trends highlight the dynamic nature of the market and its potential to become a significant player in the sustainable construction revolution.

Key Players:

-

The Hague CMC (Netherlands)

-

Texo Geotextiles Pvt. Ltd. (India)

-

Dril-Quip, Inc. (US)

-

Maharaja Fibre Glass Pvt. Ltd (India)

-

Natural Fibres (New Zealand)

-

EcoCoir (Sri Lanka)

-

Zhejiang Ruoer Textile Co., Ltd (China)

-

TerraGreen (Australia)

-

Jutefabrics.com (Bangladesh)

-

GreenMat Technologies Pvt. Ltd (India)

Chapter 1. Natural Fibre Based Geotextiles Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Natural Fibre Based Geotextiles Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Natural Fibre Based Geotextiles Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Natural Fibre Based Geotextiles Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Natural Fibre Based Geotextiles Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Natural Fibre Based Geotextiles Market – By Type

6.1 Introduction/Key Findings

6.2 Woven Geotextiles

6.3 Non-woven Geotextiles

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Natural Fibre Based Geotextiles Market – By Application

7.1 Introduction/Key Findings

7.2 Erosion Control

7.3 Filtration

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Natural Fibre Based Geotextiles Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Natural Fibre Based Geotextiles Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 The Hague CMC (Netherlands)

9.2 Texo Geotextiles Pvt. Ltd. (India)

9.3 Dril-Quip, Inc. (US)

9.4 Maharaja Fibre Glass Pvt. Ltd (India)

9.5 Natural Fibres (New Zealand)

9.6 EcoCoir (Sri Lanka)

9.7 Zhejiang Ruoer Textile Co., Ltd (China)

9.8 TerraGreen (Australia)

9.9 Jutefabrics.com (Bangladesh)

9.10 GreenMat Technologies Pvt. Ltd (India)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Natural Fibre Based Geotextiles Market was valued at USD 7.36 billion in 2023 and will grow at a CAGR of 6.7% from 2024 to 2030. The market is expected to reach USD 11.59 billion by 2030.

Sustainability Concerns, Cost-Effectiveness, Government Regulations these are the reasons which is driving the market.

Based on Application it is divided into two segments – Erosion Control, Filtration.

Asia is the most dominant region for the luxury vehicle Market.

The Hague CMC (Netherlands), Texo Geotextiles Pvt. Ltd. (India), Dril-Quip, Inc. (US), Maharaja Fibre Glass Pvt. Ltd (India), Natural Fibres (New Zealand).